Press release

Paris, September 29, 2017

Results for the first nine months

(9m 2017, compared with 9m 2016)

Value: €1,166.7 million(+15.0%) including

VAT

Volume: 5,879 housing units (+12.5%)

6.1 months compared with 7.2 months

(on a12-month rolling basis)

(9m 2017 vs 9m 2016)

With Housing Units: €820.8 million (+18.5%)

Gross margin:

€181.8 million compared with €158.3 million over 9 months in

2016

Adjusted EBIT:

€80.6 million compared with €70.9 million over 9 months in

2016

Attributable net

income:

€33.2 million compared with €27.8 million over 9 months in

2016

Net financial

debt:

€35.0 million compared with €85.1 million at the end of

2016

Of which Housing Units:

€1,529.9 million (+19.3% vs. 9 months 2016)

|

Kaufman & Broad SA today announced its results for the first

nine months of the 2017 financial year (fromDecember 1, 2016 to

August 31, 2017).

Nordine Hachemi, Chairman and Chief Executive Officer of Kaufman

& Broad, said:

"The results for the first nine months of 2017

confirm the strong momentum shown in the past four

years.

The value of housing unit orders grew by 15.0% and

volumes by 12.5%. This increase was mainly driven by first-time

buyers (+16.0% by volume). The increases in the land reserve and in

the backlog confirm our strong long-term growth

capacity.

Lastly, Kaufman & Broad has, with SERENIS, a

company specialized in senior managed accomadations and health

infrasructures, created a joint venture to develop residences for

seniors. This initiative reaffirms the Group's commitment to the

booming managed accommodation segment.

During the third quarter, Kaufman & Broad

registered for € 110M in orders in the Commercial Property

Segment.

Our capacity to maintain a significantly smaller

marketing period compared to the market allows us to manage our

working capital requirements and our margins. It results into a

reduction of the net financial debt and a strengthening of

shareholder's equity.

Those different indicators show our capacity to

deliver high quality goods with relevant pricing considering our

customers bargaining power.

As expected, french government have recently

announced the upkeep of current arrangements for purchasing and

rental proprety investment in areas with housing shortage. This

leads us to confirm our perspectives for the year in a stable

market.

Thus, we confirming a growth around 10% for 2017

revenues. Gross margin and adjusted EBIT should remain around 19%

and 8.5% respectively. Net financial debt will continue to decline

relative to 2016 to around €50 million." |

Sales activities

In the first nine months of 2017,

orders for housing amounted to €1,166.7 million (including VAT) in

value terms, up 15.0% on the same period in 2016.

In volume terms, orders for

housing totaled 5,879 units, up 12.5% on the same period in

2016.

The marketing period for projects

was 6.1 months on a rolling 12-month basis, a decrease of 1.1

months compared with the same period in 2016 (7.2 months).

The commercial offer, at 92.2% in

housing shortage areas, amounted to 4,487 units at the end of

August 2017, up 5.3% on the end of 2016.

Breakdown of the customer base

In the first nine months of the

year, orders from first-time buyers accounted for 16% of sales by

volume, and those from second-time buyers 6%. Orders by investors

accounted for 48% of sales (Pinel arrangements alone 35%) and block

sales 29%.

In the first nine months of 2017,

the Commercial Property segment recorded €108.6 million (including

VAT) in orders.

During the summer, Kaufman &

Broad (through its specialist subsidiary Concerto) signed an

off-plan sale (VEFA) and a promissory off-plan sale for two

logistics platforms totaling more than 100,000 sq.m, representing

some €110 million excluding VAT of orders, in line with the €150 to

€200 million target announced last July.

At the end of August 2017, the

Commercial Property backlog totaled €194.7 million (excluding

VAT).

At August 31, 2017, the Housing

backlog amounted to €1,529.9 million (excluding VAT), i.e. 15.4

months of business. Kaufman and Broad had 238 housing programs on

the market at the same date, which represent 4,487 housing units,

compared with 208 programs representing 4,739 housing units at the

end of August 2016.

The Housing property portfolio,

98% of which is in housing shortage areas, amounted to 28,167

units, and was up 17.0% compared with the portfolio at the end of

August 2016. This corresponds to potential revenue of close to 4

years of business, stable relative to November 30, 2016 (4.1 years)

and to August 31, 2016 (4 years).

In the 4th quarter of

2017, the Group is planning to launch 50 new programs, including 15

in the Ile-de-France Region, representing 1,466 units; 34 programs

in the French Regions, representing 2,907 units, and 1 Commercial

Property program.

Total revenues amounted to €947.9

million (excluding VAT), up 13.5% compared with the same period in

2016.

Housing revenues amounted to

€820.8 million (excluding VAT), compared with €692.5 million

(excluding VAT) in 2016. They accounted for 86.6% of the group's

revenues.

Revenues from the Apartments

business were up 20% compared with the first nine months of 2016,

and amounted to €792.6 million (excluding VAT).

Revenues from the Commercial

property segment totaled €122.9 million (excluding VAT), compared

with €137.8 million (excluding VAT) over the same period in

2016.

The other businesses generated

revenues of €4.3 million (excluding VAT).

The gross margin for the first

nine months of 2017 totaled €181.8 million compared with €158.3

million in 2016. The gross margin ratio was 19.2%, or slightly

higher than in the same period of 2016 (19.0%).

Current operating expenses for the

first nine months amounted to €106.4 million (11.2% of revenues),

versus €92.5 million for the same period in 2016 (11.1% of

revenues).

Current operating profit totaled

€75.4 million, compared with €65.8 million in the first nine months

of 2016. The current operating margin was 8.0%, compared with 7.9%

in the first nine months of 2016.

The Group's adjusted EBIT amounted

to €80.6 million in the first nine months of 2017 (versus €70.9

million in the same period 2016). The adjusted EBIT was 8.5%

(stable relative to the same period in 2016).

Attributable net income amounted

to €33.2 million, compared with €27.8 million for the first nine

months of 2016.

Net financial debt amounted to

€35.0 million at August 31, 2017. Cash assets (available cash and

investment securities) amounted to €214.7 million, compared with

€118.1 million at November 30, 2016. Financing capacity totaled

€314.7 million (€218.1 million at November 30, 2016).

Working capital requirement

amounted to €118.9 million (8.8% of revenues on a 12-month rolling

basis), compared with €129.2 million at November 30, 2016 (10.4% of

revenues). The tight control on working capital primarily relies on

the very short marketing period for the Group's programs.

Pursuant to a decision by its

Board of Directors on July 10, Kaufman & Broad launched a

subscription offer for new shares reserved for group employees,

from September 21 to October 1 inclusive, representing a maximum

total of 1.7% of the share capital at August 31, 2017. Subscribed

through the corporate mutual fund (FCPE "KB Actions 2017"), the

shares will be unavailable until July 1, 2022 unless released early

where permitted by applicable regulations.

The main objective is to link

employees more closely to the future of the business by allowing

them to subscribe to shares on preferential terms. Currently

holding close to 12.4% of their company's capital, employees are

now the largest shareholder in Kaufman & Broad. A policy of

strong employee shareholding is a guarantee of independence and

stability for the company, as well as an opportunity for every

employees to benefit from its growth.

The group believes that the

increase in its revenues over the 2017 fiscal year should be in the

order of 10%, despite the wait-and-see attitudes to government land

tax announcements. The gross margin and adjusted EBIT ratios should

remain around 19% and 8.5% respectively. Net financial debt will

continue to decline relative to 2016 to around €50 million.

This release is available on the

www.kaufmanbroad.fr website

Contacts

Chief

Financial Officer

Bruno Coche

+33 (0)1 41 43 44 73

Infos-invest@ketb.com |

Press Relations

Marianne Cruciani

|

Corporate Communication

Emmeline Cacitti |

Burson-Marsteller

+33 (0)1 56 03 12 80

contact.presse@ketb.com |

(+33) 1 41 43 44 17

ECACITTI@ketb.com

|

About Kaufman

& Broad - Kaufman & Broad has been designing,

building and selling single-family homes in communities,

apartments, and offices on behalf of third parties for almost 50

years. Kaufman & Broad is one of the leading French

Property Development & Construction companies due to the

combination of its size and profitability, and the strength of its

brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.17.0286 on March 31, 2017. It

is available on the AMF (www.amf-france.org)

and Kaufman & Broad (www.kaufmanbroad.fr)

websites. It contains a detailed description of Kaufman &

Broad's business activities, results, and prospects, as well as of

the related risk factors. Kaufman & Broad specifically draws

attention to the risk factors set out in Chapter 1.2 of the

Registration Document. The materialization of one or several of

these risks may have a material adverse impact on the Kaufman &

Broad Group's business activities, net assets, financial position,

results, and outlook, as well as on the price of Kaufman &

Broad's shares.

This press

release does not amount to, and cannot be construed as amounting to

a public offering, a sale offer or a subscription offer, or as

intended to seek a purchase or subscription order in any

country.

Backlog: For

off-plan sales (VEFA), it covers housing ordered but not delivered

for which the notarized sale deeds have not yet been signed, and

housing ordered but not delivered for which the notarized sale

deeds have been signed but not yet posted to revenue (for a program

that is 30% completed, 30% of housing revenue for which the

notarized sale deed has been signed is accounted for as sales, 70%

is included in the backlog). The backlog is a summary at any given

time that allows an estimate of the remaining revenue to be

recognized in the months ahead and that serves as a basis the

group's forecasts. It should be noted that a degree of uncertainty

exists when converting backlog into revenue, especially for orders

not yet officially notarized.

Off-plan lease

(BEFA): an off-plan lease involves a customer leasing a

building before it is even built or redeveloped.

Marketing

period: the inventory marketing period is the number of months

required for the available housing units to be sold, if sales

continue at the same rate as for the previous units, or the number

of housing units (available supply) per quarter divided by the

orders for the previous quarter, and divided by three in turn.

Adjusted

EBIT: corresponds to income from current operations restated

for capitalized "IAS 23 revised" borrowing costs, which are

deducted from the gross margin.

EHU: The EHUs

(Equivalent Housing Units) delivered are a direct reflection of

business volumes. The number of EHUs is obtained by multiplying (i)

the number of housing units in a given program for which notarized

sale deeds have been signed by (ii) the ratio between the Group's

property expenses and construction expenses incurred on said

program and the total expense budget for said program.

Gross margin:

Gross margin corresponds to revenues less cost of sales. Cost of

sales consists of the price of land parcels, the related property

costs (taxes, etc.), commissions paid to developers and to Kaufman

& Broad sales staff, as well as fees and commissions provided

for in the agency agreements executed by Kaufman & Broad

in order to sell its real estate programs, construction costs and

borrowing costs that may be directly attributed to program

development.

Commercial

offer: is represented by the total inventory of housing units

available for sale at the relevant date, i.e. all housing units

that have not been ordered on that (minus the sales tranches that

have not been released for marketing).

Property

portfolio: represents all of the land for which any commitment

(contract for sale, etc.) has been signed.

Orders:

measured in volume (Units) and in value terms; orders reflect the

Group's sales activity. Their inclusion in revenues is conditional

on the time required to turn an order into a signed and notarized

deed, which is the triggering event for booking the income. In

addition, in the case of multiple-dwelling programs that include

mixed-use buildings (apartments, business premises, retail space,

and offices), all of the floor space is converted into housing

equivalents.

Land reserve:

This includes land to be developed (otherwise known as the "land

portfolio"), i.e. land for which a deed or contract of sale has

been signed, as well as land still being surveyed or assessed, i.e.

land for which a deed or a contract of sale has not yet been

signed.

Marketing period

ratio: the marketing period ratio represents the percentage of

the initial inventory that is sold on a monthly basis for a

property program (sales per month divided by the initial

inventory), i.e. net monthly orders divided by the ratio between

the opening inventory and the closing inventory, divided by two.

NB: The inverse of the take-up rate (1/Te) gives the projected

duration (in months) of the marketing of a program, i.e. the

take-up period. For example, a 4.0% take-up rate corresponds to a

projected duration of 25 months of marketing.

Units: units

are used to define the number of housing units or equivalent

housing units (for mixed programs) in a given program. The number

of equivalent housing units is calculated as a ratio between the

surface area by type (business premises, retail space, or offices)

and the average surface area of the housing units previously

obtained.

Off-plan sale

(VEFA): anoff-plan sale is an agreement via which the vendor

transfers their rights to the land and their ownership of the

existing buildings to the purchaser immediately. The future

structures will become the purchaser's property as they are

completed: the purchaser is required to pay the price of these

structures as the works progress. The vendor retains Project

Management powers until the works are accepted.

APPENDICES

Key consolidated data*

| € '000s |

Q3 2017 |

9M 2017 |

T3 2016 |

9M 2016 |

|

Revenues |

320,264 |

947,940 |

260,504 |

835,304 |

|

|

285,855 |

820,820 |

240,960 |

692,529 |

|

|

35,850 |

122,866 |

17,527 |

137,766 |

|

|

1,529 |

4,254 |

2017 |

5,009 |

| |

|

|

|

|

| Gross margin |

61,859 |

181,762 |

49,372 |

158,338 |

| Gross

margin (%) |

19.3% |

19.2% |

19.0% |

19.0% |

| Current operating

profit |

26,630 |

75,380 |

20,163 |

65,793 |

| Current operating margin (%) |

8.3% |

8.0% |

7.7% |

7.9% |

| Adjusted EBIT** |

28,498 |

80,597 |

21,465 |

70,902 |

| Adjusted EBIT margin (%) |

8.9% |

8.5% |

8.2% |

8.5% |

| Attributable net

income |

13,048 |

33,200 |

9,609 |

27,756 |

|

Attributable net earnings per share (€/share)*** |

0.63 |

1.59 |

0.46 |

1.33 |

***Based on the number of shares that make up Kaufman &

Broad S.A.'s share capital, i.e. 20,839,037 shares.

Consolidate income statement*

| € '000s |

Q3 2017 |

9M 2017 |

Q3 2016 |

9M 2016 |

| Revenues |

320,264 |

947,940 |

260,504 |

835,304 |

| Cost of sales |

-258,405 |

-766,178 |

-211,132 |

-676,966 |

| Gross

margin |

61,859 |

181,762 |

49,372 |

158,338 |

| Selling expenses |

-9,196 |

-27,082 |

-7,231 |

-23,329 |

| Administrative

expenses |

-15,408 |

-47,949 |

-12,643 |

-40,082 |

| Technical and customer

service expenses |

-4,454 |

-15,044 |

-4,611 |

-14,404 |

| Development and

program expenses |

- 6,171 |

-16,306 |

-4,724 |

-14,730 |

| Current operating profit |

26,630 |

75,380 |

20,163 |

65,793 |

| Other non-recurring

income and expenses |

- |

- |

- |

- |

| Operating income |

26,630 |

75,380 |

20,163 |

65,793 |

| Cost of net financial

debt |

-1,266 |

-3,397 |

-1,016 |

-2,410 |

| Other financial

expenses and income |

- |

- |

- |

- |

| Income tax |

-7,407 |

-20,773 |

-5,529 |

-20,435 |

Share of

income/loss

of equity affiliates and joint ventures |

709 |

507 |

-67 |

-187 |

| Net

income of the consolidated entity |

18,666 |

51,717 |

13,552 |

42,761 |

|

Non-controlling interests |

5,617 |

18,517 |

3,943 |

15,005 |

| Attributable net income |

13,049 |

33,200 |

9,609 |

-

27,756

|

*Unaudited and not approved by the Board of

Directors.

Consolidated balance sheet*

| € '000s |

August 31, 2017 |

30 Nov 2016 |

| ASSETS |

|

|

|

Goodwill |

68,661 |

68,661 |

| Intangible assets |

88,659 |

87,570 |

| Property, plant and

equipment |

8,149 |

7,449 |

| Equity affiliates and

joint ventures |

12,008 |

5,634 |

| Other non-current

financial assets |

1,752 |

2,504 |

| Deferred tax

assets |

2,613 |

- |

| Non-current assets |

181,842 |

171,818 |

| Inventories |

379,918 |

371,381 |

| Accounts

receivable |

317,201 |

375,669 |

| Other receivables |

147,313 |

159,772 |

| Cash and cash

equivalents |

214,745 |

118,108 |

| Prepaid expenses |

1,337 |

1,345 |

| Current assets |

1,060,514 |

1,026,275 |

| TOTAL ASSETS |

1,242,356 |

1,198093 |

| |

|

| LIABILITIES |

|

|

| Share capital |

5,418 |

5,418 |

| Premiums, reserves and

other |

124,983 |

79,119 |

| Attributable net

income |

33,200 |

46,035 |

| Attributable equity capital |

163,601 |

130,571 |

| Non-controlling

interests |

13,905 |

15,196 |

| Equity capital |

177,506 |

145,767 |

| Non-current

provisions |

22,746 |

23,229 |

Borrowings and other

non-current financial liabilities

(portion maturing in > 1 year) |

248,319 |

191,362 |

| Deferred tax

liabilities |

64,037 |

45,471 |

| Non-current

liabilities |

335,102 |

260,062 |

| Current

provisions |

1,441 |

1,499 |

| Other current

financial liabilities (portion maturing in < 1 year) |

1,435 |

11,841 |

| Trade payables |

641,660 |

675,146 |

| Other payables |

84,777 |

97,382 |

| State - current

taxes |

- |

5,858 |

| Deferred

income |

435 |

539 |

| Current liabilities |

729,748 |

792,264 |

| TOTAL LIABILITIES |

1,242,356 |

1,198093 |

*Unaudited and not approved by

the Board of Directors.

| Housing |

Q3 2017 |

9M 2017 |

Q3 2016 |

9M 2016 |

| |

|

|

|

|

| Revenues (€ million,

excl. VAT) |

282.9 |

820.8 |

241.0 |

692.5 |

|

|

272.7 |

792.6 |

229.7 |

660.6 |

|

|

10.2 |

28.2 |

11.3 |

31.9 |

| |

|

|

|

|

| Deliveries (EHUs) |

1,800 |

5,271 |

1,446 |

4,244 |

|

|

1,746 |

5,135 |

1,396 |

4,105 |

|

|

54 |

136 |

50 |

139 |

| |

|

|

|

|

| Net orders (in

number) |

1,779 |

5,879 |

1,711 |

5,228 |

|

|

1,664 |

5,669 |

1,684 |

5,093 |

|

|

115 |

210 |

27 |

135 |

| |

|

|

|

|

| Net orders (€

millions, excl. VAT) |

381.9 |

1,166.7 |

340.9 |

1,014.5 |

|

|

341.2 |

1,105.3 |

333.6 |

979.0 |

|

|

40.7 |

61.3 |

7.3 |

35.4 |

| |

|

|

|

|

| Commercial offer at

end of period (by number) |

4,508 |

4,739 |

| |

|

|

|

|

| Backlog at end of

period |

|

|

|

|

|

|

1,529.9 |

1,282.9

1,245.8

37.1

14.9

24,077 |

|

|

1,459.2 |

|

|

70.7 |

|

|

15.4 |

| |

|

| Land

reserve at end of period (by number) |

28,167 |

| Commercial property |

Q3 2017 |

9M 2017 |

Q3 2016 |

9M 2016 |

| |

|

|

|

|

| Revenues (€ million,

excl. VAT) |

35.8 |

122.9 |

17.5 |

137.8 |

| Net orders (€

millions, excl. VAT) |

108.6 |

108.6 |

29.7 |

251.3 |

| Backlog at

end of period (€ millions, excl. VAT) |

194.7 |

245.0 |

RESULTS FOR THE FIRST NINE MONTHS

2017 Kaufman & Broad

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

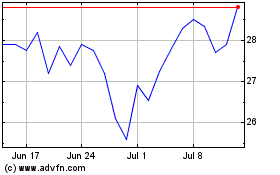

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kaufman and Broad (EU:KOF)

Historical Stock Chart

From Apr 2023 to Apr 2024