Will Fidelity Be The Catalyst That Brings Crypto Trading To The Masses?

October 17 2018 - 7:10AM

ADVFN Crypto NewsWire

Cryptocurrencies have had a rough go of it this

year, with the prices of the leading digital tokens including

bitcoin and ethereum plummeting. The knock on virtual currency: it

has failed to take off with the masses as regulators have increased

scrutiny and retailers haven’t embraced it as a payment

method.

Fidelity Investments, however,

could play a role in changing all that.

This week it announced it was

creating a stand-alone company that is focused solely on bringing

cryptocurrency trading to institutional investors. Dubbed Fidelity

Digital Assets, the company will offer institutional investors

custody services, a cryptocurrency platform and advising to its

institutional clients.

Fidelity isn’t going after retail

investors with the offering, but it could help boost the validity

of cryptocurrencies, eventually pushing it downstream to regular

investors. After all, when the CME Group and CBOE World

Markets launched their bitcoin futures in the early part of 2018

most of the online brokerages balked at offering it to their retail

clients. They worried that the price fluctuation and lack of

regulatory oversight could get their customers in trouble. TD

Ameritrade, E*TRADE and TradeStation were among the few to move

full steam ahead but none have come up with a way yet for retail

investors to trade digital tokens directly.

“Fidelity gets it,” said Jason

Davis, former Senior UX Designer at Wells Fargo and current Chief

Executive of Hoard, a platform that enables the integration and

management of both crypto and fiat currencies of its new business

unit. “I wholeheartedly believe Fidelity brings stronger validity

to the marketplace.” While Fidelity is focused on the institutional

side of cryptocurrency trading, Davis predicted it's only a matter

of time before it trickles down to the retail investors, similar to

how other investment products have in the past.

The executive did acknowledge that

the custody model still needs to be proven at Fidelity to give more

validity to the digital token marketplace but if it can, then

cryptocurrency trading may very well take off with the masses.

“There is still a very strong demand appetite” even with the

precipitous decline in the value of the leading digital tokens,

said Davis. “A lot of investors, for the time being, are just

waiting to make their next moves,. Davis predicts that will happen

when bitcoin starts trading between $8,000 and $8,500 again, giving

it a market capitalization of more than $350 billion. As it stands

bitcoin’s market cap has been reduced 70% from its all-time high

reached late last year.

Investors Trust Thier Brokerages, Amazon Over Crypto

Exchanges

Aiming to ascertain what it will

take for retail investors to embrace cryptocurrency investing,

LendEDU, the online student loan lender teamed with The Daily Hodl,

the cryptocurrency news website, to survey 1,000 U.S. adults that

invest via a brokerage account that doesn’t offer cryptocurrency

trading. None of the investors surveyed own digital tokens. The

result: 52% of respondents said they are likely to use their

brokerage accounts to invest in cryptocurrency if they had the

option while 59% of those investors signaled they would scale back

investments in stocks, bonds, and other traditional products to

invest more in cryptocurrency. What’s more, 41% of those

polled said they would trust a traditional brokerage over the likes

of Coinbase, the leading operator of a cryptocurrency exchange. Bad

news for Coinbase: 39% would even trust Amazon.com over Coinbase

when it comes to handling cryptocurrency investments.

“It ties into the overall

perception of virtual currency,” said Michael Brown, research

analyst at LendEDU. “There’s still a dark cloud over virtual

currency and even the name cryptocurrency sounds a little bit

sketchy to be people. They think its used in the dark web and not

for the best reasons. They don’t fully understand.”

LendEDU found that only

44% of the survey respondents who signaled interest in

cryptocurrency investing would do it outside their traditional

brokerage. As for trading in digital tokens via Amazon, that too

could be because of its reputation, said Brown. Amazon and

brokerages have been at it for years, building a reputation of

trust and convenience. Coinbase isn’t there yet, in part because of

the market it is operating it in.

Given the decline in the price of

virtual currency, the increased scrutiny on the part of regulators,

hacks of cryptocurrency exchanges and the wild wild west nature of

it all, Brown was surprised survey respondents not only want to

invest in it but would allocate some of the money going toward

traditional investments to meet that end. “No one wants to miss out

again,” said Brown, nothing there could be some boredom with

traditional investments as well. “People wanted to get in on

the wave and this is residual from that. It was all over the news.

People were seeing every day a person getting rich from investing

in bitcoin.”

Sources:

Forbes

By

Donna Fuscaldo

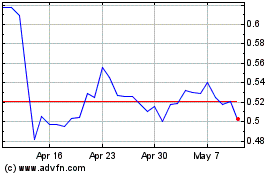

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

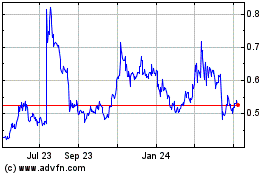

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024