Strong Card Spending Lifts Visa's Revenue and Profit -- Update

February 01 2018 - 8:13PM

Dow Jones News

By AnnaMaria Andriotis

A rise in card spending from increasingly confident consumers

helped Visa Inc. beat revenue expectations for the first quarter of

its fiscal year.

Visa's revenue for the quarter ended Dec. 31 rose 9% from the

year before to $4.86 billion, just above the $4.85 billion analysts

polled by Thomson Reuters expected.

Visa's profit rose to $2.52 billion, or $1.07 a share, from

$2.07 billion, or 86 cents a share, the year before. But excluding

two special items related to the impact of the new U.S. tax law,

profit totaled $2.54 billion or $1.08 a share. Analysts expected

adjusted earnings of 99 cents a share.

The company, however, updated its outlook for adjusted operating

expense growth to the high end of mid-single digits, which is up

from mid-single digits. It reaffirmed its outlook for annual net

revenue growth of high single digits on a nominal dollar basis.

Visa shares fell 1.8% in after-hours trading.

Card networks, including Visa and Mastercard Inc., which also

reported earnings on Thursday, are posting large revenue increases

as economies in many markets strengthen, particularly in the U.S.

They are also reaping the benefits of increased credit-card usage

among consumers because more transactions run over their

networks.

Visa, the largest U.S. card network by many measures, including

cards in circulation and number of transactions, processed a total

of 30.5 billion transactions, up 12% from a year prior. The company

reported a 10% increase on a constant-dollar basis in debit and

credit payments volume that was processed on its network in the

quarter from a year prior, totaling $2.0 trillion.

The company is planning to invest expected windfalls from the

tax overhaul in several ways. Its board of directors approved a new

$7.5 billion share-repurchase program and increased Visa's

quarterly cash dividend to $0.21 a share. Separately, Visa recently

said it is improving 401(k) benefits for its U.S.-based employees

by increasing its matching contributions beginning in February. The

company, which contributes $2 for every $1 an employee contributes,

up to 3% of base pay, is increasing that to 5% of base pay.

Alfred Kelly, Visa's CEO, said in the company's earnings release

that Visa is also "evaluating ways to further invest in our

business, our people and our communities to digitize payments and

contribute to overall economic growth," as a result of the benefits

from the tax law.

Operating expenses at the company totaled $1.5 billion for the

quarter, up 13% from a year earlier, due in large part to higher

personnel costs. Mr. Kelly on the earnings call also said the

company is "making significant investments" in strategic

priorities, which contributed to higher expense levels. The company

recently began testing a biometrics card in the U.S. that involves

fingerprint identification. Cardholders place their finger on the

card while they are at the payment terminal to authorize the

payment.

The large networks are competing for lucrative co-brand

partnerships, deals that are supposed to increase transactions on

their network. Visa is the network for the new Starbucks credit

card that the coffee giant and issuer JPMorgan Chase & Co.

announced on Thursday. Visa also recently became the network for

the Uber credit card issued by Barclaycard. Mastercard on Thursday

said it won the Cabela's credit-card business, which will be

flipping from Visa, following other recently announced

conversions.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

February 01, 2018 19:58 ET (00:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

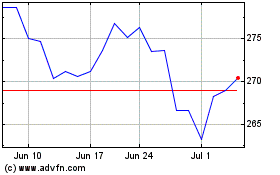

Visa (NYSE:V)

Historical Stock Chart

From Aug 2024 to Sep 2024

Visa (NYSE:V)

Historical Stock Chart

From Sep 2023 to Sep 2024