SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

Commission File Number: 001-37954

NOTIFICATION OF LATE FILING

|

¨

Form 10-K

|

¨

Form 11-K

|

¨

Form 20-F

|

x

Form 10-Q

|

¨

Form N-SAR

|

For Period Ended:

November 30, 2017

|

¨

Transition Report on Form 10-K

|

¨

Transition Report on Form 10-Q

|

|

¨

Transition Report on Form 20-F

|

¨

Transition Report on Form N-SAR

|

For the Transition Period Ended: _________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates: ____________

PART I

REGISTRANT INFORMATION

|

Full name of registrant

|

ShiftPixy, Inc.

|

|

|

|

|

|

|

Address of principal executive office

|

1 Venture, Suite 150

|

|

|

|

|

|

|

City, state and zip code

|

Irvine CA 92618

|

|

PART II

RULE 12b-25 (b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25 (b), the following should be completed. (Check box if appropriate.)

|

x

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

x

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, 20-F, 11-K or Form 10-Q, or portion thereof will be filed on or before the 15

th

calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or portion thereof will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III

NARRATIVE

State below in reasonable detail the reasons why Form 10-K, 11-K, 20-F, 10-Q, N-SAR or the transition report portion thereof could not be filed within the prescribed time period.

The compilation, dissemination and review of the information required to be presented in the Form 10-Q for our 2018 first quarter ended November 30, 2017, has imposed requirements that have rendered timely filing of the Form 10-Q impracticable. More specifically, with the recent resignation of our former chief financial officer which took effect on October 20, 2017, and our change in independent registered accounting firms on December 18, 2017, additional time is warranted in order to properly compile, prepare and review the Form 10-Q filing.

PART IV OTHER INFORMATION

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

Scott Absher

|

|

(888)

|

|

798-9100

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

x

Yes

¨

No

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

x

Yes

¨

No

|

|

|

|

|

|

If so: attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

|

ShiftPixy, Inc.

Name of Registrant as Specified in Charter.

Has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

Dated: January 17, 2018

|

By:

|

/s/ Scott W. Absher

|

|

|

|

|

Scott W. Absher

|

|

|

|

|

Chief Executive Officer and Principal Financial Officer

|

|

Explanation of the Anticipated Change in Results of Operations, Both Narratively and Quantitatively

Quantitative Explanation

Condensed consolidated results of our operations for the quarter ended November 30, 2017,

vs. the quarter ended November 30, 2016

The following table summarizes what we believe to be the condensed consolidated results of operations for the quarter ended November 30, 2017, as well as the consolidated results of operations for the quarter ended November 30, 2016, reporting on a net basis in view of the provisions of ASC 605-45-45:

ShiftPixy, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

|

|

|

For the Three

Months Ended

|

|

|

|

|

November

30, 2017

|

|

|

November

30, 2016

|

|

|

|

|

|

|

|

|

|

|

Revenues (gross billings of $40.2 million and $35.0 million less worksite employee payroll cost of $33.7 million and $29.4 million, respectively)

|

|

$

|

6,511,919

|

|

|

$

|

5,681,676

|

|

|

Cost of Revenue

|

|

|

5,266,403

|

|

|

|

3,730,553

|

|

|

Gross Profit

|

|

|

1,245,516

|

|

|

|

1,951,123

|

|

|

Operating Expenses

|

|

|

4,586,733

|

|

|

|

1,573,024

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Income

|

|

$

|

(3,341,217

|

)

|

|

$

|

378,099

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Income per common share available to Common Shareholders:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.12

|

)

|

|

$

|

0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

$

|

(0.12

|

)

|

|

$

|

0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Used in Per Share Computations:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

28,767,850

|

|

|

|

26,213,800

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

28,767,850

|

|

|

|

26,974,150

|

|

Narrative Explanation

The following information summarizes, in a narrative manner, what we believe to be the condensed consolidated results of operations for the quarter ended November 30, 2017, as well as the condensed consolidated results of operations for the quarter ended November 30, 2016:

Results of Operations

Revenues.

ShiftPixy, Inc., provides contingent staffing and workforce management solutions, principally to businesses that make significant use of part-time employees; we are currently focusing on the restaurant and hospitality industries. The company currently targets clients in Southern California but has begun to expand our geographic coverage.

Our revenues, which represent gross billings net of worksite employee payroll cost, increased by 14.6% to $6.5 million in the three months ended November 30, 2017, compared to $5.7 million in the three months ended November 30, 2016. Gross billings for the three months ending November 30, 2017, were earned from billings to clients to whom we provide staff or workforce management support (PEO and ASO). Gross billings (a non-GAAP measurement) for the three months ended November 30, 2017, increased by $5.2 million or 14.7% to $40.2 million, compared to $35.0 million for the three months ended November 30, 2016. The revenue increase was primarily due to the increase in worksite employees by 719 to 5,682 employees, compared to 4,963 employees for the three months ended November 30, 2016. Revenues are recognized ratably over the payroll period as worksite employees perform their service at the client worksite.

Cost of Revenues.

Our cost of revenues mainly includes the costs of employer-side taxes and workers’ compensation insurance coverage. Our cost of revenues for the three months ended November 30, 2017, increased by $1.5 million or 41.2% to $5.3 million, compared to $3.7 million for the three months ended November 30, 2016.

Approximately $0.5 million of the increase is attributed to the additional worksite employees the Company is serving, which increased from 4,963 employees in the three months ended November 30, 2016, to 5,682 employees in the three months ended November 30, 2017.

Approximately $0.3 million of the increase is attributed to workers’ compensation premium, which was over-expensed in the fiscal year ended August 30, 2016. This resulted in an understatement of our gross profit for the fiscal year ended August 30, 2016. Such difference was not deemed quantitatively and qualitatively material to the August 2016 financial statements.

Approximately $0.6 million of the increase is attributed to the increase in workers’ compensation expense, resulting from engaging with two clients in the janitorial business, serving approximately 200 worksite employees, for which the cost of workers’ compensation insurance is triple the average cost of coverage for employees in the industries in which we otherwise operate. The Company incurred $0.6 million of workers’ compensation insurance expense for these two clients in the three months ended November 30, 2017, compared to $0 in the three months ended November 30, 2016.

Gross Profit.

Gross profit for the three months ended November 30, 2017, decreased by $0.7 million or 36.2% to $1.2 million, compared to $1.9 million in the three months ended November 30, 2016. The gross profit, as a percentage of revenues, decreased from 34.3% in the three months ended November 30, 2016, to 19.1% in the three months ended November 30, 2017, which is a consequence of the workers’compensation issue related to fiscal year ended August 30, 2016, as explained in the cost of revenues section above, and the additional $0.6million in workers’ compensation insurance expense attributable to the two clients highlighted above. We anticipate gross profit to increase in the near future from the current level, as a result of positive initiatives that have been implemented in the workers’ compensation program and economies of scale.

Total Operating Expenses.

Total operating expenses for the three months ended November 30, 2017, have increased by $3.0 million or 191.6% to $4.6 million, compared to $1.6 million for the three months ended November 30, 2016.

The increase of $3.0 million in operating expenses is primarily attributed to the development costs for the Company’s new mobile application from $0 in the three months ended November 30, 2016, to $1.9 million in the three months ended November 30, 2017. This software is an important component of our overall Ecosystem and is fundamental to our strategy to establish the first ecosystem that links businesses to a large number of part-time workers and the ever-growing number of shift workers in the new Gig Economy.

Selling, General & Administrative expenses for the three months ended November 30, 2017, increased by $471k to $943k, compared to $472k for the three months ended November 30, 2016. The increase of $471k is primarily attributed to the $168k increase in commissions, which is a direct consequence of the increase in gross billings and secondarily to a $147k increase in investor relations expenses resulting from being a listed company.

Professional fees for the three months ended November 30, 2017, increased by $322k or 190.3% to $492k, compared to $170k for the three months ended November 30, 2016. This increase results from additional audit fees to our year-end audit, consulting fees and other fees incurred following our IPO. We anticipate professional fees and other general & administrative expenses to remain consistent for the remainder of the fiscal year as most of the expenses are fixed in nature.

Net loss/Income.

As a result of the explanations described above, the net loss for the three months ended November 30, 2017, was $3.3 million, compared to a net profit of $0.4 million for the three months ended November 30, 2016. The Company expects the core business operations of ShiftPixy, Inc., excluding the software development costs and one-time workers’ compensation fee, to be profitable by the end of our current fiscal year.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 12b-25 may include, certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are intended to enjoy the benefits of that act. Unless the context provides otherwise, the forward-looking statements included in this Form 12b-25 address activities, events or developments that ShiftPixy, Inc. (hereinafter referred to as “we,” “us,” “our,” “our Company” or “ShiftPixy”) expects or anticipates, will or may occur in the future. Any statements in this document about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “will continue,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” and similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning economic conditions, rates of growth, rates of income or values as may be included in this document are based on information available to us on the dates noted, and except as expressly provided herein, we assume no obligation to update any such forward-looking statements. It is important to note that our actual results may differ materially from those in such forward-looking statements due to fluctuations in interest rates, inflation, government regulations, economic conditions and competitive product and pricing pressures in the geographic and business areas in which we conduct operations, including our plans, objectives, expectations and intentions and other factors discussed elsewhere in this Report.

Certain risk factors could materially and adversely affect our business, financial conditions and results of operations and cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. The risks and uncertainties we currently face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, you may lose all or part of your investment.

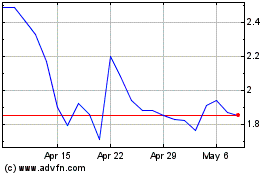

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

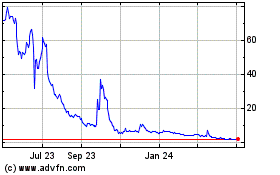

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024