ADTRAN, Inc. (NASDAQ:ADTN) reported results for the fourth

quarter 2018. For the quarter, sales were $140.1 million compared

to $126.8 million for the fourth quarter of 2017. Net loss was $8.4

million compared to a net loss of $11.1 million for the fourth

quarter of 2017. Earnings per share were a loss of $0.18 compared

to a loss of $0.23 for the fourth quarter of 2017. Non-GAAP

earnings per share were a loss of $0.12 compared to earnings of

$0.05 for the fourth quarter of 2017. Net loss and GAAP and

non-GAAP earnings per share for the fourth quarter 2018 reflect the

effect of a loss in other income of $6.8 million, which resulted

primarily from the impact of unrealized losses in our equity

investment portfolio arising from U.S. equity market volatility

during the quarter. Non-GAAP earnings per share exclude stock-based

compensation expense, acquisition related amortizations and other

expenses, restructuring expenses, gain on bargain purchase of a

business and the impact of the Tax Cuts and Jobs Act in 2017. The

reconciliation between GAAP earnings per share and non-GAAP

earnings per share is in the table provided.

ADTRAN Chairman and Chief Executive Officer Tom

Stanton stated, “Operating results for the final quarter of

2018 came in largely as expected with strong international revenue

growth and an increase in U.S. tier 1 sales allowing the company to

offset its normal sequential seasonal trend. International revenue

contributed 46.6% of the total with strong contributions from the

Asia-Pacific and LATAM regions. Our customer engagements increased,

centering around our comprehensive portfolio of software-defined

access, 10G solutions and G.fast products. During the quarter, we

also acquired SmartRG, a leading provider of open-source connected

home platforms and cloud services, whose software approach to

delivering both hardware-based and virtualized solutions will

enable us to extend the value of our open, programmable and web

scalable Mosaic Cloud platform. Looking forward, we believe that

ADTRAN is well positioned to leverage our customer, geographic and

product diversity momentum as service providers look to accelerate

service velocity and scale networks in size, scope and service

capabilities.”

The Company also announced that its Board of Directors declared

a cash dividend for the fourth quarter of 2018. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on February 7, 2019. The ex-dividend date

is February 6, 2019, and the payment date is February 21, 2019.

The Company confirmed that it will hold a conference call to

discuss its fourth quarter results Thursday, January 24, 2019, at

9:30 a.m. Central Time. ADTRAN will webcast this conference call.

To listen, simply visit the Investor Relations site at

www.investors.adtran.com approximately 10 minutes prior to the

start of the call and click on the conference call link

provided.

An online replay of the conference call, as well as the text of

the Company's earnings release, will be available on the Investor

Relations site approximately 24 hours following the call and will

remain available for at least 12 months. For more information,

visit www.investors.adtran.com or via email

at investor.relations@adtran.com.

At ADTRAN, we believe amazing things happen when people connect.

From the cloud edge to the subscriber edge, we help communications

service providers around the world manage and scale services that

connect people, places and things to advance human progress.

Whether rural or urban, domestic or international, telco or cable,

enterprise or residential—ADTRAN solutions optimize existing

technology infrastructures and create new, multi-gigabit platforms

that leverage cloud economics, data analytics, machine learning and

open ecosystems—the future of global networking. Find more at

ADTRAN, LinkedIn and Twitter.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2017.

These risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

Condensed Consolidated Balance

Sheet

(Unaudited)

(In thousands)

December 31, December 31, 2018

2017 Assets Cash and cash equivalents $ 105,504 $

86,433 Short-term investments 3,246 16,129 Accounts receivable, net

99,385 144,150 Other receivables 36,699 26,578 Inventory, net

99,848 122,542 Prepaid expenses and other current assets

10,744 17,282

Total Current Assets 355,426

413,114 Property, plant and equipment, net 80,635

85,079 Other non-current assets (1) 83,144 40,645 Long-term

investments 108,822 130,256

Total Assets

$ 628,027 $ 669,094

Liabilities and Stockholders' Equity Accounts payable $

61,054 $ 60,632 Unearned revenue 17,940 13,070 Accrued expenses

11,746 13,232 Accrued wages and benefits 14,752 15,948 Income tax

payable, net 12,518 3,936

Total Current

Liabilities 118,010 106,818 Non-current

unearned revenue 5,296 4,556 Other non-current liabilities 33,842

34,209 Bonds payable 24,600 25,600

Total

Liabilities 181,748 171,183

Stockholders' Equity 446,279 497,911

Total Liabilities and Stockholders' Equity $

628,027 $ 669,094 (1) Other non-current

assets includes certain identifiable intangible assets as a result

of the preliminary purchase accounting for the acquisition of

SmartRG Inc, net deferred tax assets, goodwill and other

non-current assets. The purchase accounting is still considered

preliminary pending management’s final assessment of fair values

and therefore is subject to further adjustments. The final

valuation is expected to result in goodwill equal to the excess of

the purchase price over the identifiable intangible assets.

Consolidated Statements of

Income

(Unaudited)

(In thousands, except per share

data)

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017 Sales

Products $ 116,873 $ 95,789 $ 458,232 $ 540,396 Services

23,215 31,047 71,045

126,504

Total Sales 140,088 126,836

529,277 666,900 Cost of sales Products 70,745

49,702 278,929 279,563 Services 13,955 18,325

46,783 83,702

Total Cost of

Sales 84,700 68,027 325,712 363,265

Gross Profit 55,388 58,809 203,565

303,635 Selling, general and administrative expenses 28,079

31,412 124,440 135,583 Research and development expenses

31,092 31,550 124,547

130,666

Operating Income (Loss) (3,783

) (4,153 ) (45,422 )

37,386 Interest and dividend income 1,422 1,523 4,026 4,380

Interest expense (135 ) (139 ) (533 ) (556 ) Net investment gain

(loss) (9,450 ) 1,816 (4,050 ) 4,685 Other income (expense), net

1,359 219 1,286 (1,208 ) Gain on bargain purchase of a business

— — 11,322 —

Income (Loss) before provision for income taxes

(10,587 ) (734 ) (33,371

) 44,687 (Provision) benefit for income taxes

2,140 (10,376 ) 14,029 (20,847 )

Net Income (Loss) $ (8,447 ) $

(11,110 ) $ (19,342 ) $

23,840 Weighted average shares outstanding –

basic 47,730 48,280 47,880 48,153 Weighted average shares

outstanding – diluted 47,730 48,280 47,880 48,699

(1)

Earnings (loss) per common share – basic $ (0.18 ) $ (0.23 )

$ (0.40 ) $ 0.50 Earnings (loss) per common share – diluted $ (0.18

) $ (0.23 ) $ (0.40 ) $ 0.49

(1)

(1) Assumes exercise of dilutive stock

options calculated under the treasury stock method.

Consolidated Statements of

Comprehensive Income

(Unaudited)

(In thousands)

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017 Net Income

(Loss) $ (8,447 ) $ (11,110 ) $ (19,342 ) $ 23,840

Other

Comprehensive Income (Loss), net of tax Net unrealized gains

(losses) on available-for-sale securities 210 (349 ) (3,130 ) 2,163

Net unrealized gains on cash flow hedges — 196 — — Defined benefit

plan adjustments (3,859 ) 517 (3,755 ) 731 Foreign currency

translation (1,203 ) 597 (4,236 )

5,999

Other Comprehensive Income (Loss), net of tax

(4,852 ) 961

(11,121 ) 8,893 Comprehensive Income

(Loss), net of tax $ (13,299 ) $

(10,149 ) $ (30,463 ) $

32,733

Consolidated Statements of Cash

Flows

(Unaudited)

(In thousands)

Twelve Months Ended December 31,

2018 2017 Cash flows from operating

activities Net income (loss) $ (19,342 ) $ 23,840

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 15,891 15,692 Amortization of net

premium (discount) on available-for-sale investments (50 ) 425 Net

unrealized (gain) loss on long-term investments 4,050 (4,685 ) Net

(gain) loss on disposal of property, plant and equipment 67 (145 )

Gain on bargain purchase of a business (11,322 ) — Stock-based

compensation expense 7,155 7,433 Deferred income taxes (17,257 )

14,073 Change in operating assets and liabilities: Accounts

receivable, net 49,200 (49,103 ) Other receivables (8,522 ) (10,222

) Inventory 24,192 (15,518 ) Prepaid expenses and other assets

10,727 (4,830 ) Accounts payable (2,669 ) (17,742 ) Accrued

expenses and other liabilities (3,226 ) (5,455 ) Income taxes

payable 7,690 3,858

Net cash

provided by (used in) operating activities 56,584

(42,379 ) Cash flows from

investing activities Purchases of property, plant and equipment

(8,110 ) (14,720 ) Proceeds from disposals of property, plant and

equipment — 151 Proceeds from sales and maturities of

available-for-sale investments 153,649 173,752 Purchases of

available-for-sale investments (123,209 ) (93,141 ) Acquisition of

business (23,275 ) —

Net cash provided by

(used in) investing activities (945 )

66,042 Cash flows from financing

activities Proceeds from stock option exercises 1,483 13,412

Purchases of treasury stock (15,532 ) (17,348 ) Dividend payments

(17,267 ) (17,368 ) Payments on long-term debt (1,000 )

(1,100 )

Net cash used in financing activities

(32,316 ) (22,404 ) Net

increase in cash and cash equivalents 23,323 1,259 Effect of

exchange rate changes (4,252 ) 5,279

Cash and cash equivalents,

beginning of year 86,433

79,895 Cash and cash equivalents, end of

year $ 105,504 $ 86,433

Supplemental disclosure of non-cash investing

activities Purchases of property, plant and equipment included in

accounts payable $ 62 $ 408

Supplemental Information

Restructuring Expenses

(Unaudited)

(In thousands)

Restructuring expense was recorded in the

following Consolidated Statements of Income categories for the

three and twelve months ended December 31, 2018 and 2017:

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017

Restructuring expense included in cost of sales $

— $ — $ 2,761

$ — Selling, general and

administrative expense 25 59 2,686 152 Research and development

expense — — 1,814

122

Restructuring expense included in operating

expenses 25 59

4,500 274 Total

restructuring expense 25 59 7,261

274 Provision for income taxes (6 ) (23 )

(1,888 ) (107 )

Total restructuring

expense, net of tax $ 19 $

36 $ 5,373 $ 167

Supplemental Information

Acquisition Related Expenses,

Amortizations and Adjustments

(Unaudited)

(In thousands)

On August 4, 2011, we closed on the

acquisition of Bluesocket, Inc., on May 4, 2012, we closed on the

acquisition of the Nokia Siemens Networks Broadband Access business

(NSN BBA), on September 13, 2016, we closed on the acquisition of

CommScope’s active fiber business (CommScope), on March 19, 2018,

we closed on the acquisition of Sumitomo Electric Lightwave Corp.’s

North American EPON business (Sumitomo), and on November 30, 2018,

we closed on the acquisition of SmartRG Inc. (SmartRG). Acquisition

related expenses, amortizations and adjustments for the three and

twelve months ended December 31, 2018 and 2017 for all five

transactions are as follows:

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017 Bluesocket, Inc.

acquisition Amortization of acquired intangible assets $ — $

158 $ 369 $ 632 NSN BBA acquisition

Amortization of acquired intangible assets 85 95 355 527

Amortization of other purchase accounting adjustments 2

— 3 39

Subtotal

- NSN BBA acquisition 87 95

358 566

CommScope acquisition Amortization of acquired intangible assets

110 219 483 1,732 Amortization of other purchase accounting

adjustments 3 3 4 88 Acquisition related professional fees, travel

and other expenses — — —

8

Subtotal - CommScope acquisition

113 222 487

1,828 Sumitomo acquisition Amortization

of acquired intangible assets 663 — 2,097 — Amortization of other

purchase accounting adjustments 7 — 86 — Acquisition related

professional fees, travel and other expenses (1 ) —

123 —

Subtotal - Sumitomo

acquisition 669 —

2,306 — SmartRG

acquisition Amortization of acquired intangible assets 150 — 150 —

Amortization of other purchase accounting adjustments 181 — 181 —

Acquisition related professional fees, travel and other expenses

233 — 233 —

Subtotal - SmartRG acquisition 564

— 564 —

Total acquisition related expenses, amortizations

and

adjustments

1,433 475 4,084 3,026 Provision for

income taxes (378 ) (178 ) (1,080 )

(1,135 )

Total acquisition related expenses, amortizations

and

adjustments, net of tax

$ 1,055 $ 297 $

3,004 $ 1,891

The acquisition related expenses,

amortizations and adjustments above were recorded in the following

Consolidated Statements of Income categories for the three and

twelve months ended December 31, 2018 and 2017:

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017 Cost of

goods sold $ 542 $ 2

$ 1,381 $ 88

Selling, general and administrative expenses 583 51 1,457 215

Research and development expenses 308 422

1,246 2,723

Total acquisition

related expenses, amortizations and

adjustments included in operating

expenses

891 473 2,703 2,938 Total

acquisition related expenses, amortizations and

adjustments

1,433 475 4,084 3,026 Provision for

income taxes (378 ) (178 ) (1,080 )

(1,135 )

Total acquisition related expenses, amortizations

and

adjustments, net of tax

$ 1,055 $ 297 $

3,004 $ 1,891

Supplemental Information

Stock-based Compensation

Expense

(Unaudited)

(In thousands)

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017

Stock-based compensation expense included in cost of sales

$ 120 $ 98 $

418 $ 379 Selling,

general and administrative expense 1,065 1,045 3,989 4,063 Research

and development expense 727 717

2,748 2,991

Stock-based compensation

expense included in operating expenses 1,792

1,762 6,737

7,054 Total stock-based compensation

expense 1,912 1,860 7,155 7,433 Tax

benefit for expense associated with non-qualified options, PSUs,

RSUs and restricted stock

(416 ) (484 ) (1,432 ) (1,699 )

Total stock-based compensation expense, net of tax $

1,496 $ 1,376 $

5,723 $ 5,734

Reconciliation of GAAP earnings (loss)

per share, diluted, to

Non-GAAP earnings (loss) per common

share, diluted

(Unaudited)

Three Months Ended Twelve Months Ended

December 31, December 31, 2018

2017 2018 2017 GAAP

earnings (loss) per common share - diluted $

(0.18 ) $ (0.23 ) $

(0.40 ) $ 0.49 Restructuring

expense — — 0.11 — Acquisition related expenses, amortizations and

adjustments 0.02 0.01 0.06 0.04 Stock-based compensation expense

0.03 0.03 0.12 0.12 Impact of the Tax Cuts and Jobs Act — 0.24 —

0.24 Gain on bargain purchase of a business —

— (0.24 ) —

Non-GAAP earnings (loss)

per common share - diluted (1) $ (0.12

) $ 0.05 $ (0.35 )

$ 0.89

(1) Table may not foot due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190123005893/en/

ADTRAN, Inc.Investor Services/Assistance:Cathy Hoffman-Young,

256-963-7054investor@adtran.com

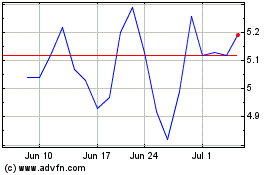

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024