Current Report Filing (8-k)

February 21 2018 - 5:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2018

TTM TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

0-31285

|

|

91-1033443

|

|

(State of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1665 Scenic Avenue, Suite 250,

Costa Mesa, California

|

|

92626

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(714)

327-3000

Registrant’s telephone number, including area code

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this

chapter).

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 8 – Other Events

Item 8.01. Other Events.

On

February 21, 2018, TTM Technologies, Inc. (the “Company”) announced the completion of allocation of $600 million of commitments from lenders in the syndication for incremental term loans under its existing Term Loan Credit

Agreement (the “Term Loan Credit Agreement”). The incremental term loans are expected to be issued with 0.25% of original issue discount, have an interest rate of LIBOR + 2.50% and have terms otherwise identical to the terms of the

existing term loans under the Term Loan Credit Agreement. The closing of the incremental term loans is expected to occur concurrently with the closing of the Company’s pending acquisition of Anaren Inc., which in turn is expected to occur

shortly after the receipt of all required regulatory approvals for the transaction.

Item 9.01 – Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

TTM TECHNOLOGIES, INC.

|

|

|

|

|

|

|

Date: February 21, 2018

|

|

|

|

|

|

/s/ Daniel J. Weber

|

|

|

|

|

|

By:

|

|

Daniel J. Weber

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel & Secretary

|

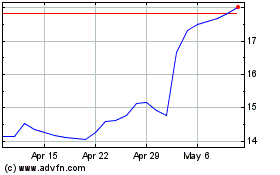

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

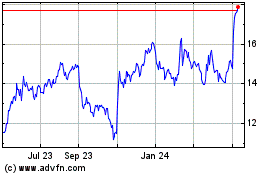

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Apr 2023 to Apr 2024