Amended Statement of Beneficial Ownership (sc 13d/a)

February 22 2022 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE

13D/A

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)

Platinum

Group Metals Ltd.

(Name of Issuer)

Common shares, no par value

(Title of Class of Securities)

72765Q601

(CUSIP Number)

Karen Oliver

Deepkloof Limited

No. 2, The Forum

Grenville Street

St

Helier

Jersey

JEI 4HH

Telephone

Number: +44 1534 823000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 11, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| |

* |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

|

|

|

| CUSIP No. 72765Q601 |

|

Page 2 of 6 |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSONS

Deepkloof Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP* (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

AF/OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Jersey, Channel

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

24,837,349 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

24,837,349 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,837,349 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 25.9% (1) |

| 14 |

|

TYPE OF REPORTING

PERSON* CO |

| (1) |

Based on 95,891,331 common shares outstanding as of February 21, 2022 (as disclosed on the Issuer’s

website on such date). See Item 4 of this Schedule 13D for further information. |

|

|

|

| CUSIP No. 72765Q601 |

|

Page 3 of 6 |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSONS

HCI Invest14 Holdco (Pty) Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP* (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

AF/OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION South

Africa |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

24,837,349 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

24,837,349 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,837,349 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 25.9% (1) |

| 14 |

|

TYPE OF REPORTING

PERSON* CO |

| (1) |

Based on 95,891,331 common shares outstanding as of February 21, 2022 (as disclosed on the Issuer’s

website on such date). See Item 4 of this Schedule 13D for further information. |

- 3 -

|

|

|

| CUSIP No. 72765Q601 |

|

Page 4 of 6 |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSONS

Hosken Consolidated Investments Limited |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP* (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

AF/OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION South

Africa |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

24,837,349 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

24,837,349 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,837,349 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 25.9% (1) |

| 14 |

|

TYPE OF REPORTING

PERSON* CO |

| (1) |

Based on 95,891,331 common shares outstanding as of February 21, 2022 (as disclosed on the Issuer’s

website on such date). See Item 4 of this Schedule 13D for further information. |

- 4 -

|

|

|

| CUSIP No. 72765Q601 |

|

Page 5 of 6 |

EXPLANATORY NOTE

This Amendment No. 2 to Schedule 13D amends and supplements the Schedule 13D filed by the Reporting Persons with the Securities and

Exchange Commission on December 28, 2020 (as amended by Amendment No. 1 on Schedule 13D filed on March 1, 2021, the “Schedule 13D”), and amends and supplements the Schedule 13D as specifically set forth herein. All

capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D. Information given in response to each item shall be deemed incorporated by reference in all other items, as applicable.

Except as set forth below, all previous items remain unchanged.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of Schedule 13D is hereby amended and supplemented by adding the following paragraph:

The source of funds for the February 11 Private Placement (as defined in Item 4 below) was the Reporting Persons’ capital available

for investment.

Item 4. Purpose of Transaction.

Item 4 of Schedule 13D is hereby amended and supplemented by adding the following paragraphs:

From April 27, 2021 to May 10, 2021, HCI, through Deepkloof, sold an aggregate of 294,495 Shares in open market

transactions on the New York Stock Exchange for aggregate gross proceeds of $1,521,038.

On February 11, 2022, HCI purchased an

aggregate of 3,539,823 Shares directly from the Company in a non-brokered private placement (the “February 11 Private Placement”). The shares were sold at a price per share of $1.695 for aggregate

gross proceeds to the Company of $6.0 million. After giving effect to the February 11 Private Placement, the Reporting Persons beneficially owned 25.9% of the total amount of Shares outstanding as of February 21, 2022. A copy of the

Subscription Agreement, dated January 25, 2022, between the Company and Deepkloof relating to the private placement is attached as Exhibit 99.9.

Item 5. Interest in Securities of the Issuer.

Item 5 of Schedule 13D is hereby amended and restated in its entirety as follows:

(a), (b)

Deepkloof

beneficially owns 24,837,349 Shares, representing 25.9% of the 95,891,331 Shares outstanding as of February 21, 2022 as reported on the Company’s website on such date. HCI holds 100% of the equity interests in Invest14, and Invest14

holds 100% of the equity interests in Deepkloof. As a result, each of HCI and Invest14 may be deemed to beneficially own, and have shared voting and dispositive power with respect to, all such Shares.

(c)

On February 11, 2022,

HCI purchased an aggregate of 3,539,823 Shares directly from the Company in a non-brokered private placement. The shares were sold at a price per share of $1.695 for aggregate gross proceeds to the Company of

$6.0 million.

(d)

No

person (other than the Reporting Persons) has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, Shares beneficially owned by the Reporting Persons.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of Schedule 13D is hereby amended and supplemented by adding the following paragraphs:

The information set forth in Item 4 of this Amendment No. 2 with respect to the February 11 Private Placement is incorporated by

reference in its entirety into this Item 6.

Item 7. Materials to be Filed as Exhibits.

Item 7 of Schedule 13D is hereby amended and supplemented by adding a reference to the following exhibit:

Exhibit 99.10 Subscription Agreement, dated January 25, 2022.

- 5 -

|

|

|

|

|

| CUSIP No. 72765Q601 |

|

|

Page 6 of 6 |

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

In accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934,

as amended, the persons named below have agreed to the joint filing on behalf of each of them for this statement.

Date: February 22, 2022

|

|

|

| DEEPKLOOF LIMITED |

|

|

| By: |

|

Beaumont (Directors) Limited, corporate director |

|

|

| By: |

|

/s/ Karen Oliver |

|

|

Name: Karen Oliver |

|

|

Title: Director of Beaumont (Directors) Limited |

|

|

| By: |

|

/s/ Richard Stride |

|

|

Name: Richard Stride |

|

|

Title: Director of Beaumont (Directors) Limited |

|

| HCI INVEST14 HOLDCO (PTY) LIMITED |

|

|

| By: |

|

/s/ John Anthony Copelyn |

|

|

Name: John Anthony Copelyn |

|

|

Title: Director of HCI Invest14 Holdco (Pty) Limited |

|

| HOSKEN CONSOLIDATED INVESTMENTS LIMITED |

|

|

| By: |

|

/s/ John Anthony Copelyn |

|

|

Name: John Anthony Copelyn |

|

|

Title: Director of Hosken Consolidated Investments Limited |

- 6 -

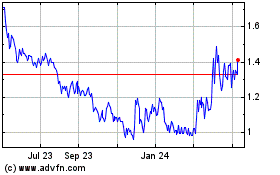

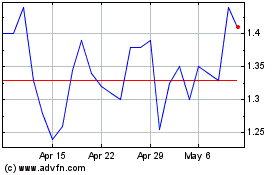

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Apr 2023 to Apr 2024