Uber's First Quarter Shows Food Delivery's Continuing Strength

May 05 2021 - 4:44PM

Dow Jones News

By Preetika Rana

Uber Technologies Inc.'s first-quarter bookings rose despite

weak demand for its ride-sharing service, as sustained growth in

its food-delivery business offset the slump in its core

operations.

Uber's gross bookings grew 24% year-over-year to $19.5 billion

in the three months ended March, of which $12.5 billion came from

its food-delivery arm. Uber Eats' bookings more than doubled from a

year earlier, while Uber's ride business declined 38% over the same

period.

Even though Uber's total bookings grew and beat analyst

forecasts, its overall revenue declined because of an adjustment

tied to a driver reclassification dispute in the U.K. The company

reported revenue of $2.9 billion after setting aside $600 million

tied to the reclassification. That compares with revenue of $3.2

billion in the same period last year.

In March -- after losing a monthslong legal battle -- Uber

granted its U.K. drivers an employment status entitling them to

vacation pay and pension contributions. While Uber won a major

reclassification dispute in its home state of California late last

year, regulatory challenges are far from over.

The Biden administration said earlier Wednesday it would block a

Trump-era proposal that sought to make it easier for Uber and

others to continue classifying gig workers as independent

contractors. The move maintains the status quo, meaning Uber

doesn't need to change its labor model. But the current

administration's stance may add to regulatory snares down the

road.

Despite the U.K. changes, the company reported a narrower net

loss as it benefited from the recent sale of its self-driving unit.

Uber reported a net loss of $108 million, compared with a loss of

$2.9 billion in the year-earlier period.

The San Francisco-based ride-hailing company also narrowed its

adjusted loss before interest, taxes, depreciation and

amortization, beating Wall Street's projections. Uber reported an

adjusted Ebitda loss of $359 million, compared with a loss by that

measure of $612 million in the same year-ago period. Analysts

surveyed by FactSet had expected an adjusted Ebitda loss of $452

million.

Investors are closely watching this number because Uber has said

it expects to be profitable by this measure before the year ends.

Silicon Valley startups often point to an adjusted metric that

strips the business of certain costs so they can show investors a

path to profitable growth.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

May 05, 2021 16:29 ET (20:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

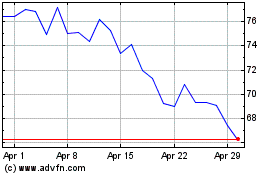

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Aug 2024 to Sep 2024

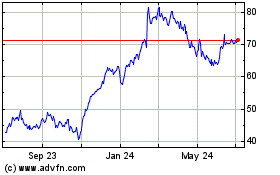

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Sep 2023 to Sep 2024