Elliott Urges Duke Energy to Consider Separation Into Three Companies

May 17 2021 - 12:10PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Activist investor Elliott Management Corp. is urging Duke Energy

Corp. to consider separating into three companies, in what would be

a major transformation of one of the nation's biggest

utilities.

Elliott is seeking board seats at Duke and wants the company to

form a strategic-review committee that would explore the

possibility of a tax-free separation of the utility into three

companies, according to people familiar with the matter. The three

companies would be based on the three major geographies it serves:

the Carolinas, Florida and parts of the Midwest.

The Wall Street Journal previously reported that Elliott had a

stake in Duke and was agitating for change, but the firm's exact

intentions weren't clear, nor was the size of its stake. Elliott

told Duke in a letter that it is one of its 10-largest

shareholders, which would put the stake above $900 million, one of

the people said.

Charlotte, N.C.-based Duke, which has a market value of around

$65 billion, provides electricity to nearly eight million customers

in six states including the Carolinas, some Midwestern states and

Florida. It distributes natural gas to 1.6 million customers in

Ohio, Kentucky, Tennessee and the Carolinas.

Write to Cara Lombardo at cara.lombardo@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

May 17, 2021 11:55 ET (15:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

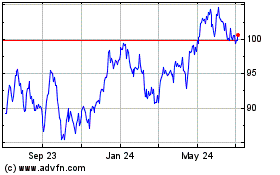

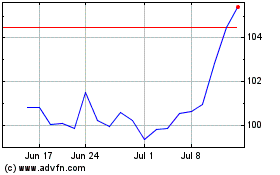

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Sep 2023 to Sep 2024