Notification That Annual Report Will Be Submitted Late (nt 10-k)

March 16 2018 - 4:03PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

SEC File Number:

001-08007

|

☒

Form 10-K

|

☐

Form 20-F

|

☐

Form 11-K

|

☐

Form 10-Q

|

☐

Form 10-D

|

☐

Form N-SAR

|

☐

Form N-CSR

|

For period ended: December 31, 2017

☐

Transition Report on Form 10-K

☐

Transition Report on Form 20-F

☐

Transition Report on Form 11-K

☐

Transition Report on Form 10-Q

☐

Transition Report on Form N-SAR

For the Transition Period Ended: N/A

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein

.

|

PART I - REGISTRANT INFORMATION

|

Real Industry, Inc.

|

|

Full Name of Registrant:

|

|

|

|

|

|

3700 Park East Drive, Suite 300

|

|

Address of Principal Executive Office

|

|

|

|

|

|

Beachwood, Ohio 44122

|

|

City, State and Zip Code

|

|

PART II - RULES 12b-25 (b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed.

|

☒

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

☐

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K or Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

☐

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached, if applicable.

|

PART III - NARRATIVE

As previously disclosed in its Current Reports on Form 8-K, on November 17, 2017 (the “Petition Date”), Real Industry, Inc. (the “Company”), Real Alloy Intermediate Holding, LLC (“RAIH”), Real Alloy Holding, Inc. (“Real Alloy”) and certain of Real Alloy’s wholly owned domestic subsidiaries (collectively with RAIH and Real Alloy, the “Real Alloy Debtors,” and the Real Alloy Debtors with the Company, the “Debtors”) filed voluntary petitions in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”). The Chapter 11 cases are being jointly administered under the caption “In re Real Industry, Inc., et al.”, Case No. 17-12464, in the Bankruptcy Court (the “Chapter 11 Cases”). The Debtors continue to operate their business and manage their properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions and orders of the Bankruptcy Code.

On March 1, 2018, as previously disclosed in a Current Report on Form 8-K, the Company filed a Disclosure Statement and Plan of Reorganization for Real Industry (as further modified, the “RI Plan”) with the Bankruptcy Court whereby the lenders providing the Company’s debtor-in-possession (“DIP”) financing, along with affiliated investors (collectively, the “Plan Sponsor”), are acting as a plan sponsor to provide $17.5 million of capital in exchange for 49% of newly issued equity in the Company on a reorganized basis (“Reorganized RELY”). Under the RI Plan, the Company’s existing common stockholders will receive their pro rata share of 20% of the newly issued equity in Reorganized RELY, assuming such stockholders vote to accept the RI Plan as a class. The holder of the Company’s Series B Preferred Shares (the “Redeemable Preferred Stock”), who has agreed to vote in favor of the RI Plan, will receive a $2.0 million cash payment plus 31% of the newly issued equity in Reorganized RELY, in exchange for full settlement of its $28.5 million liquidation preference and $1.8 million of accrued dividends. If the stockholders do not vote to approve the RI Plan as a class, the common stockholders will receive 16%, and the Redeemable Preferred Stock holder will receive 35% of the newly issued equity in Reorganized RELY. There is a scheduled hearing with the Bankruptcy Court to consider and approve the adequacy of the RI Plan and the related solicitation procedures on March 29, 2018.

Also as previously disclosed in a Current Report on Form 8-K, in connection with the DIP financing obtained by the Real Alloy Debtors (the “RA DIP Financing”), the Real Alloy Debtors agreed to pursue a sale of substantially all of their assets pursuant to Section 363 of the Bankruptcy Code (a “Section 363 Sale”). On March 8, 2018, the Real Alloy Debtors filed a form of stalking horse asset purchase agreement with the Bankruptcy Court for a sale of substantially all of the assets of the Real Alloy Debtors for to-be-determined consideration (including

, inter alia

, cash, a credit bid, and the assumption of certain of the Real Alloy Debtors’ liabilities), which is subject to further negotiation and amendment of an asset purchase agreement (the “Asset Purchase Agreement”), receipt of higher and otherwise better bids by March 19, 2018, and approval by the Bankruptcy Court.

Since the Petition Date, the Company has been principally engaged in addressing bankruptcy-related matters for all of the Debtors, including obtaining, negotiating and complying with the requirements of DIP financing; negotiating with suppliers, creditors, committees, stockholders and potential strategic partners; conducting the actions incident to the Section 363 Sale and negotiating the Asset Purchase Agreement; negotiating the RI Plan and related disclosure statement (collectively, the “Bankruptcy Administration”); and overseeing the operations of Real Alloy. The Company’s financial, accounting and administrative personnel have devoted a substantial amount of their time to the Bankruptcy Administration and the Company’s ongoing operations, including the development and implementation of Real Alloy and the Company’s post-petition strategy and negotiations with potential purchasers of assets. The Company’s ability to address all of these matters concurrently has also been adversely affected by departures of certain administrative personnel.

The Chapter 11 Cases and Bankruptcy Administration matters discussed above occurred at a time during which the year-end close procedures for the Company and Real Alloy would normally be conducted. As a result of the increased burdens placed upon the Company’s financial, accounting and administrative staff, the diversion of significant financial resources, time and attention towards the Bankruptcy Administration, and the subsequent changes in the Company’s operations and anticipated operations, the Company has been unable to timely complete the preparation of its Annual Report on Form 10-K. The Company anticipates filing its Annual Report on Form 10-K within the additional 15 calendar days provided by this Form 12b-25 filing.

Further, since the Petition Date, the Company has filed, and intends to continue to file, monthly Current Reports on Form 8-K with the Securities and Exchange Commission (“SEC”) that include, as exhibits, copies of the unaudited monthly operating reports filed by the Debtors with the Bankruptcy Court commencing on December 20, 2017 for the period from the Petition Date to November 30, 2017, and on a monthly basis thereafter (collectively, the “Monthly Operating Reports”). The Monthly Operating Reports include, and will continue to include, information regarding the results of operations of the Real Alloy Debtors during the periods covered by such reports.

Court filings and other information related to the court-supervised proceedings are available at a website administered by the Company’s claims agent, Prime Clerk, at

https://cases.primeclerk.com/realindustry

.

Cautionary Note Regarding Forward-Looking Statements

This Form 12b-25 contains forward-looking statements, which are based on our current expectations, estimates, and projections about the businesses and prospects of the Company, Real Alloy and their subsidiaries (“we” or “us”), as well as management’s beliefs, and certain assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” and variations of these words are intended to identify forward-looking statements. Such statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Forward-looking statements discuss, among other matters: our financial and operational results, as well as our expectations for future financial trends and performance of our business in future periods; our strategy; risks and uncertainties associated with Chapter 11 Cases; the negative impacts on our businesses as a result of filing for and operating under Chapter 11 protection; the time, terms and ability to confirm a Chapter 11 plan of reorganization for our businesses; the adequacy of the capital resources of our businesses and the difficulty in forecasting the liquidity requirements of the operations of our businesses; the unpredictability of our financial results during the Chapter 11 Cases; our ability to discharge claims in the Chapter 11 Cases; negotiations with the “stalking horse” bidder on a definitive agreement for the terms of purchase; receipts of other acquisition bids and negotiations with associated bidders; negotiations with the holders of Real Alloy’s senior secured notes, its asset-based facility lender, and its trade and other unsecured creditors; risks and uncertainties with performing under the terms of the Debtors’ DIP financing arrangements and any other arrangement with lenders or creditors while during the Chapter 11 Cases; the Debtors’ ability to operate our businesses within the terms of their respective DIP financing arrangements; the forecasted uses of funds in the Debtors’ DIP budgets; negotiations with DIP lenders; the impact of Real Alloy’s Chief Restructuring Officer on its restructuring efforts and negotiations with creditors and other stakeholders in the Chapter 11 Cases; our ability to retain employees, suppliers and customers as a result of Chapter 11 Cases; the ability to pay any amounts under key employee incentive or retention plans adopted in connection with the Chapter 11 Cases; Real Alloy’s ability to conduct business as usual in the United States and worldwide; Real Alloy’s ability to continue to serve customers, suppliers and other business partners at the high level of service and performance they have come to expect from Real Alloy; our ability to continue to pay suppliers and vendors; our ability to fund ongoing business operations through the applicable DIP financing arrangements; the use of the funds anticipated to be received in the DIP financing arrangements; the ability to control costs during the Chapter 11 Cases; the risk that our Chapter 11 Cases may be converted to cases under Chapter 7 of the Bankruptcy Code; the ability of the Company to preserve and utilize the net operating loss tax carryforwards (“NOLs”) following the Chapter 11 Cases; the Company’s ability to secure operating capital; the Company’s ability to take advantage of opportunities to acquire assets with upside potential; the Company’s ability to execute on its strategic plan to evaluate and close potential M&A opportunities; our long-term outlook; our preparation for future market conditions; statements regarding the anticipation of the Company that it will file its Annual Report Form 10-K within 15 calendar days of the prescribed due date; statements regarding the Company’s intention to continue to file Current Reports on Form 8-K that include unaudited monthly operating reports and statements regarding the information to be included in such monthly reports; and any statements or assumptions underlying any of the foregoing. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors.

Important factors that may cause such differences include, but are not limited to, the decisions of the Bankruptcy Court; negotiations with Real Alloy’s debt holders, our creditors and any committee approved by the Bankruptcy Court; negotiations with lenders on the definitive DIP financing, equity investment and post-emergence credit facility documents; the Company’s ability to meet the closing conditions of its DIP financing, equity investment or post-emergence credit facilities; the Debtors’ ability to meet the requirements, and compliance with the terms, including restrictive covenants, of their respective DIP financing arrangements and any other financial arrangement during the Chapter 11 Cases; changes in our operational or cash needs from the assumptions underlying our DIP budgets and forecasts; changes in our cash needs as compared to our historical operations or our planned reductions in operating expense; adverse litigation; changes in domestic and international demand for recycled aluminum; the cyclical nature and general health of the aluminum industry and related industries; commodity and scrap price fluctuations and our ability to enter into effective commodity derivatives or arrangements to effectively manage our exposure to such commodity price fluctuations; inventory risks, commodity price risks, and energy risks associated with Real Alloy’s buy/sell business model; the impact of tariffs and trade regulations on our operations; the impact of the recently approved U.S. tax legislation and any other changes in U.S. or non-U.S. tax laws on our operations or the value of our NOLs; our ability to successfully identify, acquire and integrate additional companies and businesses that perform and meet expectations after completion of such acquisitions; our ability to achieve future profitability; our ability to control operating costs and other expenses; that general economic conditions may be worse than expected; that competition may increase significantly; changes in laws or government regulations or policies affecting our current business operations and/or our legacy businesses; the Company’s ability to devote sufficient personnel and resources to complete the work necessary to prepare and file the Company’s Annual Report Form 10-K, as well as those risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Forms 10-Q filed with the SEC on May 10, 2017, August 8, 2017 and November 9, 2017 and Form 10-K filed with the SEC on March 13, 2017, and similar disclosures in subsequent reports filed with the SEC.

PART IV - OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification.

|

|

|

|

|

|

|

Michael J. Hobey

|

|

(805)

|

|

435-1255

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

☒

Yes

☐

No

(3) Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

☒

Yes

☐

No

The Company and a number of its direct and indirect subsidiaries filed for bankruptcy protection on the Petition Date due to insufficient liquidity to continue operating the businesses. Real Alloy, the Company’s primary operating subsidiary’s operations in the United States, had been affected by severely tightened liquidity during the past year, due in part to constrained trade credit terms, which increased during the fourth quarter, and ultimately hindered Real Alloy’s ability to timely refinance its $305 million 10% senior secured notes due January 2019 (“Senior Secured Notes”) or to expand borrowing capacity under its asset-based lending facility. As a holding company, the Company relies on the operations of its subsidiaries and external financing sources for its liquidity needs. During 2017, the holding company’s liquidity and financial position declined substantially. After an extensive review by the Company’s Board of Directors, the Real Alloy Board of Directors, management, and advisors, a determination was made that it would be in the best interest of all stakeholders to initiate the Chapter 11 proceedings.

The Company reported a net loss available to common stockholders of $105.9 million for the year ended December 31, 2016. Of that amount, $61.8 million was attributed to a goodwill impairment charge taken during the fourth quarter. Through the nine months ended September 30, 2017, the Company reported a net loss available to common stockholders of $61.1 million, compared to a loss of $24.7 million in the prior year period as more fully discussed in the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 9, 2017. Management expects that the impact of the bankruptcy filing on our operations, impairment charges associated with goodwill, identifiable intangible assets, and property, plant and equipment, increases in interest expense, professional fees, and reorganization items, to result in a net loss to common stockholders for the year ended December 31, 2017 that will be greater than the net loss reported in 2016.

As noted above, the Company files copies of the Monthly Operating Reports filed with the Bankruptcy Court on Current Reports on Form 8-K with the SEC.

The foregoing information is based on the Company’s preliminary estimates of its results of operations for the fiscal year ended December 31, 2017 and anticipated changes from the prior year period. The Company’s estimates are subject to change, and actual results may differ significantly from these estimates.

|

|

|

Real Industry, Inc.

|

|

(Name of Registrant as Specified in Charter)

|

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 16, 2018

|

|

|

By:

|

/s/ MICHAEL J. HOBEY

|

|

|

Michael J. Hobey

|

|

|

Title:

|

Interim President and Chief Executive Officer,

|

|

|

|

and Chief Financial Officer

|

|

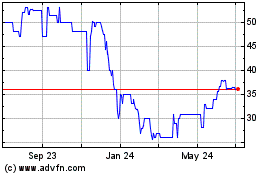

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Mar 2024 to Apr 2024

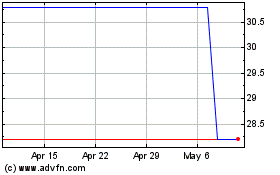

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Apr 2023 to Apr 2024