Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on September 6, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Protagonist Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

98-0505495

(I.R.S. Employer

Identification Number)

|

7707 Gateway Boulevard, Suite 140

Newark, California 94560-1160

(510) 474-0170

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Dinesh Patel

President and Chief Executive Officer

Protagonist Therapeutics, Inc.

7707 Gateway Boulevard, Suite 140

Newark, California 94560-1160

(510) 474-0170

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Kenneth L. Guernsey

Michael E. Tenta

Josh Seidenfeld

Cooley LLP

3175 Hanover Street

Palo Alto, CA 94304

(650) 843-5000

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

ý

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

Emerging growth company

ý

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

ý

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Unit(2)

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

Amount of

Registration Fee(2)

|

|

|

|

Common Stock, par value $0.00001 per share

|

|

2,750,000

|

|

$9.64

|

|

$26,510,000

|

|

$3,301

|

|

|

-

(1)

-

Consists

of 2,750,000 shares of common stock that may be issued upon the exercise of outstanding warrants. Pursuant to Rule 416 under the Securities Act of

1933, as amended, the shares of common stock being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares of common stock being

registered hereunder as a result of stock splits, stock dividends or similar transactions.

-

(2)

-

Pursuant

to Rule 457(c), calculated on the basis of the average of the high and low prices per share of the registrant's Common Stock reported on the Nasdaq

Global Market on September 4, 2018, a date within five business days prior to the filing of this registration statement.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

Table of Contents

The information contained in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these

securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 6, 2018

PROSPECTUS

2,750,000 Shares

Common Stock

This prospectus relates to the disposition from time to time of up to 2,750,000 shares of our common stock issuable upon the exercise of

outstanding warrants, which are held by the selling stockholders named in this prospectus. We are not selling any common stock under this prospectus and will not receive any of the proceeds from the

sale of shares by the selling stockholders. We will, however, receive the net proceeds of any warrants exercised for cash.

The

selling stockholders identified in this prospectus, or their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if

required, a post-effective amendment to the registration statement of which this prospectus is a part, may offer the shares from time to time through public or private transactions at fixed prices, at

prevailing market prices, at varying prices determined at the time of sale, or at privately negotiated prices. We provide more information about how the selling stockholders may sell their shares of

common stock in the section entitled "Plan of Distribution" beginning on page 12 of this prospectus. We have agreed to pay certain expenses incurred in connection with the registration of these

shares, however, we will not be paying any underwriting discounts or commissions in connection with any offering of common stock under this prospectus.

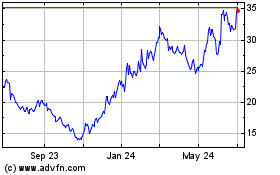

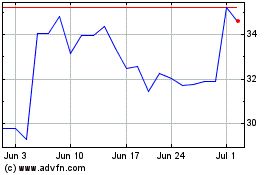

Our

common stock is listed on the NASDAQ Global Market under the symbol "PTGX." On September 4, 2018, the last reported sale price of our common stock on the NASDAQ Global Market

was $9.51 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties incorporated by reference

herein under the heading "Risk Factors" on page 5 of this prospectus, and under similar headings in the other documents that are filed after the date hereof and incorporated by reference into

this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2018.

Table of Contents

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should carefully read this prospectus, any prospectus supplement and any related free writing prospectus, together with the additional

information described under "Where You Can Find More Information," before buying any of the securities being offered.

You

should rely only on the information contained in or incorporated by reference in this prospectus (as supplemented or amended). We have not authorized anyone to provide you with

different information. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. The information contained in this prospectus, as well as the

information filed previously with the SEC, and incorporated by reference in this prospectus, is accurate only as of the date of the document containing the information, regardless of the time of

delivery of this prospectus or any applicable prospectus supplement or any sale of our common stock.

This

prospectus contains and incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available

information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although

we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and

uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" contained in the applicable prospectus supplement and any related free

writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this

information.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All

of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as

exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled "Where You Can Find More

Information."

Except

as otherwise indicated herein or as the context otherwise requires, references in this prospectus to "Protagonist," "the company," "we," "us," "our" and similar references refer

to Protagonist Therapeutics, Inc., a corporation under the laws of the State of Delaware.

This

prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and

trade

names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

i

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference herein

and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus any applicable prospectus supplement and any

related free writing prospectus, including the risks of investing in our securities discussed under the heading "Risk Factors" contained in the applicable prospectus supplement and any related free

writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference

into this prospectus, including our financial statements and related notes, and the exhibits to the registration statement of which this prospectus is a part, before making your investment

decision.

Protagonist Therapeutics, Inc.

Overview

We are a clinical stage biopharmaceutical company with a proprietary technology platform that enables the discovery and development of novel

constrained peptide-based drug candidates that address significant unmet medical needs. Our product candidates are designed to affect critical steps in the biological pathways of particular diseases,

for example, by blocking protein-protein interactions. We believe our peptide-based approach has advantages over alternative approaches such as small molecules and antibodies. Our clinical stage

product candidates PTG-100 and PTG-200 are oral drugs that block biological pathways currently targeted by marketed injectable antibody drugs and offer targeted delivery to the gastrointestinal ("GI")

tissue compartment. We believe that, as compared to antibody drugs, these product candidates have the potential to provide improved safety due to minimal exposure in the blood, increased convenience

and compliance due to oral delivery, and the opportunity for the earlier introduction of targeted therapy.

PTG-100,

an oral, alpha-4-beta-7 ("

a

4

b

7") integrin antagonist, is being developed for potential treatment of

inflammatory bowel disease ("IBD"), a GI disease consisting primarily of ulcerative colitis ("UC"), and Crohn's disease ("CD"). In March 2018, we announced the discontinuation of a global

Phase 2b clinical trial for the treatment of moderate-to-severe UC. This decision followed a planned interim analysis by an independent Data

Monitoring Committee ("DMC"). The interim data revealed an unusually high placebo rate of clinical remission that led to a futility decision and discontinuation of the trial. In August 2018, we

announced that a re-read of the endoscopies from the study by the subcontractor of the contract research organization ("CRO") and a subsequent fully blinded re-read of the endoscopies by an

independent third party confirmed that a subset of the initial endoscopy reads provided by the CRO were in error. If the re-read of endoscopy results had been utilized for the interim futility

analysis, the trial would have continued. In addition, a pre-specified blinded histopathology analysis of colon biopsies supported the observations of clinical remission and endoscopy responses for

PTG-100. Based on this entire analysis, we plan to discuss the next steps in advancing the clinical development of PTG-100 with the U.S. Food and Drug Administration ("FDA") and other global

regulatory authorities in the second half of 2018.

PTG-200

is a potential first-in-class oral, Interleukin-23 receptor ("IL-23R") antagonist for the treatment of IBD. It is currently in a Phase 1 healthy volunteer clinical study

that was initiated in Australia in the fourth quarter of 2017. The IL-12/23 pathway blockade is an approach that has been validated through an FDA approved injectable antibody drug. We have entered

into a worldwide license and collaboration agreement with Janssen Biotech, Inc. ("Janssen"), a Johnson & Johnson company, to co-develop and co-detail PTG-200 for all indications,

including IBD. See the section below entitled "Janssen License and Collaboration Agreement" for additional information. In the fourth quarter of 2018, we expect an Investigational New Drug application

("IND") in the United States by Janssen that will support the initiation of a global Phase 2 study of PTG-200 in CD to be conducted in

1

Table of Contents

collaboration

with Janssen. This IND filing would trigger a milestone payment from Janssen of $25 million under the Janssen License and Collaboration Agreement.

Our

novel peptides have potential applicability in a wide range of therapeutic areas in addition to GI diseases. We have applied our versatile platform outside of the GI disease areas

and are developing PTG-300, an injectable hepcidin mimetic, for the potential treatment of anemia and iron overload in certain rare blood disorders, with an initial focus on beta-thalassemia. In the

fourth quarter of 2017, we completed a successful Phase 1 study of PTG-300 in healthy volunteers which established pharmacodynamic-based clinical proof of concept. PTG-300 received an orphan

drug designation from the FDA for the treatment of beta-thalassemia in March 2018. We completed discussions with U.S. and global regulatory agencies and filed an IND in the United States in the second

quarter of 2018. We

plan other global regulatory submissions to support the initiation of a global Phase 2 study of PTG-300 in patients with beta-thalassemia in the fourth quarter of 2018. Treatment of patients

with myelodysplastic syndromes, hereditary hemochromatosis and polycythemia vera represent additional opportunities for future development of PTG-300.

In

addition, we continue to use our peptide technology platform to discover product candidates against targets in disease areas with significant unmet medical needs. In 2018, we

anticipate initiating IND-enabling studies for a fourth product candidate, an oral peptide targeting a GI condition other than IBD.

We

have not generated any revenue from product sales and we do not currently have any products approved for commercialization. We have never been profitable and have incurred net losses

in each year since inception and we do not anticipate that we will achieve sustained profitability in the near term. Our net losses were $8.7 million and $16.3 million for the three and

six months ended June 30, 2018, respectively, and $15.0 million and $29.1 million for the three and six months ended June 30, 2017, respectively. As of June 30,

2018, we had an accumulated deficit of $117.9 million. Substantially all of our net losses have resulted from costs incurred in connection with our research and development programs and from

general and administrative costs associated with our operations. We expect to continue to incur significant research, development and other expenses related to our ongoing operations and product

development, including clinical development activities under the Janssen License and Collaboration Agreement, and as a result, we expect to continue to incur losses in the future as we continue our

development of, and seek regulatory approval for, our product candidates.

Janssen License and Collaboration Agreement

On May 26, 2017, we and Janssen, one of the Janssen Pharmaceutical Companies of Johnson & Johnson, entered into an exclusive

license and collaboration agreement (the "Janssen License and Collaboration Agreement") for the clinical development, manufacture and potential commercialization of PTG-200 worldwide for the treatment

of CD and UC. Janssen is a related party to us as Johnson & Johnson Innovation—JJDC, Inc., a significant stockholder of ours, and Janssen are both subsidiaries of

Johnson & Johnson. During the third quarter of 2017, we received a non-refundable, upfront cash payment of $50.0 million from Janssen. We can also receive up to an additional

$940.0 million in payments, including potential license option payments of $125.0 million at the Phase 2 interim analysis and $200.0 million at Phase 2 completion,

and $615.0 million in other potential clinical development, regulatory approval and sales milestones. We and Janssen will co-develop and co-fund PTG-200 through Phase 2 clinical

development. Janssen will be responsible for funding Phase 3 studies in CD and UC. We will receive double-digit tiered royalties on future net sales and retain the option to co-detail PTG-200

in the United States.

2

Table of Contents

Company Information

Protagonist Pty Limited (Protagonist Australia) was incorporated in Australia in September 2001. We were incorporated under the laws of the

State of Delaware in 2006, under the name Protagonist Therapeutics, Inc., and became the parent of Protagonist Australia pursuant to a transaction in which all of the issued and outstanding

capital stock of Protagonist Australia was exchanged for shares of our common stock and Series A preferred stock. Our principal executive offices are located at 7707 Gateway Boulevard,

Suite 140, Newark, California 94560. Our telephone number is (510) 474-0170. Our website address is www.protagonist-inc.com. The information contained in, or accessible through, our

website does not constitute part of this prospectus, should not be relied on in determining whether to make an investment decision, and the inclusion of our website address in this prospectus is an

inactive textual reference only.

The

Protagonist logo and other trademarks or service marks of Protagonist Therapeutics, Inc. appearing in this prospectus are the property of Protagonist Therapeutics, Inc.

Other trademarks, service marks or trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other companies' trade names, trademarks

or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Private Placement

On August 6, 2018, we entered into a securities purchase agreement, pursuant to which we agreed to sell and issue to the selling

stockholders warrants to purchase an aggregate of 2,750,000 shares of Common Stock (each, a "Warrant," and collectively, the "Warrants"). Each Warrant is exercisable from August 8, 2018 until

August 8, 2023. Warrants to purchase 1,375,000 shares of Common Stock have an exercise price of $10.00 per share (the "Class A Warrants") and Warrants to

purchase 1,375,000 shares of Common Stock have an exercise price of $15.00 per share (the "Class B Warrants"). The exercise price and number of shares of Common Stock issuable upon the exercise

of the Warrants (the "Warrant Shares") is subject to adjustment in the event of any stock dividends and splits, reverse stock split, recapitalization, reorganization or similar transaction, as

described in the Warrants. Under certain circumstances, the Warrants will be exercisable on a "cashless" basis.

In

connection with the issuance and sale of the Warrants, we granted certain registration rights with respect to the Warrants and the Warrant Shares, pursuant to a Registration Rights

Agreement by and among us and the selling stockholders (the "Rights Agreement").

As

required by the Rights Agreement, we agreed to, among other things, (i) file a registration statement with the SEC to cover the resale of the Warrant Shares by the

selling stockholders, (ii) use commercially reasonable efforts to cause such registration statement to become effective following the filing thereof and (iii) take all other actions as

may be necessary to keep such registration statement continuously effective during the timeframes set forth in the Rights Agreement.

The

registration statement of which this prospectus is a part relates to the resale of the Warrant Shares that may be issued to the selling stockholders in connection with the exercise

of the Warrants issued in the foregoing private placement. Shares of common stock that may be offered under this prospectus will be fully paid and non-assessable.

3

Table of Contents

The Offering

|

|

|

|

|

Common stock offered by selling stockholders

|

|

2,750,000 shares

|

|

Term of offering

|

|

Each selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described

in "Plan of Distribution."

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

|

|

Risk factors

|

|

See the section below entitled "Risk Factors" for a discussion of factors you should carefully consider before deciding to

invest in our common stock.

|

|

Nasdaq Global Market Symbol

|

|

PTGX

|

The

selling stockholders named in this prospectus may offer and sell up to 2,750,000 shares of our common stock. Our common stock is currently listed on The Nasdaq Global Market under

the symbol "PTGX." Shares of common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholders

of any of the common stock covered by this prospectus. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and

resale, we are referring to the shares of common stock issued to the selling stockholders in connection with the exercise of Warrants issued in our private placement as described above. When we refer

to the selling stockholders in this prospectus, we are referring to the selling stockholders identified in this prospectus and, as applicable, their permitted transferees or other

successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

4

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks and uncertainties described under the heading "Risk Factors" contained in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as

well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this

prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering. The risks described in these documents are not the

only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse

effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future

periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock

to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled "Forward-Looking Statements."

FORWARD-LOOKING STATEMENTS

This prospectus, the documents incorporated by reference any applicable prospectus supplement and any free writing prospectus that we have

authorized for use in connection with this offering contain forward-looking statements, including statements regarding our future financial condition, business strategy and plans and objectives of

management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as

"believe," "will," "may," "estimate," "continue," "anticipate," "intend," "should," "plan," "might," "approximately," "expect," "predict," "could," "potentially" or the negative of these terms or

other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus, the documents incorporated by reference and any free writing prospectus that we have

authorized for use in connection with this offering and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, the

potential for our programs, the timing of our clinical trials, the potential for eventual regulatory approval and commercialization of our product candidates and our potential receipt of milestone

payments and royalties under our collaboration agreement with Janssen, the potential outcome of any litigation or proceeding, future operating results or the ability to generate sales, income or cash

flow are forward-looking statements.

Discussions

containing these forward-looking statements may be found, among other places, in the sections entitled "Risk Factors," "Business" and "Management's Discussion and Analysis of

Financial Condition and Results of Operations" incorporated by reference from our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments

thereto, filed with SEC. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual

results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These statements reflect our current views with

respect to future events and are based on assumptions and subject to risks and uncertainties. Given these risks and uncertainties, you should not place undue reliance on these forward-looking

statements. We discuss in greater detail many of these risks under the heading "Risk Factors" in the documents incorporated by reference herein, and elsewhere in this prospectus. Also, these

forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement and, except as required by law, we undertake no obligation to

update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

5

Table of Contents

In

addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as

of the date of this

prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate

that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly

rely upon these statements.

6

Table of Contents

USE OF PROCEEDS

The selling stockholders will receive all of the net proceeds from sales of the common stock sold pursuant to this prospectus. However, upon any

exercise of Warrants for cash, the selling stockholders would pay us an exercise price of $10.00 per share of common stock in the case of Class A Warrants, and $15.00 per share of common stock

in the case of Class B Warrants, subject to any adjustment pursuant to the terms of the Warrants. We expect to use any such Warrant exercise proceeds primarily for working capital and general

corporate purposes. Under certain circumstances, the Warrants are exercisable on a cashless basis by net exercise. If any of the Warrants are exercised on a cashless basis, we would not receive any

cash payment from the applicable selling stockholder upon any such cashless exercise of a Warrant.

7

Table of Contents

SELLING STOCKHOLDERS

We are registering the resale of 2,750,000 shares of common stock which are issuable upon the exercise of Warrants held by the selling

stockholders identified below to permit each of them, or their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a

post-effective amendment to the registration statement

of which this prospectus is a part, to resell or otherwise dispose of these shares in the manner contemplated under the section entitled "Plan of Distribution" in this prospectus (as may be

supplemented and amended).

The

selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders will hold the shares before selling them, and we currently have no

agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of the shares. The shares covered hereby may be offered from time to time by the

selling stockholders. As a result, we cannot estimate the number of shares of common stock each of the selling stockholders will beneficially own after termination of sales under this prospectus. In

addition, each of the selling stockholders may have sold, transferred or otherwise disposed of all or a portion of its shares of common stock since the date on which it provided information for this

table.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common stock. Generally, a person "beneficially

owns" shares of our common stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights

within 60 days.

The

information in the table below and the footnotes thereto regarding shares of common stock to be beneficially owned after the offering assumes the sale of all shares being offered by

the selling stockholders under this prospectus. The percentage of shares owned prior to and after the offering is based on 24,085,588 shares of common stock outstanding as of August 15, 2018.

This information has

8

Table of Contents

been

obtained from the selling stockholders or in Schedules 13G or 13D and other public documents filed with the SEC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to Offering

|

|

|

|

After Offering(3)

|

|

|

Name and Address

|

|

Number of

Shares

Beneficially

Owned(1)

|

|

Percentage of

Shares

Beneficially

Owned

|

|

Number of

Shares

Offered(2)

|

|

Number of

Shares

Beneficially

Owned

|

|

Percentage of

Shares

Beneficially

Owned

|

|

|

BVF Partners L.P.

|

|

|

3,867,967

|

(4)

|

|

16.1

|

%

|

|

1,250,000

|

|

|

2,617,967

|

|

|

10.9

|

%

|

|

44 Montgomery Street, 40th Floor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94104

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital Offshore Investors II, LP

|

|

|

1,829,684

|

(5)

|

|

7.6

|

%

|

|

746,200

|

|

|

1,083,484

|

|

|

4.5

|

%

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital Institutional Partners, LP

|

|

|

764,500

|

(6)

|

|

3.2

|

%

|

|

292,500

|

|

|

472,000

|

|

|

2.0

|

%

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital Partners, LP

|

|

|

723,300

|

(7)

|

|

3.0

|

%

|

|

277,500

|

|

|

445,800

|

|

|

1.9

|

%

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital Institutional Partners II, LP

|

|

|

132,000

|

(8)

|

|

*

|

|

|

52,500

|

|

|

79,500

|

|

|

*

|

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Four Crossings Institutional Partners V, L.P.

|

|

|

113,100

|

(9)

|

|

*

|

|

|

45,000

|

|

|

68,100

|

|

|

*

|

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital F5 Master I, L.P.

|

|

|

92,600

|

(10)

|

|

*

|

|

|

37,500

|

|

|

55,100

|

|

|

*

|

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital Institutional Partners III, LP

|

|

|

90,400

|

(11)

|

|

*

|

|

|

33,800

|

|

|

56,600

|

|

|

*

|

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farallon Capital (AM) Investors, LP

|

|

|

44,300

|

(12)

|

|

*

|

|

|

15,000

|

|

|

29,300

|

|

|

*

|

|

|

c/o Farallon Capital Management, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Maritime Plaza, #2100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

*

-

Less

than 1%

-

(1)

-

Under

the terms of the Warrants, the number of shares of our common stock that may be acquired by a selling stockholder upon any exercise of a Warrant is generally

limited to the extent necessary to ensure that, following such exercise, such selling stockholder would not, together with its affiliates and any other persons or entities whose beneficial ownership

of our common stock would be aggregated with such selling stockholder for purposes of Section 13(d) of the Exchange Act, beneficially own in excess of 9.99% of the total number of shares of our

common stock then issued and outstanding and/or the then combined voting power of all of our voting securities (the

9

Table of Contents

"Blockers");

provided, that such Blocker is waivable by the selling stockholder upon notice to us up to a 19.99% maximum. As noted in footnote (2), the number of shares shown under the column titled

"Number of Shares Offered" is shown without regard to the foregoing limitations on exercise.

-

(2)

-

The

number of shares offered hereby, for each selling stockholder, consists solely of the shares issuable upon exercise of the Class A Warrants and

Class B Warrants issued to such selling stockholder. The shares issuable upon exercise of the warrants will become eligible for sale by the selling stockholders under this prospectus only as

the warrants are exercised. In addition, the number of shares offered hereby shown under the column titled "Number of Shares Offered" includes the maximum number of shares issuable upon the exercise

of the Warrants without regard to the limitations on exercise described in footnote (1) above.

-

(3)

-

Assumes

sale of all shares available for sale under this prospectus and no further acquisitions of shares by the selling stockholders.

-

(4)

-

Consists

of (i) 1,209,268 outstanding shares of common stock owned by Biotechnology Value Fund, L.P. ("BVF") and 577,541 shares of common stock

issuable upon the exercise of warrants held by BVF, (ii) 951,770 outstanding shares of common stock owned by Biotechnology Value Fund II, L.P. ("BVF2") and 454,455 shares of

common stock issuable upon the exercise of warrants held by BVF2, (iii) 199,196 outstanding shares of common stock owned by Biotechnology Value Trading Fund OS, L.P. ("Trading Fund OS")

and 88,264 shares of common stock issuable upon the exercise of warrants held by Trading Fund OS, (iv) 98,347 outstanding shares of common stock owned by Investment 10, LLC ("INV10") and 44,748

shares of common stock issuable upon the exercise of warrants held by ("INV10") and (v) 159,386 outstanding shares of common stock owned by MSI BVF SPV, L.L.C. ("MSI" and together with BVF,

BVF2, Trading Fund OS and INV10, the "BVF Investment Entities") and 84,992 shares of common stock issuable upon the exercise of warrants held by MSI. BVF Partners L.P. ("BVF Partners") is the general

partner of BVF and BVF2, and the investment manager of each of Trading Fund OS, INV10 and MSI, and may be deemed to beneficially own the shares held by the BVF Investment Entities. BVF, Inc., as the

general partner of BVF Partners, may be deemed to beneficially own the shares beneficially owned by BVF Partners. Mark Lampert, as a director and officer of BVF, Inc., may be deemed to beneficially

own the shares beneficially owned by BVF, Inc.

-

(5)

-

Consists

of (i) 1,083,484 outstanding shares of common stock owned by Farallon Capital Offshore Investors II, LP ("FCOI II") and (ii) 746,200

shares of common stock issuable upon the exercise of warrants held by FCOI II. Each of Philip D. Dreyfuss, Michael B. Fisch, Richard B. Fried, David T. Kim, Monica R. Landry, Michael G. Linn, Rajiv A.

Patel, Thomas G. Roberts, Jr., William Seybold, Andrew J.M. Spokes, John R. Warren and Mark C. Wehrly (collectively, the "Managing Members"), as a managing member or senior managing member of the

general partner, share voting and dispositive power with respect to the shares held by FCOI II. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his

or her pecuniary interest therein.

-

(6)

-

Consists

of (i) 472,000 outstanding shares of common stock owned by Farallon Capital Institutional Partners, LP ("FCIP") and (ii) 292,500 shares

of common stock issuable upon the exercise of warrants held by FCIP. Each of the Managing Members, as a managing member or senior managing member of the general partner, share voting and dispositive

power with respect to the shares held by FCIP. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(7)

-

Consists

of (i) 445,800 outstanding shares of common stock owned by Farallon Capital Partners, LP ("FCP") and (ii) 277,500 shares of common

stock issuable upon the exercise of warrants held by FCP. Each of the Managing Members, as a managing member or senior managing member of the general partner, share voting and dispositive power with

respect to the shares held by FCP. Each of

10

Table of Contents

the

Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(8)

-

Consists

of (i) 79,500 outstanding shares of common stock owned by Farallon Capital Institutional Partners II, LP ("FCIP II") and (ii) 52,500

shares of common stock issuable upon the exercise of warrants held by FCIP II. Each of the Managing Members, as a managing member or senior managing member of the general partner, share voting and

dispositive power with respect to the shares held by FCIP II. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(9)

-

Consists

of (i) 68,100 outstanding shares of common stock owned by Four Crossings Institutional Partners V, L.P. ("Four CIP V") and (ii) 45,000

shares of common stock issuable upon the exercise of warrants held by Four CIP V. Each of the Managing Members, as a manager or senior manager of the general partner, share voting and dispositive

power with respect to the shares held by Four CIP V. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(10)

-

Consists

of (i) 55,100 outstanding shares of common stock owned by Farallon Capital F5 Master I, L.P. ("FCF5M") and (ii) 37,500 shares

of common stock issuable upon the exercise of warrants held by FCF5M. Each of the Managing Members, as a manager or senior manager of the general partner, share voting and dispositive power with

respect to the shares held by FCF5M. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(11)

-

Consists

of (i) 56,600 outstanding shares of common stock owned by Farallon Capital Institutional Partners III, LP ("FCIPIII") and (ii) 33,800

shares of common stock issuable upon the exercise of warrants held by FCIPIII. Each of the Managing Members, as a managing member or senior managing member of the general partner, share voting and

dispositive power with respect to the shares held by FCIPIII. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

-

(12)

-

Consists

of (i) 29,300 outstanding shares of common stock owned by Farallon Capital (AM) Investors, LP ("FCAMI") and (ii) 15,000 shares of

common stock issuable upon the exercise of warrants held by FCAMI. Each of the Managing Members, as a managing member or senior managing member of the general partner, share voting and dispositive

power with respect to the shares held by FCAMI. Each of the Managing Members disclaims beneficial ownership of such shares except to the extent of his or her pecuniary interest therein.

11

Table of Contents

PLAN OF DISTRIBUTION

We are registering the shares of common stock issuable to the selling stockholders upon the exercise of the selling stockholders' Warrants to

permit the resale of such shares of common stock by such holders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders

of the shares of common stock. We will bear all fees and expenses incident to our obligation to register such shares of common stock.

Each

selling stockholder, which may include donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received

after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of

its shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be

at fixed prices, at

prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at privately negotiated prices.

A

selling stockholder may use any one or more of the following methods when disposing of shares or interests therein:

-

•

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

•

-

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction;

-

•

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its own account;

-

•

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

•

-

privately negotiated transactions;

-

•

-

to the extent permitted by law, short sales effected after the date the registration statement of which this prospectus is a part is declared

effective by the SEC;

-

•

-

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

-

•

-

through agreements between broker-dealers and the selling stockholders to sell a specified number of such shares at a stipulated price per

share;

-

•

-

a combination of any such methods of sale; and

-

•

-

any other method permitted by applicable law.

The

selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of

their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under

Rule 424(b) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling

stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the pledgees, transferees or other successors in

interest will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver

these securities to close

12

Table of Contents

out

their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into options or other transactions with

broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to each such broker-dealer or other financial institution of shares

offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any.

Each of the selling stockholders reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly

or through agents. We will not receive any of the proceeds from this offering.

The

selling stockholders also may resell all or a portion of the shares in open market transactions, rather than under this prospectus, in reliance upon Rule 144 under the

Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The

selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters" within the meaning of

Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities

Act. Selling stockholders who are "underwriters" within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To

the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any

agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a

post-effective amendment to the registration statement that includes this prospectus.

If

underwriters are used in the sale, the shares of common stock will be acquired by the underwriters for their own account and may be resold from time to time in one or more

transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. In connection with any such underwritten sale of shares of common

stock, underwriters may receive compensation from the selling stockholders, for whom they may act as agents, in the form of discounts, concessions or commissions. If the selling stockholders use an

underwriter or underwriters to effectuate the sale of shares of common stock, we and/or they will execute an underwriting agreement with those underwriters at the time of sale of those shares of

common stock. To the extent required by law, the names of the underwriters will be set forth in a prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes the prospectus supplement and the accompanying prospectus used by the underwriters to sell those securities. The obligations of the underwriters to purchase those shares of common stock

will be subject to certain conditions precedent, and unless otherwise specified in a prospectus supplement, the underwriters will be obligated to purchase all the shares of common stock offered by

such prospectus supplement if any of such shares of common stock are purchased. Any public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from

time to time.

We

have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities

of the selling stockholders and their affiliates. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain

liabilities, including liabilities arising under the Securities Act.

13

Table of Contents

We

are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock of the selling stockholders. We have agreed to indemnify the

selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act, and the selling stockholders may be entitled to contribution. We may be

indemnified by the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act that may arise from any written information furnished to

us by the selling stockholders specifically for use in this prospectus, or we may be entitled to contribution.

We

have agreed with the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (1) such time as all of

the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement or pursuant to Rule 144 of the Securities Act or

(2) August 8, 2020.

14

Table of Contents

LEGAL MATTERS

Cooley LLP will pass upon the validity of the securities offered pursuant to this registration statement.

EXPERTS

The financial statements incorporated in this registration statement by reference to the Annual Report on Form 10-K for the year ended

December 31, 2017 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm

as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in

the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus, we refer you to the

registration statement and the exhibits and schedules filed as a part of the registration statement. Neither we nor any agent, underwriter or dealer has authorized any person to provide you with

different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any

date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC's public reference

room at 100 F Street, N.E., Washington, D.C., 20549. Please call the SEC at 1.800.SEC.0330 for further information on the operation of the public reference room. Our SEC filings are also

available to the public at the SEC's website at http://www.sec.gov.

15

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" the information we file with it, which means that we can disclose important information to you

by referring you to those documents instead of having to repeat the information in this prospectus. The information incorporated by reference is considered to be part of this prospectus, and later

information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings (including those made

after the date of the initial filing of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration statement) we will make with the SEC under

Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act until the termination of the offering of the shares covered by this prospectus (other than information furnished under Item 2.02

or Item 7.01 of Form 8-K):

-

•

-

our annual report on Form 10-K for the year ended December 31, 2017, filed with the SEC on March 7, 2018, including the

information specifically incorporated by reference therein from our definitive proxy statement on Schedule 14A, filed on April 18, 2018;

-

•

-

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, filed with the SEC on May 9, 2018;

-

•

-

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, filed with the SEC on August 7, 2018;

-

•

-

our current reports on Form 8-K, filed with the SEC on February 27, 2018, March 26, 2018, May 16, 2018,

May 31, 2018 and August 7, 2018; and

-

•

-

the description of our common stock set forth in our registration statement on Form 8-A, filed with the SEC on August 9, 2016,

including any amendments thereto or reports filed for the purposes of updating this description.

You

can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Protagonist

Therapeutics, Inc.

7707 Gateway Boulevard, Suite 140

Newark, California 94560

(510) 474-0170

Attn: Chief Financial Officer

This

prospectus is part of a registration statement we filed with the SEC. That registration statement and the exhibits filed along with the registration statement contain more

information about us and the shares in this offering. Because information about documents referred to in this prospectus is not always complete, you should read the full documents which are filed as

exhibits to the registration statement. You may read and copy the full registration statement and its exhibits at the SEC's public reference rooms or its website.

16

Table of Contents

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following sets forth the estimated costs and expenses, all of which shall be borne by the Registrant, in connection with the offering of the

securities pursuant to this Registration Statement:

|

|

|

|

|

|

|

SEC Registration Fee

|

|

$

|

3,301

|

|

|

Legal Fees and Expenses

|

|

$

|

125,000

|

|

|

Accounting Fees

|

|

$

|

10,000

|

|

|

Printing and Miscellaneous Fees

|

|

$

|

30,699

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

169,000

|

|

|

|

|

|

|

|

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation's board of directors to grant,

indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under

the Securities Act.

Our

certificate of incorporation provides for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation

Law, and our bylaws provide for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law.

We

have entered into indemnification agreements with our directors and officers whereby we have agreed to indemnify our directors and officers to the fullest extent permitted by law,

including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact that such

director or officer is or was a director, officer, employee or agent of Protagonist, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably

believed to be in, or not opposed to, the best interest of Protagonist. At present, there is no pending litigation or proceeding involving a director or officer of Protagonist regarding which

indemnification is sought, nor is the registrant aware of any threatened litigation that may result in claims for indemnification.

We

maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the Exchange Act of 1934, as amended, that might

be incurred by any director or officer in his capacity as such.

The

underwriting agreement(s) that the Registrant may enter into may provide for indemnification by any underwriters of the Registrant, its directors, its officers who sign the

registration statement and the Registrant's controlling persons for some liabilities, including liabilities arising under the Securities Act.

II-1

Table of Contents

Item 16. Exhibits and Financial Statement Schedules

-

(1)

-

Previously

filed as an exhibit to the Registrant's Current Report on Form 8-K (File No. 001-37852) filed with the Securities and Exchange Commission on

August 16, 2016 and incorporated herein by reference.

-

(2)

-

Previously

filed as an exhibit to the Registrant's Registration Statement on Form S-1, as amended (File No. 333-212476), filed with the Securities and

Exchange Commission on August 1, 2016 and incorporated herein by reference.

-

(3)

-

Previously

filed as an exhibit to the Registrant's Current Report on Form 8-K (File No. 001-37852) filed with the Securities and Exchange Commission on

August 7, 2018 and incorporated herein by reference.

Item 17. Undertakings

The undersigned registrants hereby undertakes:

(a) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may

be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

II-2

Table of Contents

represent

no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

provided, however

, that the undertakings set forth in paragraphs (i), (ii) and (iii) of this section do not apply if

the registration statement is on Form S-3, Form SF-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in

reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in

the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(b) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(d) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to

an offering made pursuant to

Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering

described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective

date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a

time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made

in any such document immediately prior to such effective date.

(e) That

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to Section 13(a) or

Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Securities Exchange

Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

II-3

Table of Contents

(f) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant

pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as

expressed in the Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a

director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with

the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

II-4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Newark,

California, on September 6, 2018.

|

|

|

|

|

|

|

|

|

PROTAGONIST THERAPEUTICS, INC.

|

|

|

By:

|

|

/s/ DINESH V. PATEL, PH.D.

Dinesh V. Patel, Ph.D.

President, Chief Executive Officer and Director

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Dinesh V. Patel and Thomas P.

O'Neil, his or her true and lawful agent, proxy and attorney-in-fact, each acting alone, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in

any and all capacities, to (i) act on, sign, and file with the SEC any and all amendments (including post-effective amendments) to this registration statement together with all schedules and