Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the

Securities Exchange Act of 1934

|

PHOENIX INTERNATIONAL VENTURES, INC.

|

|

(

Exact name of registrant as specified in its charter

)

|

|

Nevada

|

|

20-8018146

|

|

(

State of other jurisdiction of

incorporation or organization

)

|

|

(

IRS Employer

Identification No.)

|

99 Wall Street

Suite 542

New York, NY 10005

(

Address of Principal

Executive Offices

) (

Zip Code

)

631-991-5461

(Registrant’s telephone number,

including area code)

Securities to be Registered Under

Section 12(b) of the Act:

None

Securities

to be Registered Under Section 12(g) of the Act:

Common Stock, Par Value $0.001

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated

filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

PHOENIX INTERNATIONAL VENTURES, INC.

INDEX TO FORM 10

Cautionary Note Regarding Forward-Looking

Statements

This registration statement on Form 10

contains “forward-looking statements” concerning our future results, future performance, intentions, objectives, plans,

and expectations, including, without limitation, statements regarding the plans and objectives of management for future operations,

any statements concerning our proposed services, any statements regarding future economic conditions or performance, and any statements

of assumptions underlying any of the foregoing. All forward-looking statements included in this document are made as of the date

hereof and are based on information available to us as of such date. We assume no obligation to update any forward-looking statements.

In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,”

“expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,”

“potential,” or “continue,” or the negative thereof or other comparable terminology. Although we believe

that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that

such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially

from those projected or assumed in the forward-looking statements. Future financial condition and results of operations, as well

as any forward-looking statements are subject to inherent risks and uncertainties, including those discussed under “Risk

Factors” and elsewhere in this Form 10.

Introductory Comment

We are filing this General Form for Registration

of Securities on Form 10 to register our common stock pursuant to Section 12(g) of the Exchange Act. Once this registration statement

is deemed effective, we will be subject to the requirements of Section 13(a) under the Exchange Act, which will require us to file

annual reports on Form 10-K (or any successor form), quarterly reports on Form 10-Q (or any successor form), and current reports

on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration

statements pursuant to Section 12(g) of the Exchange Act.

Throughout this Form 10, unless the context

otherwise requires, the terms “we,” “us,” “our,” the “Company” and “our company”

refer to Phoenix International Ventures, Inc. a Nevada corporation.

Item 1.

Business

(a) Business Development

The Company was incorporated

on

August 7, 2006 under the laws of the State of Nevada.

Our fiscal year end is December

31.

On December 1, 2006

, the Company and Phoenix Aerospace, Inc. entered into a Share

Exchange Agreement whereby Phoenix Aerospace, Inc. exchanged all of its issued and outstanding common shares for 3,000,000 of the

Company’s common shares. As a result of this transaction, Phoenix Aerospace, Inc. became a wholly owned subsidiary of the

Company.

The Company was formed

to invest and develop business in the fields of aerospace and defense. The Company, through its wholly owned subsidiary, Phoenix

Aerospace, Inc. (ISO-Certified), designed, manufactured, upgraded and remanufactured electrical, hydraulic and mechanical support

equipment primarily for the United States Air Force and Navy and the United States defense-aerospace industry.

On September 4, 2018 the

Eighth District Court of Clark County, Nevada granted the Application for Appointment of Custodian as a result of the absence of

a functioning board of directors and the revocation of the Company’s charter. The order appointed Small Cap Compliance, LLC

custodial with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock and authorize

new classes of stock. On September 7, 2018, the Company filed a Form 15 terminating the registration of its Common Stock under

Section 12(g) of the Securities Exchange Act of 1934.

Small Cap Compliance, LLC performed the following actions in

its capacity as custodian:

|

|

·

|

funded any expenses of the company including paying off outstanding liabilities, incurred in 2018.

|

|

|

|

|

|

|

·

|

brought the Company back into compliance with the Nevada Secretary of State, resident agent, transfer agent, OTC Markets Group

|

|

|

|

|

|

|

·

|

Appointed officers and directors and held a shareholders meeting

|

Small Cap Compliance, LLC received $40,000 in 2018 from an investor

on behalf of the Company in connection with performing its role as custodian of the Company and paying Company debt.

On September 6, 2018, Rhonda Keaveney was appointed officer

and director; Ms. Keaveney is owner of Small Cap Compliance, LLC. She resigned all positions on September 25, 2018.

On February 1, 2019, the Company acquired Neon Bloom, Inc. f/k/a

Green Leaf Investment Fund, Inc. (the “Subsidiary”). This acquisition was made by the issuance of shares at a one for

one conversion rate with the existing shareholders of the Subsidiary.

On September 25, 2018, Douglas DiSanti was appointed the Company’s

sole officer and director.

We are currently a shell company, as defined in Rule 405 under

the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2.

(b) Business of Issuer

Neon Bloom, Inc. f/k/a,

Green

Leaf Investment Fund, Inc.

and

Weed Real Estate, Inc., (“

NEON

”),

is a developmental stage company, incorporated under the laws of the State of Nevada on May 4, 2015.

We are a science-based

company that uses plant science, innovative proprietary products and technology to promote wellness and remedies in the medical

cannabis and hemp industries. In summary,

NEON is focused on making strategic investments

and providing consulting in both the cannabis and hemp industries.

Subject to available capital, the Company intends to invest

in and form joint ventures in the following areas of the cannabis industry:

|

|

·

|

Owning land under cultivation

|

|

|

·

|

Contract farming under cultivation

|

|

|

·

|

Build platforms in the following areas:

|

|

|

·

|

Marketing and Social Media

|

|

|

·

|

Extraction, processing and packaging

|

The Company intends to implement its business plan through acquisitions

and portfolio holdings.

The analysis of new Business Combinations will be undertaken

by or under the supervision of our management. As of the date of this filing, we have entered into definitive agreements. In our

continued efforts to analyze potential Business Combinations, we intend to consider the following factors:

|

|

·

|

Potential for growth, indicated by anticipated market expansion, new products or new technology;

|

|

|

·

|

Competitive position as compared to other firms of similar size and experience within the industry segment as well as within

the industry as a whole;

|

|

|

·

|

Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional

assistance and other required items;

|

|

|

·

|

Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through

the sale of additional securities or convertible debt, through joint ventures or similar arrangements or from other sources;

|

|

|

·

|

The cost of participation by the Company as compared to the perceived tangible and intangible values and potentials;

|

|

|

·

|

The extent to which the business opportunity can be advanced in the marketplace; and

|

|

|

·

|

Other relevant factors.

|

In applying the foregoing criteria, no one of which will be

controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative

measures and available data. Due to our limited capital available for investigation, we may not discover or adequately evaluate

adverse facts about the opportunity to be acquired. Additionally, we will be competing against other entities that may have greater

financial, technical and managerial capabilities for identifying and completing business acquisitions or mergers.

We are unable to predict when we will, if ever, identify and

enter into any definitive agreement with potential merger or acquisition candidates. We anticipate that proposed Business Combinations

would be made available to us through personal contacts of our directors, officers and principal stockholders, professional advisors,

broker-dealers, venture capitalists, members of the financial community and others who may present unsolicited proposals. In certain

cases, we may agree to pay a finder’s fee or to otherwise compensate the persons who introduce the Company to business opportunities

in which we participate.

We expect that our due diligence will encompass, among other

things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well as a

review of financial and other information which is made available to the Company. This due diligence review will be conducted either

by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu

of cash payments for services or expenses related to any analysis.

We may incur time and costs required to select and evaluate

a target business opportunity and to structure and complete a Business Combination, which cannot presently be determined with any

degree of certainty. Any costs incurred with respect to the indemnification and evaluation of a prospective Business Combination

that is not ultimately completed may result in a loss to the Company. Also, fees may be paid in connection with the acquisitions

or mergers. These fees may include legal costs, accounting costs, finder’s fees, consultant’s fees and other related

expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific business opportunities

and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial

management time and attention and substantial cost for accountants, attorneys, consultants and others. Costs may be incurred in

the investigation process, which may not be recoverable, if a decision is made not to participate in a specific Business Combination.

Furthermore, even if an agreement is reached for the participation in a specific business opportunity, the failure to consummate

that transaction may result in a loss to the Company of the related costs incurred.

Competition

Our competitors in

both the hemp and cannabis spaces, include professional growers and sellers of products and services dedicated to the

regulated cannabis industry, including the cultivation, processing, or retail sale of hemp and cannabis products. We compete

in markets where cannabis has been legalized and regulated. We expect that the quantity and composition of our competitive

environment will continue to evolve as the industry matures. Additionally, increased competition is possible to the extent

that new states and geographies enter the marketplace as a result of continued enactment of regulatory and legislative

changes that de-criminalize and regulate cannabis products. We believe that diligently establishing and expanding Business

Combination in new and existing locations will establish us established in the industry. Additionally, we expect that

establishing our product offerings in new and existing locations are factors that mitigate the risk associated with operating

in a developing competitive environment. Additionally, the contemporaneous growth of the industry as a whole will result in

new customers entering the marketplace, thereby further mitigating the impact of competition on our operations and

results.

Effect of Existing or Probable Governmental Regulations

on the Business

Upon effectiveness of this Form 10, we will be subject to the

Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, we will be required to file with the SEC annual reports

on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent

accounting oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also

(1) requires steps be taken to enhance the direct responsibility of senior members of management for financial reporting and for

the quality of financial disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to

public view, possible conflicts of interest affecting securities analysts; (3) creates guidelines for audit committee members’

appointment, and compensation and oversight of the work of public companies’ auditors; (4) prohibits certain insider trading

during pension fund blackout periods; and (5) establishes a federal crime of securities fraud, among other provisions.

We will also be subject to Section 14(a) of the Exchange Act,

which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules

and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders

at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information

outlined in Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least

10 days prior to the date that definitive copies of this information are provided to our stockholders.

In addition, the

United States federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811), which places controlled

substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I drug, which is viewed as highly addictive

and having no medical value. The United States Federal Drug Administration has not approved the sale of marijuana for any medical

application. Doctors may not prescribe cannabis for medical use under federal law, however, they can recommend its use under the

First Amendment. In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not

be denied services or other medications that are denied to those using illegal drugs.

Thirty-three states

and the District of Columbia currently have laws legalizing marijuana in some form. Three other states will soon join them after

recently passing measures permitting use of medical marijuana.

In January 2019, with the Democrats

regaining control of the House of Representatives a new bill was introduced into congress that seeks to regulate marijuana like

alcohol and has been numbered H.R. 420. The proposed bill would remove marijuana from the federal controlled substances list. The

“Regulate Marijuana Like Alcohol Act” would establish regulation for cannabis that would be overseen by the Bureau

of Alcohol, Tobacco, Firearms and Explosives.

Employees

As of January 1, 2019, we had one officer, but otherwise no

employees. We anticipate that we will begin to fill out our management team as and when we raise capital to begin implementing

our business plan. In the interim, we will utilize independent consultants to assist with accounting and administrative matters.

We currently have no employment agreements, and believe our consulting relationships are satisfactory. We plan to continue to hire

independent consultants from time to time on an as-needed basis.

Item 1A. Risk Factors

Risks Relating to Our Business

Our business involves

a number of very significant risks. Our business, operating results and financial condition could be seriously harmed as a result

of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks. You should

invest in our common stock only if you can afford to lose your entire investment.

We have extremely limited assets, have incurred

operating losses and have no current source of revenue.

We have had minimal assets. We do not expect to generate revenues

until we begin to implement our business plan. However, we can provide no assurance that we will produce any material revenues

for our stockholders, or that our business will operate on a profitable basis.

We will, in all likelihood, sustain operating expenses without

corresponding revenues, at least until the consummation of a Business Combination or successful internal development. This may

result in our incurring a net operating loss that will increase unless we consummate a Business Combination with a profitable business

or internally develop our business. We cannot assure you that we can identify a suitable Business Combination or successfully internally

develop our business, or that any such business will be profitable at the time of its acquisition by the Company or ever.

Our capital resources may not be sufficient to meet

our capital requirements, and in the absence of additional resources we may have to curtail or cease business operations.

We have historically generated negative cash flow and losses

from operations and could experience negative cash flow and losses from operations in the future. Our independent auditors have

included an explanatory paragraph in their report on our financial statements for the fiscal years ended December 31, 2017 and

2016 expressing doubt regarding our ability to continue as a going concern. We currently only have a minimal amount of cash available,

which will not be sufficient to fund our anticipated future operating needs. The Company will need to raise substantial sums to

implement its business plan. There can be no assurance that the Company will be successful in raising funds. To the extent that

the Company is unable to raise funds, we will be required to reduce our planned operations or cease any operations.

Marijuana remains illegal under

federal law

Marijuana remains a Schedule I controlled

substances and are illegal under federal law. Even in states that have legalized the use of marijuana, its sale and use remain

violations of federal law. The illegality of marijuana under federal law preempts state laws that legalize its use. Therefore,

strict enforcement of federal law regarding marijuana would likely result in our inability to proceed with our business plan.

Industrial Hemp - 2018 Farm Bill

The Farm Bill allows licensed

farmers nationwide to grow industrial hemp more freely. It removes industrial hemp from the illegal Schedule 1 drugs list,

giving it the same classification as any other commercial crop (AKA an “agricultural commodity”). Plus, there are no

restrictions around selling, possessing, or transporting industrial hemp across state lines (or any products made from it) as long

as it’s cultivated in line with the law.

It’s important to

distinguish industrial hemp—the plant that’s addressed in the Farm Bill—from the one we usually refer to as marijuana.

Although both are varieties of the

cannabis sativa

plant, industrial hemp is classified by law as containing less

than 0.3 percent of the psychoactive compound THC. Marijuana, on the other hand, is cannabis with 0.3 percent THC or more.

While CBD products produced

from industrial hemp are no longer considered Schedule I substances, CBD products that come from marijuana plants with more than

.03 percent THC are still federally illegal. (Even if the finished product itself has less than 0.3 percent THC.) At this point,

it’s unclear how the FDA will respond to the Farm Bill.

Our business is dependent on

laws pertaining to the marijuana industry

The United States

federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances,

including cannabis, in a schedule. Currently, cannabis and CBD (

0.3 percent THC or more)

are classified as Schedule I drugs, which are viewed as highly addictive and having no medical value and is illegal to distribute

and use. The United States Federal Drug Administration has not approved the sale of marijuana or CBD (

0.3

percent THC or more)

for any medical application. Doctors may not prescribe cannabis or CBD (

0.3

percent THC or more)

for medical use under federal law, however they can recommend its use under the First Amendment. In

2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis or CBD (

0.3

percent THC or more)

will not be denied services or other medications that are denied to those using illegal drugs.

Currently, thirty-three

states and the District of Columbia currently have laws legalizing marijuana and CBD in some form. In November 2016, California,

Massachusetts, Maine and Nevada all passed measures legalizing recreational marijuana. California’s Prop. 64 measure allows

adults 21 and older to possess up to one ounce of marijuana and grow up to six plants in their homes. Other tax and licensing provisions

of the law didn’t take effect until January 2018.

These noted state

laws, both proposed and enacted, are in direct conflict with the federal Controlled Substances Act, which makes cannabis use and

possession illegal on a national level. However, on August 29, 2013, the U.S. Department of Justice issued a memorandum providing

that where states and local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory

and enforcement systems, the federal government will rely upon states and local enforcement agencies to address cannabis activity

through the enforcement of their own state and local narcotics laws. The memorandum further stated that the U.S Justice Department’s

limited investigative and prosecutorial resources will be focused on eight priorities to prevent unintended consequences of the

state laws, including distribution of cannabis to minors, preventing the distribution of cannabis from states where it is legal

to states where it is not, and preventing money laundering, violence and drugged driving.

On December 11,

2014, the U.S. Department of Justice issued another memorandum with regard to its position and enforcement protocol with regard

to Indian Country, stating that the eight priorities in the previous federal memo would guide the United States Attorneys' cannabis

enforcement efforts in Indian Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration

enacted regulations that prohibit the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

On January 4, 2018, The Department of Justice lead by Jeff

Sessions issued a memo on federal marijuana enforcement policy announcing a return to the rule of law and the rescission of previous

guidance documents. Since the passage of the Controlled Substances Act (CSA) in 1970, Congress has generally prohibited the cultivation,

distribution, and possession of marijuana.

However, on January 18, 2019, the

new Attorney General William Barr stated in front of the Senate Judiciary Committee that he doesn't plan on using federal resources

to "go after" companies if they are complying with state law. That would be a reversal from the approach taken by his

predecessor, former Attorney General Jeff Sessions, who vowed to pursue federal violations more aggressively. According to Erik

Altieri, executive director of the National Organization for the Reform of Marijuana Laws (NORML), Barr's stance is a good sign

for advocates but it remains to be seen if his actions will follow through on his pledge. Our business could end and investors

could lose their total investment in the company if there is a reversal in this approach.

Laws and regulations affecting

our industry are constantly changing

The constant evolution

of laws and regulations affecting the marijuana industry could detrimentally affect our operations. Local, state and federal medical

marijuana laws and regulations are broad in scope and subject to changing interpretations. These changes may require us to incur

substantial costs associated with legal and compliance fees and ultimately require us to alter our business plan. Furthermore,

violations of these laws, or alleged violations, could disrupt our business and result in a material adverse effect on our operations.

In addition, we cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible

that regulations may be enacted in the future that will be directly applicable to our business.

We face a number of risks associated with potential

Business Combinations, including the possibility that we may incur substantial debt or convertible debt, which could adversely

affect our financial condition.

We intend to use reasonable efforts to complete Business Combinations.

Such Combinations will be accompanied by risks commonly encountered in acquisitions, including, but not limited to, insufficient

revenues to offset increased expenses associated with the acquisition. Failure to manage and successfully integrate the acquisition

we make could harm our business, our strategy and our operating results in a material way. Additionally, completing a Business

Combination is likely to increase our expenses and it is possible that we may incur substantial debt or convertible debt in order

to complete a Business Combination, which can adversely affect our financial condition. Incurring a substantial amount of debt

or convertible debt may require us to use a significant portion of our cash flow to pay principal and interest on the debt, which

will reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may

negatively impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing

costs, and impact the terms, conditions, and restrictions contained in possible future debt agreements, including the addition

of more restrictive covenants; impact our flexibility in planning for and reacting to changes in our business as covenants and

restrictions contained in possible future debt arrangements may require that we meet certain financial tests and place restrictions

on the incurrence of additional indebtedness and place us at a disadvantage compared to similar companies in our industry that

have less debt.

Our ability to hire and retain key personnel will

be an important factor in the success of our business and a failure to hire and retain key personnel may result in our inability

to manage and implement our business plan.

We may not be able to attract and retain the necessary qualified

personnel. If we are unable to retain or to hire qualified personnel as required, we may not be able to adequately manage and implement

our business plan. We currently have no employment or consulting agreements.

Our future success is highly dependent on the ability

of management to locate and attract suitable business opportunities and our stockholders will not know what business we will enter

into until we consummate a transaction with the approval of our then existing directors and officers.

The nature of our operations is highly speculative, and there

is a consequent risk of loss of an investment in the Company. The success of our plan of operations will depend to a great extent

on the operations, financial condition and management of future Business Combinations and internal development. While management

intends to seek business combinations with entities having established operating histories, we cannot provide any assurance that

we will be successful in locating opportunities meeting that criterion. In the event we complete a Business Combination, the success

of our operations may be dependent upon management of the acquired firm, its financial position and numerous other factors beyond

our control.

There can be no assurance that we will successfully

consummate a business combination or internally develop a successful business.

We can give no assurance that we will successfully identify

and evaluate suitable business opportunities or that we will conclude a Business Combination. We cannot guarantee that we will

be able to negotiate a Business Combination on favorable terms. No assurances can be given that we will successfully identify and

evaluate suitable business opportunities, that we will conclude a business combination or that we will be able to internally develop

a successful business. Our management and affiliates will play an integral role in establishing the terms for any future business

combination.

We will incur increased costs as a result of becoming

a reporting company, and given our limited capital resources, such additional costs may have an adverse impact on our profitability.

Following the effectiveness of this Form 10, we will be an SEC

reporting company. The Company currently has no business that produces revenues. However, the rules and regulations under the Exchange

Act require a public company to provide periodic reports with interactive data files which will require the Company to engage legal,

accounting and auditing services, and XBRL and EDGAR service providers. The engagement of such services can be costly and the Company

is likely to incur losses, which may adversely affect the Company’s ability to continue as a going concern. In addition,

the Sarbanes-Oxley Act of 2002, as well as a variety of related rules implemented by the SEC, have required changes in corporate

governance practices and generally increased the disclosure requirements of public companies. For example, as a result of becoming

a reporting company, we will be required to file periodic and current reports and other information with the SEC and we must adopt

policies regarding disclosure controls and procedures and regularly evaluate those controls and procedures.

The additional costs we will incur in connection with becoming

a reporting company will serve to further stretch our limited capital resources. In other words, due to our limited resources,

we may have to allocate resources away from other productive uses in order to pay any expenses we incur in order to comply with

our obligations as an SEC reporting company. Further, there is no guarantee that we will have sufficient resources to meet our

reporting and filing obligations with the SEC as they come due.

The time and cost of preparing a private company

to become a public reporting company may preclude us from entering into an acquisition or merger with the most attractive private

companies and others.

Target companies that fail to comply with SEC reporting requirements

may delay or preclude acquisitions. Sections 13 and 15(d) of the Exchange Act require reporting companies to provide certain information

about significant acquisitions, including certified financial statements for the company acquired, covering one or two years, depending

on the relative size of the acquisition. The time and additional costs that may be incurred by some target entities to prepare

these statements may significantly delay or essentially preclude consummation of an acquisition. Otherwise suitable acquisition

prospects that do not have or are unable to obtain the required audited statements may be inappropriate for acquisition so long

as the reporting requirements of the Exchange Act are applicable.

A Business Combination may result in a change of

control and a change of management.

In conjunction with completion of a business acquisition, it

is anticipated that we may issue an amount of our authorized but unissued common or preferred stock which represents a majority

of the voting power and equity of our capital stock, which would result in stockholders of a target company obtaining a controlling

interest in us. As a condition of the business combination agreement, our current stockholders may agree to sell or transfer all

or a portion of our common stock as to provide the target company with all or majority control. The resulting change in control

may result in removal of our present officers and directors and a corresponding reduction in or elimination of their participation

in any future affairs.

Risks Related to Our Shareholders and Shares of Common

Stock

There is presently no public market for our securities.

Our common stock is not currently trading on any market, and

a robust and active trading market may never develop. Because of our current status as a “shell company,” Rule 144

is not currently available. Future sales of our common stock by existing stockholders pursuant to an effective registration statement

or upon the availability of Rule 144 could adversely affect the market price of our common stock. A shareholder who decides to

sell some or all of his shares in a private transaction may be unable to locate persons who are willing to purchase the shares,

given the restrictions. Also, because of the various risk factors described above, the price of the publicly traded common stock

may be highly volatile and not provide the true market price of our common stock.

Our stock is not traded, so you may be unable to

sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares.

Even if our stock becomes traded, it is likely that our common

stock will be thinly traded, meaning that the number of persons interested in purchasing our common shares at or near bid prices

at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the

fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase

of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or

more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady

volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give

you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that

current trading levels will be sustained. Due to these conditions, we can give you no assurance that you will be able to sell your

shares at or near bid prices or at all if you need money or otherwise desire to liquidate your shares.

Our common stock may be considered a “penny

stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our common stock may be a “penny stock” if it meets

one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized”

national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less than $5.00 per share; or

(iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny

stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock”

regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually

signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for

the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor

for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i)

obtain from the investor information concerning his or her financial situation, investment experience and investment objectives;

(ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that

the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions;

(iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in

(ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects

the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may

make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise

dispose of them in the market or otherwise.

We expect to issue more shares in an acquisition

or merger which will result in substantial dilution.

Our Articles of Incorporation, as amended, authorize the Company

to issue an aggregate of 150,000,000 shares of common stock of which 14,085,285 shares are currently outstanding and 5,000,000

shares of Preferred Stock of which 5,000,000 shares of Convertible Series A Preferred Stock are authorized and 200,000 shares are

outstanding. Any acquisition or merger effected by the Company may result in the issuance of additional securities without stockholder

approval and may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. Moreover,

shares of our common stock issued in any such merger or acquisition transaction may be valued on an arbitrary or non-arm’s-length

basis by our management, resulting in an additional reduction in the percentage of common stock held by our then existing stockholders.

In an acquisition type transaction, our Board of Directors has the power to issue any or all of such authorized but unissued shares

without stockholder approval. To the extent that additional shares of common stock are issued in connection with a business combination

or otherwise, dilution to the interests of our stockholders will occur and the rights of the holders of common stock might be materially

adversely affected.

Obtaining additional capital though the sale of

common stock will result in dilution of stockholder interests.

We intend to raise additional funds in the future by issuing

additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants or

preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further

dilution of the equity ownership of existing holders of our common stock. Additionally, the existing conversion rights may hinder

future equity offerings, and the exercise of those conversion rights may have an adverse effect on the value of our stock. If any

such conversion rights are exercised at a price below the then current market price of our shares, then the market price of our

stock could decrease upon the sale of such additional securities. Further, if any such conversion rights are exercised at a price

below the price at which any particular stockholder purchased shares, then that particular stockholder will experience dilution

in his or her investment.

Our directors have the authority to authorize the

issuance of preferred stock

Our Articles of Incorporation, as amended, authorize the Company

to issue an aggregate of 5,000,000 shares of Preferred Stock. Our directors, without further action by our stockholders, have the

authority to issue shares to be determined by our board of directors of Preferred Stock with the relative rights, conversion rights,

voting rights, preferences, special rights and qualifications as determined by the board without approval by the shareholders.

Any issuance of Preferred Stock could adversely affect the rights of holders of common stock. Additionally, any future issuance

of preferred stock may have the effect of delaying, deferring, or preventing a change in control of the Company without further

action by the shareholders and may adversely affect the voting and other rights of the holders of common stock. Our Board does

not intend to seek shareholder approval prior to any issuance of currently authorized stock, unless otherwise required by law or

stock exchange rules.

We have never paid dividends on our common stock,

nor are we likely to pay dividends in the foreseeable future. Therefore you may not derive any income solely from ownership of

our stock.

We have never declared or paid dividends on our common stock

and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for payment

of dividends will be re-invested into the Company to further our business strategy. This means that your potential for economic

gain from ownership of our stock depends on appreciation of our stock price and will only be realized by a sale of the stock at

a price higher than your purchase price.

Item 2.

Financial Information

Management’s Discussion And Analysis Or Plan Of Operation

Upon effectiveness of this Registration Statement, we will file

with the SEC annual and quarterly information and other reports that are specified in the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and SEC regulations. Thus, we will need to ensure that we will have the ability to prepare, on

a timely basis, financial statements that comply with SEC reporting requirements following the effectiveness of this registration

statement. We will also become subject to other reporting and corporate governance requirements, including the listing standards

of any securities exchange upon which we may list our Common Stock, and the provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), and the regulations promulgated hereunder, which impose significant compliance obligations upon us. As a public company,

we will be required, among other things, to:

|

|

·

|

Prepare and distribute reports and other stockholder communications in compliance with our obligations under the federal securities laws and the applicable national securities exchange listing rules;

|

|

|

|

|

|

|

·

|

Define and expand the roles and the duties of our Board of Directors and its committees;

|

|

|

·

|

Institute more comprehensive compliance, investor relations and internal audit functions;

|

|

|

·

|

Evaluate and maintain our system of internal control over financial reporting, and report on management’s assessment thereof, in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and related rules and regulations of the SEC; and,

|

|

|

·

|

Involve and retain outside legal counsel and accountants in connection with the activities listed above.

|

Management for each year commencing with the year ending December

31, 2018 must assess the adequacy of our internal control over financial reporting. Our internal control over financial reporting

will be required to meet the standards required by Section 404 of the Sarbanes-Oxley Act. We will incur additional costs in order

to improve our internal control over financial reporting and comply with Section 404, including increased auditing and legal fees

and costs associated with hiring additional accounting and administrative staff. Ultimately, our efforts may not be adequate to

comply with the requirements of Section 404. If we are unable to implement and maintain adequate internal control over financial

reporting or otherwise to comply with Section 404, we may be unable to report financial information on a timely basis, may suffer

adverse regulatory consequences, may have violations of the applicable national securities exchange listing rules and may breach

covenants under our credit facilities.

The significant obligations related to being a public company

will continue to require a significant commitment of additional resources and management oversight that will increase our costs

and might place a strain on our systems and resources. As a result, our management’s attention might be diverted from other

business concerns. In addition, we might not be successful in implementing and maintaining controls and procedures that comply

with these requirements. If we fail to maintain an effective internal control environment or to comply with the numerous legal

and regulatory requirements imposed on public companies, we could make material errors in, and be required to restate, our financial

statements. Any such restatement could result in a loss of public confidence in the reliability of our financial statements and

sanctions imposed on us by the SEC.

NEON is a science-based company that uses plant science, innovative

proprietary products and technology to promote wellness and remedies in the medical cannabis and hemp industries. In addition we

have expanded our business plan to include acquisition of evolving opportunities in the cannabis industry. In summary,

NEON

is focused on making strategic investments and providing consulting in both the cannabis and hemp industries.

Subject to

available capital, the Company intends to develop relationships, joint ventures of the following items:

|

|

·

|

Owning land under cultivation

|

|

|

·

|

Contract farming under cultivation

|

|

|

·

|

Build platforms in the following areas:

|

|

|

·

|

Marketing and Social Media

|

|

|

·

|

Extraction, processing and packaging

|

|

|

·

|

B2C delivery Dispensaries

|

Results of Operations for Neon Bloom, Inc.—Comparison

of the Years Ended December 31, 2017 and 2016

Revenue

We had no revenues from operations during either 2017 or 2016.

General and Administrative

Expense

General and Administrative Expenses were $98,679 for the year

ended December 31, 2017 compared to $42,384 for the year ended December 31, 2016, an increase of $56,295 or 132.8%. The increase

can be largely attributed to an increase in consulting expense from $0 to $28,500, professional fees from $3,405 to $23,254 and

computer and internet expense from $0 to 15,174.

Stock compensation expense

During the year ended December 31, 2017, we incurred $438,000

on non-cash stock compensation expense from the issuance of common stock for services. There was no stock issued for services in

the prior year.

Net Loss

We had a net loss of $536,679 for the year ended December 31,

2017 compared to $42,384 for the year ended December 31, 2016. The large increase in net loss is mainly due to stock compensation

expense.

Liquidity and Capital Resources

As of December 31, 2017, we had $219,221 of cash, no liabilities

and an accumulated deficit of $608,279. We used $98,579 of cash in operations for the year ended December 31, 2017 and received

net proceeds from financing of $317,800.

The financial statements accompanying this Report have been

prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in

the normal course of our business. As reflected in the accompanying financial statements, we have not yet generated any revenue,

had a net loss of $536,679 and have a stockholders’ deficit of $608,279 as of December 31, 2017. These factors raise substantial

doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability

to raise additional funds and implement our business plan. The financial statements do not include any adjustments that might be

necessary if we are unable to continue as a going concern.

Item 3.

Properties

We neither rent nor own any properties. We

utilize the office space and equipment of our management at no cost. Management estimates such amounts to be immaterial. We currently

have no policy with respect to investments or interests in real estate, real estate mortgages or securities of, or interests in,

persons primarily engaged in real estate activities.

Item 4.

Security Ownership of Certain Beneficial Owners and Management

(a) Security ownership of certain beneficial owners.

The following table sets forth, as of January

21, 2019, the number of shares of common stock owned of record and beneficially by our executive officer, director and persons

who beneficially own more than 5% of the outstanding shares of our common stock.

|

Name and Address of Beneficial Owner

|

|

Amount and

Nature of

Beneficial Ownership

|

|

Percentage

of Class

|

|

|

Douglas DiSanti (1) (2) (3)

|

|

200,000

Convertible Series A Preferred Stock

|

|

|

100%

|

|

|

|

|

|

|

|

|

|

Uri Wittenberg

3 ne'ar hayarded St.

Modien 71700 Israel

|

|

1,066,667

Common Stock

|

|

|

8%

|

|

|

|

|

|

|

|

|

|

Zvi Barnes Nissensohn

27 Alexander pen

Tel Aviv 69641 Israel

|

|

857,477

Common Stock

|

|

|

6%

|

|

|

|

|

|

|

|

|

|

Zahir Teja

42 Carry Way Unit 1

Mound House, NV 89706

|

|

1,362,500

Common Stock

|

|

|

10%

|

|

|

|

|

|

|

|

|

|

Eliyahu Barzelai Holdings & Investments, Ltd.

7 Boyer Avraham St.

Tel Aviv 69127 Israel

|

|

711,566

Common Stock

|

|

|

5%

|

|

_________

|

(1)

|

Douglas DiSanti serves as an Officer (CEO) and Director of the Company.

|

|

|

|

|

(2)

|

Neon Bloom, Inc. is controlled by Mr. DiSanti,

Ownership of the three million (3,000,000) Preferred shares issued, equates to voting rights of twenty (20) common shares for every

one (1) Preferred share, totaling sixty million (60,000,000) shares. Therefore, Preferred shares give Mr. DiSanti effective voting

control of NEON on a fully dilutive basis.

|

|

|

|

|

(3)

|

Phoenix International Ventures, Inc. is controlled by Mr. DiSanti. Ownership of the two hundred thousand (200,000) Preferred A shares issued has no conversion rights, and voting rights of five hundred (500) common shares for every one (1) Preferred A share, totally one hundred million (100,000,000) shares giving Mr. DiSanti effective voting control of the Company on a fully dilutive basis.

|

Item 5.

Directors and Executive Officers

A. Identification of Directors and Executive Officers.

Our Officers and directors and additional information concerning

them are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Douglas DiSanti

|

|

29

|

|

CEO, Chairman, Secretary, Treasurer, Director

|

|

|

|

|

|

|

|

Mauricio Sernande III

|

|

42

|

|

President, COO, Director

|

|

|

|

|

|

|

|

Werner Huisman

|

|

48

|

|

Director

|

|

|

|

|

|

|

|

Margaret Dombrowski

|

|

40

|

|

Director

|

|

|

|

|

|

|

|

Dr. Jason (Joohwan) Noh

|

|

55

|

|

Director

|

Douglas DiSanti, President and Director

Mr. DiSanti has over 10 years’ experience in the commercial

real estate industry. He has held the position of underwriter with major banks and structured more than $1,500,000,000 in commercial

real estate loans. These loans were in the areas of warehouse and retail/office space, co-ops, condominiums and multi-family buildings.

In addition, Mr. DiSanti managed his own portfolio in excess of $1,000,000,000 billion while also heading up a team of portfolio

managers during his tenure at a multi-international bank. Mr. DiSanti received his MBA from Texas A&M and holds an M.S in Finance

from the College of Brockport.

We believe that Mr. DiSanti's experience in underwriting and

finance qualifies Mr. DiSanti to serve as an officer and director for our Company

Mauricio Sernande III, President, COO & Director

Mr. Sernande is a forward-thinking entrepreneur who has a passion

for community and globally impacting projects. He has served in a wide range of business and technical capacities for startups

and nonprofits. Mauricio is an innovator with a track record of transformational leadership strategies. Mauricio's skill set includes

developing strategic plans, improving business processes and creating innovative product platforms. Mauricio has 19 years of management

and technology consulting experience, and has worked with leading hardware and software companies to develop their technology platforms.

He currently devotes all of his time to our operations.

Werner Huisman, Director

Mr. Huisman has over 25

years as an entrepreneur. He has completed his study register consultant business succession and has worked for more than 10 years

in the mergers and acquisition (M&A) field. Mr. Heisman is considered a people manager and has an excellent view on new business

opportunities, especially in the field of sustainability. Werner has amassed an international wide network and currently speaks

four languages: Dutch, English, German and limited Spanish. Mr. Huisman specializes in mediation and his focus is on bridging the

gap between two parties to find a suitable solution.

Margaret Dombrowski,

Director

Mrs. Dombrowksi has extensive

experience as an entrepreneur and senior analyst for more than 20 years. Born in Hong Kong, Mrs. Dombrowski moved to Washington

at an early age and was awarded a full ride scholarship to Washington State University. She graduated in 3 years with Honors while

obtaining a triple major in Management Information Systems (MIS), Decision Science (Statistics) and Management. Mrs. Dombrowski

has a proven track record in developing a logic based scalable solution that are in line with her well-developed analytical skills. She

is the owner of several successful businesses, including a catering company, Agro Company and several property management companies.

Dr. Jason (Joohwan)

Noh, Director

Dr. Noh is an accomplished

system architect and relation builder with more than 20 years of system design and development experience in mission critical IT

and OT environments. He has an impressive track record leveraging his own subject matter expertise delivering highly available

transaction processing and process control systems with customer care as a key component for increased sales, in both “overhead”

and “P&L” driven environments. A customer-focused problem solver and change facilitator, he served as CTO of NSTech,

an engineering affiliate of NongShim Group in Korea, managing 9 plants that were located in Korea, US and China before he founded

SDPlex in Sep. 2017. Dr. Noh earned his Ph.D. in Computer Science in Stanford.

B. Significant Employees. None.

C. Family Relationships. None.

D. Involvement in Certain Legal Proceedings. There have been

no events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders of decrees material to the evaluation

of the ability and integrity of any director, executive officer, promoter or control person of Registrant during the past ten years.

E. The Board of Directors acts as the Audit Committee, and the

Board has no separate committees. The Company has no qualified financial expert at this time because it has not been able to hire

a qualified candidate. Further, the Company believes that it has inadequate financial resources at this time to hire such expert.

The Company intends to continue to search for a qualified individual for hire.

Item 6.

Executive Compensation

For the past five years, no sole officer

or director has received any cash remuneration. Our sole officer and director will receive $10,000 per month beginning on April

1, 2019. No remuneration of any nature has been paid for on account of services rendered by a director in such capacity to date.

Our sole officer and director intend to devote all of his time to Phoenix International Ventures, Inc. and its subsidiaries.

The Company for the benefit of its employees

has adopted no retirement, pension, profit sharing, stock option or insurance programs or other similar programs.

Item 7.

Certain Relationship and Related Transactions, and Director Independence

We utilize the office space and equipment

of our management at no cost.

Mr. DiSanti is our CEO. He is not deemed

to be independent under applicable rules. We have not established any committees of the Board of Directors.

Except as set forth above, there have been

no related party transactions, or any other transactions or relationships required to be disclosed.

Item 8.

Legal Proceedings

Presently, there are not any material pending

legal proceedings to which the Registrant is a party or as to which any of its property is subject, and no such proceedings are

known to the Registrant to be threatened or contemplated against it.

Item 9.

Market Price and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

(a) Market information

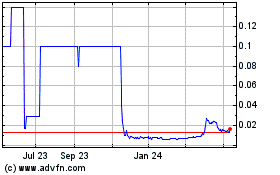

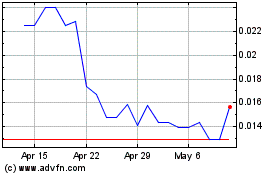

Our Common Stock is not trading on any stock

exchange. However it is currently quoted on OTC Markets under the symbol PIVN and there is no established public trading market

for the class of common equity.

(b) Holders

As of February 11, 2019, there are approximately

75 holders of an aggregate of 14,085,285 shares of our Common Stock issued and outstanding.

(c) Dividends.

We have not paid any cash dividends to date

and do not anticipate or contemplate paying dividends in the foreseeable future. It is the president intention of management to

utilize all available funds for the development of the Registrant’s business.

(d) Securities authorized for issuance under equity compensation

plans

None

Item 10.

Recent Sale of Unregistered Securities

None

Item 11.

Description of Registrant’s Securities to be Registered

(a) Common and Preferred Stock.

We are authorized by our Certificate of Incorporation

to issue an aggregate of 155,000,000 shares of capital stock, of which 150,000,000 are shares of common stock, Par Value $0.001

per share (the “Common Stock”) and 5,000,000 are shares of preferred stock, Par Value $0.001 per share (the “Preferred

Stock”). As of February 11, 2019, there are fourteen million eighty-five thousand two hundred and eighty five (14,085,285)

shares of Common Stock and two hundred thousand (200,000) shares of Convertible Series A Preferred Stock issued and outstanding

Common Stock

All outstanding shares of Common Stock are

of the same class and have equal rights and attributes. The holders of Common Stock are entitled to one vote per share on all matter

submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally dividends, if any, as may be

declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the holders of

Common Stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders do not have

cumulative or preemptive rights.

Preferred Stock

Our Certificate of Incorporation authorizes

the issuances of up to 5,000,000 shares of Preferred Stock with designations, rights and preferences determined from time to time

by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue Preferred Stock

with dividend, liquidation, conversion, voting, or other rights, which could adversely affect the voting power or, other rights

of the holders of the Common Stock. In the event of issuance, the Preferred Stock could be utilized, under certain circumstances,

as a method of discouraging, delaying or preventing a change in control of the Company.

Set forth are the rights, privileges and

terms of the outstanding series of Preferred Stock as set forth in the applicable Certificate of Designation.

CERTIFICATE OF DESIGNATION, SERIES A

PREFERRED STOCK

1. DESIGNATIONS OF SERIES; RANK.

The shares of such series shall be designated as

the "Convertible Series A Preferred Stock" (“Series A Stock”). It shall have 5,000,000 shares authorized

at $0.001 par value per share.

2 . DIVIDENDS.

The holders of Series A Stock shall not be entitled

to receive dividends paid on the Common Stock.

3. LIQUIDATION PREFERENCE.

In the event of any liquidation, dissolution or winding

up of the Corporation, either voluntary or involuntary, after setting apart or paying in full the preferential amounts due to Holders

of senior capital stock, if any, the Holders of Series A Stock and parity capital stock, if any, shall be entitled to receive,

prior and in preference to any distribution of any of the assets or surplus funds of the Corporation to the Holders of junior capital

stock, including Common Stock, an amount equal to $.001 per share [the "Liquidation Preference"]. If upon such liquidation,

dissolution or winding up of the Corporation, the assets of the Corporation available for distribution to the Holders of the Series

A Stock and parity capital stock, if any, shall be insufficient to permit in full the payment of the Liquidation Preference, then

all such assets of the Corporation shall be distributed ratably among the Holders of the Series A Stock and parity capital stock,

if any.

4. VOTING RIGHTS

The Holders of the Series A Stock shall be entitled

to 500 (five hundred) votes of Common Stock per every 1 (one) share of Series A Stock.

5. CONVERSION

RIGHTS.

The Series A Stock shall have no conversion rights.

6. REDEMPTION

RIGHTS.

The shares

of Preferred Stock shall have no redemption rights.

The description of certain matters relating to the securities

of the Company is a summary and is qualified in its entirely by the provisions of the Company’s Certificate of Incorporation

and By-Laws, copies of which have been filed as exhibits to this Form 10.

(b) Debt Securities.

None

(c) Other Securities To Be Registered.

None

Item 12.

Indemnification of Directors and Officers

Our Officers and Directors are indemnified

as provided by the Nevada corporate law and our Bylaws. We have agreed to indemnify all of our directors and certain officers against

certain liabilities, including liabilities under the Securities Act of 1933. Insofar as indemnification for liabilities arising

under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the provisions

described above, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than our payment of expenses incurred or paid by our director, officer or controlling

person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the adjudication of such issue.

We have been advised that in the opinion

of the Securities Exchange Commission indemnification for liabilities arising under the Securities Act against public policy as

expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such

liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered,

we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit question of whether

such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s

decision.

Item 13.

Financial Statements and Supplementary Data

PHOENIX INTERNATIONAL VENTURES, INC.

CONSOLIDATED FINANCIAL STATEMENTS

(Audited)

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors and Shareholders of Phoenix International

Ventures, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets

of Phoenix International Ventures, Inc. (“the Company”) as of December 31, 2017 and 2016, and the related consolidated

statements of operations, stockholders’ equity, and cash flows for each of the years in the two-year period ended December

31, 2017, and the related notes (collectively referred to as the financial statements). In our opinion, the consolidated financial

statements present fairly, in all material respects, the financial position of the Company as of December 31, 2017 and 2016, and

the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2017, in conformity

with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming

that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has an accumulated

deficit and has not established revenue to cover its operating costs. These factors raise substantial doubt about the Company’s

ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 3. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are

a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required

to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the

PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform,

an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of

internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks

of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to

those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial

statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as

well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis

for our opinion.

We have served as the Company’s auditor since 2019.

Spokane, Washington

February 22, 2019

PHOENIX INTERNATIONAL VENTURES, INC.

CONSOLIDATED BALANCE SHEETS

|

|

|

December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

–

|

|

|

$

|

–

|

|

|

Total Assets

|

|

$

|

–

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

–

|

|

|

$

|

–

|

|

|

Total Current Liabilities

|

|

|

–

|

|

|

|

–

|

|

|

Total Liabilities

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity (Deficit):

|

|

|

|

|

|

|

|

|

|

Series A Preferred Stock, par value $0.001, 5,000,000

shares authorized; no shares issued and outstanding, respectively

|

|

|

–

|

|

|

|

–

|

|

|

Common Stock, par value $0.001, 150,000,000 shares authorized; 14,085,285 and 14,085,285 shares issued and outstanding, respectively.

|

|

|

14,085

|

|

|

|

14,085

|

|

|

Additional paid-in capital

|

|

|

3,153,095

|

|

|

|

3,153,095

|

|

|

Accumulated deficit

|

|

|

(3,167,180

|

)

|

|

|

(3,167,180

|

)

|

|

Total Stockholders' Equity

|

|

|

–

|

|

|

|

–

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$

|

–

|

|

|

$

|

–

|

|

The accompanying notes are an integral

part of these consolidated financial statements.

PHOENIX INTERNATIONAL VENTURES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

For the Years Ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$

|

–

|

|

|

$

|

–

|

|

|

Total operating expenses

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

$

|

–

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

–

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share, basic and diluted

|

|

$

|

–