UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant

to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the Month of November 2017

001-36345

(Commission File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact name of Registrant as specified in

its charter)

16 Tiomkin St.

Tel Aviv 6578317, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover

Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

____

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

____

This Form 6-K contains

the quarterly report of Galmed Pharmaceuticals Ltd. (the “Company”), which includes the Company’s unaudited consolidated

financial statements for the three and nine months ended September 30, 2017, together with related information and certain other

information. The Company is not subject to the requirements to file quarterly or certain other reports under Section 13 or 15(d)

of the Securities Exchange Act of 1934, as amended. The Company does not undertake to file or cause to be filed any such reports

in the future, except to the extent required by law.

On November 9, 2017,

the Company issued a press release announcing the filing of its financial results for the three and nine months ended September

30, 2017 with the Securities and Exchange Commission. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

This Form 6-K and

the text under the heading “Financial Summary - Third Quarter 2017 vs. Third Quarter 2016” in Exhibit 99.1 is incorporated

by reference into the Company’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on August

11, 2015 (Registration No. 333-206292) and its Registration Statement on Form F-3 filed with the Securities and Exchange Commission

on March 31, 2015 (Registration No. 333-203133).

FINANCIAL INFORMATION

Financial Statements

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Balance Sheets

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

As of

September 30,

2017

|

|

|

As of

December 31,

2016

|

|

|

|

|

Unaudited

|

|

|

Audited

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

2,614

|

|

|

$

|

3,097

|

|

|

Marketable securities

|

|

|

6,344

|

|

|

|

12,351

|

|

|

Other accounts receivable

|

|

|

171

|

|

|

|

284

|

|

|

Total current assets

|

|

|

9,129

|

|

|

|

15,732

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

548

|

|

|

|

718

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

9,677

|

|

|

$

|

16,450

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$

|

1,965

|

|

|

$

|

3,122

|

|

|

Other accounts payable

|

|

|

219

|

|

|

|

363

|

|

|

Short-term portion of deferred revenue

|

|

|

811

|

|

|

|

1,094

|

|

|

Total current liabilities

|

|

|

2,995

|

|

|

|

4,579

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

|

|

|

|

|

|

|

Related parties

|

|

|

150

|

|

|

|

267

|

|

|

Long-term portion of deferred revenue

|

|

|

-

|

|

|

|

529

|

|

|

Total long-term liabilities

|

|

|

150

|

|

|

|

796

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Ordinary shares par value NIS 0.01 per share; Authorized 50,000,000; Issued and outstanding: 12,733,512 shares as of September 30, 2017; 12,149,226 shares as of December 31, 2016

|

|

|

36

|

|

|

|

34

|

|

|

Additional paid-in capital

|

|

|

79,479

|

|

|

|

75,446

|

|

|

Accumulated other comprehensive loss

|

|

|

(8

|

)

|

|

|

(85

|

)

|

|

Accumulated deficit

|

|

|

(72,975

|

)

|

|

|

(64,320

|

)

|

|

Total stockholders' equity

|

|

|

6,532

|

|

|

|

11,075

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

9,677

|

|

|

$

|

16,450

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Operations (Unaudited)

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

Three months ended

September 30,

|

|

|

Nine months ended

September 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2017

|

|

|

2016

|

|

|

Revenue

|

|

$

|

273

|

|

|

$

|

193

|

|

|

$

|

811

|

|

|

$

|

193

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

2,331

|

|

|

|

3,342

|

|

|

|

7,421

|

|

|

|

10,086

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

697

|

|

|

|

656

|

|

|

|

2,110

|

|

|

|

2,236

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

2,755

|

|

|

|

3,805

|

|

|

|

8,720

|

|

|

|

12,129

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses (income), net

|

|

|

46

|

|

|

|

(78

|

)

|

|

|

(65

|

)

|

|

|

(108

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

2,801

|

|

|

|

3,727

|

|

|

|

8,655

|

|

|

|

12,021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on Income

|

|

|

-

|

|

|

|

105

|

|

|

|

-

|

|

|

|

106

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

2,801

|

|

|

$

|

3,832

|

|

|

$

|

8,655

|

|

|

$

|

12,127

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$

|

0.23

|

|

|

$

|

0.34

|

|

|

$

|

0.71

|

|

|

$

|

1.09

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares outstanding used in computing basic and diluted net loss per share

|

|

|

12,364,249

|

|

|

|

11,150,023

|

|

|

|

12,274,536

|

|

|

|

11,101,360

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Comprehensive Loss (Unaudited)

|

|

U.S. Dollars in thousands

|

|

|

|

Three months ended

September 30,

|

|

|

Nine months ended

September 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2017

|

|

|

2016

|

|

|

Net loss

|

|

$

|

2,801

|

|

|

$

|

3,832

|

|

|

$

|

8,655

|

|

|

$

|

12,127

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss (income):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized loss (gain) on available for sale securities

|

|

|

(12

|

)

|

|

|

31

|

|

|

|

(77

|

)

|

|

|

(71

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

$

|

2,789

|

|

|

$

|

3,863

|

|

|

$

|

8,578

|

|

|

$

|

12,056

|

|

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

|

|

U.S. Dollars in thousands, except share data and per share data

|

|

|

|

Ordinary shares

|

|

|

Additional

paid-in

|

|

|

Accumulated

other

Comprehensive

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

capital

|

|

|

loss

|

|

|

Deficit

|

|

|

Total

|

|

|

Balance - December 31, 2016

|

|

|

12,149,226

|

|

|

$

|

34

|

|

|

$

|

75,446

|

|

|

$

|

(85

|

)

|

|

$

|

(64,320

|

)

|

|

$

|

11,075

|

|

|

Stock based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

1,066

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,066

|

|

|

Issuance of Ordinary Shares (*)

|

|

|

381,333

|

|

|

|

1

|

|

|

|

2,653

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,654

|

|

|

Options and Restricted stock units Exercise (**)

|

|

|

202,953

|

|

|

|

1

|

|

|

|

312

|

|

|

|

-

|

|

|

|

-

|

|

|

|

313

|

|

|

Unrealized gain from marketable securities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

77

|

|

|

|

-

|

|

|

|

77

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(8,655

|

)

|

|

|

(8,655

|

)

|

|

Balance - September 30, 2017

|

|

|

12,733,512

|

|

|

$

|

36

|

|

|

$

|

79,477

|

|

|

$

|

(8

|

)

|

|

$

|

(72,975

|

)

|

|

$

|

6,530

|

|

(*) See note 3.4

(**) See note 3.5 and 3.6

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Consolidated Statements of Cash Flows (Unaudited)

|

|

U.S. Dollars in thousands

|

|

|

|

Nine

months ended

September 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Cash flow from operating activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(8,655

|

)

|

|

$

|

(12,127

|

)

|

|

Adjustments required to reconcile net loss to net cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

180

|

|

|

|

118

|

|

|

Stock-based compensation expense

|

|

|

1,066

|

|

|

|

1,307

|

|

|

Amortization of discount/premium on marketable securities

|

|

|

(187

|

)

|

|

|

18

|

|

|

Loss from Realization of marketable securities

|

|

|

130

|

|

|

|

150

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Decrease in other accounts receivable

|

|

|

113

|

|

|

|

13

|

|

|

Decrease in trade payables

|

|

|

(1,157

|

)

|

|

|

(556

|

)

|

|

Decrease in other accounts payable

|

|

|

(144

|

)

|

|

|

(173

|

)

|

|

Increase (decrease) in related party

|

|

|

(117

|

)

|

|

|

45

|

|

|

Increase (decrease) in deferred revenue

|

|

|

(812

|

)

|

|

|

1,897

|

|

|

Net cash used in operating activities

|

|

|

(9,583

|

)

|

|

|

(9,305

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(10

|

)

|

|

|

(26

|

)

|

|

Investment in securities, available for sale

|

|

|

(1,447

|

)

|

|

|

(2,480

|

)

|

|

Maturity of securities, available for sale

|

|

|

7,589

|

|

|

|

9,956

|

|

|

Net cash provided in (used in) investing activities

|

|

|

6,132

|

|

|

|

7,450

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stock offerings, net of issuance costs (*)

|

|

|

2,655

|

|

|

|

4,479

|

|

|

Proceeds from exercise of options (**)

|

|

|

313

|

|

|

|

255

|

|

|

Net cash used in financing activities

|

|

|

2,968

|

|

|

|

4,734

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

|

|

(483

|

)

|

|

|

2,879

|

|

|

Cash and cash equivalents at the beginning of the year

|

|

|

3,097

|

|

|

|

4,156

|

|

|

Cash and cash equivalents at the end of the period

|

|

$

|

2,614

|

|

|

$

|

7,035

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash received from interest

|

|

$

|

169

|

|

|

$

|

319

|

|

(*) See note 3.4

(**) See note 3.5

The accompanying notes are an integral part of the interim consolidated

financial statements.

|

GALMED PHARMACEUTICALS LTD.

|

|

Notes to Consolidated Financial Statements

|

Note 1 - Basis of presentation

Galmed Pharmaceuticals Ltd.

(the “Company”) is a clinical-stage biopharmaceutical company focused on the development of a novel, once-daily, oral

therapy for the treatment of nonalcoholic steatohepatitis, or NASH, and other liver diseases.

The Company in its current legal

structure was incorporated in Israel on July 31, 2013 as a privately held company, and formally commenced operations on February

2, 2014. However, the Company’s business has been operating since 2000 under a different group of companies established in

2000 (the “Group”). On February 2, 2014, upon a pre-ruling from the Israeli Tax Authorities, the Company underwent

a reorganization (the “Reorganization”), pursuant to which all of the business of its predecessor, Galmed Holdings

Inc., including net assets and shares in its wholly-owned subsidiary, Galmed 2000, Inc. were transferred to the Company. Contemporaneously,

the Company effected a 729-for-1 stock split.

These unaudited interim consolidated

financial statements have been prepared as of September 30, 2017 and for the three and nine month period then ended. Accordingly,

certain information and footnote disclosures normally included in annual financial statements prepared in accordance with U.S.

GAAP have been omitted. These unaudited interim consolidated financial statements should be read in conjunction with the audited

financial statements and the accompanying notes of the Company for the year ended December 31, 2016 that are included in the Company's

Annual Report on Form 20-F, filed with the Securities and Exchange Commission on March 23, 2017 (the "Annual Report").

The results of operations presented are not necessarily indicative of the results to be expected for the year ending December 31,

2017.

Note 2 - Summary of significant accounting

policies

The significant accounting policies

that have been applied in the preparation of the unaudited consolidated interim financial statements are identical to those that

were applied in preparation of the Company’s most recent annual financial statements in connection with its Annual Report

on Form 20-F.

Note 3 - Stockholders' Equity

|

|

1.

|

In January 2017, the Company granted options to purchase 130,000 ordinary shares of the Company,

NIS 0.01 par value per share, to certain officers and employees. The options are exercisable at $3.84 per share, have a 10 year

term and vest over a period of four years. The aggregate grant date fair value of such options is approximately $376 thousand.

|

|

|

2.

|

In April 2017, the Company granted options to purchase 30,000 ordinary shares of the Company, NIS

0.01 par value per share, to two of its consultants. The options have an exercise price ranging between $4.75 and $4.87 per share,

have a 10 year term and vest over a period of between one to four years. The aggregate grant date fair value of such options is

approximately $99 thousand.

|

|

|

3.

|

In July 2017, the Company granted options to purchase 44,000 ordinary shares of the Company, NIS

0.01 par value per share, to employees and consultants. The options are exercisable at $6.57 per share, have a 10 year term and

vest over a period of four years. The aggregate grant date fair value of such options is approximately $244 thousand.

|

|

|

4.

|

In August 2017, the Company sold in a registered direct offering 332,038 ordinary shares of the Company, NIS 0.01 par

value per share, at a price of $7.10. In a concurrent private placement, which closed in August and September 2017, the

Company sold to two of the Company’s directors 49,295 ordinary shares, NIS 0.01 par value per share, at the same price.

The aggregate gross proceeds received from the above mentioned offerings is approximately $2.7 million.

|

|

|

5

.

|

During

the nine months ended September 30, 2017, certain officers, employees and former employees exercised options into 177,022 ordinary

shares of the Company, NIS 0.01 par value per share, for total consideration of $313 thousand.

|

|

|

6.

|

During the nine months ended September 30, 2017, restricted stock units held by certain officers, employees and former employees

vested resulting in the issuance of 25,931 ordinary shares of the Company, NIS 0.01 par value per share.

|

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

All references

to “we,” “us,” “our,” “the Company” and “our Company”, in this Form

6-K are to Galmed Pharmaceuticals Ltd. and its subsidiaries, unless the context otherwise requires. All references to “shares”

or “ordinary shares” are to our ordinary shares, NIS 0.01 nominal par value per share. All references to “Israel”

are to the State of Israel. “U.S. GAAP” means the generally accepted accounting principles of the United States. Unless

otherwise stated, all of our financial information presented in this Form 6-K has been prepared in accordance with U.S. GAAP. Any

discrepancies in any table between totals and sums of the amounts and percentages listed are due to rounding. Unless otherwise

indicated, or the context otherwise requires, references in this Form 6-K to financial and operational data for a particular year

refer to the fiscal year of our company ended December 31 of that year.

Our reporting currency

and financial currency is the U.S. dollar. In this Form 6-K, “NIS” means New Israeli Shekel, and “$,” “US$”

and “U.S. dollars” mean United States dollars.

Cautionary Note Regarding Forward-Looking

Statements

This Form 6-K contains

forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product development

efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our

representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified

by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,”

“may,” “should,” “anticipate,” “could,” “might,” “seek,”

“target,” “will,” “project,” “forecast,” “continue” or their negatives

or variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical

matters. These forward-looking statements may be included in, among other things, various filings made by us with the SEC, press

releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements

relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements

relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause

our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors

could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking

statements, including, but not limited to, the factors summarized below:

|

|

·

|

the timing and cost of our ongoing Phase IIb ARREST Study, and planned Phase III trials, for our

product candidate, Aramchol

TM

(hereinafter referred to as “Aramchol”) for the treatment of patients who

are overweight or obese and have pre diabetes or type II diabetes mellitus (hereinafter OD patients) with Non-Alcoholic Steato-Hepatitis,

or NASH, or whether Phase III trials will be conducted at all;

|

|

|

·

|

completion and receiving favorable results of these Phase IIB ARREST Study and Phase III trials

for Aramchol;

|

|

|

·

|

regulatory action with respect to Aramchol by the U.S. Food and Drug Administration, or FDA, or

the European Medicines Authority, or EMA, including but not limited to acceptance of an application for marketing authorization,

review and approval of such application, and, if approved, the scope of the approved indication and labeling;

|

|

|

·

|

the commercial launch and future sales of Aramchol or any other future products or product candidates;

|

|

|

·

|

our ability to comply with all applicable post-market regulatory requirements for Aramchol in the

countries in which we seek to market the product;

|

|

|

·

|

our ability to achieve favorable pricing for Aramchol;

|

|

|

·

|

our expectations regarding the commercial market for NASH in OD patients;

|

|

|

·

|

third-party payor reimbursement for Aramchol;

|

|

|

·

|

our estimates regarding anticipated capital requirements and our needs for additional financing;

|

|

|

·

|

market adoption of Aramchol by physicians and patients;

|

|

|

·

|

the timing, cost or other aspects of the commercial launch of Aramchol;

|

|

|

·

|

the development and approval of the use of Aramchol for additional indications or in combination

therapy; and

|

|

|

·

|

our expectations regarding licensing, acquisitions and strategic operations.

|

We believe these forward-looking

statements are reasonable; however, these statements are only current predictions and are subject to known and unknown risks, uncertainties

and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to

be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in our Annual

Report on Form 20-F for the year ended December 31, 2016 filed with the SEC on March 23, 2017 in greater detail under the heading

“Risk Factors” and elsewhere in the Annual Report and this Form 6-K. Given these uncertainties, you should not rely

upon forward-looking statements as predictions of future events.

All forward-looking

statements attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified in their

entirety by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking

statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

In evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

We are a clinical-stage

biopharmaceutical company focused on the development of Aramchol, a first in class, novel, once-daily, oral therapy for the treatment

of NASH for variable populations, as well as other liver associated disorders. We are currently conducting the ARREST Study, a

multicenter, randomized, double blind, placebo-controlled Phase IIb clinical study designed to evaluate the efficacy and safety

of Aramchol in 248 subjects with NASH, who are overweight or obese, and who are pre-diabetic or type-II-diabetic. Top line data

from the ARREST Study are expected to be available during the second quarter of 2018.

We also sponsor the

ARRIVE Study, a proof-of-concept Phase IIa clinical trial designed to evaluate the safety and efficacy of Aramchol in 50

patients with HIV-associated NAFLD (Non-Alcoholic Fatty Liver Disease) and lipodystrophy. The ARRIVE Study is an investigator-initiated

trial, conducted at the University of California San Diego by Professor Rohit Loomba. Top line data from the ARRIVE Study are expected

to be available during the first quarter of 2018. More information about the ARREST Study and the ARRIVE Study may be found on

ClinicalTrials.gov identifiers: NCT02279524 and NCT02684591, respectively.

Aramchol (arachidyl

amido cholanoic acid) is a novel fatty acid bile acid conjugate, inducing beneficial modulation of intra-hepatic lipid metabolism.

Aramchol’s ability to modulate hepatic lipid metabolism was discovered and validated in animal models, demonstrating down

regulation of the three key pathologies of NASH: steatosis, inflammation and fibrosis. The effect of Aramchol on fibrosis is mediated

by down regulation of steatosis and directly on human collagen producing cells. Aramchol has been granted by the FDA Fast Track

designation status for the treatment of NASH.

Financial Overview

We have funded our

operations primarily through the sale of equity and debt securities (our debt securities have since been converted in whole into

common equity; no debt remains on our balance sheet). At September 30, 2017, we had current assets of $9.1 million, which consists

of cash and cash equivalents of $2.6 million and short-term investment securities of $6.3 million. This compares with current assets

of $15.7 million at December 31, 2016, which consists of cash and cash equivalents of $3.1 million and short-term investment securities

of $12.4 million. During October 2017, we raised $1.1 million in net proceeds under our “at-the-market” equity offering

program (the “ATM Offering”). Although we provide no assurance, we believe that such existing funds will be sufficient

to continue our business and operations as currently conducted through 2018. However, we will continue to incur operating losses,

which may be substantial over the next several years, and we may need to obtain additional funds to further develop our research

and development programs.

Recent Developments

During the third quarter

of 2017, we announced the following developments:

|

|

·

|

In August 2017, we sold in a registered direct offering to existing investors 332,038 ordinary

shares at a price of $7.10 per share. In a concurrent private placement that closed in August and September 2017, we sold to our

Chairman of the Board and an additional board member 49,295 ordinary shares at the same price as the price per share in the registered

direct offering. The aggregate gross proceeds received from these offerings was approximately $2.7 million.

|

Since the end of the

third quarter of 2017 (subsequent to the balance sheet date), we had the following developments:

|

|

·

|

In October 2017, we announced the publication of a paper entitled “Role of Aramchol™

in steatohepatitis and fibrosis in mice” in Hepatology Communications, a peer-reviewed, online open access journal.

|

|

|

·

|

Dr. Tali Gorfine, our CMO, who was previously on medical leave, has returned to work.

|

|

|

·

|

As of the beginning of November, 2017, all patients have been randomized in the ARRIVE

study. ARRIVE

is a

proof-of-concept clinical trial that is evaluating the safety and efficacy of Aramchol in 50 patients with

HIV-associated lipodystrophy and NAFLD. ARRIVE is a randomized, double-blinded, placebo-controlled, proof-of-concept Phase

IIa clinical trial, comparing Aramchol at 600 mg versus placebo over 12 weeks. It is an investigator-initiated study

being conducted by Professor Rohit Loomba at the NAFLD Research Center, at the University of California San Diego. The

primary end point is improvement in hepatic steatosis as measured by MRI. Secondary endpoints measure improvements in total

body fat, metabolic profile, and liver biochemistry. Release of topline data is expected in the first quarter of 2018.

|

Revenues

On July 28, 2016, we

entered into a license agreement, referred to herein as the Samil Agreement, with Samil Pharma. Co., Ltd. for the commercialization

of Aramchol (with the option to manufacture) in the Republic of Korea. Under the terms of the Samil Agreement, we have received

upfront payments of $2.1 million, and may be eligible to receive up to $6.0 million in additional payments for development and

regulatory milestones for Aramchol in the licensed territories. For accounting purposes, the upfront payment has been recorded

as deferred revenue. The deferred revenue is then amortized on a straight-line basis over the contractual period and milestone

payments are recognized once earned.

Costs and Operating Expenses

Our current costs

and operating expenses consist of two components: (i) research and development expenses; and (ii) general and administrative expenses.

Research and Development Expenses

Our research and development

expenses consist primarily of outsourced development expenses, salaries and related personnel expenses and fees paid to external

service providers, patent-related legal fees, costs of preclinical studies and clinical trials and drug and laboratory supplies.

We charge all research and development expenses to operations as they are incurred. We expect our research and development expenses

to remain our primary expenses in the near future as we continue to conduct clinical activities, as well as develop our products.

Increases or decreases in research and development expenditures are attributable to the number or duration of the preclinical and

clinical studies that we conduct.

We expect that a large

percentage of our research and development expense in the future will be incurred in support of our current and future clinical

and, to a lesser extent, preclinical development projects. Due to the inherently unpredictable nature of clinical and preclinical

development processes, we are unable to estimate with any certainty the costs we will incur in the continued development of Aramchol

for NASH and other indications in our pipeline for potential commercialization. Clinical development timelines, the probability

of success for any given study, and development costs can differ materially from expectations. We expect to continue to conduct

additional clinical trials for Aramchol, and to test Aramchol in preclinical studies for toxicology, safety and efficacy.

While we are currently

focused on advancing our product development, our future research and development expenses will depend on the clinical success

of Aramchol, as well as ongoing assessments of Aramchol’s commercial potential. As we obtain results from clinical trials,

we may elect to discontinue or delay clinical trials for Aramchol in certain indications in order to focus our resources on more

promising indications for Aramchol. Completion of clinical trials may take several years or more, but the length of time generally

varies according to the type, complexity, novelty and intended use of Aramchol.

We expect our research

and development expenses to increase in the future from current levels as we continue the advancement of our clinical product development

and potentially in-license new product candidates. The lengthy process of completing clinical trials and seeking regulatory approval

for Aramchol requires the expenditure of substantial resources. Any failure or delay in completing clinical trials, or in obtaining

regulatory approvals, could cause a delay in generating product revenue and cause our research and development expenses to increase

and, in turn, have a material adverse effect on our operations. Because of the factors set forth above, we are not able to estimate

with any certainty when we would recognize any net cash inflows from our projects.

General and Administrative Expenses

General and administrative

expenses consist primarily of compensation for employees in executive and operational roles, including accounting, finance, legal

and investor relations. Our other significant general and administrative expenses include non-cash stock-based compensation costs

and facilities costs (including the rental expense for our offices in Tel Aviv, Israel), professional fees for outside accounting

and legal services, travel costs, investors relations, insurance premiums and depreciation.

We expect our general

and administrative expenses, such as accounting and legal fees, to increase as we grow and operate as a public company, and we

expect an increase in our salary and benefits expense as a result of the additional management and operational personnel that we

hired since our initial public offering to address the anticipated growth of our company, as well as performance-based salary increases

and bonuses, if at all.

Financial Income, Net

Our financial income

consists of interest income from marketable securities and short-term bank deposits. Our financial expense consists of bank fees.

Results of Operations

The table below provides

our results of operations for the three and nine months ended September 30, 2017 as compared to the three and nine months ended

September 30, 2016.

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

|

(In thousands, except per share data)

|

|

|

|

|

|

|

|

Revenue

|

|

|

273

|

|

|

|

193

|

|

|

|

811

|

|

|

|

193

|

|

|

Research and development expenses

|

|

|

2,331

|

|

|

|

3,342

|

|

|

|

7,421

|

|

|

|

10,086

|

|

|

General and administrative expenses

|

|

|

697

|

|

|

|

656

|

|

|

|

2,110

|

|

|

|

2,236

|

|

|

Total operating expenses

|

|

|

2,755

|

|

|

|

3,805

|

|

|

|

8,720

|

|

|

|

12,129

|

|

|

Financial expenses (income), net

|

|

|

46

|

|

|

|

(78

|

)

|

|

|

(65

|

)

|

|

|

(108

|

)

|

|

Taxes on income

|

|

|

-

|

|

|

|

105

|

|

|

|

-

|

|

|

|

106

|

|

|

Net loss

|

|

|

2,801

|

|

|

|

3,832

|

|

|

|

8,655

|

|

|

|

12,127

|

|

|

Other comprehensive (income) loss:

|

|

|

(12

|

)

|

|

|

31

|

|

|

|

(77

|

)

|

|

|

(71

|

)

|

|

Comprehensive loss

|

|

|

2,789

|

|

|

|

3,863

|

|

|

|

8,578

|

|

|

|

12,056

|

|

|

Basic and diluted net loss per share

|

|

$

|

0.23

|

|

|

$

|

0.34

|

|

|

$

|

0.71

|

|

|

$

|

1.09

|

|

Revenue

Licensing revenue

was approximately $273 thousand and approximately $811 thousand for the three and nine months ended September 30, 2017, respectively,

compared to $193 thousand for the three and nine months ended September 30, 2016. The above mentioned revenue resulted from the

amortization of the up-front payments under the license agreement with Samil Pharm.

Research and

Development Expenses

Our research and development

expenses amounted to approximately $2.3 million and approximately $7.4 million during the three and nine months ended September

30, 2017, respectively, representing a decrease of approximately $1.0 million, or 30%, and approximately $2.7 million, or 26%,

respectively, compared to approximately $3.3 million and approximately $10.1 million for the comparable period in 2016.

The decrease during

the three months ended September 30, 2017 primarily resulted from a decrease of approximately $1.0 million in subcontractor expenses

in connection with the ARREST study, as compared to such expenses for the comparable period in 2016.

The decrease during

the nine months ended September 30, 2017 primarily resulted from a decrease of approximately $1.4 million in subcontractor expenses

in connection with the ARREST study, as well as decrease of approximately $828 thousand in drug development related expenses, as

compared to such expenses for the comparable period in 2016.

General and

Administrative Expenses

Our general and administrative

expenses amounted to approximately $697 thousand and approximately $2.1 million during the three and nine months ended September

30, 2017, respectively, representing an increase of approximately $41 thousand, or 6%, and a decrease of $126 thousand, or 6%,

respectively, compared to approximately $656 thousand and approximately $2.2 million for the comparable period in 2016.

The increase during

the three months ended September 30, 2017 primarily resulted from an increase of approximately $34 thousand in professional fees,

as compared to such expenses for the comparable period in 2016.

The decrease during

the nine months ended September 30, 2017 primarily resulted from a decrease of approximately $97 thousand in professional fees,

as well as a decrease of $67 thousand in salaries and benefits expenses, as compared to such expenses for the comparable period

in 2016.

Operating Loss

As a result of the

foregoing, for the three and nine months ended September 30, 2017, our operating loss was approximately $2.8 million and approximately

$8.7 million, respectively, representing a decrease of $1.0 million, or 26%, and $3.4 million, or 28%, respectively, as compared

to our operating loss for the comparable prior year period. These decreases for the three and nine months ended September 30, 2017

primarily resulted from a decrease in our research and development expenses as well as from our licensing revenue.

Financial (Income)

Expense, Net

Our financial (income)

expense amounted to approximately $46 thousand and approximately ($65) thousand during the three and nine months ended September

30, 2017, respectively, compared to ($78) thousand and ($108) thousand for the comparable period in 2016.

The decrease during

the three months ended September 30, 2017 primarily resulted from an increase in currency exchange rates expenses, as compared

to such expenses for the comparable period in 2016.

The decrease during

the nine months ended September 30, 2017 primarily resulted from a decrease in financial income from marketable securities, as

compared to such expenses for the comparable period in 2016.

Net Loss

As a result of the

foregoing, for the three and nine months ended September 30, 2017, our net loss was $2.8 million and $8.7 million, respectively,

representing a decrease of $1.0 million, or 26%, and $3.4 million, or 28%, respectively, as compared to our net loss for the comparable

prior year period.

Liquidity and Capital Resources

To date, we have funded

our operations primarily through the sale of equity and debt securities (our debt securities have since been converted in whole

into common equity; no debt remains on our balance sheet) including since March 18, 2014, the sale of our ordinary shares in our

initial public offering (approximately $39.9 million of net proceeds), in our ATM Offering (approximately $5.6 million of net proceeds),

in an RDO and concurrent private placement (approximately $2.7 million of net proceeds), and in the upfront payment received from

Samil (approximately $2.1 million). Furthermore, under the ATM Offering, we may still raise up to approximately $10.1 million through

the sale of additional ordinary shares.

We have incurred substantial

losses since our inception. As of September 30, 2017, we had an accumulated deficit of approximately $73.0 million and positive

working capital (current assets less current liabilities) of approximately $6.1 million. We expect that operating losses will continue

for the foreseeable future.

As of September 30,

2017, we had cash and cash equivalents of approximately $2.6 million and marketable securities of approximately $6.3 million invested

in accordance with our investment policy, totaling approximately $9.0 million, as compared to approximately $3.1 million and approximately

$12.4 million as of December 31, 2016, totaling approximately $15.5 million. The decrease is mainly attributable to our net loss

of $8.7 million during the nine months ended September 30, 2017, partially offset by net proceeds of approximately $2.7 million

raised through our RDO and concurrent private placement.

We had negative cash

flow from operating activities of approximately $9.6 million for the nine months ended September 30, 2017, as compared to negative

cash flow from operating activities of approximately $9.3 million for the nine months ended September 30, 2016. The negative cash

flow from operating activities for the nine months ended September 30, 2017 is mainly attributable to our net loss of approximately

$8.7 million, and as well, a decrease of approximately $2.1 million of trade payables, other accounts payables and upfront fee

from license agreement; partially offset by non-cash stock based compensation expenses of approximately $1.1 million.

We had positive cash

flow from investing activities of approximately $6.1 million for the nine months ended September 30, 2017, as compared to positive

cash flow from investing activities of approximately $7.5 million for the nine months ended September 30, 2016. The positive cash

flow from investing activities for both periods was primarily due to the net consideration of marketable securities.

We had positive cash

flow from financing activities of approximately $3.0 million for the nine months ended September 30, 2017, as compared to positive

cash flow from financing activities of approximately $4.7 million thousand for the nine months ended September 30, 2016. The positive

cash flow from financing activities for both periods was due to the proceeds from the issuance of share offerings, net of issuance

costs; as well as proceeds from exercise of options.

Although there can

be no assurance, we believe that our existing cash resources will be sufficient to fund our projected cash requirements through

2018. Nevertheless, we will require significant additional financing in the future to fund our operations if and when we progress

into Phase III trials of Aramchol and clinical trials for other indications, obtain regulatory approval of Aramchol and commercialize

the drug. Our management may choose to raise such additional capital, which would be authorized by our board of directors, at their

discretion.

Trend Information

We are a development

stage company, and it is not possible for us to predict with any degree of accuracy the outcome of our research, development or

commercialization efforts. As such, it is not possible for us to predict with any degree of accuracy any significant trends, uncertainties,

demands, commitments or events that are reasonably likely to have a material effect on our net sales or revenues, income from continuing

operations, profitability, liquidity or capital resources, or that would cause financial information to not necessarily be indicative

of future operating results or financial condition. However, to the extent possible, certain trends, uncertainties, demands, commitments

and events are in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Controls and Procedures

As a “foreign

private issuer”, we are only required to conduct the evaluations required by Rules 13a-15(b) and 13a-15(d) of the Exchange

Act as of the end of each fiscal year and therefore have elected not to provide disclosure regarding such evaluations at this time.

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release, dated November

9, 2017

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Galmed Pharmaceuticals Ltd.

|

|

|

|

|

|

Date: November 9, 2017

|

By:

|

/s/ Allen Baharaff

|

|

|

|

Allen Baharaff

|

|

|

|

President and Chief Executive Officer

|

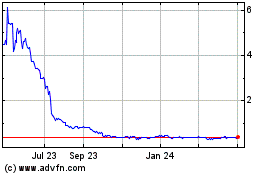

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

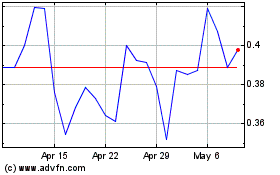

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024