Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 04 2025 - 5:00PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of March 2025

Commission

File Number 001-39001

Blue

Hat Interactive Entertainment Technology

(Translation

of registrant’s name into English)

7th

Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form

40-F ☐

Blue

Hat Interactive Entertainment Technology, a Cayman Islands company (the “Company”) furnishes under the cover of Form

6-K the following:

Submission

of Matters to a Vote of Security Holders.

On

February 28, 2025, the Company held a 2025 Extraordinary General Meeting of Shareholders (the “Meeting”) for discussion

and approval of two proposals. A quorum was present at the Meeting as required by the Second Amended and Restated Memorandum and Articles

of Association of the Company. The final voting results for each proposal submitted to a vote of shareholders at the Meeting are as follows.

| 1. |

A proposal to approve the share capital of the Company increase from “US$5,000,000 divided into 500,000,000 ordinary shares of US$0.01 par value each” to “US$500,000,000 divided into 50,000,000,000 ordinary shares of US$0.01 par value each by the creation of an additional 49,500,000,000 ordinary shares of a par value of US$0.01 each to rank pari passu in all respects with the existing ordinary shares of the Company with immediate effect (the “Authorized Share Capital Increase”). |

| For |

|

Against |

|

Abstain |

|

| |

259,053,995 |

|

|

7,546,611 |

|

|

322,646 |

|

| 2. |

A proposal to approve a share consolidation of the Company’s ordinary shares, par value US$0.01 each in the authorized share capital of the Company (including issued and unissued share capital) at a ratio of 50-1 or 100-1, with the exact ratio to be selected at the sole discretion of the Company’s board of directors, at the time when it deems in the best interests of the Company and its shareholders, which shall be on or before a date that is in compliance with the Cayman law (the “Share Consolidation”). |

The following resolutions was

put to the shareholders to consider and to vote upon at the Meeting:

“IT IS RESOLVED THAT

immediately following the Authorized Share Capital Increase, the following resolutions shall be approved as ordinary resolutions of the

Company, and subject to and conditional upon that the Board determining which of the below resolutions is to be effective:

| |

(A) |

Every 50 ordinary shares of par value of US$0.01 each in the authorized share capital of the Company (including issued and unissued share capital) be consolidated into 1 ordinary share of par value of US$0.5 each, and following such consolidation the authorized share capital of the Company is US$500,000,000 divided into 1,000,000,000 ordinary shares of par value of US$0.5 each, with such consolidation to be effective on such date as determined by the Directors which date must be on or before a date that is in compliance with Cayman law; or |

| |

(B) |

Every 100 ordinary shares of par value of US$0.01 each in the authorized share capital of the Company (including issued and unissued share capital) be consolidated into 1 ordinary share of par value of US$1 each, and following such consolidation the authorized share capital of the Company is US$500,000,000 divided into 500,000,000 ordinary shares of par value of US$1 each, with such consolidation to be effective on such date as determined by the Directors which date must be on or before a date that is in compliance with Cayman law.” |

| For |

|

Against |

|

Abstain |

|

| |

259,996,680 |

|

|

6,709,101 |

|

|

217,472 |

|

Pursuant to the foregoing votes the Company has obtained the shareholders’

approvals to effect both the Authorized Share Capital Increase and Share Consolidation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 4, 2025

| |

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY |

| |

|

| |

By: |

/s/ Xiaodong Chen |

| |

|

Name: Xiaodong Chen |

| |

|

Title: Chief Executive Officer |

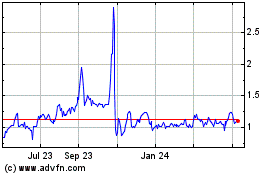

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Mar 2025 to Apr 2025

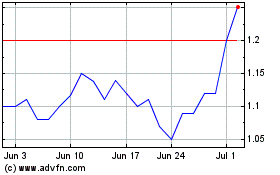

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Apr 2024 to Apr 2025