Expects Positive Momentum to Continue

Today, Jabil Inc. (NYSE: JBL), reported preliminary, unaudited

financial results for its fourth quarter and fiscal year ended

August 31, 2018.

“I’m really pleased with our fiscal 2018 results and the

positive momentum we’re seeing across the business,” said CEO Mark

Mondello. “Our team’s performance during the year culminated in

double-digit revenue growth, 24 percent core EPS expansion and core

ROIC of 19 percent, an increase of approximately 400 basis points

year-on-year. At the same time, we made strategically important

investments in areas like additive manufacturing and factory

automation, while the underlying business allowed for nearly $1

billion in cash flow generation and $500 million in shareholder

returns. By many measures, 2018 was another great year as we

position the company to continue to deliver on our stated goals,”

he added.

Fiscal Year 2018 Highlights:

- Net revenue: $22.1 billion

- Diversified Manufacturing Services

(DMS) year-on-year revenue growth: 23 percent

- Electronics Manufacturing Services

(EMS) year-on-year revenue growth: 11 percent

- U.S. GAAP operating income: $542.2

million

- U.S. GAAP diluted earnings per share:

$0.49

- Core operating income (Non-GAAP):

$768.1 million

- Core diluted earnings per share

(Non-GAAP): $2.62

“As we begin fiscal 2019, we’re steadfast in our commitment to

deliver value for shareholders. We’ll continue to pursue strategic

capabilities and technologies in select end-markets that should

result in even more sustainable earnings and cash flows over the

next three to four years.” added Mondello.

First Quarter of Fiscal Year 2019 Guidance:

• Net revenue $5.8 billion to $6.4 billion • U.S.

GAAP operating income $158 million to $223 million • U.S. GAAP

diluted earnings per share $0.45 to $0.74 per diluted share • Core

operating income (Non-GAAP) (1) $215 million to $265 million • Core

diluted earnings per share (Non-GAAP) (1) $0.79 to $0.99 per

diluted share • Diversified Manufacturing Services Increase revenue

5 percent year-on-year • Electronics Manufacturing Services

Increase revenue 13 percent year-on-year • Total company Increase

revenue 9 percent year-on-year

(1) Core operating income and core diluted earnings per share

exclude anticipated adjustments of $8 million for amortization of

intangibles (or $0.05 per diluted share), $24 million for

stock-based compensation expense and related charges (or $0.14 per

diluted share), $7 million to $2 million for restructuring and

related charges (or $0.04 to $0.01 per diluted share) and $18

million to $8 million for acquisition and integration charges (or

$0.11 to $0.05 per diluted share).

(Definitions: “U.S. GAAP” means U.S. generally accepted

accounting principles. Jabil defines core operating income as U.S.

GAAP operating income before amortization of intangibles,

stock-based compensation expense and related charges, restructuring

and related charges, distressed customer charges, acquisition and

integration charges, loss on disposal of subsidiaries, settlement

of receivables and related charges, impairment of notes receivable

and related charges, goodwill impairment charges and business

interruption and impairment charges, net. Jabil defines core

earnings as U.S. GAAP net income before amortization of

intangibles, stock-based compensation expense and related charges,

restructuring and related charges, distressed customer charges,

acquisition and integration charges, loss on disposal of

subsidiaries, settlement of receivables and related charges,

impairment of notes receivable and related charges, goodwill

impairment charges, business interruption and impairment charges,

net, impairment on securities, income (loss) from discontinued

operations, gain (loss) on sale of discontinued operations and

certain other expenses, net of tax and certain deferred tax

valuation allowance charges. Jabil defines core diluted earnings

per share as core earnings divided by the weighted average number

of outstanding diluted shares as determined under U.S. GAAP. Jabil

reports core operating income, core earnings and core diluted and

basic earnings per share to provide investors an additional method

for assessing operating income, earnings and diluted earnings per

share from what it believes are its core manufacturing operations.

See the accompanying reconciliation of Jabil’s core operating

income to its U.S. GAAP operating income, its calculation of core

earnings and core diluted earnings per share to its U.S. GAAP net

income and U.S. GAAP earnings per share and additional information

in the supplemental information.)

Forward Looking Statements: This release contains

forward-looking statements, including those regarding our

anticipated financial results for our fourth quarter and full

fiscal year 2018 and our guidance for future financial performance

in our first quarter of fiscal year 2019 (including, net revenue,

total company and segment revenue, U.S. GAAP operating income, U.S.

GAAP diluted earnings per share, core operating income (Non-GAAP),

core diluted earnings per share (Non-GAAP) results and the

components thereof, net interest expense, and core tax

rate(Non-GAAP). The statements in this release are based on current

expectations, forecasts and assumptions involving risks and

uncertainties that could cause actual outcomes and results to

differ materially from our current expectations. Such factors

include, but are not limited to: our determination as we finalize

our financial results for our fourth quarter and full fiscal year

2018 that our financial results and conditions differ from our

current preliminary unaudited numbers set forth herein; unexpected,

adverse seasonal impacts on demand; performance in the markets in

which we operate; changes in macroeconomic conditions; the

occurrence of, success and expected financial results from, product

ramps; our ability to maintain and improve costs, quality and

delivery for our customers; whether our restructuring activities

and the realignment of our capacity will adversely affect our cost

structure, ability to service customers and labor relations;

reliance on a limited number of suppliers for critical components;

changes in technology; competition; anticipated growth for us and

our industry that may not occur; managing rapid growth; managing

rapid declines in customer demand and other related customer

challenges that may occur; our ability to successfully consummate

acquisitions and divestitures; managing the integration of

businesses we acquire; risks associated with international sales

and operations; retaining key personnel; our dependence on a

limited number of large customers; and adverse changes in political

conditions, in the U.S. and internationally, including, among

others, adverse changes in tax laws and rates and our ability to

estimate and manage their impact. Additional factors that could

cause such differences can be found in our Annual Report on Form

10-K for the fiscal year ended August 31, 2017 and our other

filings with the Securities and Exchange Commission. We assume no

obligation to update these forward-looking statements.

Supplemental Information Regarding Non-GAAP Financial

Measures: Jabil provides supplemental, non-GAAP financial

measures in this release to facilitate evaluation of Jabil’s core

operating performance. These non-GAAP measures exclude certain

amounts that are included in the most directly comparable U.S. GAAP

measures, do not have standard meanings and may vary from

the non-GAAP financial measures used by other companies.

Management believes these “core” financial measures are useful

measures that facilitate evaluation of the past and future

performance of Jabil’s ongoing operations on a comparable

basis.

Jabil reports core operating income, core earnings, core ROIC

and core diluted and basic earnings per share to provide investors

an additional method for assessing operating income, earnings and

earnings per share from what it believes are its core manufacturing

operations. Among other uses, management uses non-GAAP

financial measures to make operating decisions, assess business

performance and as a factor in determining certain employee

performance when determining incentive compensation. The Company

determines the tax effect of the items excluded from core earnings

and core basic and diluted earnings per share based upon evaluation

of the statutory tax treatment and the applicable tax rate of the

jurisdiction in which the pre-tax items were incurred, and for

which realization of the resulting tax benefit, if any, is

expected. In certain jurisdictions where the Company does not

expect to realize a tax benefit (due to existing tax incentives or

a history of operating losses or other factors resulting in a

valuation allowance related to deferred tax assets), a reduced or

0% tax rate is applied. Detailed definitions of certain of the

core financial measures are included above under “Definitions” and

a reconciliation of the disclosed core financial measures to the

most directly comparable U.S. GAAP financial measures is included

under the heading “Supplemental Data” at the end of this

release.

Meeting and Replay Information: Jabil will hold a

conference call today at 8:30 a.m. ET to discuss its earnings for

the fourth quarter and full fiscal year 2018 and to provide an

investor briefing. To access the live audio webcast and view the

accompanying slide presentations, visit the Investor Relations

section of Jabil’s website, located at https://investors.jabil.com.

An archived replay of the webcast will also be available after

completion of the call.

About Jabil: Jabil (NYSE: JBL) is a product solutions

company providing comprehensive design, manufacturing, supply chain

and product management services. Operating from over 100 facilities

in 29 countries, Jabil delivers innovative, integrated and tailored

solutions to customers across a broad range of industries. For more

information, visit jabil.com.

JABIL INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (in thousands)

August 31, 2018 (unaudited) August 31,

2017 ASSETS Current assets: Cash and cash equivalents $

1,257,949 $ 1,189,919 Accounts receivable, net 1,693,268 1,397,424

Inventories, net 3,457,706 2,942,083 Prepaid expenses and other

current assets 1,141,000 1,097,257

Total current assets 7,549,923 6,626,683 Property, plant and

equipment, net 3,198,016 3,228,678 Goodwill and intangible assets,

net 906,876 892,780 Deferred income taxes 218,252 205,722 Other

assets 172,574 142,132 Total assets $

12,045,641 $ 11,095,995

LIABILITIES AND EQUITY

Current liabilities: Current installments of notes payable and

long-term debt $ 25,197 $ 444,255 Accounts payable 4,942,932

4,257,623 Accrued expenses 2,262,744 2,168,715

Total current liabilities 7,230,873 6,870,593 Notes payable

and long-term debt, less current installments 2,493,502 1,606,017

Other liabilities 94,617 100,812 Income tax liabilities 148,884

100,902 Deferred income taxes 114,385 49,327

Total liabilities 10,082,261 8,727,651

Commitments and contingencies Equity: Jabil Inc.

stockholders’ equity: Preferred stock — — Common stock 257 253

Additional paid-in capital 2,218,673 2,104,203 Retained earnings

1,760,097 1,730,893 Accumulated other comprehensive (loss) income

(19,399 ) 54,620 Treasury stock, at cost (2,009,371 )

(1,536,455 ) Total Jabil Inc. stockholders’ equity 1,950,257

2,353,514 Noncontrolling interests 13,123

14,830 Total equity 1,963,380 2,368,344

Total liabilities and equity $ 12,045,641 $

11,095,995

JABIL INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except for per share data) (Unaudited)

Three Months Ended Fiscal Year

Ended August 31, 2018 August 31,

2017 August 31, 2018 August 31,

2017 Net revenue $ 5,771,831 $ 5,023,029 $ 22,095,416 $

19,063,121 Cost of revenue 5,329,684 4,597,211

20,388,624 17,517,478 Gross profit 442,147

425,818 1,706,792 1,545,643 Operating expenses: Selling, general

and administrative 261,234 241,823 1,050,716 907,702 Research and

development 10,996 7,698 38,531 29,680 Amortization of intangibles

8,581 9,262 38,490 35,524 Restructuring and related charges 7,440

46,866 36,902 160,395 Loss on disposal of subsidiaries —

2,112 — 2,112 Operating income

153,896 118,057 542,153 410,230 Interest and other, net

45,349 36,445 168,752 153,997

Income before income tax 108,547 81,612 373,401 256,233 Income tax

expense 165,155 35,571 285,860

129,066 Net (loss) income (56,608 ) 46,041 87,541 127,167

Net income (loss) attributable to noncontrolling interests, net of

tax 706 362 1,211 (1,923 ) Net

(loss) income attributable to Jabil Inc. $ (57,314 ) $ 45,679 $

86,330 $ 129,090 (Loss) earnings per share attributable to

the stockholders of Jabil Inc.: Basic $ (0.34 ) $ 0.26 $ 0.50 $

0.71 Diluted $ (0.34 ) $ 0.25 $ 0.49 $ 0.69 Weighted

average shares outstanding: Basic 166,968

178,697 172,237 181,902 Diluted 166,968

182,977 175,044 185,838

JABIL INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (in thousands)

(Unaudited) Fiscal Year Ended August

31, 2018 August 31, 2017 Cash flows from

operating activities: Net income $ 87,541 $ 127,167 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 773,704 760,405 Restructuring and

related charges 16,264 94,346 Recognition of stock-based

compensation expense and related charges 90,664 48,544 Deferred

income taxes 52,705 (63,001 ) Provision for allowance for doubtful

accounts 38,030 10,112 Other, net (13,600 ) 22,109 Change in

operating assets and liabilities, exclusive of net assets acquired:

Accounts receivable (316,262 ) (31,353 ) Inventories (499,105 )

(445,089 ) Prepaid expenses and other current assets (76,602 )

19,346 Other assets (34,747 ) (30,413 ) Accounts payable, accrued

expenses and other liabilities 815,258 744,470

Net cash provided by operating activities 933,850

1,256,643 Cash flows used in investing

activities: Acquisition of property, plant and equipment (1,036,651

) (716,485 ) Proceeds and advances from sale of property, plant and

equipment 350,291 175,000 Cash paid for business and intangible

asset acquisitions, net of cash (109,664 ) (36,620 ) Other, net

(2,360 ) (1,360 ) Net cash used in investing

activities (798,384 ) (579,465 ) Cash flows used in

financing activities: Borrowings under debt agreements 9,677,424

7,434,107 Payments toward debt agreements (9,206,016 ) (7,479,150 )

Payments to acquire treasury stock (450,319 ) (306,640 ) Dividends

paid to stockholders (57,833 ) (59,959 ) Net proceeds from exercise

of stock options and issuance of common stock under employee stock

purchase plan 24,865 21,791 Treasury stock minimum tax withholding

related to vesting of restricted stock (22,597 ) (12,268 ) Other,

net (12,568 ) (2,427 ) Net cash used in financing

activities (47,044 ) (404,546 ) Effect of exchange

rate changes on cash and cash equivalents (20,392 )

5,228 Net increase in cash and cash equivalents 68,030

277,860 Cash and cash equivalents at beginning of period

1,189,919 912,059 Cash and cash equivalents at

end of period $ 1,257,949 $ 1,189,919

JABIL INC. AND SUBSIDIARIES SUPPLEMENTAL DATA

RECONCILIATION OF U.S. GAAP FINANCIAL RESULTS TO NON-GAAP

MEASURES (in thousands, except for per share data)

(Unaudited) Three Months

Ended Fiscal Year Ended August 31, 2018

August 31, 2017 August 31, 2018

August 31, 2017 Operating income (U.S. GAAP) $

153,896 $ 118,057 $ 542,153 $ 410,230

Amortization of intangibles 8,581 9,262 38,490 35,524 Stock-based

compensation expense and related charges 15,689 15,167 98,511

48,544 Restructuring and related charges 7,440 46,866 36,902

160,395 Distressed customer charge 18,004 — 32,710 10,198 Business

interruption and impairment charges, net 577 — 11,299 — Loss on

disposal of subsidiaries — 2,112 — 2,112 Acquisition and

integration charges 8,082 —

8,082 — Adjustments to operating income 58,373

73,407 225,994 256,773

Core operating income (Non-GAAP) $ 212,269 $ 191,464

$ 768,147 $ 667,003

Net (loss) income attributable

to Jabil Inc. (U.S. GAAP) $ (57,314 ) $ 45,679 $ 86,330 $

129,090 Adjustments to operating income 58,373 73,407 225,994

256,773 Impairment on securities — — — 11,539 Adjustments for

taxes(1) 117,167 (1,933 ) 146,206

(4,726 )

Core earnings (Non-GAAP) $ 118,226 $

117,153 $ 458,530 $ 392,676

(Loss) earnings per

share (U.S. GAAP): Basic $ (0.34 ) $ 0.26 $ 0.50 $ 0.71

Diluted $ (0.34 ) $ 0.25 $ 0.49 $ 0.69

Core

earnings per share (Non-GAAP): Basic $ 0.71 $ 0.66

$ 2.66 $ 2.16 Diluted $ 0.70 $ 0.64 $

2.62 $ 2.11

Weighted average shares outstanding used in

the calculations of earnings per share (U.S. GAAP): Basic

166,968 178,697 172,237

181,902 Diluted 166,968 182,977

175,044 185,838

Weighted average shares

outstanding used in the calculations of earnings per share

(Non-GAAP): Basic 166,968

178,697 172,237 181,902

Diluted 169,728 182,977 175,044

185,838 (1) Includes a $111.4 million

and $142.3 million provisional estimate to account for the effects

of the Tax Cuts and Jobs Act for the three months and fiscal year

ended August 31, 2018, respectively.

JABIL INC.

AND SUBSIDIARIES SUPPLEMENTAL DATA RETURN ON INVESTED

CAPITAL AND CORE RETURN ON INVESTED CAPITAL (in

thousands) (Unaudited)

Three Months Ended Fiscal Year Ended August 31,

2018 August 31, 2017 August 31,

2018 August 31, 2017 Numerator:

Operating income (U.S. GAAP) $ 153,896 $ 118,057 $ 542,153 $

410,230 Tax effect (1) (88,126 ) (35,771 )

(300,979 ) (137,087 ) After-tax operating income 65,770

82,286 241,174 273,143 x4 x4 x1 x1

Annualized after-tax

operating income $ 263,080 $ 329,144 $ 241,174

$ 273,143

Core operating income (Non-GAAP) $

212,269 $ 191,464 $ 768,147 $ 667,003 Tax effect (2) (49,875

) (37,610 ) (144,261 ) (134,930 ) After-tax

core operating income 162,394 153,854 623,886 532,073 x4 x4 x1 x1

Annualized after-tax core operating income $ 649,576

$ 615,416 $ 623,886 $ 532,073

Denominator: Average total Jabil Inc. stockholders' equity

(3) $ 2,061,699 $ 2,340,495 $ 2,151,886 $ 2,395,843 Average notes

payable and long-term debt, less current installments (3) 2,321,562

1,638,591 2,063,047 1,853,302 Average current installments of notes

payable and long-term debt (3) 148,698 492,241 235,348 245,654

Average cash and cash equivalents (3) (967,720 )

(966,925 ) (1,223,934 ) (1,050,989 )

Net invested

capital base $ 3,564,239 $ 3,504,402 $ 3,226,347

$ 3,443,810

Return on Invested Capital

(U.S. GAAP) 7.4 % 9.4 % 7.5

% 7.9 % Adjustments noted above

10.8 % 8.2 % 11.8 %

7.6 % Core Return on Invested Capital

(Non-GAAP) 18.2 % 17.6 %

19.3 % 15.5 % (1) This

amount is calculated by adding the amount of income taxes

attributable to its operating income (U.S. GAAP) and its interest

expense.

(2)

This amount is calculated by adding the

amount of income taxes attributable to its core operating income

(Non-GAAP) and its interest expense.

(3)

The average is based on the addition of

the account balance at the end of the most recently-ended quarter

to the account balance at the end of the prior quarter for the

three months ended August 31, 2018 and 2017, respectively, and

dividing by two. The average is based on the addition of the

account balance at the end of the most recently-ended fiscal year

to the account balance at the end of the prior fiscal year for the

fiscal years ended August 31, 2018 and 2017, respectively, and

dividing by two.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180925005300/en/

Jabil Inc.Adam Berry, 727-803-5772Vice President, Investor

Relationsadam_berry@jabil.com

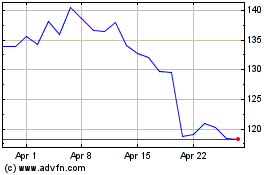

Jabil (NYSE:JBL)

Historical Stock Chart

From Apr 2024 to May 2024

Jabil (NYSE:JBL)

Historical Stock Chart

From May 2023 to May 2024