Current Report Filing (8-k)

August 14 2020 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

August 14, 2020

Date of Report

(Date of earliest event reported)

ODYSSEY GROUP

INTERNATIONAL, INC.

(Exact name of

registrant as specified in its charter)

333-200785

(Commission File

Number)

|

Nevada

|

47-1022125

|

|

(State or other jurisdiction of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

2372 Morse Ave., Irvine, CA

|

92614

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(619) 832-2900

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(g) of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock ($0.001 par value)

|

ODYY

|

OTC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On August 14,

2020, Odyssey Group International, Inc. (“Odyssey” or the “Company”) entered into a Securities

Purchase Agreement (the “Labrys SPA”) with Labrys Fund, LP, a Delaware limited partnership (“Labrys”)

pursuant to which Labrys purchased a Self-Amortization Promissory Note (the “Note”) in the principal amount of

$350,000 (the “Principal Amount”) for $315,000 in immediately available funds. The Company also issued Labrys

420,000 shares (the “Commitment Shares”) of common stock, par value $0.001 per share (“Common Stock”)

as a condition of the Labrys SPA. 350,000 of the Commitment Shares (the “Second Commitment Shares”) will be

returned to the Company if the Note is fully repaid and satisfied on or prior to August 14, 2021 (the “Maturity

Date”), subject further to the terms and conditions of the Note.

Labrys purchased

the Note for $315,000 with and original issuance discount of approximately 10%, resulting in the $350,000 principal amount of

the Note. The Note bears interest at 12% per year and matures on the Maturity Date. Upon the occurrence of any “Event

of Default” as defined in the Note and as further described below, the Note is convertible into shares of the

Company’s Common Stock at a price share equal to the closing bid price of the Common Stock on the trading day

immediately preceding the date of conversion, per share (the “Conversion Price”); provided, however, that

Labrys may not convert any portion of the Note which would cause Labrys collectively with its affiliates to hold more than

4.99% of the Company’s issued and outstanding Common Stock, unless such limit is waived.

Labrys may not execute

any short sales on any of the Company’s Common Stock at any time while the Note is outstanding.

The Note requires that the Company reserve

from its authorized and unissued Common Stock equal to the greater of: (a) 1,140,000 shares of Common Stock or (b) the sum of (i)

the number of shares of Common Stock issuable upon conversion of or otherwise pursuant to the Note and such additional shares of

Common Stock, if any, as are issuable on account of interest on the Note pursuant to the Labrys SPA issuable upon the full conversion

of the Note (assuming no payment of the principal amount or interest) as of any issue date (taking into consideration any adjustments

to the Conversion Price pursuant to Section 2 thereof or otherwise) multiplied by (ii) one and a half (1.5) (the “Reserved

Amount”). The Company is subject to penalties for failure to timely deliver shares to Labrys following a conversion request.

The Labrys SPA and the Note contain

other covenants and restrictions common with this type of debt transaction. Furthermore, the Company is subject to certain negative

covenants under the Labrys SPA and the Note, which the Company also believes are also customary for transactions of this type.

The foregoing descriptions of the Labrys SPA and the Note are qualified in their entirety by the terms of the full text of the

Labrys SPA and the Note, which are filed as, respectively, Exhibits 10.1 and 10.2 hereto.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant.

|

The Labrys SPA and

the Note create a direct financial obligation of the Company as of August 14, 2020 to Labrys and are described in Item 1.01 above.

The Note obligates the Company to pay to Labrys the Principal Amount and interest accrued thereon at a rate of 12% per annum from

the date thereof until the Principal Amount becomes due and payable on the Maturity Date, or upon acceleration, prepayment or as

further provided therein. The default interest rate is the lesser of 16% per annum and the maximum amount permitted by law. Upon

the occurrence and during the continuation of any “Event of Default” as defined in the Note, Labrys shall no longer

be required to return the Second Commitment Shares to the Company and the Note shall become immediately due and payable and the

Company shall pay to Labrys in full satisfaction of its obligations hereunder, an amount equal to the Principal Amount then outstanding

plus accrued interest (including any default interest) through the date of full repayment multiplied by 115%. Labrys has the right,

upon the occurrence of an Event of Default, to convert all or any portion of the then outstanding and unpaid Principal Amount and

interest thereon (including any default interest) into fully paid and non-assessable shares of Common Stock, or any shares of capital

stock or other securities of the Company into which such Common Stock shall thereafter be changed or reclassified, at the Conversion

Price determined as provided therein.

Upon a change of control

or sale conveyance or disposition of all or substantially all of the assets of the Company, the Company, the Company shall be required

to pay to Labrys upon the consummation of and as a condition to such transaction an amount equal to the total outstanding balance

under the Note.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

See Item 1.01 for discussion

of the Commitment Shares and the Note issued to Labrys. The Commitment Shares and the Note were issued in reliance upon the exemption

from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”), as amended,

and Rule 506(b) of Regulation D as promulgated by the Securities and Exchange Commission under the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ODYSSEY GROUP INTERNATIONAL, INC.

|

|

|

|

|

|

Date:

August 14, 2020

|

By:

|

/s/ Joseph Michael Redmond

|

|

|

|

Name: Joseph Michael Redmond

|

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

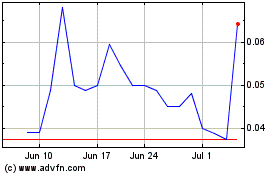

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

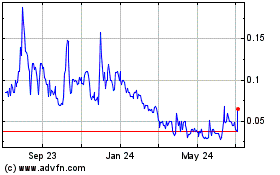

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Apr 2023 to Apr 2024