Amended Annual Report (10-k/a)

March 25 2022 - 2:16PM

Edgar (US Regulatory)

0001586554

true

2021

FY

1231

0001586554

2021-12-31

2021-12-31

0001586554

2021-06-30

0001586554

2022-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

| x |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE YEAR ENDED DECEMBER 31, 2021

OR

| ¨ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ________ to ________

Commission

file number 000-55066

TARGET

GROUP INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

46-3621499 |

| (State or Other Jurisdiction of |

|

(IRS Employer |

| Incorporation or Organization) |

|

Identification No.) |

| |

|

|

| 20 Hempstead Drive |

|

|

| Hamilton, Ontario, Canada |

|

L8W 2E7 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code +1 905-541-3833

Securities

registered under Section 12(b) of the Act:

None

Securities

registered under Section 12(g) of the Act:

Common

Stock, Par Value $0.0001

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate

by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the last 90 days.

Yes x

No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Yes x

No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of the large, accelerated filer, accelerated filer, non-accelerated filer, and smaller reporting company

in Rule 12b-2 of the Exchange Act.

Large,

accelerated filer ¨

Accelerated

filer ¨

Non-accelerated

filer x

Smaller

reporting company x

Emerging

growth company¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed second fiscal quarter was $14,824,053 as of June 30, 2021.

State

the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of March

18, 2022, the registrant had 617,025,999 shares of Common Stock issued and outstanding.

| Auditor Name |

|

Auditor Location |

|

Auditor Firm ID |

| Fruci & Associates II, PLLC |

|

Spokane, Washington |

|

5525 |

EXPLANATORY

NOTE

THIS

AMENDMENT NO. 1 ON FORM 10-K/A TO OUR ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021 FILED ON MARCH 18, 2022 IS BEING FILED

SOLELY TO REVISE ITEM 12-SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS-

BY AMENDING THE NUMBER OF SHARES OF COMMON STOCK BENEFICIALLY OWNED BY A DIRECTOR AND ALL DIRECTORS OF THE COMPANY.

AS REQUIRED BY RULE 12B-15 UNDER THE SECURITIES

EXCHANGE ACT OF 1934, AS AMENDED, NEW CERTIFICATIONS BY OUR PRINCIPAL EXECUTIVE OFFICER AND PRINCIPAL FINANCIAL OFFICER ARE FILED AS EXHIBITS

TO THIS FORM 10-K/A.

Item 12. Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters

The following table sets forth certain information

as of March 18, 2022, regarding the beneficial ownership of our Common Stock by (i) our named executive officer, (ii) each of

our directors, and (iii) each person we know to beneficially own more than 5% of our outstanding Common Stock. All shares of our

Common Stock shown in the table reflect sole voting and investment power.

| | |

| |

| | |

Percent of | |

| | |

| |

| | |

Common shares | |

| | |

| |

Common shares | | |

beneficially owned | |

| Name and Address of Beneficial Owner | |

Position | |

| beneficially owned | | |

| (1) | |

| Anthony Zarcone 35 Second Avenue West, Simcoe, Ontario, Canada N3Y 4L5 | |

Chief Executive Officer and Director | |

| 10,259,300 | (2) | |

| 1.66 | % |

| Barry Alan Katzman 35 Second Avenue West, Simcoe, Ontario, Canada N3Y 4L5 | |

Director | |

| ─ | | |

| * | |

| Saul Niddam 35 Second Avenue West, Simcoe, Ontario, Canada N3Y 4L5 | |

Director | |

| 1,666,687 | | |

| * | |

| Frank Monte 35 Second Avenue West, Simcoe, Ontario, Canada N3Y 4L5 | |

Director | |

| 8,148,104 | | |

| 1.32 | % |

| Oakland Family Trust 3448 Lakeshore Road, Burlington, Ontario, Canada L7N 1B3 | |

| |

| 50,129,355 | | |

| 8.12 | % |

| | |

| |

| | | |

| | |

| Total owned by officers and directors | |

| |

| 20,074,091 | | |

| 3.25 | % |

* indicates less than 1%.

| (1) | Based on 617,025,999 shares outstanding as of the date of this Report. |

| (2) | 9,259,300 shares are held by The PJB Trust of which Anthony

Zarcone is the Trustee. |

EXHIBIT INDEX

| |

|

|

|

Incorporated by Reference |

Exhibit

No. |

|

Description |

|

Form |

|

Exhibit |

|

Filing

Date |

| 2.1 |

|

Asset Acquisition Agreement |

|

8-K |

|

2.1 |

|

12/11/14 |

| |

|

|

|

|

|

|

|

|

| 2.1.1 |

|

Agreement and Plan of Share Exchange dated June 27, 2018 with Visava Inc. |

|

8-K |

|

2.1 |

|

07/03/18 |

| |

|

|

|

|

|

|

|

|

| 2.1.2 |

|

Agreement and Plan of Share Exchange dated January 25, 2019 with CannaKorp Inc. and David Manly, as Stockholder Representative |

|

8-K |

|

2.1 |

|

01/29/19 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Articles of Incorporation |

|

10-12G |

|

3.1 |

|

09/13/13 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Amended Articles of Incorporation |

|

8-K |

|

|

|

05/13/14 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Certificate of Amendment |

|

8-K |

|

3(i) |

|

10/20/16 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Certificate of Amendment |

|

8-K |

|

3(i) |

|

04/12/17 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Certificate of Amendment |

|

8-K |

|

3(i) |

|

07/03/17 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Certificate of Amendment |

|

8-K |

|

3(i) |

|

11/01/17 |

| |

|

|

|

|

|

|

|

|

| 3(i)(a) |

|

Certificate of Amendment |

|

8-K |

|

3(i) |

|

09/25/18 |

| |

|

|

|

|

|

|

|

|

| 3.2 |

|

Bylaws |

|

10-12G |

|

3.2 |

|

09/13/13 |

| |

|

|

|

|

|

|

|

|

| 4.1 |

|

Description of Capital Stock |

|

10-K |

|

4.1 |

|

04/14/20 |

| |

|

|

|

|

|

|

|

|

| 10.1 |

|

Form of Securities Purchase Agreement-Blackbridge Capital Growth Fund, LLC |

|

10-K |

|

10.1 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.2 |

|

Form of Convertible Promissory Note |

|

10-K |

|

10.2 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.3 |

|

Form of Convertible Promissory Note |

|

10-K |

|

10.3 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.4 |

|

Form of Convertible Promissory Note |

|

10-K |

|

10.4 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.5 |

|

Form of Securities Purchase Agreement-Crown Bridge Partners, LLC |

|

10-K |

|

10.5 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.6 |

|

Form of Convertible Promissory Note |

|

10-K |

|

10.6 |

|

03/31/17 |

| |

|

|

|

|

|

|

|

|

| 10.10 |

|

Securities Purchase Agreement-Power Up Lending Group Ltd. |

|

10-K |

|

10.10 |

|

03/28/18 |

| |

|

|

|

|

|

|

|

|

| 10.11 |

|

Convertible Promissory Note-Power-Up Lending Group Ltd. |

|

10-K |

|

10.11 |

|

03/28/18 |

| |

|

|

|

|

|

|

|

|

| 10.12 |

|

Securities Purchase Agreement-Power Up Lending Group Ltd. |

|

10-K |

|

10.12 |

|

03/28/18 |

| |

|

|

|

|

|

|

|

|

| 10.13 |

|

Convertible Promissory Note-Power-Up Lending Group Ltd. |

|

10-K |

|

10.13 |

|

03/28/18 |

| |

|

|

|

|

|

|

|

|

| 10.14 |

|

Securities Purchase Agreement-Power Up Lending Group Ltd. dated December 24, 2018 |

|

10-K |

|

10.14 |

|

04/01/19 |

| |

|

|

|

|

|

|

|

|

| 10.15 |

|

Convertible Promissory Note-Power-Up Lending Group Ltd. dated December 24, 2018 |

|

10-K |

|

10.15 |

|

04/01/19 |

| |

|

|

|

|

|

|

|

|

| 10.16 |

|

Distribution, Collaboration and Licensing Agreement dated December 6, 2018 between Target Group Inc, Canary Rx Inc., Serious Seeds B.V. and Simon Smit |

|

10-K |

|

10.16 |

|

04/01/19 |

| |

|

|

|

|

|

|

|

|

| 10.17 |

|

Licensed Producer/Licensed Processor Sales Agency Agreement dated December 13, 2018 with Cannavolve Inc. |

|

10-K |

|

10.17 |

|

04/01/19 |

| |

|

|

|

|

|

|

|

|

| 10.18 |

|

Exclusive License Agreement dated August 8, 2019 with cGreen Inc. |

|

8-K |

|

2.1 |

|

08/13/19 |

| 10.19 |

|

Purchase, Licensing and Purchase Agreement dated September 17,2019 between CannaKorp, Inc. and Nabis Arizona LLC |

|

8-K |

|

10.1 |

|

09/19/19 |

| |

|

|

|

|

|

|

|

|

| 10.20 |

|

Loan Agreement dated December 20, 2019 with Jerry Zarcone |

|

10-K |

|

10.20 |

|

04/14/20 |

| |

|

|

|

|

|

|

|

|

| 10.21 |

|

First Amending Agreement dated March 11, 2020 with Jerry Zarcone |

|

10-Q |

|

10.21 |

|

06/05/20 |

| |

|

|

|

|

|

|

|

|

| 10.22 |

|

Second Amending Agreement dated April 30, 2020 with Jerry Zarcone |

|

10-Q |

|

10.22 |

|

08/10/20 |

| |

|

|

|

|

|

|

|

|

| 10.23 |

|

Third Amending Agreement dated May 15, 2020 with Jerry Zarcone |

|

10-Q |

|

10.23 |

|

08/10/20 |

| |

|

|

|

|

|

|

|

|

| 10.24 |

|

Promissory Note Between Target Group Inc. and Frank Zarcone |

|

10-Q |

|

10.24 |

|

08/10/20 |

| |

|

|

|

|

|

|

|

|

| 10.25 |

|

Joint Venture Agreement between Canary Rx Inc. and 9258159 Canada, Inc. dated May 14, 2020 |

|

10-Q |

|

10.25 |

|

08/10/20 |

| |

|

|

|

|

|

|

|

|

| 10.26 |

|

Debt Purchase and Assignment Agreement dated June 15, 2020 |

|

8-K |

|

10.1(i) |

|

08/18/20 |

| |

|

|

|

|

|

|

|

|

| 10.27 |

|

Amendment dated August 14, 2020 to Debt Purchase and Assignment Agreement |

|

8-K |

|

10.1(ii) |

|

08/18/20 |

| |

|

|

|

|

|

|

|

|

| 10.28 |

|

Amendment dated May 12, 2021 to Debt Purchase and Assignment Agreement |

|

10-Q |

|

10.285 |

|

05/07/21 |

* Filed

herewith

SIGNATURES

Pursuant to the requirements of Section 13 or

15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| Date: March 24, 2022 |

TARGET GROUP INC. |

| |

|

| |

By: |

/s/ Anthony Zarcone |

| |

|

Anthony Zarcone |

| |

|

Chief Executive Officer, Principal Financial Officer and Director |

Pursuant to the requirements of the Securities

Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and

on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

Chief Executive Officer

and Director |

|

|

| /s/ Anthony Zarcone |

|

|

|

March 24, 2022 |

| Anthony Zarcone |

|

|

|

|

| |

|

|

|

|

| /s/ Barry Alan Katzman |

|

Director |

|

March 24, 2022 |

| Barry Alan Katzman |

|

|

|

|

| |

|

|

|

|

| /s/ Saul Niddam |

|

Director |

|

March 24, 2022 |

| Saul Niddam |

|

|

|

|

| |

|

|

|

|

| /s/ Frank Monte |

|

Director |

|

March 24, 2022 |

| Frank Monte |

|

|

|

|

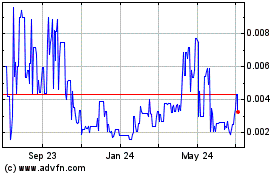

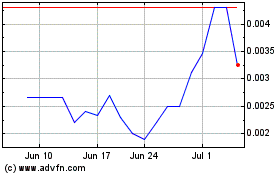

Target (PK) (USOTC:CBDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Target (PK) (USOTC:CBDY)

Historical Stock Chart

From Apr 2023 to Apr 2024