Lands' End Announces the Completion of a New $175 Million ABL Revolving Credit Facility That Refinances the Existing $175 Mil...

November 20 2017 - 7:09AM

Lands' End, Inc. (NASDAQ:LE) today announced that it has

successfully completed the closing of a new $175 million ABL

Revolving Credit Facility, which matures in November 2022.

The new Credit Facility refinances the existing $175 million

facility, with similar collateral support realization, but with

lower borrowing and unused facility costs. The ABL Revolving

Credit Facility was placed with institutional lenders and bears

interest at a rate of LIBOR plus 125 to 175 basis points, based

upon facility utilization.

James Gooch, Executive Vice President, Chief Operating Officer

and Chief Financial Officer, commented, “We are pleased to have

completed this new financing. It provides us with continued

access to strategic liquidity reserves, at a more favorable cost

structure, as we remain focused on executing our short- and

long-term initiatives to drive improved financial performance. We

appreciate the support of our current lenders and the new

institutional lenders who have joined our bank group. We look

forward to continuing to partner with them in the future.”

About Lands' End, Inc.

Lands' End, Inc. (NASDAQ:LE) is a leading

multi-channel retailer of casual clothing, accessories, footwear

and home products. We offer products through catalogs, online at

www.landsend.com and affiliated specialty and international

websites, and through retail locations. We are a classic American

lifestyle brand with a passion for quality, legendary service and

real value, and seek to deliver timeless style for women, men, kids

and the home.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks and uncertainties, including statements about access

to liquidity and execution of initiatives to drive financial

performance. All statements other than statements of historical

fact, including without limitation, those with respect to the

Company's goals, plans, expectations and strategies set forth

herein are forward-looking statements. The following important

factors and uncertainties, among others, could cause actual results

to differ materially from those described in these forward-looking

statements: the performance of our business could impact the

availability of funds under the Credit Facility; the Company may

not be able to successfully execute its short- and long-term

initiatives, and even if executed, they may not have their intended

impact on financial performance; and other risks, uncertainties and

factors discussed in the "Risk Factors" section of our Annual

Report on Form 10-K for the fiscal year ended January 27,

2017. We intend the forward-looking statements to speak only

as of the time made and do not undertake to update or revise them

as more information becomes available, except as required by

law.

CONTACTS:

Lands' End, Inc.James GoochChief Operating Officer and Chief

Financial Officer(608) 935-9341

Investor Relations:ICR, Inc.Jean Fontana(646)

277-1214Jean.Fontana@icrinc.com

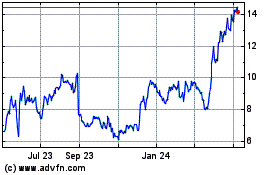

Lands End (NASDAQ:LE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lands End (NASDAQ:LE)

Historical Stock Chart

From Apr 2023 to Apr 2024