TIDMTSCO

RNS Number : 6016M

Tesco PLC

30 April 2018

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF ARTICLE 7(1) OF THE MARKET ABUSE REGULATION (EU)

596/2014.

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS

(INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN

SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (the United States)

OR IN OR INTO ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO

RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

Tesco PLC announces final results of its Tender Offers for its

GBP350,000,000 5.50 per cent. Notes due 2019, GBP900,000,000 6.125

per cent. Notes due 2022, GBP515,000,000 5 per cent. Notes due

2023, GBP200,000,000 6 per cent. Notes due 2029, GBP200,000,000

5.50 per cent. Notes due 2033, GBP300,000,000 4.875 per cent. Notes

due 2042 and GBP500,000,000 5.20 per cent. Notes due 2057

30 April 2018.

On 19 April 2018, Tesco PLC (the Company) announced separate

invitations to holders of its outstanding (a) GBP350,000,000 5.50

per cent. Notes due 2019 (ISIN: XS0159013068) (the 2019 Notes), (b)

GBP900,000,000 6.125 per cent. Notes due 2022 (ISIN: XS0414345974)

(the 2022 Notes), (c) GBP515,000,000 5 per cent. Notes due 2023

(ISIN: XS0248392812) (the 2023 Notes), (d) GBP200,000,000 6 per

cent. Notes due 2029 (ISIN: XS0105244585) (the 2029 Notes), (e)

GBP200,000,000 5.50 per cent. Notes due 2033 (ISIN: XS0159013142)

(the 2033 Notes), (f) GBP300,000,000 4.875 per cent. Notes due 2042

(ISIN: XS0248395245) (the 2042 Notes) and (g) GBP500,000,000 5.20

per cent. Notes due 2057 (ISIN: XS0289810318) (the 2057 Notes and,

together with the 2019 Notes, the 2022 Notes, the 2023 Notes, the

2029 Notes, the 2033 Notes and the 2042 Notes, the Notes and each a

Series) to tender their Notes for purchase by the Company for cash

(each such invitation an Offer and, together, the Offers).

The Company now announces the final results of the Offers.

The Offers were made on the terms and subject to the conditions

contained in the tender offer memorandum dated 19 April 2018 (the

Tender Offer Memorandum) prepared by the Company. Capitalised terms

used in this announcement but not defined have the meanings given

to them in the Tender Offer Memorandum.

Maximum Acceptance Amount and Series Acceptance Amounts

The Company announces that:

(a) it has decided to accept valid tenders of Notes pursuant to

the Offers subject to the Maximum Acceptance Amount, which it has

set at GBP600,007,000; and

(b) in respect of each Series, the Series Acceptance Amount, and

any Scaling Factor that will apply to valid tenders of Notes of

such Series as a consequence, will be as set out in the table

below.

Pricing and Settlement

Pricing for the Offers took place at or around 1.00 p.m. (London

time) today (the Pricing Time).

A summary of the final pricing for, and results of, the Offers

appears below:

Series Acceptance Scaling Benchmark Purchase Purchase Purchase Price

Amount Factor Security Spread Yield*

Rate

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2019 Notes GBP0 0.00 per Not Applicable Not Applicable Not Applicable Not Applicable

cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2022 Notes GBP369,446,000 83.40 per 0.891 per 110 bps 2.001 per 115.000 per

cent. cent. cent. cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2023 Notes GBP67,012,000 Not Applicable 1.097 per 125 bps 2.361 per 112.057 per

cent. cent. cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2029 Notes GBP60,975,000 Not Applicable 1.496 per 195 bps 3.476 per 123.769 per

cent. cent. cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2033 Notes GBP25,673,000 Not Applicable 1.692 per 205 bps 3.777 per 119.147 per

cent. cent. cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2042 Notes GBP38,451,000 Not Applicable 1.844 per 215 bps 4.034 per 112.737 per

cent. cent. cent.

----------- ------------------ --------------- --------------- --------------- --------------- ---------------

2057 Notes GBP38,450,000 Not Applicable 1.717 per 225 bps 3.967 per 124.317 per

cent. cent. cent.

* Annualised in the case of each Series except the 2057 Notes

The Company will also pay an Accrued Interest Payment in respect

of Notes accepted for purchase pursuant to the Offers.

The Settlement Date in respect of the Notes accepted for

purchase pursuant to the Offers is expected to be 2 May 2018.

Following settlement of the Offers, GBP180,767,000 in aggregate

nominal amount of the 2019 Notes, GBP530,554,000 in aggregate

nominal amount of the 2022 Notes, GBP171,064,000 in aggregate

nominal amount of the 2023 Notes, GBP97,657,000 in aggregate

nominal amount of the 2029 Notes, GBP149,855,000 in aggregate

nominal amount of the 2033 Notes, GBP63,599,000 in aggregate

nominal amount of the 2042 Notes and GBP129,100,000 in aggregate

nominal amount of the 2057 Notes will remain outstanding.

Barclays Bank PLC (Telephone: +44 20 3134 8515; Attention:

Liability Management Group; Email: eu.lm@barclays.com); Lloyds Bank

plc (Telephone: +44 20 7158 1721; Attention: Liability Management

Team, Commercial Banking; Email:

liability.management@lloydsbanking.com); and SMBC Nikko Capital

Markets Limited (Telephone: +44 20 3527 7545; Attention: Liability

Management; Email: chatterjee@smbcnikko-cm.com) are acting as

Dealer Managers for the Offers.

Lucid Issuer Services Limited (Telephone: +44 20 7704 0880;

Attention: David Shilson; Email: tesco@lucid-is.com) is acting as

Information and Information and Tender Agent for the Offers.

This announcement is released by Tesco PLC and contains

information that qualified or may have qualified as inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) 596/2014 (MAR), encompassing information relating

to the Offers described above. For the purposes of MAR and Article

2 of Commission Implementing Regulation (EU) 2016/1055, this

announcement is made by Robert Welch, Group Company Secretary at

Tesco PLC.

LEI Number: 2138002P5RNKC5W2JZ46

DISCLAIMER This announcement must be read in conjunction with

the Tender Offer Memorandum. No offer or invitation to acquire any

securities is being made pursuant to this announcement. The

distribution of this announcement and/or the Tender Offer

Memorandum in certain jurisdictions may be restricted by law.

Persons into whose possession this announcement and/or the Tender

Offer Memorandum come(s) are required by each of the Company, the

Dealer Managers and the Information and Tender Agent to inform

themselves about, and to observe, any such restrictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TENWGUGPCUPRGWU

(END) Dow Jones Newswires

April 30, 2018 09:30 ET (13:30 GMT)

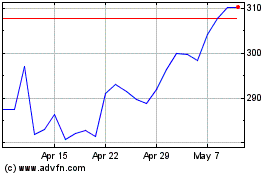

Tesco (LSE:TSCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

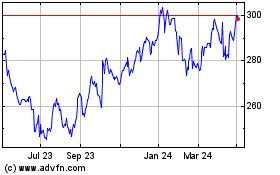

Tesco (LSE:TSCO)

Historical Stock Chart

From Sep 2023 to Sep 2024