Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 04 2022 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2022

Commission File Number: 001- 39258

METEN HOLDING GROUP LTD.

(Translation of registrant’s name into English)

3rd Floor, Tower A

Tagen Knowledge & Innovation Center

2nd Shenyun West Road, Nanshan District

Shenzhen, Guangdong Province 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Consolidation of Ordinary

Shares

As previously disclosed, on

April 14, 2022, Meten Holding Group Ltd. (the “Company”) held its extraordinary general meeting of shareholders, at which

the Company’s shareholders approved a share consolidation or reverse stock split, of the Company’s ordinary shares, par value

US$0.0001 per share, at a ratio of one-for-thirty, such that each thirty ordinary shares of the Company shall be combined into one ordinary

share of the Company with a par value of US$0.003 (the “Share Consolidation”).

Reason for the Share Consolidation

The Share Consolidation was

effected solely to enable the Company to expeditiously meet the continued listing standards of the Nasdaq Stock Market (“Nasdaq”)

relating to the minimum bid price under Nasdaq Listing Rule 5550(a)(2) and to reduce the

risk of the Company being automatically delisted from the Nasdaq Capital Market due to the closing bid price of its ordinary shares falling

below $1.00 per share for 30 consecutive business days. The Company has until July 5, 2022 to regain

compliance with Nasdaq Listing Rule 5550(a)(2).

Effects of the Share Consolidation

Effective Date; Symbol;

CUSIP Number. The Share Consolidation will become effective on May 4, 2022, and will be reflected with the Nasdaq Capital Market

and in the marketplace at the opening of business on May 6, 2022 (the “Effective Date”), whereupon the ordinary shares shall

begin trading on a post-consolidation basis. In connection with the Share Consolidation, the Company’s ordinary shares continue

to trade on the Nasdaq Capital Market under the symbol “METX” but trade under a new CUSIP Number, G6055H148.

Adjustment; No Fractional

Shares. On the Effective Date, the total number of the Company’s ordinary shares held by each shareholder will be converted

automatically into the number of whole ordinary shares equal to (i) the number of issued and outstanding ordinary shares held by such

shareholder immediately prior to the Share Consolidation, divided by (ii) thirty (30).

No fractional ordinary shares

will be issued to any shareholders in connection with the Share Consolidation. Each shareholder will be entitled to receive one ordinary

share in lieu of the fractional share that would have resulted from the Share Consolidation.

Non-Certificated Shares.

Shareholders who are holding their shares in electronic form at brokerage firms do not have to take any action as the effect of the Share

Consolidation will automatically be reflected in their brokerage accounts.

Authorized Shares.

At the time the Share Consolidation is effective, our authorized ordinary shares will be consolidated at the ratio of one-for-thirty.

The authorized share capital of the Company will be US$50,000 divided into 16,666,667 Ordinary Shares of a nominal or par value of US$0.003

each.

Capitalization.

As of May 4, 2022 and immediately prior to the Effective Date, there were 341,142,844 ordinary shares outstanding. As a result of

the Share Consolidation, there are approximately 11,371,429 ordinary shares outstanding (subject to adjustment due to the effect of

rounding fractional shares into whole shares).

Outstanding Warrants.

Upon effectiveness of the Share Consolidation, each outstanding warrant of the Company shall be exercisable for 1/30 ordinary share of

the Company, and the exercise price of Company’s outstanding warrants shall be increased to US$9.00, adjusted from $0.30 prior

to the Share Consolidation and representing the temporarily reduced price based on the Company’s Tender Offer Statement on Schedule

TO, as amended and supplemented, originally filed by the Company with the U.S. Securities and Exchange Commission on December 7, 2020

(the “Tender Offer”). Based on the terms of the Tender Offer, following the date on which the closing price of the Company’s

ordinary shares has been equal to or greater than $90.00 per share for at least twenty (20) trading days during the preceding thirty

(30) trading day period, the exercise price of the Company’s outstanding warrants will be increased to US$345.00.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 4, 2022

| |

Meten Holding Group Ltd. |

| |

|

|

| |

By: |

/s/ Siguang Peng |

| |

Name: |

Siguang Peng |

| |

Title: |

Chief Executive Officer |

2

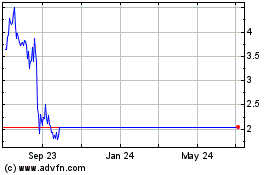

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Apr 2024 to May 2024

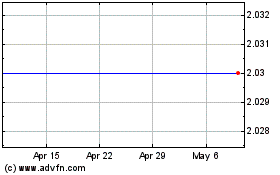

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From May 2023 to May 2024