UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SD

Specialized Disclosure Report

THE HOME DEPOT, INC.

(Exact Name of Registrant as Specified in Charter)

__________________

| | | | | | | | | | | | | | |

| Delaware | | | | 1-8207 |

(State or Other Jurisdiction

of Incorporation) | | | | (Commission

File Number) |

2455 Paces Ferry Road, Atlanta, Georgia 30339

(Address of Principal Executive Offices) (Zip Code)

Brian Mandigo, Vice President, Global Sourcing (770) 433-8211

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended_________.

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

In accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”), The Home Depot, Inc. has filed this Specialized Disclosure Report (“Form SD”) and Conflict Minerals Report for the calendar year ended December 31, 2023, and both reports are publicly available at https://corporate.homedepot.com/conflictminerals.

Item 1.02 Exhibit

The Home Depot Inc.’s Conflict Minerals Report for the calendar year ended December 31, 2023 is filed as Exhibit 1.01 to this Form SD.

Section 2 - Resource Extraction Issuer Disclosure

Not applicable

Section 3 – Exhibits

Item 3.01 Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | |

| | | |

| THE HOME DEPOT, INC. | | |

| | | |

| By: | /s/ Teresa Wynn Roseborough | | May 23, 2024 |

| Name: | Teresa Wynn Roseborough | | (Date) |

| Title: | Executive Vice President, General Counsel & Corporate Secretary | | |

Exhibit 1.01

Conflict Minerals Report of The Home Depot, Inc.

for the Calendar Year Ended December 31, 2023

This is the Conflict Minerals Report (“CMR”) of The Home Depot, Inc. for the reporting period from January 1 to December 31, 2023, in accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”). When we refer to “The Home Depot,” the “Company,” “we,” “us” or “our” in this report, we are referring to The Home Depot, Inc. and its consolidated subsidiaries.

Overview

This CMR provides a description of the measures that The Home Depot has taken to determine the origin of the gold, tantalum, tin and tungsten (“conflict minerals” or “3TG”) that were necessary to the functionality or production of products that the Company contracted to manufacture in 2023. The products that we contracted to manufacture (the “Covered Products”) during the reporting period are: Décor/Storage, Electrical/Lighting, Flooring, Kitchen and Bath, and Plumbing.

Notwithstanding our due diligence process described herein, we are unable to determine the source of all conflict minerals that are necessary to the functionality or production of the Covered Products or whether these conflict minerals directly or indirectly financed or benefited armed groups in the Democratic Republic of the Congo and adjoining countries (the “Covered Countries”).

Reasonable Country of Origin Inquiry

Introduction

We engaged a third-party service provider to assist us with data collection and aggregation. Together, we worked with our suppliers to collect information about the presence and sourcing of 3TG used in the Covered Products. Information regarding the presence of 3TG in a supplier’s products and the source of such 3TG, if present, was collected and stored using an online platform that utilized the Conflict Minerals Reporting Template (the “Template”) developed by the Responsible Minerals Initiative (“RMI”), which was founded by members of the Responsible Business Alliance and the Global e-Sustainability Initiative.

Products in Scope

We compiled a list of all Covered Products and worked with our third-party service provider to determine which Covered Products were in scope for potential use of 3TG and therefore required a Reasonable Country of Origin Inquiry (“RCOI”).

Supplier Engagement

We identified the suppliers with whom we contract directly (“Tier 1 Suppliers”) for the in-scope Covered Products and contacted them as a part of the RCOI process.

The RCOI began with an introduction email from us to the Tier 1 Suppliers describing our Conflict Minerals Compliance Program (the “CMCP”) requirements. The Tier 1 Suppliers then were sent a follow-up email containing registration information and a request to complete the Template. Non-responsive Tier 1 Suppliers received several follow-up contacts to encourage completion of the Template. The Tier 1 Suppliers that remained non-responsive were contacted and offered assistance. This assistance included, but was not limited to, further information about the CMCP, an explanation of why the information was being collected, a review of how the information would be used, and clarification regarding how the required information could be provided. Tier 1 Suppliers who failed to respond to our earlier contacts were

also contacted by our managers who maintain direct relationships with these suppliers and were further urged to respond in a timely manner.

Due Diligence Program Design

Following completion of the RCOI, we proceeded to the due diligence process to determine the source of any 3TG in the Covered Products. We conducted a due diligence process based on the Organization for Economic Cooperation and Development’s (“OECD’s”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and accompanying Supplements1 (the “OECD Guidance”).

The OECD Guidance has established a five-step framework for due diligence as a basis for responsible global supply chain management of minerals from conflict-affected and high-risk areas. This framework consists of the following elements:

1.Establish strong company management systems (“Step One”);

2.Identify and assess risk in the supply chain (“Step Two”);

3.Design and implement a strategy to respond to identified risks (“Step Three”);

4.Carry out independent third-party audit of supply chain due diligence at identified points in the supply chain (“Step Four”); and

5.Report on supply chain due diligence (“Step Five”).

Due Diligence Program Execution

Consistent with the framework above and in furtherance of our Conflict Minerals due diligence for 2023, we performed the following measures:

OECD Guidance Step One: Establish strong company management systems

(a)We maintained a policy relating to conflict minerals in our supply chain (“Conflict Minerals Policy”). Our Conflict Minerals Policy is publicly available at https://corporate.homedepot.com/conflictminerals. It states:

The Home Depot Conflict Minerals Policy

The Home Depot is committed to ensuring compliance with Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to trade in conflict minerals.

The conflict minerals law was enacted to address the exploitation and trade of certain minerals that contribute to violence and human rights abuses in the Democratic Republic of the Congo and its neighboring countries in Africa (“Covered Countries”). The law requires public companies to report to the U.S. Securities and Exchange Commission and disclose information annually about whether the defined conflict minerals – gold, columbite-tantalite (tantalum), cassiterite (tin), and wolframite (tungsten) – are necessary to the functionality or production of products they manufacture or contract to manufacture, and, if so, whether those conflict minerals are sourced from smelters or refiners that have been certified as “DRC conflict free”.

The Home Depot is committed to the responsible sourcing of materials for our products, and we expect that our suppliers are likewise committed to responsible sourcing. We expect all suppliers manufacturing our products to partner with us to provide appropriate information and conduct necessary due diligence in order to facilitate our compliance with the conflict

1 OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, 2016, http://www.oecd.org/daf/inv/mne/OECD-Due-Diligence-Guidance-Minerals-Edition3.pdf.

minerals law. We further expect all suppliers manufacturing our products to adopt sourcing practices to obtain products and materials from suppliers not involved in funding conflict in the Covered Countries.

The Home Depot provides a Supplier AlertLine for the exclusive use of suppliers to report violations of company policies, including the Conflict Minerals Policy. Suppliers may contact the Supplier AlertLine at thdsupplieralertline.com or by using the following toll-free numbers:

•United States and Canada: 1-800-435-3152

•Mexico: 001-888-765-8153

•China: 400-8-801-045

•India: (Access Code) 000-117, (Dial) 800-435-3152

•Vietnam: (Access Code) 1-201-0288, (Dial) 800-435-3152

(b)We continued to include the Conflict Minerals Policy in our current Supplier Buying Agreement.

OECD Guidance Step Two: Identify and assess risk in the supply chain

(a)After completion of the RCOI, as described above, Tier 1 Suppliers who indicated that 3TG was necessary to the functionality or production of Covered Products supplied to us were asked to provide information through the Template regarding the sourcing and origin of the 3TG (i.e., the 3TG smelters or refiners, or “SORs”). To the extent applicable, where a Tier 1 Supplier did not provide detailed information about the SORs in its supply chain, we contacted the applicable suppliers of the Tier 1 Suppliers (“Tier 2 Suppliers”), and subsequent tiers of suppliers as needed to obtain the necessary information, using the contact procedures explained above. Collectively, the Tier 1 Suppliers, Tier 2 Suppliers and any suppliers working backward from the Tier 2 Suppliers are referred to in this report as “Suppliers”.

(b)Based on information provided by the Suppliers, we used the following criteria to determine which Covered Products that contained 3TG necessary to the functionality or production of such product to include in the due diligence process:

i.The Suppliers reported sourcing from the Covered Countries;

ii.The SOR data indicated sourcing from a mine located in the Covered Countries;

iii.The SOR reportedly sourced from a mine located in the Covered Countries (based on information contained within the third-party service provider’s system, from independent certification programs, or from internet research/available public reports);

iv.There was an indication that the SOR sourced from a Covered Country or a country that is known for smuggling or exporting 3TG out of a Covered Country; or

v.Information provided about a SOR indicated the origin of the materials was not from a known reserve for the given metal.

(c)We evaluated the responses we received from Suppliers. Suppliers were contacted to address issues, including: implausible statements regarding no presence of 3TG; incomplete data on their Templates; responses that did not identify SORs; responses that indicated sourcing location without complete supporting information from the supply chain; and organizations that were identified as SORs, but not verified as such through further analysis and research.

(d)When SOR data was obtained, we used the existing SOR database of our third-party service provider, the RMI’s list of SORs, internet research, and other resources (e.g., government databases and industry and trade organization lists) to verify whether entities identified as SORs are actually 3TG SORs. Where we found that an entity named as a SOR was not directly involved in the smelting or recycling of the relevant metal, the Supplier that provided

this information was contacted to attempt to obtain additional information about the origin of the materials or information about its direct suppliers. If contact information was provided, or could be obtained, for the entity listed as a SOR, the listed entity was also contacted to obtain additional information about the origin of materials used. We also investigated Supplier statements that a SOR did not source from the Covered Countries when the stated sourcing location (country of mine origin) was not a known reserve for the given metal.

OECD Guidance Step Three: Design and implement a strategy to respond to identified risks

(a)We reported the findings of our supply chain risk assessment as outlined in this CMR to our General Counsel and supply chain senior leadership.

(b)We took such risk mitigation efforts as we deemed to be appropriate based on the findings of our supply chain risk assessment. These risk mitigation efforts were determined by taking into account the particular facts, circumstances and risks identified with respect to our supply chain over the course of 2023.

(c)To mitigate the risk that our necessary 3TG benefit armed groups, we intend to engage in the additional measures discussed under “Addressing Identified Risks” below.

OECD Guidance Step Four: Carry out independent third-party audit of supply chain due diligence at identified points in the supply chain

In connection with our due diligence, we utilized information made available by the RMI (which administers the Responsible Minerals Assurance Process), the London Bullion Market Association (“LBMA”), and the Responsible Jewellery Council (“RJC”) concerning independent third-party audits of smelters and refiners.

OECD Guidance Step Five: Report on supply chain due diligence

We filed a Form SD and this Conflict Minerals Report with the Securities and Exchange Commission and made available on our website this Conflict Minerals Report and the Form SD.

Summary of Findings

A total of seven Tier 1 Suppliers were identified as in-scope for conflict mineral regulatory purposes and contacted as part of the RCOI process. The response rate among these Suppliers was one hundred percent (100%). Fifty-seven percent (57%), or four, of the responding Suppliers indicated one or more of the conflict minerals as necessary to the functionality or production of the Covered Products.

Based on the information provided by our Tier 1 Suppliers and our own due diligence efforts with known smelters and refiners through December 31, 2023, we believe that the facilities that may have been used to process the conflict minerals in the Covered Products include the eight SORs listed in Annex I. Based on review of certain SOR databases, there was an indication of sourcing from the Covered Countries for one out of the eight uniquely identified SORs. The SOR with an indication of sourcing in the Covered Countries was certified as DRC Conflict Free by either the RMI, LBMA or RJC.

In 2023, we were successful in obtaining a 100% survey response rate from our Tier 1 Suppliers. Notwithstanding the due diligence process described above, we do not have sufficient information to conclusively determine whether any 3TG originating in the Covered Countries was included in our Covered Products and, if so, whether the 3TG was from recycled or scrap sources, and whether or not these conflict minerals directly or indirectly financed or benefited armed groups in the Covered Countries. Based on the information provided by our Tier 1 Suppliers and SORs, as well as from the

RMI and other sources, however, we believe that the countries of origin of the conflict minerals contained in our Covered Products include the countries listed in Annex II below, as well as recycled and scrap sources.

Addressing Identified Risks

In 2023, our efforts continued to be focused on collecting and disseminating information from our Tier 1 Suppliers on their sourcing practices using the Template and creating a database for that information. In 2023, as part of its annual assessment of products in scope, the Company continued to exclude any supplier of products where the supplier merely affixed Company brands, trademarks, logos, or labels to generic products manufactured by a third party, as permitted by Securities and Exchange Commission guidance. As a result, the total number of in-scope Tier 1 suppliers decreased to 7 in 2023, from 14 in 2022.

In the 2024 reporting year, we will continue our Supplier engagement process with an aim to decrease the number of Covered Products with 3TG of indeterminate origin. We expect that our 2024 efforts will include:

•Reviewing and updating the list of Covered Products and associated Tier 1 Suppliers designated as in-scope as needed;

•Re-engaging each in-scope Tier 1 Supplier to verify and update sourcing information as needed; and

•Continuing to work with Suppliers to gain information about supply chain actors closer upstream to the smelter or refiner to facilitate the exchange of information on the origin of 3TG.

We intend to undertake the following steps during the 2024 reporting year to further mitigate the risk that our Covered Products contain conflict minerals that benefit armed groups in the Covered Countries:

•Continuing to engage with Tier 1 Suppliers to obtain current, accurate and complete information about the supply chain;

•Encouraging Tier 1 Suppliers to implement responsible sourcing and to encourage their smelters and refiners to obtain a “conflict-free” certification from an independent, third-party auditor; and

•Engaging in industry initiatives encouraging “conflict-free” supply chains.

ANNEX I

| | | | | |

| Metal | Smelter or Refiner Name |

| Tin | China Tin Group Co., Ltd.* |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd.* |

| Gold | Heraeus Metals Hong Kong Ltd.* |

| Gold | Jiangxi Copper Co., Ltd.* |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd.* |

| Gold | Torecom* |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd.* |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation* |

*Smelter or refiner certified by the RMI, LBMA or RJC

ANNEX II

Countries of Origin

| | | | | |

| Australia | Belgium |

| Bolivia | Brazil |

| Canada | Chile |

| China | Ethiopia |

| France | Germany |

| Hong Kong | Indonesia |

| Japan | Korea, Republic of |

| Kyrgyzstan | Laos |

| Malaysia | Mexico |

| Mongolia | Mozambique |

| Myanmar | Papua New Guinea |

| Peru | Philippines |

| Poland | Russian Federation |

| Rwanda | Singapore |

| South Africa | Switzerland |

| Taiwan | Tajikistan |

| Thailand | United States |

| Vietnam | |

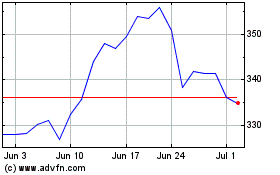

Home Depot (NYSE:HD)

Historical Stock Chart

From May 2024 to Jun 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Jun 2023 to Jun 2024