Amazon Aggregator' Thrasio Tops $3.4 Billion of Funding With Silver Lake-Led Round

October 25 2021 - 1:51PM

Dow Jones News

By Josh Beckerman

Thrasio, an "Amazon aggregator" that has completed more than 150

acquisitions, reported the initial closing of more than $1 billion

in Series D financing led by Silver Lake, increasing total funding

to more than $3.4 billion.

The funding also includes Advent International, which remains

Thrasio's largest shareholder, as well as Upper 90, Oaktree Capital

Management, PEAK6 Investments and Corner Capital.

Thrasio products include Angry Orange pet deodorizers and stain

removers and SafeRest mattress protectors.

Investors quoted in Thrasio's press releases call it "the

largest ecommerce aggregator globally" and say it "created the

Amazon aggregator category," but a potentially more notable sign of

its importance is how often it's mentioned by other companies.

Nebula Brands said in July that it was joining the "race" with

Thrasio, and in September, Nebula led its own press release with a

discussion of Thrasio's financing and called itself "China's

Thrasio."

In September, shares of hemp, health and wellness company Grove

Inc. surged after the company said it was launching an Amazon

aggregation division. Grove quoted comments from research firm

Marketplace Pulse about a "breakout year" for Amazon aggregation in

2020 that included "Thrasio raising hundreds of millions of

dollars."

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

October 25, 2021 13:36 ET (17:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

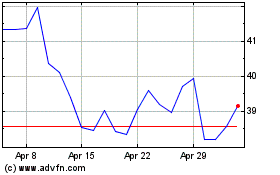

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Apr 2023 to Apr 2024