360 DigiTech, Inc. (QFIN) (“360 DigiTech” or the “Company”), a

leading financial technology platform in China, today announced its

unaudited financial results for the second quarter ended June 30,

2021.

Second Quarter 2021 Business

Highlights

- As of June 30, 2021, our digital

platform has connected 108 financial institutional partners and

175.9 million consumers*1 with potential credit needs,

cumulatively, an increase of 18.1% from 149.0 million a year

ago.

- Cumulative users with approved

credit lines*2 was 34.7 million as of June 30, 2021, an increase of

25.3% from 27.7 million as of June 30, 2020.

- Cumulative borrowers with

successful drawdown, including repeat borrowers was 22.3 million as

of June 30, 2021, an increase of 25.3% from 17.8 million as of June

30, 2020.

- In the second quarter of 2021,

financial institutional partners originated 27,714,920 loans*3,

totaling RMB88,452 million*4 through our platform, an increase of

50.2% from RMB58,905 million in the same period of 2020.

- Out of those loans originated by

financial institutions, RMB49,638 million was under capital-light

model and other technology solutions, representing 56.1% of the

total, an increase of 213.3% from RMB15,844 million in the same

period of 2020.

- Total outstanding balance*5 of the

loans originated by financial institutional partners through our

platform was RMB117,559 million as of June 30, 2021, an increase of

49.8% from RMB78,480 million as of June 30, 2020.

- RMB58,187 million of such loan

balance was under capital-light model and other technology

solutions, an increase of 186.4% from RMB20,316 million as of June

30, 2020.

- Financial institutions granted

approximately RMB7.1 billion credit lines to small and micro-sized

enterprises (SMEs)*6 through our platform in the second quarter of

2021, an increase of 22.4% from approximately RMB5.8 billion in the

prior quarter.

- The weighted average contractual

tenor of loans originated by financial institutions across our

platform in the second quarter of 2021 was approximately 10.66

months, compared with 9.57 months in the same period of 2020.

- 90 day+ delinquency ratio*7 of

loans originated by financial institutions across our platform was

1.19% as of June 30, 2021.

- Repeat borrower contribution*8 of

loans originated by financial institutions across our platform for

the second quarter of 2021 was 88.7%.

1 Refers to cumulative registered users across

our platform. 2 “Users with approved credit lines” refers to the

total number of users who had submitted their credit applications

and were approved with a credit line by the Company at the end of

each period. 3 Including 13,300,248 loans across “V-pocket”, and

14,414,672 loans across other products. 4 Refers to the total

principal amount of loans facilitated and originated during the

given period, including loans volume facilitated through

Intelligence Credit Engine (“ICE”) and other technology solutions.

“ICE” is an open platform on our “360 Jietiao” APP, we match

borrowers and financial institutions through big data and cloud

computing technology on “ICE”, and provide pre-loan investigation

report of borrowers. For loans facilitated through “ICE”, the

Company do not provide post-loan risk management nor bear principal

risk. 5 “Total outstanding loan balance” refers to the total amount

of principal outstanding for loans facilitated and originated at

the end of each period, including loan balance for “ICE” and other

technology solutions, excluding loans delinquent for more than 180

days. 6 SME loans are Loans issued to SMEs with e-commerce

operations, with business sales receipt, and/or with business

taxation record. 7 “90 day+ delinquency ratio” refers to the

outstanding principal balance of on- and off-balance sheet loans

that were 90 to 179 calendar days past due as a percentage of the

total outstanding principal balance of on- and off-balance sheet

loans across our platform as of a specific date. Loans that are

charged-off and loans under “ICE” and other technology solutions

are not included in the delinquency rate calculation. 8 “Repeat

borrower contribution” for a given period refers to (i) the

principal amount of loans borrowed during that period by borrowers

who had historically made at least one successful drawdown, divided

by (ii) the total loan facilitation and origination volume through

our platform during that period.

Second Quarter 2021 Financial

Highlights

- Total net revenue increased by

19.8% to RMB4,001.6 million (US$619.8 million) from RMB3,340.1

million in the same period of 2020.

- Income from operations increased by

86.6% to RMB1,853.1 million (US$287.0 million) from RMB993.2

million in the same period of 2020.

- Non-GAAP*9 income from operations

increased by 81.4% to RMB1,920.4 million (US$297.4 million) from

RMB1,058.9 million in the same period of 2020.

- Operating margin was 46.3%.

Non-GAAP operating margin was 48.0%.

- Net income increased by 76.6% to

RMB 1,547.9 million (US$239.7 million) from RMB876.5 million in the

same period of 2020.

- Non-GAAP net income increased by

71.4% to RMB1,615.2 million (US$250.2 million) from RMB942.1

million in the same period of 2020.

- Net income margin was 38.7%

Non-GAAP net income margin was 40.4%.

9 Non-GAAP income from operations (Adjusted

Income from operations), Non-GAAP net income (Adjusted net income),

Non-GAAP operating margin and Non-GAAP net income margin are

non-GAAP financial measures. For more information on this non-GAAP

financial measure, please see the section of “Use of Non-GAAP

Financial Measures Statement” and the table captioned "Unaudited

Reconciliations of GAAP and Non-GAAP Results" set forth at the end

of this press release.

Mr. Haisheng Wu, Chief Executive Officer and

Director of 360 DigiTech, commented, “We are very pleased to report

another record setting quarter that exceeded our expectations

across multiple fronts of operations. During the quarter, financial

institutions originated RMB88.5 billion loans through our platform,

up 50% year-on-year. Approximately 56% of the loans was facilitated

under the capital-light model and other technology solutions*10,

further demonstrating the attractiveness of our capital-light

models to financial institutions, and marking continued success in

our technology driven strategic transition and upgrading.

“Our embedded finance model gained further

popularity among our business partners with 22 leading traffic

platforms on board by the quarter ending, contributing

approximately 39% of new users with approved credit lines for the

quarter. On the SME front, we continued to ramp the operations

nicely with 22% sequential growth as the number of new SME

borrowers grew rapidly. Our strategic collaboration with Kincheng

Bank of Tianjin Co., Ltd. (“KCB”) also progressed smoothly and KCB

remained our largest institution partner in terms of loan

facilitation volume.

“In the first half of 2021, we delivered robust

growth in key operational and financial metrics as we gained market

share in a relatively stable macro environment. As we enter the

second half of the year, we continue to experience strong customer

demand, despite some uncertainties in macro environment. We

strongly believe recent regulatory actions will ultimately provide

additional policy clarity for a more healthy and consolidated

industry and benefit leading platforms like us. Our stress tests

indicate that even under the more restrictive regulatory guidelines

we should be able to maintain healthy growth and profitability in

the coming quarters and years. As our strategic initiatives have

achieved outstanding results across our operations thus far, we

feel more confident than ever to become one of the premium

financial technology platforms in the long run.”

“We are very pleased to report another quarter

of record financial results. Total revenue was RMB4.0 billion and

non-GAAP net income reached RMB1.62 billion. The robust financial

performance was driven by better than expected credit demand by

consumers and SMEs, further progress in our business initiatives,

and solid overall executions,” Mr. Alex Xu, Chief Financial

Officer, commented. “Continued improvement in asset quality, and

increased contribution from capital light model continued to drive

noticeable improvement in operating margins for the quarter. As we

close the stronger than expected first half 2021, we see continued

business momentum into the current quarter thus far, which gives us

increased confidence to exceed our previous operational targets for

2021.”

Mr. Yan Zheng, Chief Risk Officer, added, “Our

key risk management metrics remained at the best level in history

during the quarter as overall asset quality continued to improve.

Among the key leading indicators, Day-1 delinquency*11 remained at

a record low of approximately 5.0% in the second quarter, while the

30-day collection rate*12 staying above 90%, the best levels too.

More encouragingly, risk management metrics for the SME business

have performed better than we expected thus far, as we rapidly ramp

the business. Although we will continue to take prudent approach in

overall risk management operations, the effectiveness of our risk

management systems should enable us to deliver strong growth of

business while maintaining outstanding overall asset quality in the

foreseeable future.”

10 "We've used mainly data technology tools and

AI risk management systems in the process of providing such

services as loan facilitation, post-facilitation and borrowers'

referral to our customers. Revenue from these technology powered

services amount to 53% of our total net revenue." 11 "D1

delinquency rate" is defined as (i) the total amount of principal

that became overdue as of a specified date, divided by (ii) the

total amount of principal that was due for repayment as of such

date. 12 "M1 collection rate" is defined as (i) the amount of

principal that was repaid in one month among the total amount of

principal that became overdue as a specified date, divided by (ii)

the total amount of principal that became overdue as a specified

date.

Second Quarter 2021 Financial

Results

Total net revenue was

RMB4,001.6 million (US$619.8 million), compared to RMB3,340.1

million in the same period of 2020, and RMB3,599.2 million in the

prior quarter.

Net revenue from Credit Driven

Services was RMB2,404.7 million (US$372.4 million),

compared to RMB3,081.1 million in the same period of 2020, and

RMB2,451.3 million in the prior quarter.

Loan facilitation and servicing fees-capital

heavy were RMB540.7 million (US$83.7 million), compared to

RMB1,353.9 million in the same period of 2020 and RMB724.3 million

in the prior quarter. The year-over-year and sequential declines

were in part due to declined loan volume under capital heavy

model.

Financing income*13 was

RMB488.1 million (US$75.6 million), compared to RMB628.1 million in

the same period of 2020 and RMB409.4 million in the prior quarter.

The year-over-year and sequential changes reflected changes in

on-balance sheet loans.

Revenue from releasing of guarantee liabilities

was RMB1,352.3 million (US$209.4 million), compared to RMB1,076.6

million in the same period of 2020, and RMB1,295.4 million in the

prior quarter. The year-over-year and sequential growth was mainly

due to increase in average outstanding balance of off-balance-sheet

capital-heavy loans during the period.

Other services fees were RMB23.6 million (US$3.6

million), compared to RMB22.6 million in the same period of 2020,

and RMB22.2 million in the prior quarter. The year-over-year and

sequential increases were primarily due to fluctuation of late

payment fees.

Net revenue from Platform

Services was RMB1,596.9 million (US$247.3 million),

compared to RMB258.9 million in the same period of 2020 and

RMB1,147.9 million in the prior quarter.

Loan facilitation and servicing fees-capital

light were RMB1,398.7 million (US$216.6 million), compared to

RMB178.6 million in the same period of 2020 and RMB993.9 million in

the prior quarter. The year-over-year and sequential growth was

primarily due to growth in loan facilitation volume under

capital-light model.

Referral services fees were RMB160.3 million

(US$24.8 million), compared to RMB64.5 million in the same period

of 2020 and RMB126.3 million in the prior quarter. The

year-over-year and sequential increases were primarily due to the

facilitation volume growth through ICE.

Other services fees were RMB37.9 million (US$5.9

million), compared to RMB15.9 million in the same period of 2020

and RMB27.6 million in the prior quarter. The year-over-year and

sequential increases were mainly due to growth in late payment fees

as loan facilitation volume under capital-light model

increased.

Total operating costs and

expenses were RMB2,148.4 million (US$332.8 million),

compared to RMB2,346.8 million in the same period of 2020 and

RMB2,041.4 million in the prior quarter.

Facilitation, origination and servicing expenses

were RMB558.0 million (US$86.4 million), compared to RMB399.8

million in the same period of 2020 and RMB477.8 million in the

prior quarter. The year-over-year and sequential increases was

primarily due to growth in loan facilitation and origination

volume.

Funding costs were RMB83.2 million (US$12.9

million), compared to RMB161.1 million in the same period of 2020

and RMB79.1 million in the prior quarter. The year-over-year

decline was mainly due to increased funding contribution from ABS

with lower cost and decrease in on-balance sheet loans. The

sequential increase was primarily due to increase in outstanding

balance of on-balance sheet loans.

Sales and marketing expenses were RMB499.9

million (US$77.4 million), compared to RMB269.1 million in the same

period of 2020 and RMB385.0 million in the prior quarter. The

year-over-year and sequential increases were mainly due to a more

proactive customer acquisition strategy, development of new

customer acquisition channels, and higher online traffic costs as

overall business activities continued to expand in China.

General and administrative expenses were

RMB139.3 million (US$21.6 million), compared to RMB109.5 million in

the same period of 2020 and RMB104.5 million in the prior quarter.

The year-over-year and sequential increases were primarily due to

expanded business operations.

Provision for loans receivable was RMB247.0

million (US$38.3 million), compared to RMB218.6 million in the same

period of 2020 and RMB134.9 million in the prior quarter. The

year-over-year and sequential increases mainly reflect the

Company’s consistent approach in assessing provisions commensurate

with its underlying loan profile.

Provision for financial assets receivable was

RMB58.5 million (US$9.1 million), compared to RMB79.2 million in

the same period of 2020 and RMB45.1 million in the prior quarter.

The year-over-year decline was primarily due to decrease in

facilitation volume under capital-heavy model. The sequential

increase reflects the Company’s consistent approach in assessing

provisions commensurate with its underlying loan profile.

Provision for accounts receivable and contract

assets was RMB100.7 million (US$15.6 million), compared to RMB90.8

million in the same period of 2020 and RMB56.4 million in the prior

quarter. The year-over-year and sequential increases were primarily

due to growth in loan facilitation volume and in part due to the

Company’s consistent approach in assessing provisions commensurate

with its underlying loan profile.

Provision for contingent liability was RMB461.9

million (US$71.5 million), compared to RMB1,018.9 million in the

same period of 2020 and RMB758.7 million in the prior quarter. The

year-over-year and sequential declines were mainly due to loans

facilitated in prior quarters performed better than expected.

Income from operations was

RMB1,853.1 million (US$287.0 million), compared to RMB993.2 million

in the same period of 2020 and RMB1,557.8 million in the prior

quarter.

Non-GAAP income from

operations was RMB1,920.4 million (US$297.4 million),

compared to RMB1,058.9 million in the same period of 2020 and

RMB1,617.3 million in the prior quarter.

Operating margin was 46.3%.

Non-GAAP operating margin was 48.0%.

Income before income tax

expense was RMB1,953.2 million (US$302.5 million),

compared to RMB1,042.7 million in the same period of 2020 and

RMB1,605.3 million in the prior quarter.

Net income attributed to the

Company was RMB1,547.6 million (US$239.7 million),

compared to RMB876.5 million in the same period of 2020 and

RMB1,347.4 million in the prior quarter.

Non-GAAP net income

attributed to the Company was RMB1,614.9 million

(US$250.1 million), compared to RMB942.2 million in the same period

of 2020 and RMB1,407.0 million in the prior quarter.

Net income margin was 38.7%.

Non-GAAP net income margin was 40.4%.

Net income per fully diluted

ADS was RMB9.62 (US$1.48).

Non-GAAP net income per fully diluted

ADS was RMB10.03 (US$1.55).

Weighted average basic ADS used in

calculating GAAP and non-GAAP net income per ADS was

153.44 million.

Weighted average diluted ADS used in

calculating GAAP and non-GAAP net income per ADS was

160.98 million.

13 “Financing income” is generated from loans

facilitated through the Company’s platform funded by the

consolidated trusts and Fuzhou Microcredit, which charge fees and

interests from borrowers.

M1+ Delinquency Rate by Vintage and M6+

Delinquency Rate by Vintage

The following charts and tables display the

historical cumulative M1+ delinquency rates by loan facilitation

and origination vintage and M6+ delinquency rates by loan

facilitation and origination vintage for all loans facilitated and

originated through the company’s platform, loans that are

charged-off and loans under “ICE” and other technology solutions

are not included in the M1+ charts, loans under “ICE” and other

technology solutions are not included in the M6+ charts:

http://ml.globenewswire.com/Resource/Download/84b8ec08-b339-4369-92de-bb3eb964d81d

http://ml.globenewswire.com/Resource/Download/5bc9a261-1fd8-47d0-a01e-7793be795fc0

Share Repurchase Plan

The board of directors of the Company has

approved a share repurchase program whereby the Company is

authorized to repurchase up to US$200 million worth of its Class A

ordinary shares in the form of American depositary shares over the

next twelve-month period. The Company’s proposed repurchases may be

made from time to time in the open market at prevailing market

prices, in privately negotiated transactions, in block trades

and/or through other legally permissible means, depending on market

conditions and in accordance with applicable rules and regulations.

The Company expects to fund the repurchase out of its existing cash

balance.

Business Outlook

While we intend to keep our tradition of prudent

decision making and business planning, we are encouraged by strong

operating metrics in the first half of 2021. We see continued

healthy growth for the rest of the year. As such we now expect

total loan facilitation and origination volume for 2021 to be

between RMB340 billion and RMB350 billion, compared to our previous

guidance of between RMB310 billion and RMB330 billion, representing

year-on-year growth of 38% to 42%. This forecast reflects the

Company’s current and preliminary views, which is subject to

material change.

Conference Call

360 DigiTech’s management team will host an

earnings conference call at 8:30 PM U.S. Eastern Time on Thursday,

Aug 19, 2021 (8:30 AM Beijing Time on Aug 20).

|

United States: |

+1-646-722-4977 |

|

Hong Kong: |

+852-3027-6500 |

|

Mainland China: |

400-821-0637 |

|

International: |

+65-6408-5782 |

|

PIN: |

23407160# |

Please dial in 15 minutes before the call is

scheduled to begin and provide the PIN to join the call.

A telephone replay of the call will be available

after the conclusion of the conference call until August 26,

2021:

|

United States: |

+1-646-982-0473 |

|

International: |

+65-6408-5781 |

|

Access code: |

319341300# |

Additionally, a live and archived webcast of the

conference call will be available on the Investor Relations section

of the Company's website at ir.360shuke.com.

About 360 DigiTech

360 DigiTech, Inc. (NASDAQ: QFIN) (“360

DigiTech” or the “Company”) is a leading financial technology

platform. Through its platform the Company enables financial

institutions to provide better and targeted products and services

to a broader consumer base. The Company also offers standardized

risk management service, in the form of SaaS modules to

institutional clients. When coupled with its partnership with 360

Group, the Company’s solutions created noticeable advantages in

customer acquisition, funding optimization, risk assessment and

post-lending management.

For more information, please visit:

ir.360shuke.com

Use of Non-GAAP Financial Measures

Statement

To supplement our financial results presented in

accordance with U.S. GAAP, we use non-GAAP financial measure, which

is adjusted from results based on U.S. GAAP to exclude share-based

compensation expenses. Reconciliations of our non-GAAP financial

measures to our U.S. GAAP financial measures are set forth in

tables at the end of this earnings release, which provide more

details on the non-GAAP financial measures.

We use non-GAAP income from operation, non-GAAP

operation margin, non-GAAP net income, non-GAAP net income margin,

Non-GAAP net income attributed to the Company and Non-GAAP net

income per fully diluted ADS in evaluating our operating results

and for financial and operational decision-making purposes.

Non-GAAP income from operation represents income from operation

excluding share-based compensation expenses, non-GAAP net income

represents net income excluding share-based compensation expenses,

non-GAAP net income attributed to the Company represents net income

attributed to the Company excluding share-based compensation

expenses and non-GAAP net income per fully diluted ADS represents

net income per fully diluted ADS excluding share-based

compensation. Such adjustments have no impact on income tax. We

believe that non-GAAP income from operation and non-GAAP net income

help identify underlying trends in our business that could

otherwise be distorted by the effect of certain expenses that we

include in results based on U.S. GAAP. We believe that non-GAAP

income from operation and non-GAAP net income provide useful

information about our operating results, enhance the overall

understanding of our past performance and future prospects and

allow for greater visibility with respect to key metrics used by

our management in its financial and operational decision-making.

Our non-GAAP financial information should be considered in addition

to results prepared in accordance with U.S. GAAP, but should not be

considered a substitute for or superior to U.S. GAAP results. In

addition, our calculation of non-GAAP financial information may be

different from the calculation used by other companies, and

therefore comparability may be limited.

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars at specified rates solely for

the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB6.4566 to US$1.00, the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of June 30, 2021.

Safe Harbor Statement

Any forward-looking statements contained in this

announcement are made under the "safe harbor" provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by terminology such as

"will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates" and similar statements. Among other things,

the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. 360 DigiTech may also

make written or oral forward-looking statements in its reports to

the U.S. Securities and Exchange Commission ("SEC"), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including the Company’s business outlook, beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, which factors include

but not limited to the following: the Company’s growth strategies,

the Company’s cooperation with 360 Group, changes in laws, rules

and regulatory environments, the recognition of the Company’s

brand, market acceptance of the Company’s products, services,

trends and developments in the credit-tech industry, governmental

policies relating to the credit-tech industry, general economic

conditions in China and around the globe, and assumptions

underlying or related to any of the foregoing. Further information

regarding these and other risks and uncertainties is included in

360 DigiTech's filings with the SEC. All information provided in

this press release and in the attachments is as of the date of this

press release, and 360 DigiTech does not undertake any obligation

to update any forward-looking statement, except as required under

applicable law.

For more information, please

contact:

360 DigiTech E-mail: ir@360shuke.com

Christensen

In China Mr. Eric Yuan Phone: +86-138-0111-0739

E-mail: Eyuan@christensenir.com

In US Ms. Linda Bergkamp Phone: +1-480-614-3004

Email: lbergkamp@christensenir.com

| |

|

|

|

| Unaudited

Condensed Consolidated Balance Sheets |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD") except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

| |

|

|

|

| |

December 31, |

June 30, |

June 30, |

| |

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

4,418,416 |

|

5,191,999 |

|

804,138 |

|

| Restricted

cash |

2,355,850 |

|

2,644,701 |

|

409,612 |

|

| Security

deposit prepaid to third-party guarantee companies |

915,144 |

|

960,992 |

|

148,839 |

|

| Funds

receivable from third party payment service providers |

131,464 |

|

107,430 |

|

16,639 |

|

| Accounts

receivable and contract assets, net |

2,394,528 |

|

2,161,313 |

|

334,745 |

|

| Financial

assets receivable, net |

3,565,482 |

|

4,066,901 |

|

629,883 |

|

| Amounts due

from related parties |

193,305 |

|

927,464 |

|

143,646 |

|

| Loans

receivable, net |

7,500,629 |

|

8,283,703 |

|

1,282,982 |

|

| Prepaid

expenses and other assets |

401,224 |

|

317,154 |

|

49,121 |

|

|

Total current assets |

21,876,042 |

|

24,661,657 |

|

3,819,605 |

|

|

Non-current assets: |

|

|

|

| Accounts

receivable and contract assets, net-non current |

307,937 |

|

310,426 |

|

48,079 |

|

| Financial

assets receivable, net-non current |

645,326 |

|

575,492 |

|

89,132 |

|

| Amounts due

from related parties |

- |

|

424,965 |

|

65,819 |

|

| Loans

receivable, net-non current |

87,685.00 |

|

1,181,681 |

|

183,019 |

|

| Property and

equipment, net |

19,360.00 |

|

18,965 |

|

2,937 |

|

| Intangible

assets |

3,403 |

|

4,814 |

|

746 |

|

| Deferred tax

assets |

1,398,562 |

|

1,026,681 |

|

159,013 |

|

| Other

non-current assets |

48,990 |

|

41,048 |

|

6,358 |

|

|

Total non-current assets |

2,511,263 |

|

3,584,072 |

|

555,103 |

|

|

TOTAL ASSETS |

24,387,305 |

|

28,245,729 |

|

4,374,708 |

|

|

|

|

|

|

|

LIABILITIES AND EQUITY LIABILITIES |

|

|

|

|

Current liabilities: |

|

|

|

| Payable to

investors of the consolidated trusts-current |

3,117,634 |

|

2,914,748 |

|

451,437 |

|

| Accrued

expenses and other current liabilities |

809,761 |

|

1,181,876 |

|

183,051 |

|

| Amounts due

to related parties |

71,562 |

|

83,036 |

|

12,861 |

|

| Short term

loans |

186,800 |

|

336,273 |

|

52,082 |

|

| Guarantee

liabilities-stand ready |

4,173,497 |

|

4,517,620 |

|

699,690 |

|

| Guarantee

liabilities-contingent |

3,543,454 |

|

3,248,496 |

|

503,128 |

|

| Income tax

payable |

1,227,314 |

|

876,932 |

|

135,819 |

|

| Other tax

payable |

254,486 |

|

248,737 |

|

38,524 |

|

|

Total current liabilities |

13,384,508 |

|

13,407,718 |

|

2,076,592 |

|

|

Non-current liabilities: |

|

|

|

| Deferred tax

liabilities |

37,843 |

|

98,777 |

|

15,299 |

|

| Payable to

investors of the consolidated trusts-noncurrent |

1,468,890 |

|

2,239,372 |

|

346,835 |

|

| Other

long-term liabilities |

14,974 |

|

12,605 |

|

1,952 |

|

|

Total non-current liabilities |

1,521,707 |

|

2,350,754 |

|

364,086 |

|

|

TOTAL LIABILITIES |

14,906,215 |

|

15,758,472 |

|

2,440,678 |

|

| Ordinary

shares |

21 |

|

21 |

|

3 |

|

| Additional

paid-in capital |

5,417,406 |

|

5,544,236 |

|

858,693 |

|

| Retained

earnings |

4,137,542 |

|

7,032,629 |

|

1,089,216 |

|

| Other

comprehensive income (loss) |

(74,391 |

) |

(90,183 |

) |

(13,968 |

) |

|

TOTAL 360 DIGITECH INC EQUITY |

9,480,578 |

|

12,486,703 |

|

1,933,944 |

|

|

Noncontrolling interests |

512 |

|

554 |

|

86 |

|

|

TOTAL EQUITY |

9,481,090 |

|

12,487,257 |

|

1,934,030 |

|

|

TOTAL LIABILITIES AND EQUITY |

24,387,305 |

|

28,245,729 |

|

4,374,708 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Unaudited

Condensed Consolidated Statements of Operations |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD") except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

2020 |

2021 |

2021 |

|

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

RMB |

RMB |

USD |

|

Credit driven services |

3,081,104 |

|

2,404,695 |

|

372,439 |

|

|

5,891,154 |

|

4,856,038 |

|

752,105 |

|

|

Loan facilitation and servicing fees-capital heavy |

1,353,871 |

|

540,737 |

|

83,749 |

|

|

2,520,990 |

|

1,265,047 |

|

195,931 |

|

|

Financing income |

628,117 |

|

488,088 |

|

75,595 |

|

|

1,237,513 |

|

897,528 |

|

139,009 |

|

|

Revenue from releasing of guarantee liabilities |

1,076,555 |

|

1,352,307 |

|

209,446 |

|

|

2,082,731 |

|

2,647,734 |

|

410,082 |

|

|

Other services fees |

22,561 |

|

23,563 |

|

3,649 |

|

|

49,920 |

|

45,729 |

|

7,083 |

|

|

Platform services |

258,948 |

|

1,596,863 |

|

247,323 |

|

|

631,793 |

|

2,744,729 |

|

425,105 |

|

|

Loan facilitation and servicing fees-capital light |

178,588 |

|

1,398,713 |

|

216,633 |

|

|

482,210 |

|

2,392,602 |

|

370,567 |

|

|

Referral services fees |

64,497 |

|

160,264 |

|

24,822 |

|

|

119,063 |

|

286,594 |

|

44,388 |

|

|

Other services fees |

15,863 |

|

37,886 |

|

5,868 |

|

|

30,520 |

|

65,533 |

|

10,150 |

|

|

Total net revenue |

3,340,052 |

|

4,001,558 |

|

619,762 |

|

|

6,522,947 |

|

7,600,767 |

|

1,177,210 |

|

|

Facilitation, origination and servicing |

399,766 |

|

557,979 |

|

86,420 |

|

|

747,419 |

|

1,035,735 |

|

160,415 |

|

|

Funding costs |

161,062 |

|

83,164 |

|

12,880 |

|

|

319,676 |

|

162,242 |

|

25,128 |

|

|

Sales and marketing |

269,054 |

|

499,937 |

|

77,430 |

|

|

492,062 |

|

884,946 |

|

137,061 |

|

|

General and administrative |

109,488 |

|

139,278 |

|

21,571 |

|

|

218,219 |

|

243,774 |

|

37,756 |

|

|

Provision for loans receivable |

218,569 |

|

246,979 |

|

38,252 |

|

|

525,828 |

|

381,887 |

|

59,147 |

|

|

Provision for financial assets receivable |

79,199 |

|

58,516 |

|

9,063 |

|

|

172,923 |

|

103,576 |

|

16,042 |

|

|

Provision for accounts receivable and contract assets |

90,811 |

|

100,684 |

|

15,594 |

|

|

147,787 |

|

157,116 |

|

24,334 |

|

|

Provision for contingent liabilities |

1,018,860 |

|

461,910 |

|

71,541 |

|

|

2,721,617 |

|

1,220,586 |

|

189,045 |

|

|

Total operating costs and expenses |

2,346,809 |

|

2,148,447 |

|

332,751 |

|

|

5,345,531 |

|

4,189,862 |

|

648,928 |

|

|

Income from operations |

993,243 |

|

1,853,111 |

|

287,011 |

|

|

1,177,416 |

|

3,410,905 |

|

528,282 |

|

|

Interest (expense) income, net |

15,228 |

|

46,491 |

|

7,201 |

|

|

24,978 |

|

82,875 |

|

12,836 |

|

|

Foreign exchange gain (loss) |

4,685 |

|

21,886 |

|

3,390 |

|

|

(23,887 |

) |

13,895 |

|

2,152 |

|

|

Other income, net |

29,569 |

|

31,697 |

|

4,909 |

|

|

92,290 |

|

50,811 |

|

7,870 |

|

|

Income before income tax expense |

1,042,725 |

|

1,953,185 |

|

302,511 |

|

|

1,270,797 |

|

3,558,486 |

|

551,140 |

|

|

Income taxes benefit (expense) |

(166,260 |

) |

(405,305 |

) |

(62,774 |

) |

|

(211,177 |

) |

(663,357 |

) |

(102,741 |

) |

| Net

income |

876,465 |

|

1,547,880 |

|

239,737 |

|

|

1,059,620 |

|

2,895,129 |

|

448,399 |

|

|

Net loss(income) attributable to noncontrolling interests |

49 |

|

(235 |

) |

(36 |

) |

|

302 |

|

(42 |

) |

(7 |

) |

| Net

income attributable to ordinary shareholders of the

Company |

876,514 |

|

1,547,645 |

|

239,701 |

|

|

1,059,922 |

|

2,895,087 |

|

448,392 |

|

| Net income

per ordinary share attributable to ordinary shareholders of 360

DigiTech, Inc. |

|

|

|

|

|

|

|

| Basic |

2.96 |

|

5.04 |

|

0.78 |

|

|

3.60 |

|

9.46 |

|

1.47 |

|

| Diluted |

2.88 |

|

4.81 |

|

0.74 |

|

|

3.50 |

|

9.02 |

|

1.40 |

|

| |

|

|

|

|

|

|

|

| Net income

per ADS attributable to ordinary shareholders of 360 DigiTech,

Inc. |

|

|

|

|

|

|

|

| Basic |

5.93 |

|

10.08 |

|

1.56 |

|

|

7.19 |

|

18.92 |

|

2.94 |

|

| Diluted |

5.76 |

|

9.62 |

|

1.48 |

|

|

6.99 |

|

18.04 |

|

2.80 |

|

| |

|

|

|

|

|

|

|

| Weighted

average shares used in calculating net income per ordinary

share |

|

|

|

|

|

|

|

| Basic |

295,737,611 |

|

306,879,800 |

|

306,879,800 |

|

|

294,669,797 |

|

305,886,883 |

|

305,886,883 |

|

| Diluted |

304,583,237 |

|

321,969,767 |

|

321,969,767 |

|

|

303,261,250 |

|

320,958,192 |

|

320,958,192 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Unaudited

Condensed Consolidated Statements of Cash Flows |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD") except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

2020 |

2021 |

2021 |

|

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

RMB |

RMB |

USD |

|

Net cash provided by operating activities |

1,371,444 |

|

1,296,321 |

|

200,775 |

|

|

2,743,957 |

|

3,049,369 |

|

472,287 |

|

| Net cash

provided (used in) by investing activities |

(783,765 |

) |

(2,251,756 |

) |

(348,753 |

) |

|

(485,390 |

) |

(2,707,090 |

) |

(419,275 |

) |

| Net cash

provided by financing activities |

258,833 |

|

538,379 |

|

83,384 |

|

|

645,303 |

|

722,907 |

|

111,964 |

|

| Effect of

foreign exchange rate changes |

1,126 |

|

(1,316 |

) |

(204 |

) |

|

3,514 |

|

(2,752 |

) |

(426 |

) |

| Net

increase(decrease) in cash and cash equivalents |

847,638 |

|

(418,372 |

) |

(64,798 |

) |

|

2,907,384 |

|

1,062,434 |

|

164,550 |

|

| Cash, cash

equivalents, and restricted cash, beginning of year |

5,895,596 |

|

8,255,072 |

|

1,278,548 |

|

|

3,835,850 |

|

6,774,266 |

|

1,049,200 |

|

| Cash, cash

equivalents, and restricted cash, end of year |

6,743,234 |

|

7,836,700 |

|

1,213,750 |

|

|

6,743,234 |

|

7,836,700 |

|

1,213,750 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

| Unaudited

Condensed Consolidated Statements of Comprehensive

(Loss)/Income |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD") except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

| |

Three months ended June 30, |

| |

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

Net income |

876,465 |

|

1,547,880 |

|

239,737 |

|

| Other

comprehensive income, net of tax of nil: |

|

|

|

| Foreign

currency translation adjustment |

(3,559 |

) |

(22,013 |

) |

(3,409 |

) |

| Other

comprehensive income |

(3,559 |

) |

(22,013 |

) |

(3,409 |

) |

|

Total comprehensive income |

872,906 |

|

1,525,867 |

|

236,328 |

|

| Net

loss(income) attributable to noncontrolling interests |

49 |

|

(235 |

) |

(36 |

) |

|

Comprehensive income attributable to ordinary

shareholders |

872,955 |

|

1,525,632 |

|

236,292 |

|

| |

|

|

|

| |

|

|

|

| |

Six months ended June 30, |

| |

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

| Net

income |

1,059,620 |

|

2,895,129 |

|

448,399 |

|

| Other

comprehensive income, net of tax of nil: |

|

|

|

| Foreign

currency translation adjustment |

27,401 |

|

(15,792 |

) |

(2,446 |

) |

| Other

comprehensive (loss) income |

27,401 |

|

(15,792 |

) |

(2,446 |

) |

|

Total comprehensive income |

1,087,021 |

|

2,879,337 |

|

445,953 |

|

| Net

loss(income) attributable to noncontrolling interests |

302 |

|

(42 |

) |

(7 |

) |

|

Comprehensive income attributable to ordinary

shareholders |

1,087,323 |

|

2,879,295 |

|

445,946 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

| Unaudited

Reconciliations of GAAP and Non-GAAP Results |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD") except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

|

| |

Three months ended June 30, |

| |

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

Reconciliation of Non-GAAP Net Income to Net

Income |

|

|

|

|

|

Net income |

876,465 |

|

1,547,880 |

|

239,737 |

|

| Add:

Share-based compensation expenses |

65,677 |

|

67,285 |

|

10,421 |

|

|

Non-GAAP net income |

942,142 |

|

1,615,165 |

|

250,158 |

|

| Non-GAAP net

income margin |

28.2 |

% |

40.4 |

% |

|

|

| GAAP net

income margin |

26.2 |

% |

38.7 |

% |

|

|

| |

|

|

|

|

| Net

income attributable to shareholders of 360 DigiTech,

Inc |

876,514 |

|

1,547,645 |

|

239,701 |

|

| Add:

Share-based compensation expenses |

65,677 |

|

67,285 |

|

10,421 |

|

|

Non-GAAP net income attributable to shareholders of 360

DigiTech, Inc |

942,191 |

|

1,614,930 |

|

250,122 |

|

| Weighted

average ADS used in calculating net income per ordinary share for

both GAAP and non-GAAP EPS -diluted |

152,291,619.00 |

|

160,984,884.00 |

|

160,984,884.00 |

|

| Net income

per ADS attributable to ordinary shareholders of 360 DigiTech, Inc.

-diluted |

5.76 |

|

9.62 |

|

1.48 |

|

| Non-GAAP net

income per ADS attributable to ordinary shareholders of 360

DigiTech, Inc. -diluted |

6.19 |

|

10.03 |

|

1.55 |

|

| |

|

|

|

|

|

Reconciliation of Non-GAAP Income from operations to Income

from operations |

|

|

|

|

| Income from

operations |

993,243 |

|

1,853,111 |

|

287,011 |

|

| Add:

Share-based compensation expenses |

65,677 |

|

67,285 |

|

10,421 |

|

|

Non-GAAP Income from operations |

1,058,920 |

|

1,920,396 |

|

297,432 |

|

| Non-GAAP

operating margin |

31.7 |

% |

48.0 |

% |

|

|

| GAAP

operating margin |

29.7 |

% |

46.3 |

% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Six months ended June 30, |

| |

2020 |

2021 |

2021 |

| |

RMB |

RMB |

USD |

|

Reconciliation of Non-GAAP Net Income to Net

Income |

|

|

|

|

| Net

income |

1,059,620 |

|

2,895,129 |

|

448,399 |

|

| Add:

Share-based compensation expenses |

137,051 |

|

126,831 |

|

19,644 |

|

|

Non-GAAP net income |

1,196,671 |

|

3,021,960 |

|

468,043 |

|

| Non-GAAP net

income margin |

18.3 |

% |

39.8 |

% |

|

|

| GAAP net

income margin |

16.2 |

% |

38.1 |

% |

|

|

| |

|

|

|

|

| Net

income attributable to shareholders of 360 Finance,

Inc |

1,059,922 |

|

2,895,087 |

|

448,392 |

|

|

Non-GAAP net income attributable to shareholders of 360

Finance, Inc |

1,196,973 |

|

3,021,918 |

|

468,036 |

|

| Weighted

average ADS used in calculating net income per ordinary share

-diluted |

151,630,625 |

|

160,479,096 |

|

160,479,096 |

|

| Net income

per ADS attributable to ordinary shareholders of 360 Finance, Inc.

-diluted |

6.99 |

|

18.04 |

|

2.79 |

|

| Non-GAAP net

income per ADS attributable to ordinary shareholders of 360

Finance, Inc. -diluted |

7.89 |

|

18.83 |

|

2.92 |

|

| |

|

|

|

|

|

Reconciliation of Non-GAAP Income from operations to Income

from operations |

|

|

|

|

| Income from

operations |

1,177,416 |

|

3,410,905 |

|

528,282 |

|

| Add:

Share-based compensation expenses |

137,051 |

|

126,831 |

|

19,644 |

|

|

Non-GAAP Income from operations |

1,314,467 |

|

3,537,736 |

|

547,926 |

|

| Non-GAAP

operating margin |

20.2 |

% |

46.5 |

% |

|

|

| GAAP

operating margin |

18.1 |

% |

44.9 |

% |

|

|

| |

|

|

|

|

|

|

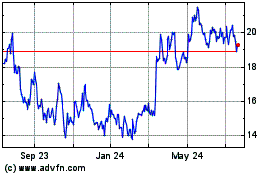

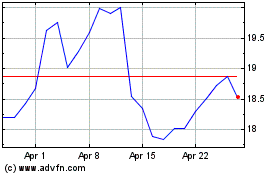

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024