| |

Filed Pursuant

to Rule 424(b)(5) |

| |

Registration

No. 333-262288

|

PROSPECTUS

10,947,201

Shares of Common Stock

BIOTRICITY

INC.

This

prospectus relates to the public offering of up to 10,947,201 shares of our common stock, par value $0.001 per share (the “Common

Stock”), by the selling stockholder which is comprised of shares of Common Stock issued to the selling stockholders upon the conversion

of convertible promissory notes issued to certain selling stockholders pursuant to private placements between June 2020 and February

2021, shares of Common Stock and shares of Common Stock underlying Exchangeable Shares issued to certain investors in connection with

the Company’s reverse take-over of iMedical Innovations Inc., shares of Common Stock issued to advisors and consultants of the

Company between February 2016 and January 2022 as share-based compensation for services, and shares of Common Stock issued to certain

shareholders in connection with private placements between February 2016 and June 2020. Please see “Description of Transactions”

beginning on page 4 of this prospectus.

We

will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

The

selling stockholders may sell or otherwise dispose of the shares of Common Stock covered by this prospectus in a number of different

ways and at varying prices. The prices at which the selling stockholders may sell the shares will be determined by prevailing market

prices for the shares or in negotiated transactions. We provide more information about how the selling stockholders may sell or

otherwise dispose of their shares of Common Stock in the section titled “Plan of Distribution.” The selling stockholders

will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and

similar expenses) relating to the registration of the shares of Common Stock with the Securities and Exchange Commission.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

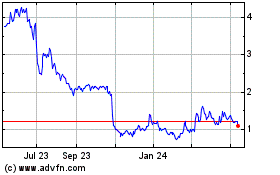

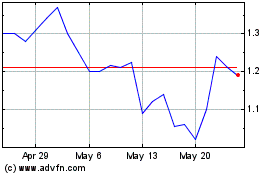

Our Common Stock is currently

traded on the Nasdaq Capital Market under the symbol “BTCY” On April 7, 2022, the last reported sales price for our

Common Stock was $2.11 per share.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 4, in addition

to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated April 25, 2022

Table

of Contents

You

may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide

you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities

other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an

offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus

nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change

in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any

time after its date.

ABOUT

THIS PROSPECTUS

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to tactual

documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the

documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement

of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where

You Can Find Additional Information.”

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Forward-looking statements include statements concerning:

| |

● |

our

possible or assumed future results of operations; |

| |

|

|

| |

● |

our

business strategies; |

| |

|

|

| |

● |

our

ability to attract and retain customers; |

| |

|

|

| |

● |

our

ability to sell additional products and services to customers; |

| |

|

|

| |

● |

our

cash needs and financing plans; |

| |

● |

our

competitive position; |

| |

|

|

| |

● |

our

industry environment; |

| |

|

|

| |

● |

our

potential growth opportunities; |

| |

|

|

| |

● |

expected

technological advances by us or by third parties and our ability to leverage them; |

| |

|

|

| |

● |

the

effects of future regulation; and |

| |

|

|

| |

● |

the

effects of competition. |

All

statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical

facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions

or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except

as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that

you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated

by reference herein. In particular, attention should be directed to our “Risk Factors,” “Information With Respect to

the Company,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the

financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment

decision.

All

brand names or trademarks appearing in this report are the property of their respective holders. Unless the context requires otherwise,

references in this report to “Biotricity,” the “Company,” “we,” “us” and “our”

refer to Biotricity Inc., a Nevada corporation.

Corporate

Information

Our

Company was incorporated on August 29, 2012 in the State of Nevada. Our principal executive office is located at 203 Redwood Shores

Parkway, Suite 600, Redwood City, California, and our telephone number is (650) 832-1626. Our website address is www.biotricity.com.

The information on our website is not part of this prospectus. Our fiscal year end is March 31.

Business

Overview

Biotricity

Inc. is a medical technology company focused on biometric data monitoring solutions. Our aim is to deliver innovative, remote monitoring

solutions to the medical, healthcare, and consumer markets, with a focus on diagnostic and post-diagnostic solutions for lifestyle and

chronic illnesses. We approach the diagnostic side of remote patient monitoring by applying innovation within existing business models

where reimbursement is established. We believe this approach reduces the risk associated with traditional medical device development

and accelerates the path to revenue. In post-diagnostic markets, we intend to apply medical grade biometrics to enable consumers to self-manage,

thereby driving patient compliance and reducing healthcare costs. We intend to first focus on a segment of the diagnostic mobile cardiac

telemetry market, otherwise known as MCT, while providing our chosen markets with the capability to also perform other cardiac studies.

We

developed our FDA-cleared Bioflux® MCT technology, comprised of a monitoring device and software components, which we made

available to the market under limited release on April 6, 2018, in order to assess, establish and develop sales processes and market

dynamics. The fiscal year ended March 30, 2020 marked the Company’s first year of expanded commercialization efforts, focused on

sales growth and expansion. We have expanded our sales efforts to 26 states, with intention to expand further and compete in the

broader US market using an insourcing business model. Our technology has a large potential total addressable market, which can include

hospitals, clinics and physicians’ offices, as well as other IDTFs. We believe our solution’s insourcing model, which empowers

physicians with state-of-the-art technology and charges technology service fees for its use, has the benefit of a reduced operating overhead

for the Company, and enables a more efficient market penetration and distribution strategy. This, when combined with the value the Company’s

solution in the diagnosis of cardiac arrhythmias, enhancement of patient outcomes, improved patient compliance, and the corresponding

reduction of healthcare costs, is driving growth and increasing revenues.

We

are a technology company focused on earning utilization-based recurring technology fee revenue. The Company’s ability to grow this

type of revenue is predicated on the size and quality of its sales force and their ability to penetrate the market and place devices

with clinically focused, repeat users of its cardiac study technology. The Company plans to grow its sales force in order to address

new markets and achieve sales penetration in the markets currently served. The Company has also developed or is developing several other

ancillary technologies, which will require application for further FDA clearances, which the Company anticipates applying for within

the next to twelve months. Among these are:

| |

● |

advanced

ECG analysis software that can analyze and synthesize patient ECG monitoring data with the purpose of distilling it down to the important

information that requires clinical intervention, while reducing the amount of human intervention necessary in the process; |

| |

|

|

| |

● |

the

Bioflux® 2.0, which is the next generation of our award winning Bioflux® |

During fiscal 2021,

the Company announced that it received a 510(k) clearance from the FDA for its Bioflux Software II System, engineered to improve

workflows and reduce estimated analysis time from 5 minutes to 30 seconds. ECG monitoring requires significant human oversight to review

and interpret incoming patient data to discern actionable events for clinical intervention, highlighting the necessity of driving operational

efficiency. This improvement in analysis time reduces operational costs and allows the company to continue to focus on excellent customer

service and industry-leading response times to physicians and their at-risk patients. Additionally, these advances mean we can focus

our resources on high-level operations and sales to help drive greater revenue.

During

the latter part of fiscal 2022, the Company completed development of its Biocare system, which is designed to service the chronic care

monitoring needs of clinics and cardiac patients on an ongoing basis. The Company concurrently launched its Bioheart product, which is

a wearable consumer device that is a personal heart monitor which allows the consumer to access constant and accurate heart rhythm monitoring.

In January 2022 the Company announced that it has received the 510(k)

FDA clearance of its Biotres patch solution, which is a novel product in the field of Holter monitoring. This three-lead technology can

provide connected Holter monitoring that is designed to produce more accurate arrythmia detection than is typical of competing remote

patient monitoring solutions. The Company has already developed further improvements to this technology that are expected to follow,

which are not known by the Company to be currently available in the market for clinical and consumer patch solution applications.

THE

OFFERING

| Issuer |

|

Biotricity Inc. |

| |

|

|

| Common Stock Offered by the Selling Stockholder |

|

10,947,201 shares |

| |

|

|

| Common Stock Outstanding before this offering |

|

49,927,049 shares |

| |

|

|

| Common Stock Outstanding after this offering |

|

49,927,049 shares |

| |

|

|

| Terms of this Offering |

|

The selling stockholders will determine when and how it will sell the Common Stock offered in this Prospectus, as described in “Plan of Distribution.” |

| |

|

|

| Use of Proceeds |

|

The selling stockholders will receive

the proceeds from the sale of shares of Common Stock offered hereby. We will not receive any proceeds from the sale of the shares of

Common Stock offered hereby. We will pay the expenses (other than any broker’s commissions and similar expenses) of this

offering. |

| |

|

|

| Trading Market |

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “BTCY” |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

This

prospectus relates to shares of our Common Stock that may be offered and sold from time to time by the selling stockholders. We

will not receive any of the proceeds resulting from the sale of Common Stock by the selling stockholders.

DESCRIPTION

OF TRANSACTIONS WITH THE SELLING STOCKHOLDERS

In

connection with the Company’s reverse take-over of iMedical Innovations, Inc. in February 2016, certain investors were issued Exchangeable

Shares, which were convertible into shares of the Company’s Common Stock. Certain of those Exchangeable Shares that have not yet

been converted and which are convertible on a one for one basis into 1,442,782 shares of the Company’s Common Stock are being registered

pursuant to this prospectus.

Between

February 2016 and April 2022, we issued shares of Common Stock to certain Selling Shareholders who were advisors and consultants

to the Company. Of those shares 1,832,910 shares are being registered pursuant to this prospectus.

Between

February 2016 and June 2020, we issued shares of Common Stock to certain Selling Stockholders pursuant to private placement transactions.

Of those shares, 1,809,432 shares are being registered pursuant to this prospectus.

During

the year ended March 31, 2021, the Company issued $11,275,500 (face value) in two series of convertible promissory notes (the “Series

A Notes”) sold under subscription agreements to accredited investors, of which approximately $700,000 remains to be converted into

shares of the Company’s common stock. The Series A Notes mature one year from the final closing date of the offering and accrue

interest at 12% per annum.

For

the first series of Series A Notes, commencing six months following the issuance date of such Series A Notes, and at any time thereafter

(provided the holder of such Series A Notes has not received notice of the Company’s intent to prepay the note), at the sole election

of such holder, any amount of the outstanding principal and accrued interest of this note (the “Series A Outstanding Balance”)

may be converted into that number of shares of Common Stock equal to: (i) the Series A Outstanding Balance divided by (ii) 75% of the

volume weighted average price of the Common Stock for the five (5) trading days prior to the Conversion Date (the conversion price).

For

the first series of Series A Notes, the notes will automatically convert into common stock (in each case, subject to the trading volume

of the Company’s common stock being a minimum of $500,000 for each trading day in the twenty (20) consecutive trading days immediately

preceding the conversion date), upon the earlier to occur of (i) the Company’s common stock being listed on a national securities

exchange, in which event the conversion price will be equal to 75% of the volume weighted average price of the common stock for the twenty

(20) trading days prior to the conversion date, or (ii) upon the closing of the Company’s next equity round of financing for gross

proceeds of greater than $5,000,000, in which event the conversion price will be equal to 75% of the price per share of the common stock

(or of the conversion price in the event of the sale of securities convertible into common stock) sold in such financing. The Company

may, at its discretion redeem the notes for 115% of their face value plus accrued interest.

For

the second series of Series A Notes, the notes will be convertible into shares of common stock, at the option of the holder, commencing

six months from issuance, at a conversion price equal to the lower of $4.00 per share or 75% of the volume weighted average price of

the common stock for the five (5) trading days prior to the conversion date.

For

the second series of Series A Notes, the notes will automatically convert into common stock (in each case, subject to the trading volume

of the Company’s common stock being a minimum of $500,000 for each trading day in the twenty (20) consecutive trading days immediately

preceding the conversion date), upon the earlier to occur of (i) the Company’s common stock being listed on a national securities

exchange, in which event the conversion price will be equal to the lower of $4.00 per share or 75% of the volume weighted average price

of the common stock for the 20 trading days prior to the conversion date, or (ii) upon the closing of the Company’s next equity

round of financing for gross proceeds of greater than $5,000,000, in which event the conversion price will be equal to the lower of $4.00

per share or 75% of the price per share of the common stock (or of the conversion price in the event of the sale of securities convertible

into common stock) sold in such financing. The Company may, at its discretion redeem the notes for 115% of their face value plus accrued

interest.

The

Company is obligated to issue warrants that accompany the convertible notes and provide 50% warrant coverage. The warrants have a three-year

term from date of issuance and an exercise price that is 120% of the 20-day volume weighted average price of the Company’s common

shares at the time final closing.

The

Company is obligated to pay the placement agent of the first series of Series A Notes a 12% cash fee for $8,925,550 (face value) of the

notes and 2.5% cash fee and other sundry expenses for the remaining $2,350,000 (face value) of the notes.

Net

proceeds to the Company from Series A Notes issuance up to March 31, 2021 amounted to $10,135,690 after payment of the relevant financing

related fees.

The

Company is also obligated to issue warrants to the placement agent that have a 10-year term and cover 12% of funds raised for $8,925,550

(face value) of the notes (first series) of which approximately $200,000 remains to be converted into shares of the Company’s common

stock and 2.5% of funds raised for the remaining $2,350,000 (face value) of notes (second series) of which approximately $500,000 remains

to be converted into shares of the Company’s common stock, with an exercise price that is 120% of the 20-day volume weighted average

price of the Company’s common shares at the time final closing.

Prior

to final closing, the warrants’ exercise price is variable and will not be struck until that date.

Prior

to January 8, 2021 (final closing date), the Company determined that the conversion and redemption features, investor warrants and placement

agent warrants contained in those Series A Notes represented a single compound derivative liability that meets the requirements for liability

classification under ASC 815. The Company accounted for these obligations by determining the fair value of the related derivative liabilities

associated with the embedded conversion and redemption features, as well as investor warrants and placement agent warrants. The initial

fair value of the derivative liabilities generated as a result of issuing the Series A Notes that were issued until March 31, 2021 was

$6,932,194.

Subsequently,

the exercise price of all warrants was concluded and locked as of January 8, 2021. Since the exercise price was no longer a

variable, the Company concluded that the noteholder and placement agent warrants should no longer be accounted for as a derivative liability

in accordance with ASC 815 guidelines related to equity indexation and classification. The derivative liabilities related to those warrants

were therefore marked to market as of January 8, 2021 and then transferred to equity (collectively, “End of warrants derivative

treatment”).

At

March 31, 2021, 733,085 common shares were issued and 18,402 common shares would be issued subsequent to year-end.

In

addition, during the year ended March 31, 2021, the Company also issued $1,312,500 (face value) of convertible promissory notes (“Series

B Notes”) to various accredited investors, of which $840,000 have not yet been converted.

Commencing

six months following the issuance date of such Series B Notes, and at any time thereafter, subject to the Company’s Conversion

Buyout clause (as defined in the Series B Notes), at the sole election of the holder, any amount of the outstanding principal and accrued

interest of the note (the “Series B Outstanding Balance”) may be converted into that number of shares of Common Stock equal

to: (i) the Series B Outstanding Balance divided by (ii) the Conversion Price. Partial conversions of the note shall have the effect

of lowering the outstanding principal amount of the note. The holder may exercise such conversion right by providing written notice to

the Company of such exercise in a form reasonably acceptable to the Company (a “conversion notice”). Conversion price means

(subject in all cases to proportionate adjustment for stock splits, stock dividends, and similar transactions), seventy-five percent

(75%) multiplied by the average of the three (3) lowest closing prices during the previous ten (10) trading days prior to the receipt

of the conversion notice.

The

Series B Notes will automatically convert into common stock upon a merger, consolidation, exchange of shares, recapitalization, reorganization,

as a result of which the Company’s common stock shall be changed into another class or classes of stock of the Company or another

entity, or in the case of the sale of all or substantially all of the assets of the Company other than a complete liquidation of the

Company. Within the first 180 days after the issuance date, the Company may, at its discretion redeem the notes for 115% of their face

value plus accrued interest.

The

Company is obligated to issue warrants that accompany the convertible notes and provide 50% warrant coverage. The warrants have a three-year

term from date of issuance and an exercise price that is $1.06 per share for 100,000 warrant shares and $1.50 per share for 212,500

warrant shares.

Net

proceeds to the Company from convertible note issuances to March 31, 2021 amounted to $1,240,000 after the original issuance discount

as well as payment of the financing related fees. The Company determined that the conversion and redemption features contained in the

Series B Notes represented a single compound derivative liability that meets the requirements for liability classification under ASC

815. The Company accounted for these obligations by determining the fair value of the related derivative liability associated with the

embedded conversion and redemption features. The initial fair value of the derivative liabilities generated as a result of issuing the

Series B Notes was $497,042.

In

connection with the foregoing, the Company relied upon the exemption from registration provided by Section 4(a)(2) under the Securities

Act of 1933, as amended, for transactions not involving a public offering.

SELLING

STOCKHOLDERS

| Name of Selling Stockholder | |

| |

Number

of Shares Beneficially Owned # | | |

Shares

of Common Stock Offered by the Selling Stockholder | | |

Shares

Underlying Warrants | | |

Shares

Underlying Exchangeable Shares | | |

Unconverted Convertible Notes Outstanding

(assumed VWAP of $3) | | |

Unregistered

Shares Beneficially Owned After Offering Number | | |

% of

Shares Owned After Offering Percent | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| 1903790 ONTARIO INC | |

(7) | |

| 544,711 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 484,711 | | |

| * | |

| 2427304 Ontario Inc. | |

(5) | |

| 111,793 | | |

| 60,000 | | |

| - | | |

| 111,793 | | |

| | | |

| 51,793 | | |

| * | |

| Abdulla Silim (1) | |

(5) | |

| 11,969 | | |

| 11,969 | | |

| - | | |

| 11,969 | | |

| | | |

| - | | |

| - | |

| ABRAR HUSSAIN | |

(7) | |

| 60,000 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Albert Landstrom | |

(3) | |

| 60,425 | | |

| - | | |

| 60,425 | | |

| | | |

| | | |

| 60,425 | | |

| * | |

| Ali Bokhari (1) | |

(5) | |

| 11,969 | | |

| 11,969 | | |

| - | | |

| 11,969 | | |

| | | |

| - | | |

| - | |

| ALISON SLORACH | |

(7) | |

| 13,333 | | |

| 13,333 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ALLEN GABRIEL | |

(1) | |

| 93,999 | | |

| 46,829 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| ALLIANCE TRUST COMPANY | |

(1) | |

| 182,302 | | |

| 87,962 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| ALOK AGRAWAL | |

(1) | |

| 10,303 | | |

| 4,407 | | |

| 5,896 | | |

| | | |

| | | |

| 5,896 | | |

| * | |

| AMER A SAMAD | |

(7) | |

| 35,883 | | |

| 35,883 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ANSARI AMERICAN HOLDINGS LLC | |

(7) | |

| 1,436,322 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 1,376,322 | | |

| 2.76 | % |

| ARTHUR HIESS | |

(7) (8) | |

| 182,948 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 122,948 | | |

| * | |

| Arthur Steinberg | |

(1) | |

| 22,853 | | |

| 22,853 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ASHOK PATEL | |

(1) | |

| 22,529 | | |

| 10,737 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| ASIAN GATEWAY LTD | |

(1) | |

| 112,336 | | |

| 53,374 | | |

| 58,962 | | |

| | | |

| | | |

| 58,962 | | |

| * | |

| ASIF MUSTAFA | |

(7) | |

| 59,846 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| (154 | ) | |

| - | |

| Atik Nakrawala (1) | |

(5) | |

| 2,393 | | |

| 2,393 | | |

| - | | |

| 2,393 | | |

| | | |

| - | | |

| - | |

| BARRET MARSHALL MILLER | |

(1) | |

| 9,006 | | |

| 4,289 | | |

| 4,717 | | |

| | | |

| | | |

| 4,717 | | |

| * | |

| BARRY PRESSMAN | |

(7) | |

| 148,490 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 88,490 | | |

| * | |

| BARRY SAXE | |

(1) | |

| 22,556 | | |

| 10,764 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| BASIL CHRISTAKOS | |

(7) | |

| 661 | | |

| 661 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| BLAINE 2000 REVOCABLE TRUST | |

(1) | |

| 208,963 | | |

| 114,623 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| BMM CAPITAL LLC | |

(1) | |

| 90,058 | | |

| 42,888 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| BRADLEY & LORI ABESON REV FAMILY TRUST | |

(1) | |

| 31,546 | | |

| 22,584 | | |

| 8,962 | | |

| | | |

| | | |

| 8,962 | | |

| * | |

| BRIAN LANGHAM | |

(1) | |

| 68,483 | | |

| 33,106 | | |

| 35,377 | | |

| | | |

| | | |

| 35,377 | | |

| * | |

| BRIAN LONNER | |

(1) | |

| 112,765 | | |

| 53,803 | | |

| 58,962 | | |

| | | |

| | | |

| 58,962 | | |

| * | |

| BRIAN SKILLERN | |

(1) | |

| 45,000 | | |

| 21,415 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| BRIAN WHEELER | |

(1) | |

| 25,424 | | |

| 25,424 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| BRUCE CLARKE & PAULA IGNATOWICZ TTEES | |

(7) | |

| 13,500 | | |

| 13,500 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| BRUCE MCFADDEN | |

(7) | |

| 3,900 | | |

| 3,900 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| BURT STANGARONE | |

(1) | |

| 62,943 | | |

| 29,924 | | |

| 33,019 | | |

| | | |

| | | |

| 33,019 | | |

| * | |

| CALCOTT FAMILY TRUST | |

(1) | |

| 116,267 | | |

| 69,097 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| CHARLES G GATES | |

(1) | |

| 32,211 | | |

| 32,211 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| CHITAYAT HOLDINGS LLC | |

(1) | |

| 45,158 | | |

| 21,573 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| CHRIS DEGROAT | |

(7) | |

| 1,032 | | |

| 1,032 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| CHRISTOPHER CLARK | |

(3) | |

| 83,349 | | |

| 83,349 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Name of Selling Stockholder | |

| |

Number

of Shares Beneficially Owned # | | |

Shares

of Common Stock Offered by the Selling Stockholder | | |

Shares

Underlying Warrants | | |

Shares

Underlying Exchangeable Shares | | |

Unconverted

Convertible Notes Outstanding (assuming VWAP of $3) | | |

Unregistered

Shares Beneficially Owned After Offering Number | | |

% of

Shares Owned After Offering Percent | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| CHRISTOPHER HUBBARD | |

(7) | |

| 14,286 | | |

| 14,286 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| CHRISTOPHER P GUTEK | |

(1) | |

| 33,865 | | |

| 10,280 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| CLAYTON M SNOOK | |

(1) | |

| 21,403 | | |

| 9,611 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| CLAYTON STRUVE | |

(1) | |

| 156,908 | | |

| 95,587 | | |

| 61,321 | | |

| | | |

| | | |

| 61,321 | | |

| * | |

| COHEN FAMILY TRUST | |

(1) | |

| 91,539 | | |

| 42,482 | | |

| 49,057 | | |

| | | |

| | | |

| 49,057 | | |

| * | |

| COLLEGIATE TUTORING INC | |

(1) | |

| 16,485 | | |

| 7,051 | | |

| 9,434 | | |

| | | |

| | | |

| 9,434 | | |

| * | |

| CONNIFF FAMILY TRUST | |

(1) | |

| 21,477 | | |

| 9,685 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| COREY DEUTSCH | |

(7) | |

| 50,000 | | |

| 50,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| CRAIG BORDON | |

(1) | |

| 51,909 | | |

| 23,607 | | |

| 28,302 | | |

| | | |

| | | |

| 28,302 | | |

| * | |

| CRISTIAN JOSE LAPRIDA | |

(7) | |

| 16,666 | | |

| 16,666 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Dan Mancuso | |

(3) | |

| 6,868 | | |

| - | | |

| 6,868 | | |

| | | |

| | | |

| 6,868 | | |

| * | |

| DAN’S DOORS & GLASS LIMITED | |

(7) | |

| 24,843 | | |

| 24,843 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| David Allen | |

(3) | |

| 5,000 | | |

| - | | |

| 5,000 | | |

| | | |

| | | |

| 5,000 | | |

| * | |

| DAVID JONG | |

(7) | |

| 16,850 | | |

| 16,850 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DAVID LIEPERT | |

(6) | |

| 25,000 | | |

| 25,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DAVID RICHARD JOHNSON TTEE | |

(7) | |

| 11,532 | | |

| 11,532 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DAVID SLORACH | |

(7) | |

| 27,619 | | |

| 27,619 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DAVID ZEHARIA | |

(7) | |

| 140,608 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 80,608 | | |

| * | |

| DELL DARRELL ROLAND | |

(1) | |

| 12,798 | | |

| 12,798 | | |

| | | |

| | | |

| | | |

| - | | |

| - | |

| DEREK SLORACH | |

(7) | |

| 6,667 | | |

| 6,667 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DIANE DOWSETT | |

(7) | |

| 20,993 | | |

| 20,993 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DONALD P SESTERHENN | |

(7) | |

| 14,300 | | |

| 14,300 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DONALD R CROWLEY | |

(1) | |

| 40,248 | | |

| 40,248 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DOUGLAS KNIGHTON | |

(1) | |

| 46,590 | | |

| 22,533 | | |

| 24,057 | | |

| | | |

| | | |

| 24,057 | | |

| * | |

| DRAPER INC | |

(7) | |

| 5,000 | | |

| 5,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| DUE MONDI INVESTMENTS LTD | |

(1) | |

| 22,556 | | |

| 10,764 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| DUNLAP CAPITAL PARTNERS | |

(2) | |

| 580,148 | | |

| 273,544 | | |

| 306,604 | | |

| | | |

| 201,818 | | |

| 306,604 | | |

| * | |

| DYKE ROGERS | |

(7) | |

| 18,857 | | |

| 18,857 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| EDWARD ROTTER | |

(1) | |

| 90,008 | | |

| 42,838 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| EDWIN ROBERSON | |

(7) | |

| 36,193 | | |

| 36,193 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| EKM CAPITAL LLC | |

(1) | |

| 9,006 | | |

| 4,289 | | |

| 4,717 | | |

| | | |

| | | |

| 4,717 | | |

| * | |

| ELDORET LLC | |

(1) | |

| 92,120 | | |

| 44,950 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| ELEVEN 11 FINANCIAL LLC | |

(1) | |

| 41,218 | | |

| 41,218 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ELISE HENDRICKSEN | |

(7) | |

| 38,287 | | |

| 38,287 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ERNEST W MOODY TTEE | |

(7) | |

| 169,739 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 109,739 | | |

| * | |

| FAISAL B JOSEPH | |

(6) | |

| 97,500 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 37,500 | | |

| * | |

| FRANCIS LYMBURNER | |

(1) | |

| 305,284 | | |

| 147,737 | | |

| 157,547 | | |

| | | |

| | | |

| 157,547 | | |

| * | |

| FRED BIALEK | |

(1) | |

| 44,977 | | |

| 21,392 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| G&D CONNIFF LLC | |

(1) | |

| 21,477 | | |

| 9,685 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| Gary Saccaro | |

(3) | |

| 138,444 | | |

| - | | |

| 138,444 | | |

| | | |

| | | |

| 138,444 | | |

| * | |

| GARY W LEVINE | |

(1) | |

| 90,288 | | |

| 43,118 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| GEORGE MARTIN | |

(1) | |

| 103,197 | | |

| 46,593 | | |

| 56,604 | | |

| | | |

| | | |

| 56,604 | | |

| * | |

| GERALD A TOMSIC 1995 TRUST | |

(1) | |

| 45,839 | | |

| 22,254 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| GERALD MCBRIDE | |

(1) | |

| 181,930 | | |

| 87,590 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| GREG SYMONS | |

(7) | |

| 43,333 | | |

| 43,333 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Gregory Gomes | |

(1) | |

| 43,767 | | |

| 20,182 | | |

| 23,585 | | |

| | | |

| 20,182 | | |

| 23,585 | | |

| * | |

| GUILLERMO IVANISSEVICH | |

(6) | |

| 10,000 | | |

| 10,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Harry Striplin | |

(3) | |

| 5,295 | | |

| - | | |

| 5,295 | | |

| | | |

| | | |

| 5,295 | | |

| * | |

| HASAN AHMED MALIK | |

(7) | |

| 28,571 | | |

| 28,571 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| HAZEM ALGENDI | |

(3) | |

| 185 | | |

| 185 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Name of Selling Stockholder | |

| |

Number

of Shares Beneficially Owned # | | |

Shares

of Common Stock Offered by the Selling Stockholder | | |

Shares

Underlying Warrants | | |

Shares

Underlying Exchangeable Shares | | |

Unconverted

Convertible Notes Outstanding (assuming VWAP of $3) | | |

Unregistered

Shares Beneficially Owned After Offering Number | | |

% of

Shares Owned After Offering Percent | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| HELIOS ALPHA FUND, LP | |

(2) | |

| 1,388,824 | | |

| 704,862 | | |

| 683,962 | | |

| | | |

| | | |

| 683,962 | | |

| 1.37 | % |

| HUNSE INVESTMENTS LP | |

(1) | |

| 27,118 | | |

| 12,967 | | |

| 14,151 | | |

| | | |

| | | |

| 14,151 | | |

| * | |

| Idris Elbakri (1) | |

(5) | |

| 71,816 | | |

| 60,000 | | |

| - | | |

| 71,816 | | |

| | | |

| 11,816 | | |

| * | |

| IMRAN TOUFEEQ | |

(7) | |

| 18,392 | | |

| 18,392 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| IRTH COMMUNICATIONS LLC | |

(6) | |

| 60,000 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ISA AL-KHALIFA | |

(7) | |

| 2,814,594 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 2,754,594 | | |

| 5.52 | % |

| JACOB ROSENBERG | |

(1) | |

| 70,642 | | |

| 47,057 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| JAMES E BUTCHER | |

(1) | |

| 22,420 | | |

| 22,420 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JAMES G DIEMERT | |

(1) | |

| 45,437 | | |

| 21,852 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| JASON CHIRIANO | |

(1) | |

| 103,009 | | |

| 55,839 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| JAVIER SANCHEZ | |

(7) | |

| 11,279 | | |

| 11,279 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JEFFREY TARRAND | |

(1) | |

| 45,112 | | |

| 21,527 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| JEFFREY WOO | |

(6) | |

| 299,229 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 239,229 | | |

| * | |

| JENNIFER COOK | |

(5) | |

| 612,107 | | |

| 60,000 | | |

| - | | |

| 478,774 | | |

| | | |

| 552,107 | | |

| 1.11 | % |

| JESSICA Ayanoglou | |

(6) | |

| 128,048 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 68,048 | | |

| * | |

| JIMMY GU | |

(6) | |

| 120,714 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 60,714 | | |

| * | |

| JOE MARTIN | |

(1) | |

| 34,592 | | |

| 16,903 | | |

| 17,689 | | |

| | | |

| | | |

| 17,689 | | |

| * | |

| JOHN DUSHINSKI | |

(5) | |

| 370,742 | | |

| 60,000 | | |

| - | | |

| 179,540 | | |

| | | |

| 310,742 | | |

| * | |

| JOHN NOLE | |

(3) | |

| 3,774 | | |

| 3,774 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JOHN SILVESTRI | |

(7) | |

| 38,287 | | |

| 38,287 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JOHN ZIEGLER | |

(7) | |

| 83,333 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 23,333 | | |

| * | |

| JOSEPH HOSTETLER | |

(7) | |

| 12,712 | | |

| 12,712 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JOSEPH MANZI | |

(7) | |

| 15,000 | | |

| 15,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| JUHA TUOMINEN | |

(1) | |

| 145,523 | | |

| 86,561 | | |

| 58,962 | | |

| | | |

| | | |

| 58,962 | | |

| * | |

| JULIE M OSBORNE | |

(7) | |

| 6,667 | | |

| 6,667 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| KAM CAPITAL LLC | |

(1) | |

| 9,006 | | |

| 4,289 | | |

| 4,717 | | |

| | | |

| | | |

| 4,717 | | |

| * | |

| KAMALJIT KHARA | |

(1) | |

| 50,804 | | |

| 50,804 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| KEITH GELLES | |

(1) | |

| 229,793 | | |

| 135,453 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| KENNETH LISZEWSKI | |

(1) | |

| 14,326 | | |

| 7,251 | | |

| 7,075 | | |

| | | |

| | | |

| 7,075 | | |

| * | |

| KENT H ELLIOTT | |

(1) | |

| 83,326 | | |

| 59,741 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| KEVIN EIKE | |

(1) | |

| 66,602 | | |

| 47,734 | | |

| 18,868 | | |

| | | |

| | | |

| 18,868 | | |

| * | |

| KIM MCKENZIE | |

(7) | |

| 24,692 | | |

| 24,692 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| LEANNE DOLAN | |

(7) | |

| 3,898 | | |

| 3,898 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| LEONARD MAZUR | |

(7) | |

| 132,794 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 72,794 | | |

| * | |

| LIFESTYLE HEALTHCARE LLC | |

(6) | |

| 421,823 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 361,823 | | |

| * | |

| LORRAINE MAXFIELD | |

(3) | |

| 2,014 | | |

| 2,014 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| LOVESTRONG SHAH INC | |

(6) | |

| 6,250 | | |

| 6,250 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MALAKA EL-AILY | |

(7) | |

| 15,866 | | |

| 15,866 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MARC COHEN | |

(1) | |

| 49,721 | | |

| 23,778 | | |

| 25,943 | | |

| | | |

| | | |

| 25,943 | | |

| * | |

| MARK AZZOPARDI | |

(1) | |

| 11,792 | | |

| 11,792 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MARK SANCHEZ | |

(6) | |

| 9,143 | | |

| 9,143 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MARK SPATES | |

(1) | |

| 90,078 | | |

| 42,908 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| MARK SUWYN | |

(1) | |

| 314,496 | | |

| 149,402 | | |

| 165,094 | | |

| | | |

| 60,546 | | |

| 165,094 | | |

| * | |

| MARTA WYPYCH | |

(3) | |

| 40,737 | | |

| 40,737 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MARTIN BUTTERICK | |

(7) | |

| 25,524 | | |

| 25,524 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Martin Vidou | |

(6) | |

| 4,167 | | |

| 4,167 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Mason Sexton | |

(3) | |

| 5,284 | | |

| - | | |

| 5,284 | | |

| | | |

| | | |

| 5,284 | | |

| * | |

| MERRI MOKEN | |

(1) | |

| 45,892 | | |

| 22,307 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| Name of Selling Stockholder | |

| |

Number

of Shares Beneficially Owned # | | |

Shares

of Common Stock Offered by the Selling Stockholder | | |

Shares

Underlying Warrants | | |

Shares

Underlying Exchangeable Shares | | |

Unconverted

Convertible Notes Outstanding (assuming VWAP of $3) | | |

Unregistered

Shares Beneficially Owned After Offering Number | | |

% of

Shares Owned After Offering Percent | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| MICHAEL AHEARN | |

(1) | |

| 40,524 | | |

| 19,298 | | |

| 21,226 | | |

| | | |

| | | |

| 21,226 | | |

| * | |

| MICHAEL G CHIECO | |

(1) | |

| 36,787 | | |

| 17,919 | | |

| 18,868 | | |

| | | |

| | | |

| 18,868 | | |

| * | |

| MICHAEL GINDER | |

(1) | |

| 44,940 | | |

| 21,355 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| MIDAS RIVER INC | |

(6) | |

| 40,318 | | |

| 40,318 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MIKE ZIMMERMAN | |

(1) | |

| 40,563 | | |

| 19,337 | | |

| 21,226 | | |

| | | |

| | | |

| 21,226 | | |

| * | |

| MIR AMIR ALI | |

(6) (9) | |

| 1,146,345 | | |

| 1,146,345 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| MIS EQUITY STRATEGIES LP | |

(1) | |

| 45,354 | | |

| 21,769 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| MOHAMMAD JAINAL BHUIYAN | |

(3) | |

| 587,045 | | |

| 490,000 | | |

| 97,045 | | |

| | | |

| | | |

| 97,045 | | |

| * | |

| MOHAMMAD SIDDIQUI | |

(7) | |

| 646,345 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 586,345 | | |

| 1.17 | % |

| MONTE ANGLIN | |

(1) | |

| 22,579 | | |

| 10,787 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| MUNRO FASTENINGS & TEXTILES | |

(6) | |

| 14,286 | | |

| 14,286 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Naveed Malik (1) | |

(5) | |

| 502,713 | | |

| 60,000 | | |

| - | | |

| 502,713 | | |

| | | |

| 442,713 | | |

| * | |

| NICHOLAS ADAMS | |

(1) | |

| 44,940 | | |

| 21,355 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| NICK PANAYOTOU | |

(1) | |

| 587,260 | | |

| 304,241 | | |

| 283,019 | | |

| | | |

| | | |

| 283,019 | | |

| * | |

| NICKOLAY KUKEKOV | |

(3) | |

| 307,045 | | |

| 210,000 | | |

| 97,045 | | |

| | | |

| | | |

| 97,045 | | |

| * | |

| NOAH ANDERSON | |

(1) | |

| 83,261 | | |

| 36,091 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| NORTHLEA PARTNERS LTD | |

(1) | |

| 22,760 | | |

| 10,968 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| PABLO FALABELLA | |

(7) | |

| 15,000 | | |

| 15,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| PANTHER CONSULTING INC | |

(6) | |

| 217,000 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 157,000 | | |

| * | |

| PAUL GLAUBER | |

(1) | |

| 21,576 | | |

| 9,784 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| PAUL P ALATI | |

(1) | |

| 41,508 | | |

| 29,716 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| PAULSON INVESTMENT COMPANY LLC | |

(3) | |

| 309,511 | | |

| 139,432 | | |

| 170,079 | | |

| | | |

| | | |

| 170,079 | | |

| * | |

| PEDRITO FALABELLA | |

(6) | |

| 20,000 | | |

| 20,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| PEDRO FALABELLA | |

(6) | |

| 60,000 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| PETER COLETTIS | |

(1) | |

| 39,924 | | |

| 18,698 | | |

| 21,226 | | |

| | | |

| | | |

| 21,226 | | |

| * | |

| Peter Fogarty | |

(3) | |

| 89,859 | | |

| - | | |

| 89,859 | | |

| | | |

| | | |

| 89,859 | | |

| * | |

| PINEWOOD TRADING FUND LP | |

(7) | |

| 76,593 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 16,593 | | |

| * | |

| PLATINUM POINT CAPITAL LLC | |

(4) | |

| 966,463 | | |

| 341,463 | | |

| 625,000 | | |

| | | |

| 341,463 | | |

| 625,000 | | |

| 1.25 | % |

| POI LLC | |

(7) | |

| 111,368 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 51,368 | | |

| * | |

| PORTER PARTNERS LP | |

(1) | |

| 380,374 | | |

| 191,695 | | |

| 188,679 | | |

| | | |

| | | |

| 188,679 | | |

| * | |

| RALPH WHARTON | |

(1) | |

| 67,697 | | |

| 32,320 | | |

| 35,377 | | |

| | | |

| | | |

| 35,377 | | |

| * | |

| RANDY RABIN | |

(1) | |

| 21,585 | | |

| 9,793 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| RANDY SEARS | |

(7) | |

| 14,286 | | |

| 14,286 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| RIAZUL HUDA | |

(7) | |

| 678,549 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 618,549 | | |

| 1.25 | % |

| ROBERT A JUVE | |

(1) | |

| 136,274 | | |

| 66,463 | | |

| 69,811 | | |

| | | |

| | | |

| 69,811 | | |

| * | |

| ROBERT BECK | |

(1) | |

| 83,146 | | |

| 59,561 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| ROBERT HOROWITZ | |

(1) | |

| 83,647 | | |

| 36,477 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| ROBERT HUPFER | |

(1) | |

| 41,508 | | |

| 29,716 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| ROBERT MONROE | |

(1) | |

| 195,622 | | |

| 101,282 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| ROBERT SETTEDUCATI | |

(3) | |

| 83,349 | | |

| 83,349 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| ROGER WRIGHT | |

(7) | |

| 14,285 | | |

| 14,285 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| RON HOLMAN | |

(7) | |

| 14,500 | | |

| 14,500 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| RONALD AHMANN | |

(7) | |

| 14,500 | | |

| 14,500 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| RONALD WEAVER | |

(1) | |

| 24,386 | | |

| 11,650 | | |

| 12,736 | | |

| | | |

| | | |

| 12,736 | | |

| * | |

| RWH PROPERTIES LLC | |

(7) | |

| 22,732 | | |

| 22,732 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| RZI CONSULTING LLC | |

(6) | |

| 25,000 | | |

| 25,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| SANDRA MARCINKO | |

(7) | |

| 14,286 | | |

| 14,286 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| SANTIAGO LOZA | |

(7) | |

| 5,000 | | |

| 5,000 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Name of Selling Stockholder | |

| |

Number

of Shares Beneficially Owned # | | |

Shares

of Common Stock Offered by the Selling Stockholder | | |

Shares

Underlying Warrants | | |

Shares

Underlying Exchangeable Shares | | |

Unconverted

Convertible Notes Outstanding (assuming VWAP of $3) | | |

Unregistered

Shares Beneficially Owned After Offering Number | | |

% of

Shares Owned After Offering Percent | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| SEAN MCCANCE | |

(1) | |

| 589,566 | | |

| 282,962 | | |

| 306,604 | | |

| | | |

| | | |

| 306,604 | | |

| * | |

| SHANKAR DAS | |

(1) | |

| 24,183 | | |

| 12,391 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| SOHAIRA SIDDIQUI | |

(7) | |

| 758,845 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 698,845 | | |

| 1.40 | % |

| STARGAZER ORIGINALS | |

(7) | |

| 14,286 | | |

| 14,286 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| STARLA GOFF | |

(7) | |

| 1,536 | | |

| 1,536 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| STEPHEN CONNOR | |

(1) | |

| 22,674 | | |

| 10,882 | | |

| 11,792 | | |

| | | |

| | | |

| 11,792 | | |

| * | |

| STEVEN R ROTHSTEIN | |

(1) | |

| 27,067 | | |

| 12,916 | | |

| 14,151 | | |

| | | |

| | | |

| 14,151 | | |

| * | |

| SUSAN ROGERS | |

(7) | |

| 21,124 | | |

| 21,124 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| SYED AHSAN ASLAM | |

(7) | |

| 119,693 | | |

| 60,000 | | |

| - | | |

| | | |

| | | |

| 59,693 | | |

| * | |

| SYED MUNIRUDDIN HASAN | |

(7) | |

| 7,357 | | |

| 7,357 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| SYED SALMAN RAZZAQI | |

(7) | |

| 12,017 | | |

| 12,017 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Tarek Fakhuri (1) | |

(5) | |

| 47,877 | | |

| 47,877 | | |

| - | | |

| 47,877 | | |

| | | |

| - | | |

| - | |

| THE CLEMETSON FAMILY TRUST | |

(7) | |

| 3,900 | | |

| 3,900 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| THE GBS LIVING TRUST | |

(1) | |

| 82,873 | | |

| 45,138 | | |

| 37,735 | | |

| | | |

| | | |

| 37,735 | | |

| * | |

| THOMAS ENDRES | |

(3) | |

| 3,537 | | |

| 3,537 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| THOMAS GATELY | |

(1) | |

| 36,898 | | |

| 18,030 | | |

| 18,868 | | |

| | | |

| | | |

| 18,868 | | |

| * | |

| THOMAS GRUBER | |

(1) | |

| 179,735 | | |

| 85,395 | | |

| 94,340 | | |

| | | |

| | | |

| 94,340 | | |

| * | |

| THOMAS H BUTCHER | |

(1) | |

| 45,849 | | |

| 45,849 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| THOMAS MCCHESNEY | |

(1) | |

| 12,689 | | |

| 12,689 | | |

| | | |

| | | |

| | | |

| - | | |

| - | |

| THOMAS NOLAN | |

(1) | |

| 90,712 | | |

| 43,542 | | |

| 47,170 | | |

| | | |

| | | |

| 47,170 | | |

| * | |

| THOMAS PARIGIAN | |

(3) | |

| 72,761 | | |

| 72,761 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Vaani Sigamany (1) | |

(5) | |

| 23,938 | | |

| 23,938 | | |

| - | | |

| 23,938 | | |

| | | |

| - | | |

| - | |

| VERENA FABIAN | |

(1) | |

| 49,996 | | |

| 35,845 | | |

| 14,151 | | |

| | | |

| | | |

| 14,151 | | |

| * | |

| VERONICA MARANO | |

(1) | |

| 270,382 | | |

| 128,872 | | |

| 141,510 | | |

| | | |

| | | |

| 141,510 | | |

| * | |

| VIJAY PATEL | |

(1) | |

| 64,787 | | |

| 29,410 | | |

| 35,377 | | |

| | | |

| | | |

| 35,377 | | |

| * | |

| WAMOH LLC | |

(1) | |

| 66,041 | | |

| 30,664 | | |

| 35,377 | | |

| | | |

| | | |

| 35,377 | | |

| * | |

| WAYNE WESTERMAN | |

(1) | |

| 45,276 | | |

| 21,691 | | |

| 23,585 | | |

| | | |

| | | |

| 23,585 | | |

| * | |

| WILD WEST CAPITAL | |

(2) | |

| 239,334 | | |

| 121,409 | | |

| 117,925 | | |

| | | |

| | | |

| 117,925 | | |

| * | |

| WILLIAM H COSTIGAN | |

(1) | |

| 17,371 | | |

| 10,296 | | |

| 7,075 | | |

| | | |

| | | |

| 7,075 | | |

| * | |

| WILLIAM M STOCKER III | |

(1) | |

| 135,265 | | |

| 64,510 | | |

| 70,755 | | |

| | | |

| | | |

| 70,755 | | |

| * | |

| ZORAN CHURCHIN | |

(6) | |

| 52,401 | | |

| 52,401 | | |

| - | | |

| | | |

| | | |

| - | | |

| - | |

| Total | |

| |

| 26,684,865 | | |

| 10,947,201 | | |

| 6,299,401 | | |

| 1,442,782 | | |

| 624,009 | | |

| 15,737,664 | | |

| 31.5 | % |

#

Includes shares of Common Stock underlying warrants in certain cases, which shares will not be registered under this registration statement.

*

Denotes less than 1%.

(1) Shares underlying

first series of Series A Notes issued from June 2020 to February 2021.

(2) Shares underlying

second series of Series A Notes issued from December 2020 to February 2021.

(3) Shares underlying

Placement Agent compensation costs associated with the issuance Series A Notes; share-based compensation was issued in February 2021.

(4) Shares underlying

Series B Notes issued in February 2021.

(5) Shares underlying

Exchangeable Shares issued to investors as part of the Company’s reverse take-over of iMedical Innovations Inc. in February 2016.

(6) Shares issued to

advisors and consultants pursuant to compensation arrangements with the Company between February 2016 and April 2022.

(7) Shares issued pursuant

to private placement arrangements between February 2016 and June 2020.

(8) Shares beneficially

owned by Arthur Hiess for the benefit of Judith Kucharsky, Rebecca Kucharsky Hiess, and Jordana Kucharsky Hiess.

(9) Of the 1,146,345

beneficially owned by Mir Amir Ali, 125,000 each owned for the benefit of Aisha Amir Ali and Anisha Ali Malik.

PLAN

OF DISTRIBUTION

Our

Common Stock is quoted on the Nasdaq Capital Market (the “Trading Market”) under the symbol “BTCY.”

The

selling stockholder will act independently of us in making decisions with respect to the timing, manner and size of each and any sale.

The

selling stockholder, which, as used herein, includes donees, pledgees, transferees or other successors-in-interest selling shares of

Common Stock previously issued or interests in shares of Common Stock received after the date of this prospectus from the Selling Stockholder

as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell any or all of the securities covered hereby

on the Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions.

The Common Stock may be sold in one or more transactions at fixed prices, and, if and when our Common Stock is regularly quoted on an

over-the-counter market or on a national securities exchange, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale, or at negotiated prices. The selling stockholder may use any one or more of the following methods when

selling the Common Stock:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately

negotiated transactions; |

| |

● |

settlement

of short sales; |

| |

● |

in

transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

● |

through

the writing or settlement of options or other hedging transaction whether through an options exchange or otherwise; |

| |

● |

a

combination of any such methods of sale; or |

| |

● |

any

other method permitted pursuant to applicable law |

The

selling stockholder may also sell securities under Rule 144 under the Securities Act of 1933, as amended, referred to as the Securities

Act, if available, or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers

engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction, a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling stockholder may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholder may pledge or grant a security interest in some or all of the shares of Common Stock it owns and, if it defaults

in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time

to time pursuant to this prospectus or any supplement or amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act, amending, if necessary the selling stockholder list to include the pledgee, transferee or other successors in

interest as selling stockholders under this prospectus. The selling stockholder also may transfer and donate the shares of Common Stock

in other circumstances in which case the transferees, donees or other successors in interest will be the selling beneficial owners for

purposes of this prospectus.

The

selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. The selling stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

Once

sold under the registration statement of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the

hands of persons other than our affiliates. We have agreed to pay certain fees and expenses incurred by the Company incident to the registration

of the securities. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including

liabilities under the Securities Act. The selling stockholder may indemnify any broker-dealer that participates in transactions involving

the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

The

securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In

addition, in certain states, the securities covered hereby may not be sold unless they have been registered or qualified for sale in

the applicable state or an exemption from the registration or qualification requirement is available and is complied with. To the extent

required, the shares of our Common Stock to be sold, the name of the selling stockholder, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will

be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that

includes this prospectus.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common

Stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and

have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

DESCRIPTION

OF CAPITAL STOCK

Our

authorized capital stock consists of 125,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000,000 shares

of preferred stock, with a par value of $0.001 per share. As of April 7, 2022, there were 49,927,049 shares of Common Stock

issued and outstanding, and 1,466,718 Exchangeable Shares issued and outstanding that convert directly into common shares, which when

combined with Common Stock produce an amount equivalent to 51,393,767 outstanding shares upon the exchange of Exchangeable Shares.

Common

Stock

Pursuant

to Article II of the Amended and Restated By-laws of the Company, each holder of Common Stock and securities exchangeable into Common

Stock that vote with the Common Stock are entitled to one vote for each share of Common Stock held of record by such holder with respect

to all matters to be voted on or consented to by our stockholders, except as may otherwise be required by applicable Nevada law. Unless

the vote of a greater number or voting by classes is required by Nevada statute, the Company’s Articles of Incorporation or its

bylaws, in all matters other than the election of directors, the affirmative vote of a majority of the voting power of the capital stock

(or securities exchangeable in accordance with their terms into capital stock of the Company) present in person or represented by proxy

at the meeting and entitled to vote on the subject matter shall be the act of the shareholders. Furthermore, except as otherwise required

by law, the Company’s Articles of Incorporation or its bylaws, directors shall be elected by a plurality of the voting power of

the capital stock (or securities exchangeable in accordance with their terms into capital stock of the Company) present in person or

represented by proxy at the meeting and entitled to vote on the election of directors.

The