U.S. Index Futures Mixed Following Tech Sell-Off, WTI and Brent Crude Dip Slightly

June 25 2024 - 6:37AM

IH Market News

U.S. index futures showed mixed results in Tuesday’s pre-market,

following a tech sector sell-off the previous day, resulting in the

Nasdaq Composite’s worst performance since April. Investors are

focusing on financial results from Carnival and FedEx, along with a

series of economic indicators to be released throughout the

day.

At 6:54 AM, Dow Jones futures (DOWI:DJI) fell 35 points, or

0.09%. S&P 500 futures advanced 0.16%, and Nasdaq-100 futures

gained 0.39%. The 10-year Treasury yield stood at 4.24%.

In the commodities market, West Texas Intermediate crude for

August fell 0.43%, to $81.28 per barrel. Brent crude for August

dropped 0.44%, near $85.63 per barrel. Oil prices changed little,

with concerns over China’s economic recovery balancing tensions in

the Middle East and Ukrainian attacks on Russian refineries. Iron

ore traded on the Dalian Exchange fell 0.69% to $109.53 per metric

ton.

Tuesday’s U.S. economic indicators begin at 8:30 AM with the

Chicago Fed’s May national activity index. Next, at 9 AM, S&P

will release the April S&P Case/Shiller index, which monitors

residential real estate prices. At 10 AM, the Commerce Department

will present May existing home sales data, followed by the

Conference Board at 10 AM with the June consumer confidence index.

Also at 10 AM, the Richmond Fed and Dallas Fed will publish June

manufacturing and services indexes, respectively.

Asia-Pacific markets mostly closed higher on Tuesday, with

Japan’s Nikkei 225 rising 0.95% and the Topix up 1.72%. Hong Kong’s

Hang Seng increased by 0.25%, while Australia’s ASX 200 closed

1.36% higher. South Korea’s Kospi rose 0.35%. Conversely, China’s

Shanghai Composite fell 0.44%.

Reuters reported that the Biden administration is investigating

three Chinese telecom companies, China Mobile, China Telecom, and

China Unicom, over concerns about Beijing’s access to American

data. Despite this, shares of these companies rose on Tuesday.

Asian investors also assessed South Korea’s June consumer sentiment

index, which rose to 100.9, and Japan’s services producer prices,

which increased 2.5% in May.

European markets are down on Tuesday, influenced by the U.S.

market performance. The industrial sector is underperforming, while

the oil and gas sector has risen. Among individual stocks,

Novo Nordisk (TG:NOV) shares rose 1.6% after

Wegovy’s approval in China. Zealand Pharma

(TG:22Z) increased 3.4%, while Airbus (EU:AIR)

plummeted 10.9% after reducing targets for 2024.

U.S. stocks closed mixed on Monday, with the Dow Jones rising

0.67%, while the S&P 500 and Nasdaq fell 0.31% and 1.09%,

respectively. Nvidia (NASDAQ:NVDA),

Dell (NYSE:DELL), and Qualcomm

(NASDAQ:QCOM) recorded significant declines, while the energy,

financial, and utility sectors rose.

In terms of quarterly reports, Carnival Corp

(NYSE:CCL), TD Synnex Corporation (NYSE:SNX), and

Airship (NASDAQ:AISP) are reporting before the

market opens.

After the close, FedEx (NYSE:FDX),

Progress Software Corporation (NASDAQ:PRGS), and

GreenTree Hospitality Group (NYSE:GHG) numbers are

awaited.

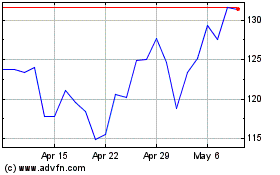

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From May 2024 to Jun 2024

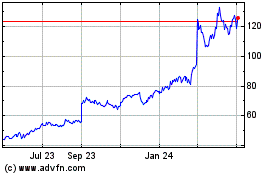

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Jun 2023 to Jun 2024