Manhattan Bridge Capital, Inc. (NASDAQ:LOAN) announced today that

its total revenue for the three months ended June 30, 2018 was

approximately $1,668,000 compared to approximately $1,401,000 for

the three months ended June 30, 2017, an increase of $267,000, or

19.1%. For the three months ended June 30, 2018, approximately

$1,423,000 of the Company's revenue represents interest income on

the secured, commercial loans that the Company offers to small

businesses compared to approximately $1,189,000 for the same period

in 2017, and approximately $244,000 represents origination fees on

such loans compared to approximately $212,000 for the same period

in 2017. The increase in revenue represents an increase in lending

operations.

Net income for the three months ended June 30,

2018 was approximately $949,000, or $0.12 per basic and diluted

share (based on approximately 8.1 million weighted-average

outstanding common shares), as compared to approximately $840,000,

or $0.10 per basic and diluted share (based on approximately 8.1

million weighted-average outstanding common shares) for the three

months ended June 30, 2017. This increase is primarily attributable

to the increase in revenue, offset by an increase in interest

expense.

Total revenue for the six months ended June 30,

2018 was approximately $3,332,000 compared to approximately

$2,731,000 for the six months ended June 30, 2017, an increase of

$601,000, or 22.0%. For the six months ended June 30, 2018,

approximately $2,853,000 of the Company's revenue represents

interest income on the secured, commercial loans that the Company

offers to small businesses compared to approximately $2,295,000 for

the same period in 2017, and approximately $480,000 represents

origination fees on such loans compared to approximately $436,000

for the same period in 2017. The increase in revenue represents an

increase in lending operations.

Net income for the six months ended June 30,

2018 was approximately $1,930,000, or $0.24 per basic and diluted

share (based on approximately 8.1 million weighted-average

outstanding common shares), as compared to approximately

$1,631,000, or $0.20 per basic and diluted share (based on

approximately 8.1 million weighted-average outstanding common

shares) for the six months ended June 30, 2017. This increase is

primarily attributable to the increase in revenue, offset by an

increase in interest expense.

As of June 30, 2018, total

shareholders' equity was approximately $23,259,000 compared to

approximately $22,247,000 as of December 31, 2017.

Effective July 11, 2018, the Company amended its

existing credit line agreement with Webster Business Credit

Corporation and Flushing Bank to, among other things, further

increase its credit line from $20 million to $25 million.

On July 24, 2018, the Company completed a public

offering of 1,428,572 of its common shares at a public offering

price of $7.00 per share. The gross proceeds raised by the Company

from the offering were $10,000,004 before deducting underwriting

discounts and commissions and other estimated offering expenses.

The total net proceeds from the offering were approximately

$9,100,000. The Company has granted the underwriters a 45-day

option to purchase up to 214,286 additional common shares to cover

over-allotments, if any.

Assaf Ran, Chairman of the Board and CEO stated,

“We believe that the financial results for the second quarter once

again reflect our strict underwriting and disciplined loan

criteria, which continue to prove themselves as we maintain a

default free loan portfolio. At the beginning of the third quarter

we increased the line of credit from our lenders by $5 million

to $25 million in the aggregate, and completed an equity raise of

$10 million. I’m confident in my belief that the additional capital

will help us achieve further growth.”

About Manhattan Bridge Capital, Inc.

Manhattan Bridge Capital, Inc. offers short-term secured,

non–banking loans (sometimes referred to as ‘‘hard money’’ loans)

to real estate investors to fund their acquisition, renovation,

rehabilitation or improvement of properties located in the New York

metropolitan area. We operate the web site:

https://www.manhattanbridgecapital.com.

Forward Looking Statements

This press release and the statements of our

representatives related thereto contain or may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements that are not

statements of historical fact may be deemed to be forward-looking

statements. Without limiting the generality of the foregoing, words

such as “plan,” “project,” “potential,” “seek,” “may,” “will,”

“expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,”

or “continue” are intended to identify forward-looking statements.

For example, when we discuss the potential exercise by the

underwriter of the over-allotment option, with respect to our

public offering, or our belief that the additional capital

represented by the offering and increase in our credit line will

help us achieve further growth we are using forward-looking

statements. Readers are cautioned that certain important factors

may affect the Company’s actual results and could cause such

results to differ materially from any forward-looking statements

that may be made in this news release. Forward-looking statements

are not guarantees of future performance and involve risks and

uncertainties. Actual results may differ materially from those

projected, expressed or implied in the forward-looking statements

as a result of various factors, including but not limited to the

following: (i) our loan origination activities, revenues and

profits are limited by available funds; (ii) we operate in a highly

competitive market and competition may limit our ability to

originate loans with favorable interest rates; (iii) our Chief

Executive Officer is critical to our business and our future

success may depend on our ability to retain him; (iv) if we

overestimate the yields on our loans or incorrectly value the

collateral securing the loan, we may experience losses; (v) we may

be subject to “lender liability” claims; (vi) our due diligence may

not uncover all of a borrower’s liabilities or other risks to its

business; (vii) borrower concentration could lead to significant

losses; and (viii) we may choose to make distributions in our own

stock, in which case you may be required to pay income taxes in

excess of the cash dividends you receive. The risk factors

contained in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2017 filed with the Securities and Exchange

Commission identify important factors that could cause such

differences. These forward-looking statements speak only as of the

date of this press release, and we caution potential investors not

to place undue reliance on such statements. We undertake no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARY |

| CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

| |

June 30, 2018 |

|

December 31, 2017 |

| |

(unaudited) |

|

(audited) |

|

Assets |

|

|

|

| Loans

receivable |

$ |

51,846,500 |

|

|

$ |

45,124,000 |

|

| Interest

receivable on loans |

|

570,805 |

|

|

|

535,045 |

|

| Cash and

cash equivalents |

|

129,490 |

|

|

|

136,441 |

|

| Deferred

financing costs |

|

31,361 |

|

|

|

45,269 |

|

| Other

assets |

|

142,064 |

|

|

|

55,941 |

|

| Total

assets |

$ |

52,720,220 |

|

|

$ |

45,896,696 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Liabilities: |

|

|

|

| Line of credit |

$ |

20,000,000 |

|

|

$ |

16,914,594 |

|

| Short term loans -

related party |

|

2,430,000 |

|

|

|

--- |

|

| Short term loan |

|

1,000,000 |

|

|

|

--- |

|

| Senior secured notes

(net of deferred financing costs of $585,041 and $622,584) |

|

|

|

| |

|

5,414,959 |

|

|

|

5,377,416 |

|

| Deferred origination

fees |

|

428,576 |

|

|

|

298,471 |

|

| Accounts payable and

accrued expenses |

|

187,511 |

|

|

|

167,559 |

|

| Dividends payable |

|

--- |

|

|

|

891,983 |

|

| Total

liabilities |

|

29,461,046 |

|

|

|

23,650,023 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity: |

|

|

|

| Preferred shares - $.01

par value; 5,000,000 shares |

|

|

|

|

authorized; none issued |

|

--- |

|

|

|

--- |

|

| Common shares - $.001

par value; 25,000,000 shares |

|

|

|

|

authorized; 8,327,917 and 8,319,036 issued, respectively; 8,117,815

and 8,108,934 outstanding, respectively |

|

8,328 |

|

|

|

8,319 |

|

| Additional paid-in

capital |

|

23,222,769 |

|

|

|

23,167,511 |

|

| Treasury stock, at cost

- 210,102 shares |

|

(541,491) |

|

|

|

(541,491) |

|

| Retained earnings

(accumulated deficit) |

|

569,568 |

|

|

|

(387,666) |

|

| Total

stockholders’ equity |

|

23,259,174 |

|

|

|

22,246,673 |

|

| |

|

|

|

| Total liabilities and

stockholders’ equity |

$ |

52,720,220 |

|

|

$ |

45,896,696 |

|

| |

|

|

|

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARYCONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited) |

| |

|

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|

|

|

2018 |

|

2017 |

|

|

2018 |

|

2017 |

|

| Interest

income from loans |

$ |

1,423,352 |

$ |

1,188,567 |

|

$ |

2,852,600 |

$ |

2,294,748 |

|

|

Origination fees |

|

244,348 |

|

212,334 |

|

|

479,574 |

|

435,759 |

|

| Total

Revenue |

|

1,667,700 |

|

1,400,901 |

|

|

3,332,174 |

|

2,730,507 |

|

|

|

|

|

|

|

| Operating

costs and expenses: |

|

|

|

|

| Interest

and amortization of debt service costs |

|

413,074 |

|

277,651 |

|

|

810,778 |

|

509,233 |

|

| Referral

fees |

|

83 |

|

841 |

|

|

416 |

|

2,201 |

|

| General

and administrative expenses |

|

305,155 |

|

270,471 |

|

|

590,674 |

|

575,986 |

|

| Total

operating costs and expenses |

|

718,312 |

|

548,963 |

|

|

1,401,868 |

|

1,087,420 |

|

| Income

from operations |

|

949,388 |

|

851,938 |

|

|

1,930,306 |

|

1,643,087 |

|

| Loss on

write-down of investment in privately held company |

|

--- |

|

(10,000) |

|

|

--- |

|

(10,000) |

|

| Income

before income tax expense |

|

949,388 |

|

841,938 |

|

|

1,930,306 |

|

1,633,087 |

|

| Income

tax expense |

|

--- |

|

(1,872) |

|

|

--- |

|

(1,872) |

|

| Net

income |

$ |

949,388 |

$ |

840,066 |

|

$ |

1,930,306 |

$ |

1,631,215 |

|

|

|

|

|

|

|

| Basic and

diluted net income per common share outstanding: |

|

|

|

|

|

--Basic |

$ |

0.12 |

$ |

0.10 |

|

$ |

0.24 |

$ |

0.20 |

|

|

--Diluted |

$ |

0.12 |

$ |

0.10 |

|

$ |

0.24 |

$ |

0.20 |

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding: |

|

|

|

|

|

--Basic |

|

8,111,276 |

|

8,119,052 |

|

|

8,110,112 |

|

8,127,000 |

|

|

--Diluted |

|

8,119,984 |

|

8,131,752 |

|

|

8,117,817 |

|

8,142,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MANHATTAN BRIDGE CAPITAL, INC. AND

SUBSIDIARYCONSOLIDATED STATEMENTS OF CASH

FLOWS(unaudited) |

| |

| |

|

|

| |

|

Six Months Ended June

30, |

| |

|

|

2018 |

|

|

|

2017 |

|

| Cash flows from

operating activities: |

|

|

|

|

| Net

Income |

|

$ |

1,930,306 |

|

|

$ |

1,631,215 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities - |

|

|

|

|

|

Amortization of deferred financing costs |

|

|

51,451 |

|

|

|

61,625 |

|

|

Depreciation |

|

|

2,274 |

|

|

|

2,186 |

|

| Non cash

compensation expense |

|

|

6,532 |

|

|

|

6,532 |

|

| Loss on

write-down of investment in privately held company |

|

|

--- |

|

|

|

10,000 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

| Interest

receivable on loans |

|

|

(35,760 |

) |

|

|

(110,599 |

) |

| Other

assets |

|

|

(76,097 |

) |

|

|

(35,109 |

) |

| Accounts

payable and accrued expenses |

|

|

19,952 |

|

|

|

(4,053 |

) |

| Deferred

origination fees |

|

|

130,105 |

|

|

|

46,112 |

|

| Other

liabilities |

|

|

--- |

|

|

|

25,000 |

|

| Net cash

provided by operating activities |

|

|

2,028,763 |

|

|

|

1,632,909 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Issuance

of short term loans |

|

|

(27,792,500 |

) |

|

|

(20,599,500 |

) |

|

Collections received from loans |

|

|

21,070,000 |

|

|

|

14,113,000 |

|

| Purchase

of fixed assets |

|

|

--- |

|

|

|

(1,666 |

) |

| Net cash

used in investing activities |

|

|

(6,722,500 |

) |

|

|

(6,488,166 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Proceeds

from line of credit, net |

|

|

3,085,406 |

|

|

|

6,683,151 |

|

| Proceeds

from short-term loans, net |

|

|

3,430,000 |

|

|

|

--- |

|

| Dividend

paid |

|

|

(1,865,055 |

) |

|

|

(1,627,007 |

) |

| Purchase

of treasury shares |

|

|

--- |

|

|

|

(172,156 |

) |

| Capital

raising costs |

|

|

(12,300 |

) |

|

|

--- |

|

| Proceeds

from exercise of warrants |

|

|

48,735 |

|

|

|

--- |

|

| Net cash

provided by financing activities |

|

|

4,686,786 |

|

|

|

4,883,988 |

|

| |

|

|

|

|

| Net (decrease) increase

in cash and cash equivalents |

|

|

(6,951 |

) |

|

|

28,731 |

|

| Cash and cash

equivalents, beginning of year |

|

|

136,441 |

|

|

|

96,299 |

|

| Cash and cash

equivalents, end of period |

|

$ |

129,490 |

|

|

$ |

125,030 |

|

| |

|

|

|

|

| Supplemental Cash Flow

Information: |

|

|

|

|

| Taxes paid during the

period |

|

$ |

--- |

|

|

$ |

1,872 |

|

| Interest paid during

the period |

|

$ |

733,215 |

|

|

$ |

415,273 |

|

| |

|

|

|

|

|

|

|

|

SOURCE: Manhattan Bridge Capital, Inc.

Contact:

Assaf Ran, CEO

Vanessa Kao, CFO

(516) 444-3400

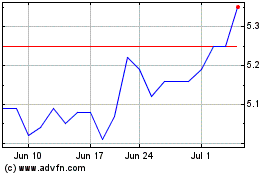

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Aug 2024 to Sep 2024

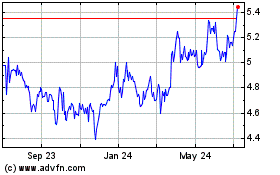

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Sep 2023 to Sep 2024