€1.7bn of commercial sales secured since

Eurosic’s acquisition and 150,000 sq.m let in 2018

Gecina confirms its target for recurrent net

income per share growth of over +8% for 2018

Regulatory News:

Gecina (Paris:GFC):

Improvement in like-for-like rental income growth

- Gross rental income up +30.7% on

a current basis

- Like-for-like growth of +2.2%,

significantly outperforming the indexation effect and higher than

the first half of the year

Strong lettings performance in a buoyant market for central

sectors

- Favorable commercial pressures in

central sectors, where Gecina’s pipeline and portfolio are

concentrated

- Almost 150,000 sq.m let,

pre-let, relet or renegotiated since the start of the year,

representing close to 10% of the Group’s total office space

and €56m of full-year rental income (with almost half

corresponding to buildings under development)

Market still buoyant in centrality sectors

- Historically low vacancy rate in

Paris’ CBD (1.5%), where available supply contracted -44% faced

with sustained demand, driving growth in market rents

- Situation that is improving more

gradually outside of Paris City

Eight real estate projects delivered since the start of the

year and renewal of the pipeline, with several buildings about to

be transferred into it

- Gecina has delivered eight

buildings since the start of the year, following

ambitious redevelopment operations in terms of both environmental

aspects and workplace wellness (four assets in Paris, three in the

Western Crescent and one in Lyon Part-Dieu)

- Pipeline to be renewed soon with

buildings that are being freed up and will benefit from

redevelopments or extensive refurbishments, to continue moving

forward with its portfolio’s gradual transformation, incorporating

innovation to serve societal and environmental changes

Nearly €1.4bn of sales completed in 2018 or under

preliminary agreements at end-September

- €1.3bn of commercial sales completed

or secured since the start of the year, achieving a premium of

over +2% versus the latest appraisal values, with €1.7bn since

Eurosic’s acquisition

- Almost €90m of residential

sales, primarily on a unit basis, including €68m finalized with

a +23% premium versus their appraisal values

Gecina confirms its targets for 2018

- 2018 will reflect Eurosic’s

integration, the deliveries of buildings, primarily over the second

half of the year, and the first effects of the high volume of sales

already secured since Eurosic’s acquisition

- Gecina is confident that it will be

able to achieve its target for over +8% recurrent net income per

share growth in 2018

Key figures

Gross rental income Sep 30, 17 Sep 30, 18

Change (%) In million euros Current basis Like-for-like

Offices 285.0 392.2 +37.6% +2.1%

Traditional residential 81.9 79.1 -3.4% +2.1% Student residences

10.7 12.2 +13.9% +3.5% Other business 1.4 11.6

na na

Total gross rental income 379.0

495.2 +30.7% +2.2% Hotels 3.7 2.4 na na

Finance leases 1.2 6.9 na na

Total

gross revenues 383.9 504.5 +31.4% na

Improvement in rental income

Gross rental income Sep 30, 17 Sep 30, 18

Change (%) In million euros Current basis Like-for-like

Offices 285.0 392.2 +37.6% +2.1%

Traditional residential 81.9 79.1 -3.4% +2.1% Student residences

10.7 12.2 +13.9% +3.5% Other business 1.4 11.6

na na

Total gross rental income 379.0

495.2 +30.7% +2.2% Hotels 3.7 2.4 na na

Finance leases 1.2 6.9 na na

Total

gross revenues 383.9 504.5 +31.4%

na

On a current basis, the +30.7% (+€116.2m) increase in

gross rental income primarily reflects Eurosic’s integration since

the end of August 2017 (for +€121.9m), as well as the like-for-like

growth achieved (+€6.4m), and rental income from recent

acquisitions and project deliveries (+€13.9m), net of the loss of

rent from the buildings with strong value creation potential

transferred to the pipeline (-€17.6m) and the still limited loss of

rent from sales of non-strategic assets (-€8.4m).

Like-for-like, the performance represents +2.2% at

end-September 2018, a sequential improvement versus June 30,

2018 (+1.8%). This improvement factors in a slightly higher level

of indexation (+1.1%), as well as the impacts of the letting of

previously vacant buildings and the rental reversion recorded in

Paris City’s most central sectors (CBD and 5th, 6th and 7th

arrondissements).

Offices: positive trends for

offices in centrality sectors

Gross rental income - Offices Sep 30, 17 Sep 30, 18

Change (%) In million euros Current basis

Like-for-like

Offices 285.0 392.2

+37.6% +2.1% - Paris CBD & 5-6-7 - Offices 82.7

104.8 +26.8% +2.0% - Paris CBD & 5-6-7 - Retail 26.3 27.0 +2.6%

+2.1% - Paris – Other 39.2 63.6 +62.1% -4.5% Western Crescent - La

Défense 100.8 119.8 +18.8% +3.4% Paris Region - Other 26.6 42.3

+59.4% +0.9% Other French regions / International 9.4

34.6 na na

On a current basis, rental income from offices shows

strong growth, up +37.6% to €392.2m (+€107.2m), driven primarily by

Eurosic’s consolidation.

Excluding like-for-like growth (+€4.6m) and Eurosic’s

integration (+€110.6m), this increase on a current basis reflects

the impact of the changes in scope (acquisitions and sales) and the

movement of assets within the pipeline (deliveries and

redevelopments). More specifically, the mainly temporary loss of

rent (-€17.5m) is linked to the launch of work to redevelop office

buildings with strong value creation potential (including the 75 GA

building, the PSA Group’s former headquarters). The impact of the

sales completed since the start of the year is still limited as

they have been or will be finalized primarily during the second

half of 2018. This loss of rent has been partially offset by the

impact of the assets delivered and the first lettings secured

during the last quarter of 2017 and since the start of 2018 (Paris

– 55 Amsterdam, Paris – Guersant, Paris – Ville l’Evêque), as well

as the two assets acquired recently (+€10.3m).

Like-for-like office rental income is up +2.1%,

benefiting from a higher level of indexation (+1.2%), the letting

of certain buildings in 2017 that were previously vacant and the

positive rental trends observed for the Paris Region’s most central

markets.

This performance is being driven primarily by the most central

sectors, where market trends are favorable, particularly Paris’ CBD

and the 5th, 6th and 7th arrondissements, where organic rental

income growth represents +2.0% (including +0.6pts attributable to

the positive reversion achieved), while the Western Crescent is up

to +3.4%, linked mainly to the reduced vacancy rate. The -4.5%

like-for-like contraction for the office portfolio in Paris

excluding the CBD reflects the renegotiation of a lease for a

single building at the gateway to Paris.

Traditional residential: positive

organic trends

For the traditional residential portfolio, rental income

is up +2.1% like-for-like, with a sequential improvement (+0.6% in

2017, +1.8% for the first half of 2018), factoring in the impact of

the reduction in the vacancy rate, as well as the positive

reversion achieved on apartments relet since January 1, 2018,

averaging out more than +5% higher than the previous tenant’s

rent.

On a current basis, the -3.4% contraction factors in the

progress made with the program rolled out by the Group in the past

few years to sell apartments on a unit basis when they become

vacant.

Student residences: operational

performance improvements for certain residences and deliveries

Rental income from student residences shows a

like-for-like increase of +3.5%, linked primarily to the

improvement in operational performance levels for a residence in

Lille.

On a current basis, the +13.9% increase also factors in the

delivery of two residences in summer 2017 in Marseille and

Puteaux.

Market trends still buoyant in centrality sectors

The Paris Region office market has continued to see positive

trends, especially in the most central sectors and the Central

Business District in particular. “Centrality” is more than ever a

key factor for users.

Rental transactions show further progress, up +6% at

end-September, and Paris City has continued to represent more

than 40% of transactions since the start of the year, even though

it accounts for less than 13% of immediate supply, highlighting the

scarcity at the heart of Paris.

Positive trends for Paris City (60% of

Gecina’s office portfolio)

The increase in rental transactions at the heart of Paris is

remarkable, particularly in an environment marked by the

shortage of available supply on the market. This performance

can be seen across all Paris City’s sub-markets and specifically

at the heart of the business districts (+16% for Paris’ extended

CBD), despite a historically low level of immediate supply in

this sector (down -44% year-on-year in the CBD and -25% in Paris

City) and a vacancy rate of 2.2% at the heart of Paris and even

1.5% in the CBD, its lowest level for nearly 20 years. Market rents

therefore show average year-on-year growth of +10% for Paris City

(source: Immostat).

The resulting reversion potential will be gradually capitalized

on in this sector as the current leases come to an end, but the

letting and delivery of assets under development will also make it

possible to harness these dynamic rental trends.

Alongside this, the strong interest from tenants can be seen in

particular for redevelopment projects upstream from their delivery,

with half of the Paris market’s one-year supply already

pre-let.

Situations less favorable although

improving in the rest of the region, where Gecina is less

present

For the rest of the Paris Region, although the trends are

improving, they are still less favorable. While the vacancy rate is

down to 5.3% for the entire region, with available supply

contracting by almost -15%, there are significant differences

between the various sectors and its future potential supply levels

are high (90% of potential supply by 2022 is located outside of

Paris City). As a result, market rents are increasing on a smaller

scale (+1.5% in the Western Crescent and La Défense for instance)

or even stable in the Outer Rim.

Occupancy rate stable and still high

The Group’s average financial occupancy rate was still

very high at end-September 2018, with 95.1%, down slightly

year-on-year.

For the office portfolio, the occupancy rate shows a

slight contraction of 0.7pts, linked in particular to the

integration of Eurosic’s portfolio in the Paris Region (outside of

Paris) and other French regions. In Paris City however, it is up

+1.6pts to 97.6%, reflecting the growing interest among

tenants for centrality in Paris.

For the student residence portfolio, the financial

occupancy rate is down slightly year-on-year following the opening

of two residences in summer 2017, which are naturally filling up

gradually in their first year, as well as the seasonal effect

linked to the residences temporarily being partially vacant during

the summer.

For the traditional residential portfolio, the financial

occupancy rate is up +0.9 points year-on-year, reflecting the

improvement in the lettings process, particularly for certain large

residential units.

Average financial occupancy rate Sep 30, 17 Dec 31,

17 Mar 31, 18 Jun 30, 18 Sep 30, 18

Offices 95.6% 95.3% 95.3% 95.4%

94.9% Traditional residential 96.6% 96.9% 97.6% 97.6% 97.5%

Student residences 88.9% 90.3% 92.5% 88.7% 87.6% Other business

94.2% 95.9% 97.8% 97.3% 97.4%

Group total 95.6% 95.4% 95.6%

95.6% 95.1%

Rental business: very positive start to the year and progress

with the pipeline’s pre-letting rate

The environment is still very buoyant for lettings, especially

in the Paris Region’s most central sectors and Paris City in

particular.

Since the start of the year, Gecina has let, pre-let, relet or

renegotiated nearly 150,000 sq.m. These lettings represent a

potential rental volume of nearly €56.4m, with almost half

generated by buildings under development.

The Group has notably secured a high volume of pre-lettings on

buildings upstream from their delivery. For the scope for office

buildings to be delivered in 2018 and 2019, the pre-letting rate is

now up to 66% (including Le Jade and Ville l’Evêque, which were

delivered during the first half of 2018). Alongside this,

several negotiations are currently underway.

For reference, the delivery of 14 projects in 2018 and 2019

(including eight delivered since the start of this year) represents

a potential headline rental volume of around €119m per

year.

Development project pipeline: eight buildings delivered since

the start of the year and new buildings currently being vacated and

about to be transferred into the pipeline

Since the start of 2018, Gecina has already delivered nearly

164,000 sq.m of real estate projects, including 156,500 sq.m of

office space.

Eight buildings delivered since the start

of the year

The eight buildings delivered since the start of the year

include four buildings in Paris, with 20 Ville l’Evêque in

the CBD, fully let to the Hermès Group, and the Le Jade, 32

Guersant and Le France buildings at other locations

in Paris City. In addition, Gecina has delivered the Sky 56

asset in Lyon Part-Dieu, with 91% of its space let, primarily to

the Orange Group, the Be Issy building in

Issy-les-Moulineaux, which is currently vacant, the

Octant-Sextant building in Levallois, and a student

residence in Puteaux.

These buildings delivered since the start of the year generated

€8.9m of rental income over the first nine months of

2018.

Upcoming pipeline renewal, with several

buildings to be transferred to the pipeline soon

Alongside this, certain buildings have been vacated or are

currently being freed up by their tenants with a view to launching

their redevelopment shortly. This primarily concerns two major

buildings at the heart of Paris’ Central Business District.

Other buildings that are currently being gradually freed up will

also be able to benefit from redevelopments or extensive

refurbishments soon.

All of these buildings that are currently being vacated

with a view to their redevelopment or extensive refurbishment soon

generated almost €20m in rental income over the first nine

months of 2018.

Close to €1.4bn of sales finalized since the start of

the year or under preliminary agreements

€1.3bn of commercial sales already

completed or covered by preliminary agreements since the start of

the year…

€1.3bn of commercial buildings have been sold since the start

of the year or are currently under preliminary agreements.

These sales primarily concern assets located in secondary sectors

and have been secured with an average premium of around 2% versus

their latest free appraisal values. This sales program aims to

realign the Group’s portfolio around the Paris Region’s most

central real estate sectors (just 8% of these disposals concern

buildings located in Paris) and bring the Group’s debt back down

below an LTV of 40%.

…in addition to €90m of residential

sales, including €22m still under preliminary sales

agreements

The Group has also completed or secured €90m of residential

sales, based primarily on vacant units, with an average premium

of around +23% versus their latest appraisal values for the firm

sales (+25% for vacant unit sales).

…and €0.4bn of sales carried out

in 2017 after Eurosic’s acquisition

For reference, by end-2017, the Group had already finalized

sales for €379m of assets, taking the commercial building sales

program’s total progress up to €1.7bn since Eurosic was

acquired.

Over the first nine months of 2018, the assets

sold since the start of the year or under preliminary

agreements generated €42m of rental income under IFRS, with

the majority of sales finalized during the second half of the

year.

Gecina confirms its targets for 2018

Thanks to the positive trends on Gecina’s core markets and the

success of Eurosic’s rapid integration, exceeding the Group’s

initial expectations, the Group is able to confirm its forecasts

for 2018 in terms of recurrent net income.

In view of the volume and timeline for the sales completed or

secured, recurrent net income (Group share) per share is expected

to deliver growth of over +8%.

Gecina, a leading real estate group

Gecina owns, manages and develops property holdings worth 19.8

billion euros at end-June 2018, with nearly 93% located in the

Paris Region. The Group is building its business around France’s

leading office portfolio and a diversification division with

residential assets and student residences. Gecina has put

sustainable innovation at the heart of its strategy to create

value, anticipate its customers’ expectations and invest while

respecting the environment, thanks to the dedication and expertise

of its staff.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60, Euronext 100, FTSE4Good, DJSI Europe and World, Stoxx Global

ESG Leaders and Vigeo indices. In line with its commitments to the

community, Gecina has created a company foundation, which is

focused on protecting the environment and supporting all forms of

disability.

www.gecina.fr

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181023005956/en/

GECINA CONTACTSFinancial communicationsSamuel

Henry-DiesbachTel: +33 (0)1 40 40 52

22samuelhenry-diesbach@gecina.frorVirginie SterlingTel: +33 (0)1 40

40 62 48virginiesterling@gecina.frorPress relationsJulien

LandfriedTel: +33 (0)1 40 40 65

74julienlandfried@gecina.frorArmelle MicloTel: +33 (0)1 40 40 51

98armellemiclo@gecina.fr

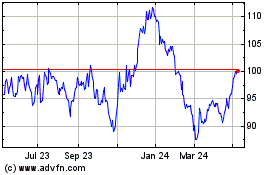

Gecina Nom (EU:GFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

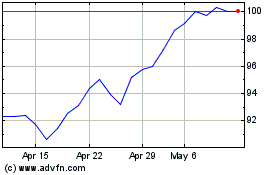

Gecina Nom (EU:GFC)

Historical Stock Chart

From Apr 2023 to Apr 2024