El Paso Electric Company (NYSE:EE):

Overview

- For the fourth quarter of 2017, El Paso

Electric Company ("EE" or the "Company") reported net income of

$6.5 million, or $0.16 basic and diluted earnings per share. In the

fourth quarter of 2016, EE reported net income of $5.7 million, or

$0.14 basic and diluted earnings per share.

- For the twelve months ended December

31, 2017, EE reported net income of $98.3 million, or $2.42 basic

and diluted earnings per share. Net income for the twelve months

ended December 31, 2016 was $96.8 million, or $2.39 basic and

diluted earnings per share.

"We reached an important milestone in the fourth quarter when

the Public Utility Commission of Texas approved the unopposed

settlement in our 2017 Texas rate case," said Mary Kipp, President

and Chief Executive Officer of El Paso Electric Company. "The

settlement is the culmination of several years of dedicated effort

and incorporates into our Texas rates over $1 billion of

infrastructure investments, including Montana Power Station Units 1

through 4. Among other things, the settlement has a provision to

pass through to our Texas customers the tax savings from the

reduction in the federal statutory income tax rate that was

recently enacted. We expect to begin issuing credits to our Texas

customers in the first half of 2018."

Earnings Summary

The table and explanations below present the major factors

affecting fourth quarter and twelve months ended December 31, 2017

net income relative to fourth quarter and twelve months ended

December 31, 2016 net income, respectively, (in thousands except

per share data):

Quarter Ended Twelve

Months Ended

Pre-TaxEffect

After-TaxEffect

BasicEPS

Pre-TaxEffect

After-TaxEffect

BasicEPS

December 31, 2016 $ 5,656 $ 0.14 $ 96,768 $ 2.39 Changes in: Retail

non-fuel base revenues 8,793 5,716 0.14 13,309 8,651 0.21 Effective

tax rate — 1,339 0.03 — 3,379 0.08 Palo Verde performance rewards,

net — — — 5,005 3,253 0.08 Depreciation and amortization (2,629 )

(1,708 ) (0.04 ) (6,526 ) (4,242 ) (0.10 ) Palo Verde O&M

(1,984 ) (1,290 ) (0.03 ) (2,450 ) (1,592 ) (0.04 ) Taxes other

than income taxes (1,419 ) (922 ) (0.02 ) (5,330 ) (3,465 ) (0.09 )

Wheeling revenues (906 ) (589 ) (0.02 ) (3,852 ) (2,504 ) (0.06 )

Allowance for funds used during construction (357 ) (350 ) (0.01 )

(6,006 ) (5,303 ) (0.13 ) Investment and interest income (520 )

(278 ) (0.01 ) 3,674 2,825 0.07 Other (1,074 ) (0.02 ) 491

0.01 December 31, 2017 $ 6,500 $ 0.16 $ 98,261

$ 2.42

Fourth Quarter 2017

Income for the quarter ended December 31, 2017, when compared to

the quarter ended December 31, 2016, was positively affected by

(presented on a pre-tax basis):

- Increased retail non-fuel base revenues

primarily due to the non-fuel base rate increase approved by the

Public Utility Commission of Texas ("PUCT") in its final order in

the Company's 2017 Texas retail rate case in Docket No. 46831 (the

"2017 PUCT Final Order"). The fourth quarter of 2017 included

approximately $8.8 million of retail non-fuel base revenues for the

period from July 18, 2017 through December 31, 2017, which was

recognized when the 2017 PUCT Final Order was approved in December

2017. Excluding the rate relief impact, retail non-fuel base

revenues were relatively unchanged. Overall, milder weather offset

the impacts of customer growth of 1.7%.

- Decreased effective tax rate primarily

due to a reduction in Texas margin taxes resulting from a

settlement with the Texas Comptroller of Public Accounts.

Income for the quarter ended December 31, 2017, when compared to

the quarter ended December 31, 2016, was negatively affected by

(presented on a pre-tax basis):

- Increased depreciation and amortization

primarily due to increases in plant and increased depreciation and

amortization of approximately $0.7 million associated with the 2017

PUCT Final Order.

- Increased Palo Verde Generating Station

("Palo Verde") operations and maintenance ("O&M") expense

primarily due to reduced employee pension and benefit expenses by

Palo Verde in 2016.

- Increased taxes other than income taxes

primarily due to increased property taxes in Texas and Arizona and

increased revenue related taxes in Texas.

- Decreased wheeling revenues primarily

due to the expiration of a contract.

- Decreased allowance for funds used

during construction ("AFUDC") primarily due to a reduction in the

AFUDC rate effective January 2017.

- Increased other primarily due to (i)

O&M expenses related to the Company's fossil-fuel generating

plants and (ii) employee incentive compensation and payroll costs

compared to the three months ended December 31, 2016.

Year to Date 2017

Income for the twelve months ended December 31, 2017, when

compared to the twelve months ended December 31, 2016, was

positively affected by (presented on a pre-tax basis):

- Increased retail non-fuel base revenues

primarily due to the non-fuel base rate increase approved in the

2017 PUCT Final Order. The fourth quarter of 2017 included

approximately $8.8 million of retail non-fuel base revenues for the

period from July 18, 2017 through December 31, 2017, which were

recognized when the 2017 PUCT Final Order was approved in December

2017. Excluding the $8.8 million 2017 PUCT Final Order impact, for

the twelve months ended December 31, 2017, retail non-fuel base

revenues increased $4.5 million, or 0.7%, compared to the twelve

months ended December 31, 2016. See "Retail Non-fuel Base Revenues"

section below for further details.

- Decreased effective tax rate primarily

due to a reduction in state income taxes primarily due to audit

settlements.

- Palo Verde performance rewards,

associated with the 2013 to 2015 performance periods, net of

disallowed fuel and purchased power costs related to the resolution

of the Texas fuel reconciliation proceeding designated as PUCT

Docket No. 46308 for the period from April 2013 through March 2016.

These rewards were recorded in June 2017 with no comparable amount

during the twelve months ended December 31, 2016.

- Increased investment and interest

income primarily due to higher realized gains on securities sold

from the Company’s Palo Verde decommissioning trust during the

twelve months ended December 31, 2017 compared to the twelve months

ended December 31, 2016.

Income for the twelve months ended December 31, 2017, when

compared to the twelve months ended December 31, 2016, was

negatively affected by (presented on a pre-tax basis):

- Decreased AFUDC due to lower balances

of construction work in progress, primarily due to Montana Power

Station ("MPS") Units 3 and 4 being placed in service in May and

September 2016, respectively, and a reduction in the AFUDC rate

effective January 2017.

- Increased depreciation and amortization

primarily due to increases in plant, including MPS Units 3 and 4,

which were placed in service in 2016. These increases were

partially offset by the sale of the Company's interest in the

coal-fired Four Corners Generating Station ("Four Corners") in July

2016.

- Increased taxes other than income taxes

primarily due to increased property valuations in Texas as a result

of MPS Units 3 and 4 being placed in service in 2016 and increased

revenue related taxes in Texas.

- Decreased wheeling revenues primarily

due to the expiration of a contract.

- Increased Palo Verde O&M primarily

due to higher administrative and general expenses.

Retail Non-fuel Base Revenues

Excluding the $8.8 million 2017 PUCT Final Order impact

recognized in the fourth quarter of 2017, retail non-fuel base

revenues for the three months ended December 31, 2017 were

relatively unchanged compared to the three months ended December

31, 2016. Overall, milder weather offset the impact of customer

growth of 1.7%. Cooling degree days decreased 9.7% in the three

months ended December 31, 2017, when compared to the three months

ended December 31, 2016. Heating degree days decreased 7.0% in the

three months ended December 31, 2017, when compared to the three

months ended December 31, 2016. Non-fuel base revenues and

kilowatt-hour ("kWh") sales for the three months ended December 31,

2017 are provided by customer class on page 12 of this news

release.

Excluding the $8.8 million 2017 PUCT Final Order impact, for the

twelve months ended December 31, 2017, retail non-fuel base

revenues increased $4.5 million, or 0.7%, compared to the twelve

months ended December 31, 2016. This increase primarily includes

(i) a $2.5 million increase in revenues from residential customers

driven by a 1.6% increase in the average number of residential

customers served and (ii) a $2.1 million increase in revenues from

small commercial and industrial customers driven by a 2.4% increase

in the average number of small commercial and industrial customers

served. The Company experienced an overall 1.7% increase in the

average number of customers served and its impact on revenues was

partially offset by milder weather when compared to the twelve

months ended December 31, 2016. Heating degree days decreased 17.8%

in the twelve months ended December 31, 2017, when compared to the

twelve months ended December 31, 2016. During our peak summer

cooling season, cooling degree days in 2017 were comparable to the

same period in 2016. Non-fuel base revenues and kWh sales for the

twelve months ended December 31, 2017 are provided by customer

class on page 14 of this news release.

Rate Case

2017 Texas Retail Rate Case

On February 13, 2017, the Company filed with the City of El

Paso, other municipalities incorporated in the Company's Texas

service territory and the PUCT in Docket No. 46831, a request for

an increase in non-fuel base revenues. On November 2, 2017, the

Company filed the Joint Motion to Implement Uncontested Stipulation

and Agreement with the Administrative Law Judges for the Company's

rate case.

On December 18, 2017, the PUCT approved the 2017 PUCT Final

Order for the Company's rate case pending in Docket No. 46831,

which provides, among other things, for the following: (i) an

annual non-fuel base rate increase of $14.5 million; (ii) a return

on equity of 9.65%; (iii) all new plant in service as filed in the

Company's rate filing package was prudent and used and useful and

therefore is included in rate base; (iv) recovery of the costs of

decommissioning Four Corners in the amount of $5.5 million over a

seven year period beginning August 1, 2017; (v) the Company to

recover reasonable rate case expenses of approximately $3.4 million

through a separate surcharge over a three year period; and (vi) a

requirement that the Company file a refund tariff if the federal

statutory income tax rate, as it relates to the Company, is

decreased before the Company files its next rate case. The 2017

PUCT Final Order also establishes baseline revenue requirements for

recovery of future transmission and distribution investment costs,

and includes a minimum monthly bill of $30.00 for new residential

customers with distributed generation, such as private rooftop

solar. Additionally, the 2017 PUCT Final Order allows for the

annual recovery of $2.1 million of nuclear decommissioning funding

and establishes annual depreciation expense that is approximately

$1.9 million lower than the annual amount requested by the Company

in its initial filing. Finally, the 2017 PUCT Final Order allows

for the Company to recover revenues associated with the relate back

of rates to consumption on and after July 18, 2017 through a

separate surcharge.

New base rates, including additional surcharges associated with

rate case expenses and the relate back of rates to consumption on

and after July 18, 2017 through December 31, 2017 were implemented

in January 2018.

For financial reporting purposes, the Company deferred any

recognition of the Company's request in its 2017

Texas retail rate case until it received the 2017 PUCT Final

Order on December 18, 2017. Accordingly, it reported in the fourth

quarter of 2017 the cumulative effect of the 2017 PUCT Final Order,

which related back to July 18, 2017. Details of the impacts of the

2017 PUCT Final Order are provided on page 17 of this news

release.

Corporate Tax Reform

On December 22, 2017, the President signed into law the Tax Cuts

and Jobs Act of 2017 ("TCJA"), which made widespread changes to the

Internal Revenue Code, including a reduction in the federal

corporate income tax rate from 35% to 21% effective January 1,

2018, and discontinuance of bonus depreciation for regulated

utilities for assets placed in service after September 27, 2017.

Accordingly, the Company reduced its accumulated deferred income

taxes (“ADIT”) liability to reflect the $298.9 million impact due

to the reduction in the federal corporate tax rate and other

changes to the tax law on its December 31, 2017 balance sheet. The

Company offset this reduction by recording a regulatory liability

to reflect the future refund of such amounts related to changes in

ADIT to ratepayers in its Texas, New Mexico and Federal Energy

Regulatory Commission (the "FERC") jurisdictions. The new tax law

change had a minimal impact on the Company’s Statements of

Operations for the three and twelve months ended December 31,

2017.

As noted earlier in this news release under "Rate Case - 2017

Texas Retail Rate Case," the Company agreed to file a refund tariff

if the federal statutory income tax rate, as it relates to the

Company, is decreased before the Company files its next rate case.

Accordingly, the Company will recognize reduced Texas

jurisdictional revenues beginning January 1, 2018, to approximate

the tax savings resulting from the TCJA and will file a refund

tariff which the Company will ask to be implemented in the first

half of 2018. The refund tariff will be updated annually until new

base rates are implemented pursuant to the Company's next rate case

filing.

The Company is required to make its next rate case filing in New

Mexico, which will reflect the Company's new corporate income tax

rate, no later than July 31, 2019. However, the New Mexico Public

Regulation Commission ("NMPRC") has initiated an investigation into

the impact of the TCJA on utility customers that may require

earlier action by the Company. The Company is evaluating possible

approaches to begin providing a refund credit for the income tax

rate decrease to New Mexico customers.

Capital and Liquidity

We continue to maintain a strong capital structure in which

common stock equity represented 45.5% of our capitalization (common

stock equity, long-term debt, current maturities of long-term debt

and short-term borrowings under our Revolving Credit Facility (the

"RCF")) as of December 31, 2017. At December 31, 2017, we had a

balance of $7.0 million in cash and cash equivalents. Based on

current projections, we believe that we will have adequate

liquidity through the issuance of long-term debt, our current cash

balances, cash from operations and available borrowings under the

RCF to meet all of our anticipated cash requirements for the next

twelve months.

Cash flows from operations for the twelve months ended December

31, 2017 were $288.6 million, compared to $231.2 million for

the twelve months ended December 31, 2016. The primary factors

contributing to the increase in cash flows from operations were the

change in net over-collection and under-collection of fuel revenues

and accounts receivable. A component of cash flows from operations

is the change in net over-collection and under-collection of fuel

revenues. The difference between fuel revenues collected and fuel

expense incurred is deferred to be either refunded

(over-recoveries) or surcharged (under-recoveries) to customers in

the future. During the twelve months ended December 31, 2017, we

had fuel over-recoveries of $17.1 million compared to

under-recoveries of fuel costs of $14.9 million during the twelve

months ended December 31, 2016. At December 31, 2017, we had a net

fuel over-recovery balance of $6.2 million, including an

over-recovery of $5.8 million in Texas and an over-recovery of $0.4

million in New Mexico. On October 13, 2017, we filed a request to

decrease our Texas fixed fuel factor by approximately 19% to

reflect decreased fuel expenses primarily related to a decrease in

the price of natural gas used to generate power. The decrease in

our Texas fixed fuel factor became effective beginning with the

November 2017 billing month and will continue thereafter until

changed by the PUCT.

During the twelve months ended December 31, 2017, our primary

capital requirements were for the construction and purchase of our

electric utility plant, debt retirements, payments of common stock

dividends, and purchases of nuclear fuel. Capital expenditures for

new electric utility plant were $190.3 million, net of insurance

proceeds, for the twelve months ended December 31, 2017 and $225.4

million for the twelve months ended December 31, 2016. Capital

expenditures for 2018 are expected to be approximately $236

million. Capital requirements for purchases of nuclear fuel were

$38.5 million for the twelve months ended December 31, 2017, and

$42.4 million for the twelve months ended December 31,

2016.

On February 1, 2018, the Board of Directors declared a quarterly

cash dividend of $0.335 per share payable on March 30, 2018 to

shareholders of record as of the close of business on March 16,

2018. On December 29, 2017, we paid a quarterly cash dividend of

$0.335 per share, or $13.6 million, to shareholders of record as of

the close of business on December 15, 2017. We paid a total of

$53.3 million in cash dividends during the twelve months ended

December 31, 2017. We expect to continue paying quarterly cash

dividends in 2018.

No shares of common stock were repurchased during the twelve

months ended December 31, 2017. As of December 31, 2017, a total of

393,816 shares remain available for repurchase under our currently

authorized stock repurchase program. We may in the future make

purchases of our common stock in open market transactions at

prevailing prices and may engage in private transactions where

appropriate.

Our cash requirements for federal and state income taxes vary

from year to year based on taxable income, which is influenced by

the timing of revenues and expenses recognized for income tax

purposes. The following summary describes the major impacts of the

TCJA on our liquidity. We continue to evaluate the TCJA and have

made assumptions based on information currently available.

The TCJA discontinued bonus depreciation for regulated utilities

which reduced tax deductions previously available to us for 2017,

2018 and 2019. The decrease in tax deductions results in the

utilization of our net operating loss carryforwards (“NOL

carryforwards”) approximately two years earlier than anticipated

and is expected to result in higher income tax payments beginning

in 2019, after the full utilization of NOL carryforwards. However,

due to the lower corporate income tax rate enacted by the TCJA, our

future tax payments will be made at the reduced rate of 21%

beginning in 2018. Due to NOL carryforwards, minimal tax payments

are expected for 2018, which are mostly related to state income

taxes.

However, we expect that the effect of the TCJA on our rates will

be beneficial to our customers. Following the enactment of the TCJA

and the reduction of the federal income tax rate, revenues

collected from our customers in 2018 will be reduced in an amount

that approximates the savings in tax expense. This reduction in

revenues is expected to negatively impact our cash flows by

approximately $26 million to $31 million during 2018.

We maintain the RCF for working capital and general corporate

purposes and financing of nuclear fuel through the Rio Grande

Resources Trust ("RGRT"). The RGRT, the trust through which we

finance our portion of nuclear fuel for Palo Verde, is consolidated

in our financial statements. On January 9, 2017, we exercised the

option to extend the maturity of the RCF by one year to January 14,

2020 and to increase the size of the facility by $50 million to

$350 million. We still have the option to extend the facility by

one additional year to January 2021 and to increase the RCF by up

to $50 million (up to a total of $400 million) upon the

satisfaction of certain conditions, more fully set forth in the

agreement, including obtaining commitments from lenders or third

party financial institutions. In August 2017, RGRT's $50.0 million

Series B 4.47% Senior Notes matured and were paid utilizing funds

borrowed under the RCF. The total amount borrowed for nuclear fuel

by the RGRT, excluding debt issuance costs, was $133.5 million at

December 31, 2017, of which $88.5 million had been borrowed under

the RCF, and $45.0 million was borrowed through the issuance of

senior notes. Borrowings by the RGRT for nuclear fuel, excluding

debt issuance costs, were $132.6 million as of December 31, 2016,

of which $37.6 million had been borrowed under the RCF and $95.0

million was borrowed through the issuance of senior notes. Interest

costs on borrowings to finance nuclear fuel are accumulated by the

RGRT and charged to us as fuel is consumed and recovered through

fuel recovery charges. In September 2017, the $33.3 million 2012

Series A 1.875% Pollution Control Bonds which were subject to

mandatory tender for purchase were redeemed and retired utilizing

funds borrowed under the RCF. At December 31, 2017, $85.0 million

was outstanding under the RCF for working capital and general

corporate purposes, which may include funding capital expenditures.

At December 31, 2016, $44.0 million was outstanding under the RCF

for working capital and general corporate purposes. Total aggregate

borrowings under the RCF at December 31, 2017 were $173.5 million

with an additional $176.4 million available to borrow.

We received approval from the NMPRC on October 7, 2015, to

guarantee the issuance of up to $65.0 million of long-term debt by

the RGRT to finance future purchases of nuclear fuel and to

refinance existing nuclear fuel debt obligations, which remains

effective. We received additional approval from the NMPRC on

October 4, 2017 to amend and extend the RCF, issue up to $350.0

million in long-term debt and to redeem and refinance the $63.5

million 2009 Series A 7.25% Pollution Control Bonds and the $37.1

million 2009 Series B 7.25% Pollution Control Bonds, which have

optional redemptions in 2019. The NMPRC approval to issue up to

$350.0 million in long-term debt supersedes prior approval. We

requested similar approval from the FERC on September 1, 2017 and

received approval on October 31, 2017. The approval requested from

the FERC also includes requests to guarantee the issuance of up to

$65.0 million of long-term debt by the RGRT and to continue to

utilize our existing RCF with the ability to amend and extend the

RCF at a future date. The authorization approved by the FERC is

effective from November 15, 2017 through November 14, 2019 and

supersedes prior approvals.

2018 Earnings Guidance

The Company is providing earnings guidance for 2018 with a range

of $2.30 to $2.65 per basic share. The guidance assumes normal

operations and considers significant variables that may impact

earnings, such as weather, expenses, capital expenditures, nuclear

decommissioning trust gains/losses, and the impact of the TCJA. The

mid-point of the guidance range assumes 10 year average weather

(cooling and heating degree days).

Conference Call

A conference call to discuss fourth quarter and year to date

2017 financial results is scheduled for 11:30 A.M. Eastern

Time, on February 27, 2018. The dial-in number is 888-600-4863 with

a conference ID number of 9726561. The international dial-in number

is 719-457-2644. The conference leader will be Lisa Budtke,

Director-Treasury Services and Investor Relations. A replay will

run through March 13, 2018 with a dial-in number of 888-203-1112

and a conference ID number of 9726561. The replay international

dial-in number is 719-457-0820. The conference call and

presentation slides will be webcast live on the Company's website

found at http://www.epelectric.com. A

replay of the webcast will be available shortly after the call.

Safe Harbor

This news release includes statements that are forward-looking

statements made pursuant to the safe harbor provisions of the

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

statements regarding the impact of the TCJA; statements regarding

expected capital expenditures; and statements regarding expected

dividends. This information may involve risks and uncertainties

that could cause actual results to differ materially from such

forward-looking statements. Additional information concerning

factors that could cause actual results to differ materially from

those expressed in forward-looking statements is contained in EE's

most recently filed periodic reports and in other filings made by

EE with the U.S. Securities and Exchange Commission ("SEC"), and

include, but is not limited to: (i) the impact of the TCJA and

other U.S. tax reform legislation; (ii) increased prices for fuel

and purchased power and the possibility that regulators may not

permit EE to pass through all such increased costs to customers or

to recover previously incurred fuel costs in rates; (iii) full

and timely recovery of capital investments and operating costs

through rates in Texas and New Mexico; (iv) uncertainties and

instability in the general economy and the resulting impact on EE's

sales and profitability; (v) changes in customers' demand for

electricity as a result of energy efficiency initiatives and

emerging competing services and technologies, including distributed

generation; (vi) unanticipated increased costs associated with

scheduled and unscheduled outages of generating plant; (vii)

unanticipated maintenance, repair, or replacement costs for

generation, transmission, or distribution facilities and the

recovery of proceeds from insurance policies providing coverage for

such costs; (viii) the size of our construction program and our

ability to complete construction on budget and on time; (ix)

potential delays in our construction schedule due to legal

challenges or other reasons; (x) costs at Palo Verde;

(xi) deregulation and competition in the electric utility

industry; (xii) possible increased costs of compliance with

environmental or other laws, regulations and policies;

(xiii) possible income tax and interest payments as a result

of audit adjustments proposed by the Internal Revenue Service

("IRS") or state taxing authorities; (xiv) uncertainties and

instability in the financial markets and the resulting impact on

EE's ability to access the capital and credit markets; (xv) actions

by credit rating agencies; (xvi) possible physical or cyber

attacks, intrusions or other catastrophic events; and

(xvii) other factors of which we are currently unaware or deem

immaterial. EE's filings are available from the SEC or may be

obtained through EE's website, http://www.epelectric.com. Any such

forward-looking statement is qualified by reference to these risks

and factors. EE cautions that these risks and factors are not

exclusive. Management cautions against putting undue reliance on

forward-looking statements or projecting any future results based

on such statements or present or prior earnings levels.

Forward-looking statements speak only as of the date of this news

release, and EE does not undertake to update any forward-looking

statement contained herein.

El Paso Electric Company Statements of

Operations Quarter Ended December 31, 2017 and 2016

(In thousands except for per share data) (Unaudited)

2017 2016

Variance Operating revenues $ 196,149 $

188,037 $ 8,112

Energy expenses: Fuel 41,401

41,921 (520 ) Purchased and interchanged power 11,858 12,012

(154 ) 53,259 53,933 (674 )

Operating

revenues net of energy expenses 142,890 134,104

8,786

Other operating expenses: Other operations

65,978 62,437 3,541 Maintenance 16,109 14,741 1,368 Depreciation

and amortization 23,849 21,220 2,629 Taxes other than income taxes

16,655 15,236 1,419 122,591 113,634

8,957

Operating income 20,299 20,470

(171 )

Other income (deductions): Allowance for

equity funds used during construction 816 1,156 (340 ) Investment

and interest income, net 3,270 3,790 (520 ) Miscellaneous

non-operating income 349 219 130 Miscellaneous non-operating

deductions (788 ) (1,031 ) 243 3,647 4,134

(487 )

Interest charges (credits): Interest on long-term

debt and revolving credit facility 17,981 18,323 (342 ) Other

interest 478 201 277 Capitalized interest (1,191 ) (1,252 ) 61

Allowance for borrowed funds used during construction (802 ) (819 )

17 16,466 16,453 13

Income before

income taxes 7,480 8,151 (671 )

Income tax expense 980

2,495 (1,515 )

Net income $

6,500 $ 5,656 $

844 Basic earnings per share $

0.16 $ 0.14 $ 0.02

Diluted earnings per share $

0.16 $ 0.14 $ 0.02

Dividends declared per share of common stock $

0.335 $ 0.310 $ 0.025

Weighted average

number of shares outstanding 40,434 40,368 66

Weighted average number of shares and

dilutive potential shares outstanding

40,590 40,445 145

El Paso

Electric Company Statements of Operations Twelve

Months Ended December 31, 2017 and 2016 (In thousands except

for per share data) (Unaudited)

2017 2016 Variance

Operating revenues $ 916,797 $ 886,936 $ 29,861

Energy

expenses Fuel 185,069 173,738 11,331 Purchased and interchanged

power 59,682 59,727 (45 ) 244,751 233,465

11,286

Operating revenues net of energy

expenses 672,046 653,471 18,575

Other

operating expenses: Other operations 242,628 242,014 614

Maintenance 69,458 66,746 2,712 Depreciation and amortization

90,843 84,317 6,526 Taxes other than income taxes 70,863

65,533 5,330 473,792 458,610 15,182

Operating income 198,254 194,861 3,393

Other income (deductions): Allowance for equity funds

used during construction 3,025 7,023 (3,998 ) Investment and

interest income, net 17,757 14,083 3,674 Miscellaneous

non-operating income 715 1,292 (577 ) Miscellaneous non-operating

deductions (3,125 ) (3,699 ) 574 18,372 18,699 (327 )

Interest charges (credits): Interest on long-term debt and

revolving credit facility 72,970 71,544 1,426 Other interest 2,388

1,303 1,085 Capitalized interest (5,022 ) (4,990 ) (32 ) Allowance

for borrowed funds used during construction (2,975 ) (4,983 ) 2,008

67,361 62,874 4,487

Income before

income taxes 149,265 150,686 (1,421 )

Income tax expense

51,004 53,918 (2,914 )

Net income $

98,261 $ 96,768 $

1,493 Basic earnings per share $

2.42 $ 2.39 $ 0.03

Diluted earnings per share $

2.42 $ 2.39 $ 0.03

Dividends declared per share of common stock $

1.315 $ 1.225 $ 0.090

Weighted average

number of shares outstanding 40,415 40,351 64

Weighted average number of shares and

dilutive potential shares outstanding

40,535 40,408 127

El Paso

Electric Company Cash Flow Summary Twelve Months

Ended December 31, 2017 and 2016 (In thousands and

Unaudited) 2017 2016

Cash flows from operating activities: Net income $ 98,261 $

96,768 Adjustments to reconcile net income to net cash provided by

operations: Depreciation and amortization of electric plant in

service 90,843 84,317 Amortization of nuclear fuel 42,476 43,748

Deferred income taxes, net 49,394 50,510 Net gains on sale of

decommissioning trust funds (10,626 ) (7,640 ) Other 15,237 11,006

Change in: Accounts receivable (138 ) (17,511 ) Net over-collection

(under-collection) of fuel revenues 17,093 (14,891 ) Accounts

payable 1,407 (2,140 ) Regulatory assets (5,729 ) (8,741 ) Other

(9,657 ) (4,276 )

Net cash provided by operating activities

288,561 231,150 Cash flows

from investing activities: Cash additions to utility property,

plant and equipment (190,305 ) (225,361 ) Cash additions to nuclear

fuel (38,481 ) (42,383 ) Decommissioning trust funds (5,883 )

(8,229 ) Other (9,275 ) 241

Net cash used for investing

activities (243,944 ) (275,732 )

Cash flows from financing activities: Dividends paid

(53,337 ) (49,603 ) Borrowings (repayments) under the revolving

credit facility, net 91,959 (60,164 ) Payment on maturing RGRT

senior notes (50,000 ) — Payment on maturing pollution control

bonds (33,300 ) — Proceeds from issuance of senior notes — 157,052

Other (1,369 ) (2,432 )

Net cash provided by (used for)

financing activities (46,047 ) 44,853

Net increase (decrease) in cash and cash

equivalents (1,430 ) 271 Cash

and cash equivalents at beginning of period 8,420

8,149 Cash and cash equivalents at end of

period $ 6,990 $ 8,420

El Paso Electric Company Quarter

Ended December 31, 2017 and 2016 Sales and Revenues

Statistics (Unaudited)

Increase (Decrease) 2017

2016 Amount Percentage

kWh sales (in

thousands):

Retail: Residential 566,229 566,680 (451 ) (0.1 )% Commercial and

industrial, small 559,314 553,829 5,485 1.0 % Commercial and

industrial, large 250,747 261,320 (10,573 ) (4.0 )% Sales to public

authorities 365,807 372,643 (6,836 ) (1.8 )% Total retail

sales 1,742,097 1,754,472 (12,375 ) (0.7 )% Wholesale: Sales

for resale 10,101 9,716 385 4.0 % Off-system sales 563,943

475,789 88,154 18.5 % Total wholesale sales 574,044

485,505 88,539 18.2 % Total kWh sales 2,316,141

2,239,977 76,164 3.4 %

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 61,326 $ 54,756 $

6,570 12.0 % Commercial and industrial, small 42,615 40,285 2,330

5.8 % Commercial and industrial, large 7,700 8,451 (751 ) (8.9 )%

Sales to public authorities 20,668 20,024 644 3.2 %

Total retail non-fuel base revenues (a) 132,309 123,516 8,793 7.1 %

Wholesale: Sales for resale 451 421 30 7.1 % Total

non-fuel base revenues 132,760 123,937 8,823 7.1 %

Fuel revenues: Recovered from customers during the period 43,240

41,030 2,210 5.4 % (Over) Under collection of fuel (3,202 ) 3,125

(6,327 ) — Total fuel revenues (b) 40,038 44,155 (4,117 )

(9.3 )% Off-system sales: Fuel cost 11,387 9,754 1,633 16.7 %

Shared margins 3,817 1,952 1,865 95.5 % Retained margins 241

277 (36 ) (13.0 )% Total off-system sales 15,445 11,983 3,462 28.9

% Other: (c) Wheeling revenues 4,403 5,309 (906 ) (17.1 )%

Miscellaneous service revenues and other (d) 3,503 2,653 850

32.0 % Total other 7,906 7,962 (56 ) (0.7 )% Total

operating revenues $ 196,149 $ 188,037 $ 8,112 4.3 %

(a) 2017 includes $8.8 million of relate back revenues in

Texas from July 18, 2017 through December 31, 2017, which was

recorded in the fourth quarter of 2017 related to the 2017 PUCT

Final Order. (b) Includes deregulated Palo Verde Unit 3 revenues

for the New Mexico jurisdiction of $2.3 million and $2.1 million in

2017 and 2016, respectively. (c) Represents revenues with no

related kWh sales. (d) 2017 includes energy efficiency bonus of

$0.8 million.

El Paso Electric Company Quarter Ended

December 31, 2017 and 2016 Other Statistical Data

Increase (Decrease) 2017 2016 Amount

Percentage

Average number of

retail customers: (a)

Residential 369,949 363,699 6,250 1.7 % Commercial and industrial,

small 42,135 41,567 568 1.4 % Commercial and industrial, large 48

49 (1 ) (2.0 )% Sales to public authorities 5,507 5,288

219 4.1 % Total 417,639 410,603

7,036 1.7 %

Number of retail

customers (end of period): (a)

Residential 370,054 363,987 6,067 1.7 % Commercial and industrial,

small 42,291 41,741 550 1.3 % Commercial and industrial, large 48

49 (1 ) (2.0 )% Sales to public authorities 5,500 5,285

215 4.1 % Total 417,893 411,062

6,831 1.7 %

Weather

statistics: (b)

10-Yr Average Cooling degree days 205 227 144 Heating degree

days 667 717 877

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2017 2016 Amount

Percentage Palo Verde 1,228,652 1,235,538 (6,886 )

(0.6 )% Gas plants 893,559 765,847 127,712

16.7 % Total generation 2,122,211 2,001,385 120,826 6.0 %

Purchased power: Photovoltaic 57,986 54,859 3,127 5.7 % Other

252,421 303,509 (51,088 ) (16.8 )% Total

purchased power 310,407 358,368 (47,961 )

(13.4 )% Total available energy 2,432,618 2,359,753 72,865 3.1 %

Line losses and Company use 116,477 119,776

(3,299 ) (2.8 )% Total kWh sold 2,316,141 2,239,977

76,164 3.4 % Palo Verde capacity factor 89.5 %

90.0 % (0.5 )% Palo Verde O&M expenses (c) $ 31,384 $

29,400 $ 1,984 (a) The number of retail customers presented

is based on the number of service locations. (b) A degree

day is recorded for each degree that the average outdoor

temperature varies from a standard of 65 degrees Fahrenheit.

(c) Represents the Company's 15.8% interest in Palo Verde.

El Paso Electric Company Twelve Months Ended

December 31, 2017 and 2016 Sales and Revenues Statistics

(Unaudited)

Increase (Decrease) 2017 2016 Amount

Percentage

kWh sales (in

thousands):

Retail: Residential 2,823,260 2,805,789 17,471 0.6 % Commercial and

industrial, small 2,410,710 2,403,447 7,263 0.3 % Commercial and

industrial, large 1,045,319 1,030,745 14,574 1.4 % Sales to public

authorities 1,564,670 1,572,510 (7,840 ) (0.5 )% Total

retail sales 7,843,959 7,812,491 31,468 0.4 %

Wholesale: Sales for resale 62,887 62,086 801 1.3 % Off-system

sales 2,042,884 1,927,508 115,376 6.0 % Total

wholesale sales 2,105,771 1,989,594 116,177 5.8 %

Total kWh sales 9,949,730 9,802,085 147,645 1.5 %

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 287,884 $ 278,774 $

9,110 3.3 % Commercial and industrial, small 198,799 194,942 3,857

2.0 % Commercial and industrial, large 38,403 39,070 (667 ) (1.7 )%

Sales to public authorities 97,890 96,881 1,009 1.0 %

Total retail non-fuel base revenues (a) 622,976 609,667 13,309 2.2

% Wholesale: Sales for resale 2,730 2,407 323 13.4 %

Total non-fuel base revenues 625,706 612,074 13,632

2.2 % Fuel revenues: Recovered from customers during the period

218,380 148,397 69,983 47.2 % (Over) under collection of fuel (b)

(c) (17,133 ) 14,893 (32,026 ) — New Mexico fuel in base rates (d)

— 33,279 (33,279 ) — Total fuel revenues (e) 201,247

196,569 4,678 2.4 % Off-system sales: Fuel cost 46,258

38,933 7,325 18.8 % Shared margins 11,055 5,632 5,423 96.3 %

Retained margins 1,673 1,137 536 47.1 %

Total off-system sales

58,986 45,702 13,284 29.1 % Other: (f) Wheeling revenues 18,114

21,966 (3,852 ) (17.5 )% Miscellaneous service revenues and other

(g) 12,744 10,625 2,119 19.9 % Total other 30,858

32,591 (1,733 ) (5.3 )% Total operating revenues $ 916,797

$ 886,936 $ 29,861 3.4 % (a) 2017 includes

$8.8 million of relate back revenues in Texas from July 18, 2017

through December 31, 2017, which was recorded in the fourth quarter

of 2017 related to the 2017 PUCT Final Order. (b) Includes the

portion of the U.S. Department of Energy refunds related to spent

fuel storage of $1.4 million and $1.6 million in 2017 and 2016,

respectively, that were credited to customers through the

applicable fuel adjustment clauses. (c) 2017 includes $5.0 million

related to the Palo Verde performance rewards, net. (d)

Historically, fuel and purchased power costs in the New Mexico

jurisdiction were recorded through base rates and the Fuel and

Purchased Power Cost Adjustment Clause ("FPPCAC") that accounts for

the changes in the costs of fuel relative to the amount included in

base rates. Effective July 1, 2016, with the implementation of the

NMPRC's final order in the Company's 2015 New Mexico retail rate

case, Case No. 15-00127-UT, these costs are no longer recovered

through base rates but are recovered through the FPPCAC. (e)

Includes deregulated Palo Verde Unit 3 revenues for the New Mexico

jurisdiction of $9.8 million and $8.7 million in 2017 and 2016,

respectively. (f) Represents revenue with no related kWh sales. (g)

Includes energy efficiency bonus of $1.5 million and $0.5 million

in 2017 and 2016, respectively.

El Paso Electric

Company Twelve Months Ended December 31, 2017 and 2016

Other Statistical Data

Increase (Decrease) 2017

2016 Amount Percentage

Average number of

retail customers: (a)

Residential 368,044 362,138 5,906 1.6 % Commercial and industrial,

small 41,978 41,014 964 2.4 % Commercial and industrial, large 48

49 (1 ) (2.0 )% Sales to public authorities 5,532

5,303 229 4.3 % Total 415,602

408,504 7,098 1.7 %

Number of retail

customers (end of period): (a)

Residential 370,054 363,987 6,067 1.7 % Commercial and industrial,

small 42,291 41,741 550 1.3 % Commercial and industrial, large 48

49 (1 ) (2.0 )% Sales to public authorities 5,500

5,285 215 4.1 % Total 417,893

411,062 6,831 1.7 %

Weather

statistics: (b)

10-Year Average Cooling degree days 2,917 2,811 2,773

Heating degree days 1,522 1,851 2,081

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2017 2016 Amount

Percentage Palo Verde 5,109,325 5,093,844 15,481 0.3

% Four Corners (c) — 175,258

(175,258

)

— Gas plants 3,841,550 3,550,904

290,646 8.2 % Total generation 8,950,875 8,820,006 130,869

1.5 % Purchased power: Photovoltaic 292,157 289,800 2,357 0.8 %

Other 1,248,684 1,262,451

(13,767 ) (1.1 )% Total purchased power 1,540,841

1,552,251 (11,410 ) (0.7 )% Total available

energy 10,491,716 10,372,257 119,459 1.2 % Line losses and Company

use 541,986 570,172 (28,186 )

(4.9 )% Total kWh sold 9,949,730 9,802,085

147,645 1.5 % Palo Verde capacity

factor

93.8

%

93.2 % 0.6 % Palo Verde O&M expenses (d) $ 99,364 $

96,914 $ 2,450 (a) The number of retail customers

presented is based on the number of service locations. (b) A

degree day is recorded for each degree that the average outdoor

temperature varies from a standard of 65 degrees Fahrenheit.

(c) The Company sold its interest in Four Corners on July 6, 2016.

(d) Represents the Company's 15.8% interest in Palo Verde.

El Paso Electric Company Financial

Statistics At December 31, 2017 and 2016 (In

thousands, except number of shares, book value per common share,

and ratios) (Unaudited)

Balance Sheet 2017 2016 Cash and

cash equivalents $ 6,990 $ 8,420 Common stock

equity $ 1,142,165 $ 1,074,396 Long-term debt 1,195,988

1,195,513 Total capitalization $ 2,338,153 $

2,269,909 Current maturities of long-term debt $ —

$ 83,143 Short-term borrowings under the

revolving credit facility $ 173,533 $ 81,574

Number of shares - end of period 40,584,338 40,517,718

Book value per common share $ 28.14 $ 26.52

Common equity ratio (a) 45.5 % 44.1 % Debt ratio 54.5

% 55.9 % (a) The capitalization component includes

common stock equity, long-term debt and the current maturities of

long-term debt, and short-term borrowings under the RCF.

El Paso Electric Company Twelve Months Ended

December 31, 2017 2017 PUCT Final Order On

December 18, 2017, the PUCT issued the 2017 PUCT Final Order. See

"Rate Case- 2017 Texas Retail Rate Case Filing" for a discussion of

the 2017 PUCT Final Order.

The increase (decrease) on operations

resulting from the 2017 PUCT Final Order is categorized in the

following periods based on consumption (in thousands):

Three Months Ended Twelve Months Ended

Category March 31, 2017 June 30,

2017 September 30, 2017

December 31, 2017 December 31, 2017 Retail non-fuel

base rate increase: Relate back $ — $ — $ 4,753 $ 4,023 $ 8,776

Depreciation and amortization expense — — (278 ) (435 ) (713 ) Rate

case expense — — — (58 ) (58 ) Pre-tax

increase $ — $ — $ 4,475 $ 3,530 $ 8,005 Income tax expense —

— 1,566

1,236 2,802 After-tax increase $

— $ — $ 2,909

$ 2,294 $ 5,203

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180227005525/en/

El Paso Electric CompanyMedia Eddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

RelationsLisa Budtke,

915-543-5947lisa.budtke@epelectric.com

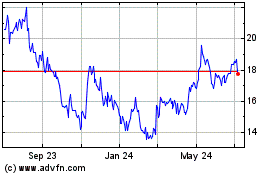

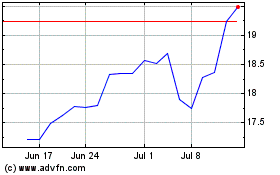

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Sep 2023 to Sep 2024