BASF Raises Guidance After Weathering Supply Bottlenecks in 3Q -- Update

October 27 2021 - 7:04AM

Dow Jones News

By Ed Frankl

BASF SE on Wednesday raised its 2021 guidance after it said it

generated strong sales growth in the third quarter, despite

flagging enduring supply-chain constraints.

The German chemicals conglomerate said that despite supply

bottlenecks, it anticipates continuing solid demand, expecting

full-year sales to grow to between EUR76 billion and EUR78 billion,

from EUR74 billion to EUR77 billion under previous guidance issued

in the summer.

The Ludwigshafen-based company posted revenue of EUR19.67

billion in the three months to the end of September, a 42% jump

on-year and above analysts' expectations of EUR17.83 billion

according to estimates provided by the company.

"Sales growth was due mainly to significantly higher prices

resulting from strong demand alongside, low product availability

and increased prices for raw materials," BASF said.

Demand remained solid during the summer months and, compared

with 3Q 2020, the company increased prices by 36% and volumes by

6%, BASF said.

"The basic demand from the consumer side is good," Chief

Executive Martin Brudermueller told a press conference, adding that

there are no signs that customers are ordering less, he said.

But growth momentum slowed compared with the second quarter of

2021 because of supply-chain issues, which the company assumes will

continue to hurt the global economic recovery in the fourth

quarter, BASF said. Hurricanes in the U.S. and raw-material

shortages negatively impacted product market availability, the

company added.

The company's automotive business was especially affected by

continuing chip shortages, it said, and BASF flagged power cuts in

China as having a negative impact on production.

Pandemic-related disruptions in production and logistics in Asia

intensified the scarcity of precursors world-wide, it added.

In its bottom line, BASF swung to a net profit of 1.25 billion

euros ($1.45 billion) for the third quarter, compared with a net

loss of EUR2.12 billion a year earlier that was heavily impacted by

the coronavirus pandemic.

Earnings before interest and taxes before special items came in

at EUR1.87 billion, around EUR1.28 billion higher year-on-year,

mainly due to its chemicals segment, BASF said.

Increases in earnings at the company's materials and industrial

solutions businesses also boosted profits. But its agricultural

solutions, automotive-centric surface technologies unit and

nutrition & care business declined considerably.

That earnings mix was comparable with the second quarter, Mr.

Brudermueller said.

"Our downstream businesses are still confronted with further

rising raw material, energy and freight costs. Price increases in

most downstream businesses could only partially offset these higher

costs," he said.

However, the company upgraded its guidance for 2021 EBIT before

special items to between EUR7.5 billion and EUR8.0 billion, from

EUR7.0 billion to EUR7.5 billion beforehand.

The company also now sees full-year return on capital employed

of 13.2%-14.1%, from between 12.1% and 12.9% before, and an

increase in its accelerator business sales to between EUR21.5

billion and EUR22.5 billion, from EUR21.0 billion-EUR22.0 billion

previously.

Olaf Ridder contributed to this article

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

October 27, 2021 06:49 ET (10:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

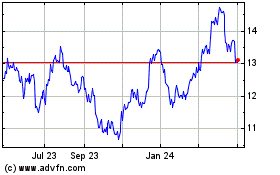

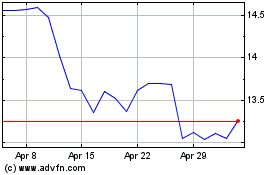

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2024 to May 2024

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From May 2023 to May 2024