- Fourth-quarter reported net sales

totaled $1.4 billion.

- Fourth-quarter GAAP earnings from

continuing operations of $0.23 per diluted share.

- Fourth-quarter adjusted

earnings1 from continuing operations of $0.30 per

diluted share.

- Generated $179 million of cash flow

from operations during fiscal 2018.

- Company issues fiscal 2019 GAAP

earnings range of $1.43 to $1.53 per diluted share and adjusted

earnings1 range of $1.73 to $1.83 per diluted

share.

Patterson Companies, Inc. (Nasdaq: PDCO) today reported

consolidated net sales of approximately $1.4 billion (see attached

Sales Summary for further details) in its fiscal fourth quarter

ended April 28, 2018, a decline of 3.1 percent compared to the same

period last year. Internal sales, which adjust for the effects of

currency translation and changes in product selling relationships,

declined 3.3 percent.

Reported net income from continuing operations for the fourth

quarter of fiscal year 2018 was $20.9 million, or $0.23 per diluted

share, compared to $61.4 million, or $0.65 per diluted share, in

last year’s fiscal fourth quarter.

Adjusted net income1 from continuing operations, which excludes

deal amortization costs and discrete tax matters, totaled $28.2

million for the fourth quarter of fiscal 2018, compared to $65.6

million in the same quarter last year, driven by the anticipated

decrease in sales and margins in our Dental segment and a change in

estimate related to year-end inventory valuations. Adjusted

earnings1 per diluted share from continuing operations totaled

$0.30 in the fourth quarter, compared to $0.69 in the fiscal 2017

fourth quarter.

“Our fourth-quarter results met our revised expectations and

reflected the impact of ongoing challenges that the Company has

been facing,” said Mark Walchirk, president and CEO of Patterson

Companies. “Looking ahead, we are executing on a number of

initiatives to stabilize the core business and build a stronger

platform for fiscal 2019, and expect to return to profit growth in

the second half of the year. These initiatives are focused on

improving our revenue, margin and cash flow performance and

unlocking the strength of our value proposition. We are confident

that we are taking the right steps to improve performance and

deliver shareholder value going forward.”

Patterson DentalReported net sales in our Dental segment

for the fourth quarter, which represented approximately 39 percent

of total company sales, were $545.8 million compared to $607.3

million in the same quarter last year. Internal sales declined 10.5

percent compared to the fiscal 2017 fourth quarter. Year-over-year

internal sales by category were as follows:

- Consumable dental supplies decreased

6.7 percent.

- Equipment and software declined 20.2

percent.

- Other services and products, primarily

composed of technical service, parts and labor, software support

services and office supplies decreased 2.5 percent.

“As expected, results in the Dental segment reflected the

continued challenges throughout the year as a result of our sales

force realignment, ERP implementation and the market transition in

the digital equipment category,” continued Walchirk. “We are

focused on improving sales productivity, strengthening product mix,

leveraging our new ERP platform and expanding our sales penetration

in the digital equipment market. We expect these actions will

contribute toward stabilizing the Dental business and building

momentum around growth and profitability in the second half of

fiscal 2019.”

Patterson Animal HealthReported net sales in our Animal

Health segment for the fourth quarter of fiscal 2018, which

comprised approximately 61 percent of the company’s total sales,

were $848.0 million compared to $827.5 in the same quarter last

year. Internal sales for the segment increased 2.4 percent from the

fiscal 2017 fourth quarter. Year-over-year internal sales by

category were as follows:

- Production animal increased 2.8

percent.

- Companion animal rose 1.9 percent.

“Sales in our Animal Health segment grew as expected in the

quarter, led by our production animal health business, which

benefitted from improving fundamentals in the swine and beef

categories, partially offset by pressures in the dairy category,”

continued Walchirk. “In fiscal 2019, we expect to improve growth

and operating performance in the Animal Health business through

driving sales execution, improved product mix and effective cost

management.”

Share Repurchases and DividendsIn the fourth quarter of

fiscal 2018, Patterson paid $24.6 million in cash dividends to

shareholders. For fiscal 2018, the company returned a total of

$186.7 million to shareholders in the form of share repurchases and

dividends.

Year-to-Date ResultsConsolidated sales for fiscal 2018

totaled $5.5 billion, a 2.3 percent year-over-year decrease.

Internal sales declined 1.6 percent. Reported net income from

continuing operations was $201.0 million,

or $2.16 per diluted share, compared to $173.8

million, or $1.82 per diluted share in fiscal 2017. This

comparison includes the recognition of a provisional net tax

benefit of $76.6 million, reflecting the revaluation of

tax-deferred assets and liabilities, net of a one-time transition

tax on unremitted foreign earnings as a result of the 2017 Tax Act

enacted during the third quarter. Fiscal 2017 results contained a

pre-tax non-cash impairment charge of approximately $36

million, or approximately $23 million after taxes,

or $0.24 per diluted share, related to the distribution

fee associated with the CEREC product component of the previously

exclusive arrangement with Sirona Dental Systems.

Adjusted net income1 from continuing operations, which excludes

transaction-related costs, deal amortization costs, intangible

asset impairment, integration and business restructuring expenses,

and discrete tax matters, totaled $156.8 million,

or $1.68 per diluted share, compared to $223.3 million,

or $2.34 per diluted share, in fiscal 2017.

FY2019 GuidancePatterson today issued fiscal 2019

earnings guidance from continuing operations, which is provided on

both a GAAP and non-GAAP adjusted1 basis:

- GAAP earnings from continuing

operations are expected to be in the range of $1.43 to $1.53 per

diluted share.

- Non-GAAP adjusted earnings1 from

continuing operations are expected to be in the range of $1.73 to

$1.83 per diluted share.

- Our non-GAAP adjusted earnings1

guidance excludes the after-tax impact of deal amortization expense

of approximately $27.3 million ($0.30 per diluted share).

Our guidance is for current continuing operations as well as

completed or previously announced acquisitions and does not include

the impact of potential future acquisitions or similar

transactions, if any, or impairments and material restructurings

beyond those previously publicly disclosed. Our guidance assumes

North American and international market conditions similar to those

experienced in fiscal 2018.

1Non-GAAP Financial MeasuresThe Reconciliation of

GAAP to non-GAAP Measures table appearing behind the accompanying

financial information is provided to adjust reported GAAP measures,

namely earnings from continuing operations, net income from

continuing operations and earnings per diluted share from

continuing operations, for the impact of transaction related costs,

deal amortization expenses, intangible asset impairment,

integration and business restructuring expenses, along with the

related tax effects of these items, the impact of the 2017 Tax Act

and other discrete tax matters.

Management believes that these non-GAAP measures may provide a

helpful representation of the company's fourth-quarter and

full-year performance and earnings guidance, and enable comparison

of financial results between periods where certain items may vary

independent of business performance. These non-GAAP financial

measures are presented solely for informational and comparative

purposes and should not be regarded as a replacement for

corresponding, similarly captioned, GAAP measures.

In addition, the term constant currency represents net sales

adjusted to exclude foreign currency impacts. Foreign currency

impact represents the difference in results that is attributable to

fluctuations in currency exchange rates the company uses to convert

results for all foreign entities where the functional currency is

not the U.S. dollar. The company calculates the impact as

the difference between the current period results translated using

the current period currency exchange rates and using the comparable

prior period's currency exchange rates. The company believes the

disclosure of net sales changes in constant currency provides

useful supplementary information to investors in light of

significant fluctuations in currency rates.

Fourth-Quarter Conference Call and ReplayPatterson’s

fourth-quarter earnings conference call will start at 10 a.m.

Eastern today. Investors can listen to a live webcast of the

conference call at www.pattersoncompanies.com. The conference call

will be archived on Patterson’s website. A replay of the fiscal

2018 fourth-quarter conference call can be heard for one week at

800-585-8367 and by providing the Conference ID 4897286 when

prompted.

About Patterson Companies Inc.Patterson Companies

Inc. (Nasdaq: PDCO) is a value-added distributor serving

the dental and animal health markets.

Dental MarketPatterson’s Dental

segment provides a virtually complete range of consumable dental

products, equipment and software, turnkey digital solutions and

value-added services to dentists and dental laboratories

throughout North America.

Animal Health

MarketPatterson’s Animal Health segment is a

leading distributor of products, services and technologies to both

the production and companion animal health markets in North

America and the U.K.

This press release contains certain forward-looking statements,

as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

Patterson's ability to control. Forward-looking statements

generally can be identified by words such as "believes," "expects,"

"anticipates," "foresees," "forecasts," "estimates" or other words

or phrases of similar import. It is uncertain whether any of the

events anticipated by the forward-looking statements will transpire

or occur, or if any of them do, what impact they will have on the

results of operations and financial condition of Patterson or the

price of Patterson stock. These forward-looking statements involve

certain risks and uncertainties that could cause actual results to

differ materially from those indicated in such forward-looking

statements. Such risks and uncertainties include, without

limitation, operations disruptions attributable to our enterprise

resource planning system implementation; our ability to attract or

retain qualified sales representatives and service technicians who

relate directly with our customers; the reduction, modification,

cancellation or delay of purchases of innovative, high-margin

equipment; material changes in our purchasing relationships with

suppliers; changes in general market and economic conditions; and

the other risks and important factors contained and identified in

Patterson's filings with the Securities and Exchange Commission,

such as its Quarterly Reports on Form 10-Q and Annual Reports on

Form 10-K, any of which could cause actual results to differ

materially from the forward-looking statements. Any forward-looking

statement in this press release speaks only as of the date on which

it is made. Except to the extent required under the federal

securities laws, Patterson does not intend to update or revise the

forward-looking statements.

PATTERSON COMPANIES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share

amounts) (Unaudited)

Three Months Ended Twelve

Months Ended

April 28,2018

April 29,2017

April 28,2018

April 29,2017

Net sales $ 1,400,609 $ 1,445,032 $ 5,465,683 $ 5,593,127

Gross profit 289,839 335,498 1,199,366 1,301,397

Operating expenses 248,588 239,343 979,477

1,013,469 Operating income from continuing operations

41,251 96,155 219,889 287,928 Other income (expense): Other

income, net 1,349 1,033 6,117 6,013 Interest expense

(12,289) (11,401) (46,743) (43,060)

Income from continuing operations before taxes 30,311 85,787

179,263 250,881 Income tax expense (benefit) 9,383

24,430 (21,711) 77,093 Net income from

continuing operations 20,928 61,357 200,974 173,788 Net loss from

discontinued operations - 334 - (2,895)

Net income $ 20,928 $ 61,691 $ 200,974 $ 170,893 Basic

earnings (loss) per share: Continuing operations $ 0.23 $ 0.65 $

2.17 $ 1.83 Discontinued operations - 0.01 -

(0.03) Net basic earnings per share $ 0.23 $ 0.66 $ 2.17 $

1.80 Diluted earnings (loss) per share: Continuing

operations $ 0.23 $ 0.65 $ 2.16 $ 1.82 Discontinued operations

- - - (0.03) Net diluted earnings per

share $ 0.23 $ 0.65 $ 2.16 $ 1.79 Weighted average shares:

Basic 91,846 93,830 92,467 94,897 Diluted 92,446 94,503 93,094

95,567 Dividends declared per common share $ 0.26 $ 0.26 $

1.04 $ 0.98

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands)

(Unaudited)

April 28,2018

April 29,2017

ASSETS Current assets: Cash and cash equivalents $ 62,984 $

94,959 Receivables 826,877 884,803 Inventory 779,834 711,903

Prepaid expenses and other current assets 103,029

111,928 Total current assets 1,772,724 1,803,593 Property and

equipment, net 290,590 298,452 Goodwill and other intangible assets

1,205,401 1,238,983 Long-term receivables, net and other

202,949 166,885 Total assets $ 3,471,664 $ 3,507,913

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 610,368 $ 616,859 Other accrued liabilities

205,415 213,318 Current maturities of long-term debt 76,598 14,754

Borrowings on revolving credit 16,000 59,000 Total

current liabilities 908,381 903,931 Long-term debt 922,030 998,272

Other non-current liabilities 179,463 211,277 Total

liabilities 2,009,874 2,113,480 Stockholders' equity

1,461,790 1,394,433 Total liabilities and stockholders'

equity $ 3,471,664 $ 3,507,913

PATTERSON

COMPANIES, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited)

Twelve Months Ended

April 28,2018

April 29,2017

Operating activities: Net income $ 200,974 $ 170,893

Net loss from discontinued operations - (2,895) Net

income from continuing operations 200,974 173,788 Adjustments to

reconcile net income from continuing operations to net cash

provided by operating activities: Depreciation and amortization

83,816 83,818 Intangible asset impairment - 36,312 Non-cash

employee compensation 36,532 19,025 Change in assets and

liabilities, net of acquired (142,427) (147,329) Net

cash provided by operating activities- continuing operations

178,895 165,614 Net cash used in operating activities- discontinued

operations - (2,895) Net cash provided by operating

activities 178,895 162,719

Investing activities:

Additions to property and equipment (43,263) (47,019) Collection of

deferred purchase price receivables 49,650 51,402 Other investing

activities 10,600 (3,190) Net cash provided by

investing activities- continuing operations 16,987 1,193 Net cash

provided by investing activities- discontinued operations -

- Net cash provided by investing activities 16,987 1,193

Financing activities: Dividends paid (99,199)

(95,910) Repurchases of common stock (87,500) (125,384) Proceeds

from issuance of long-term debt, net 150,000 - Debt amendment costs

- (1,266) Retirement of long-term debt (164,754) (26,238) Draw on

(payment on) revolver (43,000) 39,000 Other financing activities

14,291 7,635 Net cash used in financing activities

(230,162) (202,163) Effect of exchange rate changes on cash

2,305 (4,243) Net change in cash and cash equivalents $

(31,975) $ (42,494)

PATTERSON COMPANIES, INC.

SALES SUMMARY (Dollars in thousands)

(Unaudited)

April 28,2018

April 29,2017

TotalSalesGrowth

ForeignExchangeImpact

Other (a)

InternalSalesGrowth

Three Months Ended Consolidated net

sales Consumable $ 1,145,258 $ 1,148,337 (0.3) % 1.7 % (1.5) %

(0.5) % Equipment and software 168,393 207,339 (18.8) 0.4 - (19.2)

Other 86,958 89,356 (2.7)

0.8 -

(3.5) Total $ 1,400,609 $ 1,445,032

(3.1) % 1.4 % (1.2) %

(3.3) % Dental Consumable $ 317,951 $ 339,398

(6.3) % 0.4 % - % (6.7) % Equipment and software 155,979 194,493

(19.8) 0.4 - (20.2) Other 71,834 73,417

(2.2) 0.3 -

(2.5) Total $ 545,764 $

607,308 (10.1) % 0.4 % -

% (10.5) % Animal Health Consumable $ 827,307

$ 808,939 2.3 % 2.2 % (2.1) % 2.2 % Equipment and software 12,414

12,846 (3.4) 0.1 - (3.5) Other 8,257

5,687 45.2 7.9

- 37.3 Total $ 847,978

$ 827,472 2.5 % 2.2 %

(2.1) % 2.4 % Corporate Other $ 6,867

$ 10,252 (33.0) % - %

- % (33.0) % Total $ 6,867

$ 10,252 (33.0) % - %

- % (33.0) %

Twelve

Months Ended Consolidated net sales Consumable $

4,415,643 $ 4,400,888 0.3 % 0.6 % (1.5) % 1.2 % Equipment and

software 709,253 834,526 (15.0) 0.3 - (15.3) Other 340,787

357,713 (4.7)

0.3 - (5.0)

Total $ 5,465,683 $ 5,593,127 (2.3) %

0.5 % (1.2) % (1.6) %

Dental Consumable $ 1,251,642 $ 1,321,764 (5.3) % 0.3 % - %

(5.6) % Equipment and software 660,355 780,868 (15.4) 0.3 - (15.7)

Other 284,081 287,587

(1.2) 0.2 -

(1.4) Total $ 2,196,078 $ 2,390,219

(8.1) % 0.3 % - %

(8.4) % Animal Health Consumable $ 3,164,001 $

3,079,124 2.8 % 0.7 % (2.1) % 4.2 % Equipment and software 48,898

53,658 (8.9) - - (8.9) Other 29,665

27,044 9.7 1.7

- 8.0 Total $ 3,242,564

$ 3,159,826 2.6 % 0.7 %

(2.1) % 4.0 % Corporate Other $ 27,041

$ 43,082 (37.2) % - %

- % (37.2) % Total $ 27,041

$ 43,082 (37.2) % - %

- % (37.2) % (a) Sales of certain

products previously recognized on a gross basis were recognized on

a net basis during the three and twelve months ended April 28,

2018.

PATTERSON COMPANIES, INC. OPERATING

INCOME BY SEGMENT (In thousands) (Unaudited)

Three Months Ended Twelve Months Ended

April 28,2018

April 29,2017

April 28,2018

April 29,2017

Operating income (loss) Dental $ 46,036 $ 86,315 $ 229,201 $

263,671 Animal Health 20,128 27,672 78,058 88,132 Corporate

(24,913) (17,832)

(87,370) (63,875) Total $ 41,251

$ 96,155 $ 219,889 $ 287,928

PATTERSON COMPANIES, INC. RECONCILIATION OF GAAP

TO NON-GAAP MEASURES (Dollars in thousands, except per share

amounts) (Unaudited)

For the three months ended April 28, 2018 GAAP

Transaction-relatedcosts

Dealamortization

Intangibleassetimpairment

Integrationand

businessrestructuringexpenses

Discretetax matters

Non-GAAP

Operating income from continuing operations $ 41,251 $ — $ 9,533 $

— $ — $ — $ 50,784 Other expense, net (10,940) —

— — — — (10,940) Income from

continuing operations before taxes 30,311 — 9,533 — — — 39,844

Income tax expense (benefit) 9,383 — 2,893

— — (608) 11,668 Net income from

continuing operations $ 20,928 $ — $ 6,640 $ — $ — $ 608 $ 28,176

Diluted earnings

per share from continuing operations* $ 0.23 $ — $ 0.07 $ — $ — $

0.01 $ 0.30 Operating income from continuing operations as a

% of sales 2.9% 3.6% Effective tax rate 31.0% 29.3%

For

the three months ended April 29, 2017 GAAP

Transaction-relatedcosts

Dealamortization

Intangibleassetimpairment

Integrationand

businessrestructuringexpenses

Discretetax matters

Non-GAAP

Operating income from continuing operations $ 96,155 $ 178 $ 9,745

$ — $ 257 $ — $ 106,335 Other expense, net (10,368) —

— — — — (10,368) Income from

continuing operations before taxes 85,787 178 9,745 — 257 — 95,967

Income tax expense (benefit) 24,430 67 3,375

— 98 2,383 30,353 Net income from

continuing operations $ 61,357 $ 111 $ 6,370 $ — $ 159 $ (2,383) $

65,614 Diluted

earnings per share from continuing operations* $ 0.65 $ — $ 0.07 $

— $ — $ (0.03) $ 0.69 Operating income from continuing

operations as a % of sales

6.7%

7.4%

Effective tax rate

28.5%

31.6%

For the twelve months ended April 28, 2018

GAAP

Transaction-relatedcosts

Dealamortization

Intangibleassetimpairment

Integrationand

businessrestructuringexpenses

Discretetax matters

Non-GAAP

Operating income from continuing operations $ 219,889 $ — $ 38,515

$ — $ 8,594 $ — $ 266,998 Other expense, net (40,626)

— — — — — (40,626) Income from

continuing operations before taxes 179,263 — 38,515 — 8,594 —

226,372 Income tax expense (benefit) (21,711) —

11,793 — 2,879 76,648 69,609 Net

income from continuing operations $ 200,974 $ — $ 26,722 $ — $

5,715 $ (76,648) $ 156,763

Diluted earnings per share from continuing

operations* $ 2.16 $ — $ 0.29 $ — $ 0.06 $ (0.82) $ 1.68

Operating income from continuing operations as a % of sales 4.0%

4.9% Effective tax rate -12.1% 30.7%

For the twelve

months ended April 29, 2017 GAAP

Transaction-relatedcosts

Dealamortization

Intangibleassetimpairment

Integrationand

businessrestructuringexpenses

Discretetax matters

Non-GAAP

Operating income from continuing operations $ 287,928 $ 1,657 $

39,957 $ 36,312 $ 6,561 $ — $ 372,415 Other expense, net

(37,047) — — — — —

(37,047) Income from continuing operations before taxes 250,881

1,657 39,957 36,312 6,561 — 335,368 Income tax expense (benefit)

77,093 625 13,769 13,263 2,481

4,789 112,020 Net income from continuing operations $

173,788 $ 1,032 $ 26,188 $ 23,049 $ 4,080 $ (4,789) $ 223,348

Diluted earnings

per share from continuing operations* $ 1.82 $ 0.01 $ 0.27 $ 0.24 $

0.04 $ (0.05) $ 2.34 Operating income from continuing

operations as a % of sales

5.1%

6.7%

Effective tax rate

30.7%

33.4%

* May not sum due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180621005355/en/

Patterson Companies Inc.John M. Wright,

651-686-1364Investor

Relationsjohn.wright@pattersoncompanies.compattersoncompanies.com

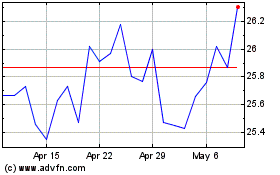

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

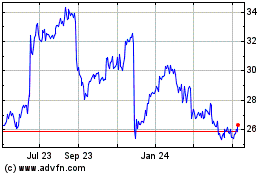

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024