Amended Statement of Beneficial Ownership (sc 13d/a)

October 05 2017 - 5:04PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

(Rule

13d-101)

Amendment

No. 7

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

WORKHORSE

GROUP INC.

(Name

of Issuer)

COMMON

STOCK, PAR VALUE $.001 PER SHARE

(Title

of Class of Securities)

98138J206

(CUSIP

Number)

C/O

Workhorse Group Inc.

100

Commerce Drive, Loveland, Ohio 45140

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

September

18, 2017

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7(b) for other parties to whom copies are to be sent.

(Continued

on following pages)

(Page

1 of 5 Pages)

|

CUSIP No. 98138J206

|

13D

|

Page 2 of 5 Pages

|

|

1

|

NAME OF REPORTING PERSONS

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

Joseph T. Lukens

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS* OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER

OF SHARES

|

7

|

SOLE

VOTING POWER

8,332,519

(1)

|

|

BENEFICIALLY

OWNED

BY

PERSON

WITH

|

8

|

SHARED

VOTING POWER

0

|

|

|

9

|

SOLE

DISPOSITIVE POWER

8,332,519

(1)

|

|

|

10

|

SHARED

DISPOSITIVE POWER 0

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,332,519

(1)

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.7%

(2)

|

|

14

|

TYPE

OF REPORTING PERSON*

IN

|

(1)

As of the date of the event which requires filing of this Schedule 13D, the Reporting Person beneficially owns 8,332,519 shares

of common stock, which includes (i) 6,970,283 shares of common stock held by the New Era Capital Fund L.P. (“New Era”).

New Era Capital LLC (“NEC”) is the General Partner of New Era. Mr. Lukens is the managing member of NEC; (ii) 154,871

shares of common stock held by The Joe & Kim Lukens Foundation; (iii) 25,000 shares of common stock held by the Joseph T Lukens,

Jr. and Gerald Budde, Co-Trustee of the Joseph T. Lukens, Jr. Irrevocable Trust for Nathan J. Lukens U/T/A Dated 2/23/2016; (iv)

25,000 shares of common stock held by the Joseph T Lukens, Jr. and Gerald Budde, Co-Trustee of the Joseph T. Lukens, Jr. Irrevocable

Trust for Roman E. Lukens U/T/A Dated 2/23/2016; (v) a common stock purchase warrant to acquire 571,429 shares of common stock

at $5.28 per share and (vi) a common stock purchase warrant to acquire 585,936 shares of common stock at $3.80 per share held

by New Era.

(2)

Percentage of class calculated based on an aggregate of 41,126,934 shares issued and outstanding as of September 29, 2017.

Page 3 of 5 Pages

Item

1. Security and Issuer.

This

Schedule 13D relates to the Common Stock, par value $0.001 per share (the “Common Stock”), of Workhorse Group Inc.,

a Nevada Corporation (the “Issuer”). The Issuer’s principal executive offices are located at 100 Commerce Drive,

Loveland, Ohio 45140.

Item

2. Identity and Background.

This

statement is being filed by and on behalf of Joseph T. Lukens (“Reporting Person”).

The

address of the principal office of the Reporting Person is c/o Workhorse Group Inc., 100 Commerce Drive, Loveland, OH 45140.

Reporting

Person is principally involved in the business of consulting.

Reporting

Person is a citizen of the United States.

Reporting

Person is an accredited investor.

During

the last five years, Reporting Person has not (i) been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors) or (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item

3. Source and Amount of Funds or Other Consideration.

US

Trust Company of Delaware Administrative Trustee of the Joe & Kim Lukens Dynasty Trust assigned 2,697,147 shares of common

stock to New Era Capital Fund L.P. (“New Era”) in exchange for 34.504% of New Era. New Era Capital LLC (“NEC”)

is the General Partner of New Era. Mr. Lukens is the managing member of NEC. Jospeh T. Lukens, Jr. assigned 3,491,888 shares of

common stock to New Era in exchange for 44.672% of New Era. New Era acquired 781,248 shares of common stock and warrants to purchase

585,936 shares of common stock for a period of five years at an exercise price of $3.80 per share from the Company on September

18, 2017.

The

Reporting Person acquired beneficial ownership of the securities with his own personal funds.

The

Reporting Person did not acquire beneficial ownership of any securities with borrowed funds.

Page 4 of 5 Pages

Item

4. Purpose of Transaction.

The

Reporting Person has acquired the securities of the Issuer for investment purposes, and such purchases have been made in the Reporting

Person’s ordinary course of business.

Item

5. Interest in Securities of the Issuer.

As

of September 28, 2017, Reporting Person beneficially owned 8,332,519 or 19.7% of Issuer’s common stock.

Except

as described in this Schedule 13D, Reporting Person has not effectuated any other transactions involving the securities in the

last 60 days.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Other

than as described in this Schedule 13D, there are no contracts, arrangements, understandings or relationships (legal or otherwise)

between the Reporting Persons and any other person with respect to any securities of the Issuer.

Item

7. Material to be Filed as Exhibits.

None.

Page 5 of 5 Pages

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and accurate.

|

October

5, 2017

|

By:

|

/s/

Joseph T. Lukens

|

|

|

|

Joseph

T. Lukens

|

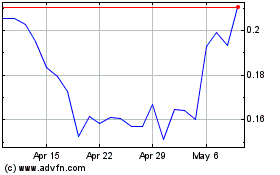

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

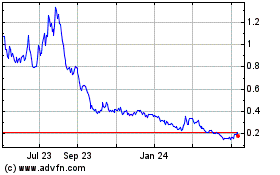

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Apr 2023 to Apr 2024