Quidel Corporation (NASDAQ: QDEL), a provider of rapid

diagnostic testing solutions, cellular-based virology assays and

molecular diagnostic systems, announced today financial results for

the third quarter ended September 30, 2017.

Third Quarter 2017 Financial Highlights

- Total revenue was $50.9 million as

compared to $49.3 million in the third quarter of 2016.

- Total Immunoassay product revenue

increased 19% from the third quarter of 2016.

- Total Molecular revenues increased 13%

from the third quarter of 2016.

- Reported GAAP EPS of $(0.16) per

share in the third quarter of 2017, as compared to $(0.02) per

share in the third quarter of 2016 and reported non-GAAP EPS

of $0.17 per diluted share in the third quarter of 2017, as

compared to $0.10 per diluted share in the third quarter of

2016.

Recent Operational Highlights

- Announced definitive agreements to

acquire Alere Triage® and B-type Naturietic Peptide (BNP) Assay

business run on Beckman Coulter Analyzers, which subsequently

closed on October 6, 2017.

- Received FDA Clearance for Its Solana®

RSV + hMPV Assay.

- Received FDA Clearance for Its

Point-of-Care Sofia® Lyme FIA.

Third Quarter 2017 Results

Total revenue for the third quarter of 2017 increased 3% over

the third quarter of 2016 to $50.9 million. Excluding the Gates

Grant Revenue, revenues increased by 12%. The increase excluding

the Gates Grant Revenue was due to higher Immunoassay product sales

that were partially offset by decreases in Virology and Specialty

Products.

Immunoassay product revenue increased 19% in the third quarter,

as Sofia revenue increased 39% to $19.6 million, while QuickVue

product revenue decreased 6% to $15.6 million. The InflammaDry® and

AdenoPlus® diagnostic businesses acquired from RPS contributed $1.3

million to this category in the quarter. During the third quarter

of 2017, Molecular revenue increased 13% to $2.8 million and

Specialty Products decreased 6% to $2.6 million. The Virology

category declined by 6%.

“Quidel has transformed itself with the completion of the

acquisition of the Alere Triage and B-type Naturietic Peptide (BNP)

Assay businesses, which we closed in early October. This

transaction broadens our business by unlocking growth opportunities

in several new end markets, both geographically and by product. We

are well underway in our efforts to bring together these two strong

organizations and look forward to providing updates as we move

through the process,” said Douglas Bryant, president and CEO of

Quidel Corporation. “For our legacy Quidel business, we had a

strong quarter, with revenues increasing 12% from the third quarter

of last year, excluding the Gates Grant revenue, supported by

continued growth in Immunoassay and Molecular product revenues. In

addition, we further advanced our rapid testing solutions with the

receipt of regulatory clearance for our Solana® and Sofia® products

to test for RSV and hMPV, the leading cause of viral respiratory

infections in both the young and elderly, and antibodies to

microorganisms associated with Lyme disease, respectively. The

future is bright for Quidel as we embark on a new chapter in our

business, which we believe will drive sustained, long-term growth

and shareholder value.”

Cost of Sales in the third quarter of 2017 increased $1.7

million to $19.4 million, driven by higher revenues, increased

manufacturing costs related to the acquisition of the RPS assets

and higher depreciation expense related to the increased number of

Sofia and Solana instrument placements. Gross margin for the

quarter was 62% as compared to 64% for the same period last year

driven by the increased manufacturing costs associated with RPS and

the decrease in grant revenues. Research and Development expense

decreased by $1.3 million in the third quarter as compared to the

same period last year, primarily due to reduced spend for Savanna.

Sales and Marketing expense increased by $1.0 million in the third

quarter of 2017, as compared to the third quarter of 2016 largely

due to the increased personnel and consulting costs associated with

the InflammaDry and AdenoPlus diagnostic businesses acquired during

the second quarter of 2017. General and Administrative expense in

the third quarter of 2017 was in line with the third quarter of

2016. In the third quarter of 2017, we recorded $4.6 million in due

diligence and integration costs related to the acquisition of the

Alere Triage and BNP assets.

Net loss for the third quarter of 2017 was $5.5 million, or

$(0.16) per share, as compared to net loss of $0.6 million, or

$(0.02) per share, for the third quarter of 2016. On a non-GAAP

basis, excluding amortization of intangibles, stock compensation

expense and certain non-recurring items, net income for the third

quarter of 2017 was $5.9 million, or $0.17 per diluted share, as

compared to net income of $3.2 million, or $0.10 per diluted share,

for the same period in 2016.

Results for the Nine Months Ended September 30, 2017

Total revenues increased 17% to $162.9

million for the nine-month period ended

September 30, 2017, as compared to $138.8

million for the same period in 2016. The increase in

revenues was primarily driven by greater sales of Immunoassay and

Molecular products that were partially offset by decreases in

Virology and Grant revenue.

Immunoassay product revenue increased 37% in the nine-month

period ended September 30, 2017, as Sofia revenue increased

58% to $52.7 million and QuickVue product revenue increased 20% to

$61.8 million. During the nine-month period ended

September 30, 2017, Molecular revenue increased 34% to $9.1

million and Specialty Products remained consistent with prior year

at $8.2 million. The Virology category declined 7% while the

Royalties, grant and other revenue category decreased by $7.1

million, as the Gates grant revenue recognized in the nine-month

period ended June 30, 2016 was not repeated in 2017.

For the nine-month period ended September 30, 2017,

total costs and expenses were $157.2 million as compared

to $149.1 million over the same period in 2016. Cost

of Sales increased by $6.4 million from the first nine months of

2016 driven by increased revenues in the current period, partially

offset by favorable product mix, with higher Influenza and

molecular product sales in the same period as compared to the prior

year. Research and Development expense decreased by $8.2 million

primarily driven by a decrease in development spending for the

Savanna MDx platform and lower spend on clinical trial activities.

Sales and Marketing expense increased by $2.4

million, due primarily to the personnel and consulting costs

associated with the acquired InflammaDry and AdenoPlus diagnostic

businesses as well as higher incentive and stock-based

compensation. General and Administrative expenses in the first

nine months of 2017 were roughly equivalent to the first nine

months of 2016. For the first nine months of 2017, we recorded $7.0

million in due diligence and integration costs related to the

acquisition of the RPS and Alere Triage and BNP assets.

For the first nine-months of 2017, net loss

was $3.1 million, or $(0.09) per share, as compared

to a net loss of $11.9 million, or $(0.36) per

share, for the same nine-month period in 2016. On a

non-GAAP basis, excluding amortization of intangibles, stock

compensation expense and certain non-recurring items, net income

for the nine months ended September 30,

2017 was $17.2 million, or $0.50 per diluted

share, as compared to net income of $0.4 million,

or $0.01 per diluted share, for the

first nine months of 2016.

Non-GAAP Financial Information

The Company is providing non-GAAP financial information to

exclude the effect of stock-based compensation, amortization of

intangibles and certain non-recurring items on income (loss) and

net earnings (loss) per share as a supplement to its consolidated

financial statements, which are presented in accordance with

generally accepted accounting principles in the U.S., or GAAP.

Management is providing the adjusted net income (loss) and

adjusted net earnings (loss) per share information for the periods

presented because it believes this enhances the comparison of the

Company’s financial performance from period-to-period, and to that

of its competitors. This press release is not meant to be

considered in isolation, or as a substitute for results prepared in

accordance with GAAP. A reconciliation of the non-GAAP financial

measures to the comparable GAAP measures is included in this press

release as part of the attached financial tables.

Conference Call Information

Quidel management will host a conference call to discuss the

third quarter 2017 results as well as other business matters today

beginning at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time).

During the conference call, management may answer questions

concerning business and financial developments and trends. Quidel’s

responses to these questions, as well as other matters discussed

during the conference call, may contain or constitute material

information that has not been previously disclosed.

To participate in the live call by telephone from the U.S., dial

877-930-5791, or from outside the U.S. dial 253-336-7286, and enter

the pass code 1067380.

A live webcast of the call can be accessed on the Investor

Relations section of the Quidel website (http://ir.quidel.com). The website replay will be

available for 14 days. The telephone replay will be available for

48 hours beginning at 8:00 p.m. Eastern Time (5:00 p.m. Pacific

Time) today by dialing 855-859-2056 from the U.S., or by dialing

404-537-3406 for international callers, and entering pass code

1067380.

About Quidel Corporation

Quidel Corporation serves to enhance the health and

well-being of people around the globe through the development of

diagnostic solutions that can lead to improved patient outcomes and

provide economic benefits to the healthcare system. Marketed under

the Sofia®, QuickVue®, D3® Direct Detection, Thyretain®, Triage®

and InflammaDry® leading brand names, as well as under the new

Solana®, AmpliVue® and Lyra® molecular diagnostic brands, Quidel’s

products aid in the detection and diagnosis of many critical

diseases and conditions, including, among others, influenza,

respiratory syncytial virus, Strep A, herpes, pregnancy, thyroid

disease and fecal occult blood. Quidel's recently

acquired Triage® system of tests comprises a comprehensive test

menu that provides rapid, cost-effective treatment decisions at the

point-of-care (POC), offering a diverse immunoassay menu in a

variety of tests to provide you with diagnostic answers for

quantitative BNP, CK-MB, d-dimer, myoglobin, troponin I and

qualitative TOX Drug Screen. Quidel’s research and development

engine is also developing a continuum of diagnostic solutions from

advanced immunoassay to molecular diagnostic tests to further

improve the quality of healthcare in physicians’ offices and

hospital and reference laboratories. For more information about

Quidel’s comprehensive product portfolio, visit quidel.com.

This press release contains forward-looking statements within

the meaning of the federal securities laws that involve material

risks, assumptions and uncertainties. Many possible events or

factors could affect our future financial results and performance,

such that our actual results and performance may differ materially

from those that may be described or implied in the forward-looking

statements. As such, no forward-looking statement can be

guaranteed. Differences in actual results and performance may arise

as a result of a number of factors including, without limitation,

fluctuations in our operating results resulting from seasonality,

the timing of the onset, length and severity of cold and flu

seasons, government and media attention focused on influenza and

the related potential impact on humans from novel influenza

viruses, adverse changes in competitive conditions in domestic and

international markets, changes in sales levels as it relates to the

absorption of our fixed costs, lower than anticipated market

penetration of our products, the reimbursement system currently in

place and future changes to that system, changes in economic

conditions in our domestic and international markets, the quantity

of our product in our distributors’ inventory or distribution

channels, changes in the buying patterns of our distributors, and

changes in the healthcare market and consolidation of our customer

base; our development and protection of intellectual property; our

development of new technologies, products and markets; our reliance

on a limited number of key distributors; our reliance on sales of

our influenza diagnostics tests; our ability to manage our growth

strategy; our ability to integrate companies or technologies we

have acquired or may acquire, including integration and transition

risks, the ability to achieve anticipated financial results and

synergies, and effects of disruptions or threatened disruptions to

our relationships, or those of the acquired businesses, with

distributors, suppliers, customers and employees; intellectual

property risks, including but not limited to, infringement

litigation; our debt service requirements; our inability to settle

conversions of our Convertible Senior Notes in cash; the effect on

our operating results from the trigger of the conditional

conversion feature of our Convertible Senior Notes; the possibility

that we may incur additional indebtedness; our need for additional

funds to finance our operating needs; volatility and disruption in

the global capital and credit markets; acceptance of our products

among physicians and other healthcare providers; competition with

other providers of diagnostic products; adverse actions or delays

in new product reviews or related to currently-marketed products by

the FDA or any loss of previously received regulatory

approvals or clearances; changes in government policies; compliance

with other government regulations, such as safe working conditions,

manufacturing practices, environmental protection, fire hazard and

disposal of hazardous substances; third-party reimbursement

policies; our ability to meet demand for our products;

interruptions in our supply of raw materials; product defects;

business risks not covered by insurance and exposure to other

litigation claims; interruption to our computer systems;

competition for and loss of management and key personnel;

international risks, including but not limited to, compliance with

product registration requirements, exposure to currency exchange

fluctuations and foreign currency exchange risk sharing

arrangements, longer payment cycles, lower selling prices and

greater difficulty in collecting accounts receivable, reduced

protection of intellectual property rights, political and economic

instability, taxes, and diversion of lower priced international

products into U.S. markets; dilution resulting from future sales of

our equity; volatility in our stock price; provisions in our

charter documents, Delaware law and our Convertible

Senior Notes that might delay or impede stockholder actions with

respect to business combinations or similar transactions; and our

intention of not paying dividends. Forward-looking statements

typically are identified by the use of terms such as “may,” “will,”

“should,” “might,” “expect,” “anticipate,” “estimate,” “plan,”

“intend,” “goal,” “project,” “strategy,” “future,” and similar

words, although some forward-looking statements are expressed

differently. The risks described in reports and registration

statements that we file with the Securities and Exchange

Commission (the “SEC”) from time to time, should be carefully

considered. You are cautioned not to place undue reliance on these

forward-looking statements, which reflect management’s analysis

only as of the date of this press release. Except as required by

law, we undertake no obligation to publicly release the results of

any revision or update of these forward-looking statements, whether

as a result of new information, future events or otherwise.

QUIDEL CORPORATION CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share data;

unaudited)

Three Months Ended September 30, 2017

2016 Total revenues $ 50,894 $ 49,341 Cost of sales

(excludes amortization of intangible assets from acquired

businesses and technology) 19,391 17,728 Research and development

7,468 8,801 Sales and marketing 12,898 11,853 General and

administrative 6,580 6,364 Amortization of intangible assets from

acquired businesses and technology 2,503 2,273 Acquisition and

integration costs 4,591 197 Total costs and expenses

53,431 47,216 Operating (loss) income (2,537 ) 2,125

Interest expense, net (2,784 ) (3,006 ) Loss before income taxes

(5,321 ) (881 ) Provision (benefit) for income taxes 204

(309 ) Net loss $ (5,525 ) $ (572 ) Basic and diluted loss

per share $ (0.16 ) $ (0.02 ) Shares used in basic and diluted per

share calculation 33,913 32,673 Gross profit as a % of total

revenues 62 % 64 % Research and development as a % of total

revenues 15 % 18 % Sales and marketing as a % of total revenues 25

% 24 % General and administrative as a % of total revenues 13 % 13

% Condensed balance sheet data (in thousands):

9/30/2017 12/31/2016 Cash and cash equivalents $

172,994 $ 169,508 Accounts receivable, net 41,575 24,990

Inventories 23,429 26,045 Total assets 413,821 388,250 Long-term

debt 152,354 148,319 Stockholders’ equity 218,884 200,630

Nine Months Ended September 30, 2017

2016 Total revenues $ 162,853 $ 138,795 Cost of sales

(excludes amortization of intangible assets from acquired

businesses and technology) 60,716 54,295 Research and development

22,970 31,164 Sales and marketing 38,813 36,376 General and

administrative 20,483 19,964 Amortization of intangible assets from

acquired businesses and technology 7,184 6,782 Acquisition and

integration costs 7,022 568 Total costs and expenses

157,188 149,149 Operating income (loss) 5,665 (10,354

) Interest expense, net (8,387 ) (8,619 ) Loss before income taxes

(2,722 ) (18,973 ) Provision (benefit) for income taxes 355

(7,115 ) Net loss $ (3,077 ) $ (11,858 ) Basic and diluted

loss per share $ (0.09 ) $ (0.36 ) Shares used in basic and

diluted per share calculation 33,538 32,645 Gross profit as

a % of total revenues 63 % 61 % Research and development as a % of

total revenues 14 % 22 % Sales and marketing as a % of total

revenues 24 % 26 % General and administrative as a % of total

revenues 13 % 14 %

Three Months Ended September 30,

Nine Months Ended September 30,

Consolidated net revenues by

productcategory are as follows (in thousands):

2017 2016 2017 2016 Immunoassays

$ 36,458 $ 30,573 $ 115,974 $ 84,924 Molecular 2,781 2,469 9,148

6,813 Virology 8,830 9,354 28,044 30,055 Specialty products 2,557

2,721 8,212 8,387 Royalties, grants and other 268 4,224

1,475 8,616 Total revenues 50,894

49,341 162,853 138,795

QUIDEL

CORPORATION Reconciliation of Non-GAAP Financial

Information (In thousands, except per share data;

unaudited) Three months ended September

30, Nine months ended September 30, 2017

2016 2017 2016 (unaudited)

(unaudited) Net loss - GAAP $ (5,525 ) $ (572 ) $ (3,077 ) $

(11,858 ) Add: Non-cash stock compensation expense 1,879 1,734

5,938 5,820 Amortization of intangibles 2,720 2,381 7,605 7,132

Amortization of debt discount and issuance costs 1,388 1,343 4,129

4,022 Acquisition and integration costs 4,591 197 7,022 568 Income

tax impact of valuation allowance for deferred tax assets 4,590 137

4,264 852

Income tax impact of non-cash stock

compensation expense, amortization of intangibles, debt discount

and issuance costs and acquisition and integration costs

(3,700 ) (1,980 ) (8,640 ) (6,140 ) Adjusted net income $ 5,943

$ 3,240 $ 17,241 $ 396 Basic earnings

(loss) per share: Adjusted net earnings $ 0.18 $ 0.10 $ 0.51 $ 0.01

Net loss - GAAP $ (0.16 ) $ (0.02 ) $ (0.09 ) $ (0.36 ) Diluted

earnings (loss) per share: Adjusted net earnings $ 0.17 $ 0.10 $

0.50 $ 0.01 Net loss - GAAP $ (0.16 ) $ (0.02 ) $ (0.09 ) $ (0.36 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171101006573/en/

Quidel Contact:Quidel CorporationRandy StewardChief Financial

Officer858.552.7931orMedia and Investors Contact:Quidel

CorporationAngie Mazza312.690.6006amazza@clermontpartners.com

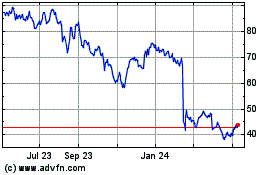

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

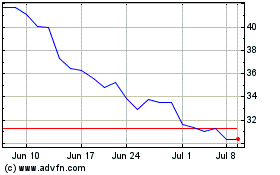

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Apr 2023 to Apr 2024