Amended Statement of Beneficial Ownership (sc 13d/a)

March 22 2018 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

SCHEDULE 13D/A

Under the Securities Exchange Act of

1934

(Amendment No. 1)*

_________________________________

GREENWAY TECHNOLOGIES, INC.

(Name of Issuer)

Common Stock, $0.0001 par value per share

(Title of Class of Securities)

Texas

(State or other jurisdiction of incorporation

or organization)

90288A101

(CUSIP Number)

David Patrick Six

8851 Camp Bowie West Blvd, Suite 240

Fort Worth, Texas, 76116

(817) 346-6900

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

April 18, 2017

(Date of Event which Requires Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box

¨

.

* The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP No. 90288A101

|

1

|

Name of reporting person

Robert Kevin Jones

|

|

2

|

Check the appropriate box if a member of a group (SEE INSTRUCTIONS)

(a)

¨

(b)

x

|

|

3

|

Sec use only

|

|

4

|

Source of funds (SEE INSTRUCTIONS)

OO

|

|

5

|

Check box if disclosure of legal proceedings is required

pursuant to items 2 (d) or 2 (e)

|

|

6

|

Citizenship or place of organization

United States of America

|

|

Number Of

Shares

Beneficially

Owned

By Each

Reporting

Person

With

|

: 7

:

:

:

|

Sole voting power

6,250,000

|

|

: 8

:

:

:

|

Shared voting power

13,175,000*

|

|

: 9

:

:

:

|

Sole dispositive power

6,250,000

|

|

:10

:

:

:

|

Shared dispositive power

13,175,000*

|

|

11

|

Aggregate amount beneficially owned by each reporting person

19,425,000* (Item 5)

|

|

12

|

Check box if the aggregate amount in row (11) excludes certain

shares

(SEE INSTRUCTIONS)

|

|

13

|

Percent of class represented by amount in row (11)

6.9%**

|

|

14

|

Type of reporting person (SEE INSTRUCTIONS)

IN

|

*Includes (a) 12,750,000 shares held by Mabert, LLC, a

Texas limited liability company, in which the Reporting Person has an ownership and is a manager, and (b) 425,000 shares owned

by the Reporting Person’s spouse in her name alone. The Reporting Person disclaims beneficial ownership of the 425,000 shares

held by his spouse.

** Percent of class is calculated using information regarding

the total number of outstanding shares provided in the most recent company filing prior to the date of this filing, which is a

Form 10-Q filed on November 20, 2017. Such filing states that as of November 5, 2017, there were 280,052,004 shares of Common

Stock (as defined below) outstanding.

CUSIP No. 90288A101

Item 1.

Security and Issuer

The class of equity securities to which this statement on Schedule

13D/A relates is the Class A common stock, par value $0.0001 per share (the “Common Stock”) of Greenway Technologies,

Inc. (f/k/a UMED Holdings, Inc.) (the “Issuer” or the “Company”), a Texas corporation with principal offices

located at 8851 Camp Bowie West Blvd, Suite 240, Fort Worth, TX 76116.

Item 2.

Identity and Background

This statement is being filed by Robert Kevin Jones (“Jones”).

Jones’ spouse is Christine Mary Earley (“Earley”). Jones and Earley each own 50% of the equity interests of Mabert,

LLC, a Texas limited liability company (“Mabert”). Jones is the sole manager and officer for Mabert and

Mabert has no directors.

Jones owns beneficially more than 5% of a class of equity securities

of the Issuer.

|

(a)

|

This statement is being filed by Jones, who shall herein be referred to as the “Reporting Person.”

|

|

(b)

|

Jones conducts his business at 2025 Meridian St., Arlington, TX 76011 and runs All Commercial Floors, Inc., with its principal offices located at such location.

|

|

(c)

|

Jones conducts his business, All Commercial Floors, Inc. Its principal address is 2025 Meridian St., Arlington, TX 76011.

|

|

(d)

|

During the past five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

|

|

(e)

|

During the past five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

(f)

|

Jones is a citizen of the United States of America.

|

Item 3.

Source and Amount of Funds or Other

Consideration

On April 18, 2017, the Company granted the Reporting Person

3,000,000 shares of the Common Stock of the Company as reported as beneficially owned in Item 5 (the “Securities”),

in consideration for consulting services provided by the Reporting Person to the Company for approximately the previous two years.

No funds were borrowed for the purpose of the Reporting Person’s acquisition of the Securities.

CUSIP No. 90288A101

Item 4.

Purpose of Transaction

The Reporting

Person acquired the Securities from the Company in order to be more invested in the Company. Except as described in this Schedule

13D/A, the Reporting Person does not have any plans or proposals which relate to or would result in: (

i) the

acquisition by any person of additional securities of the Company, or the disposition of securities of the Company; (ii) an extraordinary

corporate transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries; (iii)

a sale or transfer of a material amount of assets of the Company or any of its subsidiaries; (iv) any change in the present board

of directors or the management of the Company, including any plans or proposals to change the number or term of directors or to

fill any existing vacancies on the board; (v) any material change in the present capitalization or dividend policy of the Company;

(vi) any other material change in the Company’s business or corporate structure; (vii) changes in the Company’s charter,

bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Company by any

person; (viii) causing a class of securities of the Company to be delisted from a national securities exchange or to cease to be

authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (ix) a class of equity

securities of the Company becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities and

Exchange Act of 1934, as amended; or (x) any action similar to any of those enumerated above.

Item 5.

Interest in Securities of the Issuer

|

(a)

|

As of the date of the filing of this Schedule 13D/A, the Issuer has 280,052,004 shares of Common Stock outstanding (as of November 5, 2017), as provided in the most recent Form 10-Q filed by the Company as of November 20, 2017. Jones is the beneficial owner of 19,425,000 shares of Common Stock, or 6.9% of the outstanding Common Stock.

|

|

(b)

|

Jones has sole voting and dispositive power with respect to 6,250,000 shares of Common Stock. Jones is deemed to have shared voting and dispositive power of 13,175,000 shares of Common Stock through Jones’s 50% ownership of the equity interests and managerial control in Mabert, which control is shared with Earley, as well as through Earley’s ownership of shares of Common Stock.

|

|

(c)

|

Other than as described in this Schedule 13D/A, the Reporting

Person has not effected any transaction in the Common Stock during the past 60 days.

|

Item 6.

Contracts, Arrangements, Understandings or

Relationships with Respect to Securities of the Issuer

Except for as otherwise described in this Schedule 13D/A, there

are no contracts, arrangements, understandings or relationships between the Reporting Person and any person with respect to any

securities of the Issuer.

Item 7.

Material to be Filed as an Exhibit

Signature

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 21, 2018

|

|

By:

|

/s/ Robert Kevin Jones

|

|

|

|

|

Robert Kevin Jones

|

|

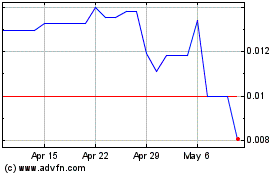

Greenway Technologies (QB) (USOTC:GWTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Greenway Technologies (QB) (USOTC:GWTI)

Historical Stock Chart

From Apr 2023 to Apr 2024