Statement of Ownership (sc 13g)

August 28 2017 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13G

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULES 13d-1 (b) (c), AND (d) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(b)

(Amendment No. N/A)

1

FALCONSTOR SOFTWARE, INC.

(Name of issuer)

Common

Stock, par value $0.001

(Title of class of securities)

306137100

(CUSIP number)

08/21/2017

(Date of event which requires filing of this statement)

Check the

appropriate box to designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☒ Rule 13d-1(c)

☐

Rule 13d-1(d)

(Continued on the following pages)

|

1

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13G

|

|

|

|

|

|

|

|

|

1

|

|

NAME

OF REPORTING PERSONS

S.S. OR I.R.S IDENTIFICATION NOS. OF ABOVE PERSONS

ESW CAPITAL, LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP*

(a)

☐

(b)

☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

6,399,361 (1)

|

|

|

6

|

|

SHARED VOTING POWER

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

6,399,361 (1)

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,399,361 (1)

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT

IN ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW 9

14.4% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON*

OO

|

Page 2 of 9

|

|

|

|

|

|

|

|

|

1

|

|

NAME

OF REPORTING PERSONS

S.S. OR I.R.S IDENTIFICATION NOS. OF ABOVE PERSONS

Joseph A. Liemandt

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP*

(a)

☐

(b)

☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

U.S.A.

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

6,399,361 (1)

|

|

|

6

|

|

SHARED VOTING POWER

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

6,399,361 (1)

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,399,361 (1)

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT

IN ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW 9

14.4% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON*

IN/HC

|

|

(1)

|

6,399,361 shares are held directly by ESW Capital, LLC (“ESW”). Joseph A. Liemandt is the sole voting member of ESW, and may be deemed to have beneficial ownership of the shares held by ESW.

|

|

(2)

|

Based upon 44,563,490 shares of common stock of the issuer as of July 31, 2017, as reported in the Issuer’s Form 10-Q filed with the Securities and Exchange Commission on August 11, 2017.

|

Page 3 of 9

FalconStor Software, Inc.

|

|

(b)

|

Address of Issuer’s Principal Executive Offices:

|

2 Huntington Quadrangle, Suite 2501

Melville, NY 11747

|

|

(a)

|

Name of Person Filing:

|

(1) ESW Capital, LLC

(2) Joseph A. Liemandt, who is the sole voting member of ESW

|

|

(b)

|

Address of Principal Business Office or, if None, Residence:

|

(1) ESW Capital, LLC

401 Congress Ave., Suite 2650

Austin, TX 78701

(2) Joseph A.

Liemandt

401 Congress Ave., Suite 2650

Austin, TX 78701

(1) ESW Capital, LLC is a Delaware limited liability company.

(2) Joseph A. Liemandt is a U.S. citizen.

|

|

(d)

|

Title of Class of Securities:

|

Common Stock, par value $0.001 per share

|

|

(e)

|

CUSIP Number: 306137100

|

Page 4 of 9

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 3

|

|

If this statement is filed pursuant to §§

240.13d-1(b)

or

240.13d-2(b)

or (c), check whether the person filing is a:

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

☐

|

|

Broker or dealer registered under section 15 of the Act (15 U.S.C. 78o).

|

|

|

|

|

|

|

|

|

|

|

|

(b)

|

|

☐

|

|

Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c).

|

|

|

|

|

|

|

|

|

|

|

|

(c)

|

|

☐

|

|

Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c).

|

|

|

|

|

|

|

|

|

|

|

|

(d)

|

|

☐

|

|

Investment company registered under section 8 of the Investment Company Act of 1940 (15 U.S.C.

80a-8).

|

|

|

|

|

|

|

|

|

|

|

|

(e)

|

|

☐

|

|

An investment adviser in accordance with

§240.13d-1(b)(1)(ii)(E);

|

|

|

|

|

|

|

|

|

|

|

|

(f)

|

|

☐

|

|

An employee benefit plan or endowment fund in accordance with

§240.13d-1(b)(1)(ii)(F);

|

|

|

|

|

|

|

|

|

|

|

|

(g)

|

|

☐

|

|

A parent holding company or control person in accordance with

§240.13d-1(b)(1)(ii)(G);

|

|

|

|

|

|

|

|

|

|

|

|

(h)

|

|

☐

|

|

A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813);

|

|

|

|

|

|

|

|

|

|

|

|

(i)

|

|

☐

|

|

A church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C.

80a-3);

|

|

|

|

|

|

|

|

|

|

|

|

(j)

|

|

☐

|

|

Group, in accordance with

§240.13d-1(b)(1)(ii)(J).

|

|

|

(a)

|

Amount Beneficially Owned: 6,399,361 shares are held directly by ESW Capital, LLC (“ESW”). Joseph A. Liemandt is the sole voting member of ESW, and may be deemed to have beneficial ownership of the shares held

by ESW.

|

|

|

(b)

|

Percent of Class: ESW Capital and Mr. Liemandt may be deemed to be the beneficial owners of 14.4% of the outstanding shares of common stock, based upon 44,563,490 shares of common stock of the issuer as of

July 31, 2017, as reported in the Issuer’s Form

10-Q

filed on August 11, 2017.

|

Page 5 of 9

|

|

(c)

|

Number of Shares as to which the person has:

|

(i) Sole power to vote or

to direct the vote: See Item 5 on the cover page(s) hereto.

(ii) Shared power to vote or to direct the vote: See

Item 6 on the cover page(s) hereto.

(iii) Sole power to dispose or to direct the disposition of: See Item 7 on the

cover page(s) hereto.

(iv) Shared power to dispose or to direct the disposition of: See Item 8 on the cover

page(s) hereto.

|

Item 5

|

Ownership of Five Percent or Less of a Class.

|

If this statement is being filed

to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following ☐.

Not applicable.

|

Item 6

|

Ownership of More than Five Percent on behalf of Another Person.

|

Not

applicable.

|

Item 7

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company.

|

See item 2(a).

|

Item 8

|

Identification and Classification of Members of the Group.

|

Not

applicable.

|

Item 9

|

Notice of Dissolution of Group.

|

Not applicable.

By signing below I certify that, to the best of my knowledge and

belief, the securities referred to above were acquired and are held in the ordinary course of business and were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the

securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Page 6 of 9

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Date: August 28, 2017

|

|

|

|

ESW CAPITAL, LLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Andrew S. Price

|

|

|

|

|

|

Andrew S. Price

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

JOSEPH A. LIEMANDT

|

|

|

|

|

|

|

|

|

|

/s/ Andrew S. Price, As

attorney-in-fact

|

|

|

|

|

|

Andrew S. Price

|

Page 7 of 9

EXHIBIT 99.1

Joint Filing Agreement

The undersigned

acknowledge and agree that the foregoing statement on Schedule 13G is filed on behalf of each of the undersigned and that all subsequent amendments to this statement on Schedule 13G shall be filed on behalf of each of the undersigned without the

necessity of filing additional joint filing statements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the information concerning him, her or it contained

herein, but shall not be responsible for the completeness and accuracy of the information concerning the other entities or persons, except to the extent that he, she or it knows or has reason to believe that such information is inaccurate.

Date: August 28, 2017

|

|

|

|

|

ESW CAPITAL, LLC

|

|

|

|

|

By:

|

|

/s/ Andrew S. Price

|

|

Andrew S. Price

|

|

Chief Financial Officer

|

|

|

|

JOSEPH A. LIEMANDT

|

|

|

|

/s/ Andrew S. Price, As

attorney-in-fact

|

|

Andrew S. Price

|

Page 8 of 9

LIMITED POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that the undersigned hereby constitutes and

appoints Andrew S. Price his true and lawful

attorney-in-fact,

with full power

of substitution, to sign any and all instruments, certificates and documents that may be necessary, desirable or appropriate to be executed on behalf of himself as an individual or in his capacity as a direct or indirect general partner, director,

officer, member or manager of any partnership, corporation or limited liability company, pursuant to section 13 or 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any and all regulations promulgated

thereunder, and to file the same, with all exhibits thereto, and any other documents in connection therewith, with the Securities and Exchange Commission, and with any other entity when and if such is mandated by the Exchange Act or by the Financial

Industry Regulatory Authority, granting unto said

attorney-in-fact

full power and authority to do and perform each and every act and thing necessary, desirable or

appropriate, fully to all intents and purposes as he might or could do in person, thereby ratifying and confirming all that said

attorney-in-fact,

or his substitutes,

may lawfully do or cause to be done by virtue hereof.

Each of the undersigned may execute this power of attorney in separate counterparts, and each

counterpart shall be deemed to be an original instrument.

This agreement shall be effective as to each of the undersigned as of the date signed by that

signatory.

IN WITNESS WHEREOF, this Power of Attorney has been signed as of the 10th day of March, 2017.

|

|

|

/s/ Joseph A. Leimandt

|

|

Joseph A. Liemandt

|

Page 9 of 9

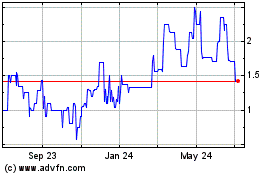

FalconStor Software (PK) (USOTC:FALC)

Historical Stock Chart

From Aug 2024 to Sep 2024

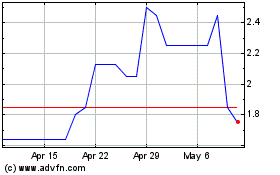

FalconStor Software (PK) (USOTC:FALC)

Historical Stock Chart

From Sep 2023 to Sep 2024