- New awards of $1.1 billion in Q3

2017; YTD book-to-burn of 1.36

- Backlog at $7.5 billion, up 12% Y/Y;

Civil segment backlog up 54% Y/Y to a new record level

- Cash Flow from Operations of $36.5

million in Q3 2017

Tutor Perini Corporation (NYSE: TPC), a leading civil, building

and specialty construction company, today reported results for the

three months ended September 30, 2017. Revenue for the third

quarter of 2017 was $1.2 billion compared to $1.3 billion for the

third quarter of last year, as various Civil and Building segment

projects are nearing completion and newer projects, particularly in

the Civil segment, are earlier in their project life cycle and are

not yet generating the higher levels of revenue that are expected

later. Revenue for the third quarter of 2017 was also impacted by

certain delays in the timing of new awards and project execution

activities for previously awarded projects, which have shifted the

timing of respective revenue contributions to 2018. Income from

construction operations was $49.1 million for the third quarter of

2017 compared to $60.9 million for the comparable period last year.

Net income attributable to Tutor Perini Corporation for the third

quarter of 2017 was $23.6 million, or $0.47 per diluted share,

compared to $28.8 million, or $0.57 per diluted share for the third

quarter of 2016. Both income from construction operations and net

income attributable to Tutor Perini Corporation were affected by

the reduced volume.

Backlog as of September 30, 2017 was $7.5 billion, up 12%

year-over-year and up 20% compared to the backlog as of December

31, 2016. Civil segment backlog climbed 54% year-over-year to $4.3

billion, a new record. New awards and adjustments to contracts in

process totaled $1.1 billion in the third quarter of 2017 and $4.8

billion in the first nine months of 2017, well outpacing revenue

for the nine-month period. The Civil segment was the major

contributor to the new award activity during the first nine months

of 2017, with civil awards comprising more than half of all new

awards through September 30, 2017. Significant new awards in the

third quarter of 2017 included a joint-venture tunnel project for a

hydroelectric generating station in British Columbia, Canada,

valued at $274 million, an electrical subcontract worth $154

million for a mass-transit project in California, a joint-venture

bridge project in Minnesota, for which the Company’s portion is

valued at $90 million, a U.S. embassy renovation project in Uruguay

valued at $87 million, a military training range project in Guam

worth $78 million, approximately $65 million for various smaller

electrical projects in the southern United States, $52 million for

three new mechanical projects in New York and $49 million of early

scope tasks for a new technology office building in California,

which is anticipated to be worth approximately $500 million once

the remaining funding is released.

The Company generated $36.5 million of operating cash in the

third quarter of 2017 and expects operating cash to be even

stronger in the fourth quarter of 2017.

“We have continued to experience certain delays in the timing of

new awards and project execution activities for previously awarded

projects, which resulted in revenue and profit shortfalls in the

quarter. On the positive side, we achieved improved operating

margins for the quarter in both our Building and Specialty

Contractors segments while maintaining good margin performance in

our Civil segment,” said Ronald Tutor, Chairman and Chief Executive

Officer. Tutor continued, “We also had solid operating cash flow,

as well as good new award bookings that resulted in stable backlog

for the quarter. We continue to see an unprecedented and growing

volume of prospective opportunities ahead, especially in our

higher-margin Civil segment, with several large project award

decisions expected in the near future. Consequently, our long-term

outlook for growth and improved profitability remains very

favorable.”

Outlook and Guidance

Based on the current backlog and market outlook, the Company is

updating its guidance for 2017, with revenue now expected to be

approximately $5.0 billion and diluted earnings per share (EPS) now

expected in the range of $1.75 to $1.90.

Third Quarter Conference Call

The Company will host a conference call at 2:00 PM Pacific Time

on Thursday, November 9, 2017, to discuss the third quarter

results. To participate in the conference call, please dial

877-407-8293 five to ten minutes prior to the scheduled time.

International callers should dial +1-201-689-8349.

The conference call will be webcast live over the Internet and

can be accessed by all interested parties on Tutor Perini's website

at www.tutorperini.com. To listen to the webcast, please visit the

Company's website at least 15 minutes prior to the start of the

call to register and to download and install any necessary

software. For those unable to participate during the live call, the

webcast will be available for replay shortly after the call on the

website.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private clients and public

agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget while adhering to strict quality control measures. We offer

general contracting, pre-construction planning and comprehensive

project management services, including the planning and scheduling

of the manpower, equipment, materials and subcontractors required

for a project. We also offer self-performed construction services

including site work, concrete forming and placement, steel

erection, electrical, mechanical, plumbing and heating, ventilation

and air conditioning (HVAC). We are known for our major complex

building project commitments, as well as our capacity to perform

large and complex transportation and heavy civil construction for

government agencies and private clients throughout the world.

Forward-Looking Statements

The statements contained in this Release, including those set

forth in the section “Outlook and Guidance,” that are not purely

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, including without limitation,

statements regarding the Company’s expectations, hopes, beliefs,

intentions or strategies regarding the future and statements

regarding future guidance or estimates and non-historical

performance. These forward-looking statements are based on the

Company’s current expectations and beliefs concerning future

developments and their potential effects on the Company. While the

Company’s expectations, beliefs and projections are expressed in

good faith and the Company believes there is a reasonable basis for

them, there can be no assurance that future developments affecting

the Company will be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond the control of the Company) or other

assumptions that may cause actual results or performance to be

materially different from those expressed or implied by such

forward-looking statements. These risks and uncertainties include,

but are not limited to, the Company’s ability to win new contracts

and convert backlog into revenue; the Company's ability to

successfully and timely complete construction projects; increased

competition and failure to secure new contracts; the outcomes of

pending or future litigation, arbitration or other dispute

resolution proceedings and the timing of related collections; the

potential delay, suspension, termination or reduction in scope of

construction projects; the continuing validity of the underlying

assumptions and estimates of total forecasted project revenues,

costs and profits and project schedules; the availability of

borrowed funds on terms acceptable to the Company; failure to meet

our obligations under our debt agreements; the ability to retain

certain members of management; the ability to obtain surety bonds

to secure the Company’s performance under certain construction

contracts; possible labor disputes or work stoppages within the

construction industry; changes in federal and state appropriations

for infrastructure projects and the impact of changing economic

conditions on federal, state and local funding for infrastructure

projects; possible changes or developments in international or

domestic political, social, economic, business, industry, market

and regulatory conditions or circumstances; failure to comply with

laws and regulations related to government contracts; actions taken

or not taken by third parties, including the Company’s customers,

suppliers, business partners and competitors and legislative,

regulatory, judicial and other governmental authorities and

officials; impairments of our goodwill or other indefinite-lived

intangible assets; possible systems and information technology

disruptions; the impact of inclement weather conditions on

projects; and other risks and uncertainties discussed under the

heading “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2016 filed with the Securities and

Exchange Commission on February 23, 2017. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

Tutor Perini Corporation Condensed Consolidated

Statements of Operations Unaudited

Three Months Ended September 30, Nine

Months Ended September 30, (in thousands, except per share

data)

2017 2016 2017 2016

Revenue $ 1,199,505 $ 1,332,978 $ 3,564,140 $ 3,726,477

Cost of operations (1,081,254 ) (1,208,310 )

(3,240,332 ) (3,386,947 ) Gross profit 118,251

124,668 323,808 339,530 General and administrative expenses

(69,179 ) (63,749 ) (203,674 ) (189,660

)

INCOME FROM CONSTRUCTION OPERATIONS 49,072 60,919

120,134 149,870 Other income, net 967 2,048 42,373 5,214

Interest expense (15,643 ) (15,041 ) (53,726 )

(44,655 )

INCOME BEFORE INCOME TAXES 34,396

47,926 108,781 110,429 Provision for income taxes

(9,096 ) (19,125 ) (37,084 ) (44,868 )

NET INCOME 25,300 28,801 71,697 65,561

LESS: NET

INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS (1,716 )

— (4,253 ) —

NET

INCOME ATTRIBUTABLE TO TUTOR PERINI CORPORATION $ 23,584

$ 28,801 $ 67,444 $ 65,561

BASIC

EARNINGS PER COMMON SHARE $ 0.47 $ 0.59 $ 1.36

$ 1.33

DILUTED EARNINGS PER COMMON

SHARE $ 0.47 $ 0.57 $ 1.33 $ 1.32

WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING:

BASIC 49,775 49,185 49,602

49,132 DILUTED 50,587

50,100 50,768 49,649

Tutor Perini Corporation Segment Information

Unaudited Reportable Segments

Specialty Consolidated (in

thousands)

Civil Building Contractors

Total Corporate Total

Three Months

Ended September 30, 2017

Total revenue $ 458,487 $ 500,420 $ 310,137 $ 1,269,044 $ — $

1,269,044 Elimination of intersegment revenue (62,667 )

(6,872 ) — (69,539 ) —

(69,539 ) Revenue from external customers $ 395,820 $ 493,548 $

310,137 $ 1,199,505 $ — $ 1,199,505 Income from construction

operations $ 38,144 $ 14,058 $ 14,575 $ 66,777 $ (17,705 ) (a) $

49,072 Capital expenditures $ 1,248 $ 36 $ 81 $ 1,365 $ 164 $ 1,529

Depreciation and amortization (b) $ 5,213 $ 502 $ 1,166 $ 6,881 $

2,824 $ 9,705

Three Months

Ended September 30, 2016

Total revenue $ 506,100 $ 560,795 $ 331,613 $ 1,398,508 $ — $

1,398,508 Elimination of intersegment revenue (47,277 )

(18,253 ) — (65,530 ) —

(65,530 ) Revenue from external customers $ 458,823 $ 542,542 $

331,613 $ 1,332,978 $ — $ 1,332,978 Income from construction

operations $ 50,307 $ 13,296 $ 11,084 $ 74,687 $ (13,768 ) (a) $

60,919 Capital expenditures $ 1,342 $ 79 $ 54 $ 1,475 $ 117 $ 1,592

Depreciation and amortization (b) $ 12,669 $ 541 $ 1,243 $ 14,453 $

2,886 $ 17,339

Reportable Segments Specialty

Consolidated (in thousands)

Civil Building

Contractors Total Corporate Total

Nine Months Ended

September 30, 2017

Total revenue $ 1,363,850 $ 1,520,356 $ 907,690 $ 3,791,896 $ — $

3,791,896 Elimination of intersegment revenue (190,873 )

(36,883 ) — (227,756 ) —

(227,756 ) Revenue from external customers $ 1,172,977 $ 1,483,473

$ 907,690 $ 3,564,140 $ — $ 3,564,140 Income from construction

operations $ 128,176 $ 25,035 $ 15,330 $ 168,541 $ (48,407 ) (a) $

120,134 Capital expenditures $ 8,665 $ 184 $ 374 $ 9,223 $ 489 $

9,712 Depreciation and amortization (b) $ 26,767 $ 1,533 $ 3,551 $

31,851 $ 8,612 $ 40,463

Nine Months Ended

September 30, 2016

Total revenue $ 1,378,531 $ 1,594,946 $ 932,288 $ 3,905,765 $ — $

3,905,765 Elimination of intersegment revenue (118,143 )

(61,145 ) — (179,288 ) —

(179,288 ) Revenue from external customers $ 1,260,388 $ 1,533,801

$ 932,288 $ 3,726,477 $ — $ 3,726,477 Income from construction

operations $ 129,028 $ 38,969 $ 25,910 $ 193,907 $ (44,037 ) (a) $

149,870 Capital expenditures $ 8,499 $ 381 $ 798 $ 9,678 $ 595 $

10,273 Depreciation and amortization (b) $ 33,200 $ 1,647 $ 3,811 $

38,658 $ 8,637 $ 47,295

(a)

Consists primarily of corporate general

and administrative expenses.

(b)

Depreciation and amortization is included

in income from construction operations.

Tutor Perini Corporation Condensed

Consolidated Balance Sheets Unaudited (in

thousands, except share and per share amounts)

September 30, 2017 December 31, 2016

ASSETS CURRENT ASSETS: Cash and cash equivalents

($79,111 and $0 related to variable interest entities ("VIEs")) $

221,878 $ 146,103 Restricted cash 17,424 50,504 Restricted

investments 48,775 — Accounts receivable ("AR") including retainage

of $574,710 and $569,391 (AR of $36,317 and $0 related to VIEs)

1,857,870 1,743,300 Costs and estimated earnings in excess of

billings 902,312 831,826 Other current assets 70,781

66,023

Total current assets 3,119,040

2,837,756 Property and equipment, net of accumulated

depreciation

of $345,546 and $313,783

447,588 477,626 Goodwill 585,006 585,006 Intangible assets, net

90,340 92,997 Other assets 40,811 45,235

TOTAL ASSETS $ 4,282,785 $ 4,038,620

LIABILITIES AND EQUITY CURRENT LIABILITIES:

Current maturities of long-term debt $ 30,951 $ 85,890 Accounts

payable ("AP") including retainage of $267,110 and $258,294 (AP of

$4,826 and $0 related to VIEs) 949,675 994,016 Billings in excess

of costs and estimated earnings ($91,750 and $0 related to VIEs)

403,635 331,112 Accrued expenses and other current liabilities

124,385 107,925

Total current

liabilities 1,508,646 1,518,943 Long-term debt, less

current maturities, net of unamortized

discounts and debt issuance costs totaling

$54,699 and $56,072

855,325 673,629 Deferred income taxes 132,335 131,007 Other

long-term liabilities 155,553 162,018

TOTAL LIABILITIES 2,651,859 2,485,597

CONTINGENCIES AND COMMITMENTS

EQUITY: Stockholders' Equity Preferred stock –

authorized 1,000,000 shares ($1 par value),

none issued

— — Common stock - authorized 75,000,000 shares ($1 par value),

issued and outstanding 49,781,010 and

49,211,353 shares

49,781 49,211 Additional paid-in capital 1,080,371 1,075,600

Retained earnings 541,069 473,625 Accumulated other comprehensive

loss (43,298 ) (45,413 )

Total Stockholders'

Equity 1,627,923 1,553,023

Noncontrolling interests

3,003 —

TOTAL EQUITY

1,630,926 1,553,023

TOTAL

LIABILITIES AND EQUITY $ 4,282,785 $ 4,038,620

Tutor Perini Corporation Condensed

Consolidated Statements of Cash Flows Unaudited

Nine Months Ended September 30, (in thousands)

2017 2016 Cash flows

from operating activities: Net income $ 71,697 $ 65,561

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation 37,806 44,638 Amortization of

intangible assets 2,657 2,657 Share-based compensation expense

16,057 10,109 Excess income tax benefit from share-based

compensation — (10 ) Change in debt discounts and deferred debt

issuance costs 14,725 7,124 Deferred income taxes 642 (8,636 )

(Gain) loss on sale of property and equipment (376 ) 300 Other

long-term liabilities (2,876 ) (8,555 ) Other 4,785 (353 ) Changes

in other components of working capital (143,213 )

(18,669 )

NET CASH PROVIDED BY OPERATING ACTIVITIES

1,904 94,166

Cash flows from

investing activities: Acquisition of property and equipment

excluding financed purchases (9,712 ) (10,273 ) Proceeds from sale

of property and equipment 1,440 1,139 Investments in securities

restricted in use (48,657 ) — Change in restricted cash

33,080 (2,872 )

NET CASH USED IN INVESTING

ACTIVITIES (23,849 ) (12,006 )

Cash

flows from financing activities: Proceeds from issuance of

convertible notes — 200,000 Proceeds from debt 1,991,457 1,003,092

Repayment of debt (1,866,072 ) (1,174,679 ) Excess income tax

benefit from share-based compensation — 10 Issuance of common stock

and effect of cashless exercise (11,147 ) (423 ) Distributions paid

to noncontrolling interests (2,500 ) — Contributions from

noncontrolling interests 1,250 — Debt issuance and extinguishment

costs (15,268 ) (14,868 )

NET CASH PROVIDED BY

FINANCING ACTIVITIES 97,720 13,132

Net increase in cash and cash equivalents 75,775

95,292

Cash and cash equivalents at beginning of period

146,103 75,452

Cash and cash

equivalents at end of period $ 221,878 $ 170,744

Tutor Perini Corporation Backlog

Information Unaudited

Revenue New Awards in the

Recognized in the Backlog at Three Months

Ended Three Months Ended Backlog at (in millions)

June 30, 2017 September 30, 2017(a)

September 30, 2017 September 30, 2017 Civil $ 4,240.6

$ 462.6 $ (395.8 ) $ 4,307.4 Building 1,808.4 283.9 (493.6 )

1,598.7 Specialty Contractors 1,511.5 394.2

(310.1 ) 1,595.6 Total $ 7,560.5 $ 1,140.7 $ (1,199.5 ) $

7,501.7

Revenue New Awards in the

Recognized in the Backlog at Nine Months Ended

Nine Months Ended Backlog at (in millions)

December 31, 2016 September 30, 2017(a)

September 30, 2017 September 30, 2017 Civil $ 2,672.1

$ 2,808.3 $ (1,173.0 ) $ 4,307.4 Building 1,981.2 1,101.0 (1,483.5

) 1,598.7 Specialty Contractors 1,573.8 929.4

(907.6 ) 1,595.6 Total $ 6,227.1 $ 4,838.7 $ (3,564.1 ) $

7,501.7 (a) New awards consist of the original

contract price of projects added to our backlog plus or minus

subsequent changes to the estimated total contract price of

existing contracts.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109006264/en/

Tutor Perini CorporationJorge Casado, 818-362-8391Vice

President, Investor Relations & Corporate

Communicationswww.tutorperini.com

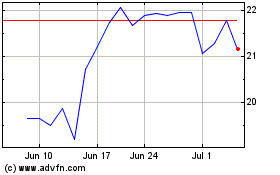

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Apr 2023 to Apr 2024