Sheldon Adelson's Casino Empire Installs New Leadership -- Update

January 26 2021 - 6:43PM

Dow Jones News

By Katherine Sayre

The reins to Sheldon Adelson's gambling empire are now in the

hands of a deputy and a son-in-law. The executive shift sets in

motion a succession plan as Las Vegas Sands Corp. moves forward

without its founder.

The company's board named Rob Goldstein, 65 years old, chief

executive and chairman on Tuesday. Until now, Mr. Adelson had been

the only CEO of the company he began in 1989. Mr. Adelson died Jan.

11 at the age of 87 from complications of treatment for non-Hodgkin

lymphoma.

Mr. Goldstein steps into the top job from his most recent post

as chief operating officer and president. He joined Sands about 25

years ago and worked on significant company projects such as the

Venetian, which opened in 1999 as Mr. Adelson's first mega-casino

on the Las Vegas Strip. Mr. Goldstein was widely viewed by Wall

Street analysts as the expected successor, and he was named acting

CEO when Mr. Adelson began a medical leave earlier this month.

Patrick Dumont, 46, Mr. Adelson's son-in-law, was elevated to

chief operating officer and president Tuesday, positioning him to

be the next Adelson family member to take the top job one day. Mr.

Dumont, previously chief financial officer, joined the company a

decade ago and is married to Sivan Ochshorn. Ms. Ochshorn is one of

two children from a prior marriage of Miriam Adelson, Mr. Adelson's

widow.

Sands, which has properties in Las Vegas, Macau and Singapore,

has a market capitalization of $40 billion, with $13.7 billion in

net revenue in 2019.

"He would expect nothing less than an aggressive pursuit of the

work he started, and I am determined to lead this company forward

in a way that best honors his vision," Mr. Goldstein said in a

written statement on Tuesday.

The Adelson family owns a majority stake in the company, with

nearly 57%. Much of the family stake -- valued at roughly $24

billion -- was already under the control of Miriam Adelson before

her husband's death, through shares she owned directly and in

family trusts she oversees.

Sands is scheduled to release 2020 earnings and host a call with

Wall Street analysts on Wednesday, the first since Mr. Adelson's

death. Company leaders are expected to say that Mr. Adelson's

estate isn't selling shares, which would assuage investor concerns

about insiders cashing in, said J.P. Morgan analyst Joseph Greff in

a note Monday.

Ms. Adelson, a physician, isn't expected to take on a day-to-day

management role in Sands, according to a person familiar with the

matter. She founded addiction-treatment and -research clinics in

Las Vegas and Tel Aviv and is publisher of a newspaper in Israel.

The Adelsons also own the Las Vegas Review-Journal and have been

large financial backers of Republican election candidates.

Randy Hyzak, previously Sands's senior vice president and chief

accounting officer, was named chief financial officer. He has been

with Sands since March 2016.

The executive changes come at a disruptive time for the gambling

industry. In part, casino operators' hopes for recovery from the

economic hit of the Covid-19 pandemic depend on how quickly

vaccines can be distributed and international travel can resume in

full. As a result of the pandemic, casinos have re-examined their

long-term operating costs. Some have turned to online and sports

betting in the U.S. for new revenue streams. Las Vegas Sands's

revenue plummeted 82% in the third quarter of last year, compared

with the same quarter of the previous year.

In Macau, where Mr. Adelson helped shape the Chinese territory

into a global gambling hub, revenue took a heavy hit last year.

Total gambling revenue fell 79% from the previous year. Casinos

closed temporarily in early 2020 and Covid-19 travel restrictions

have limited the flow of visitors into Macau. Meanwhile, Macau

operators have a critical deadline looming. Casino licenses are set

to expire in 2022, and companies will have to pursue renewed

licenses from the Macau government.

"We believe long term in the future of Macau, as an important

place to visit for all of China and perhaps even all of Asia," Mr.

Goldstein said in a recent interview, before Mr. Adelson's death.

Mr. Goldstein added that securing another casino license in Macau

is fundamental to the company's future.

In Las Vegas, casino operators' revenue depends heavily on large

group events and trade shows, a vision that Mr. Adelson helped

shape with his early development of the Sands Expo and Convention

Center on the Strip in 1990. The expo center now has 2 million

square feet of space.

In October, Sands said it was considering selling its Las Vegas

properties, which include the expo center and the Venetian and

Palazzo hotel-casinos. Mr. Goldstein said in the recent interview

that any sale of Sands's Las Vegas properties hasn't been decided,

but in the meantime, the company is looking at expansion

opportunities in Texas and New York City.

Write to Katherine Sayre at katherine.sayre@wsj.com

(END) Dow Jones Newswires

January 26, 2021 18:28 ET (23:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

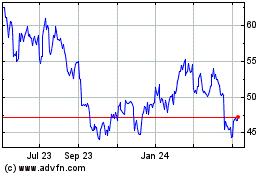

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

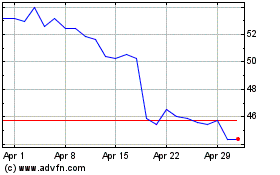

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Sep 2023 to Sep 2024