0001217234FALSE00012172342024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 9, 2024

CAREDX, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-36536 | | 94-3316839 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

8000 Marina Boulevard, 4th Floor

Brisbane, California 94005

(Address of Principal Executive Offices) (Zip Code)

(415) 287-2300

Registrant’s telephone number, including area code

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| (Title of each class) | | (Trading Symbol) | | (Name of exchange on which registered) |

| Common Stock, $0.001 Par Value | | CDNA | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, CareDx, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. A copy of the earnings presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information in this Item 2.02, including the press release attached hereto as Exhibit 99.1 and the earnings presentation attached hereto as Exhibit 99.2, are intended to be furnished under Item 2.02 and Item 9.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Date: May 9, 2024 | | | | CAREDX, INC.

|

| | | |

| | | | By: | | /s/ Abhishek Jain |

| | | | | | Abhishek Jain |

| | | | | | Chief Financial Officer |

CareDx Reports First Quarter 2024 Results

Raises 2024 Revenue Guidance to $274 to $282 Million

BRISBANE, Calif., May 9, 2024, CareDx, Inc. (Nasdaq: CDNA) — today reported financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Highlights

•Reported first quarter revenue of $72.0 million.

•Revenue for Testing Services of $53.8 million, an increase of 15% as compared to the fourth quarter 2023.

•Grew testing services patients results for the third consecutive quarter to approximately 42,000, an increase of 6% as compared to the fourth quarter 2023.

•Over 30 oral presentations, posters and two symposia highlighting CareDx's scientific advancements in heart and lung transplantation presented at the International Society for Heart and Lung Transplantation (ISHLT).

•SHORE data presented at ISHLT demonstrated that HeartCare® multimodal testing outperforms donor-derived cell-free DNA (dd-cfDNA) testing alone in identifying allograft rejection.

•Expanded payer coverage by 14 million lives nationwide.

•Reported first quarter revenue of $9.6 million for Patient and Digital Solutions and $8.6 million for Products, representing year-over-year growth of 12% and 25%, respectively.

•Ended the quarter with cash, cash equivalents, and marketable securities of approximately $216 million, with no debt.

“We set a new baseline in our Testing Services business in the second half of 2023 and are back to delivering sequential growth. I am pleased with the team’s strong performance across all businesses this quarter,” said John W. Hanna, CareDx President and CEO. “CareDx is the leader in transplant patient care and our dedication to serving patients will continue to be our catalyst for growth.”

First Quarter 2024 Financial Results

Revenue for the three months ended March 31, 2024, was $72.0 million, a decrease of 7% compared with $77.3 million for the first quarter of 2023, and an increase of 10% compared with $65.6 million in the fourth quarter of 2023. Testing Services revenue for the first quarter 2024 was $53.8 million, a decrease of 13% compared with $61.8 million in the same period in 2023, and an increase of 15% compared with $46.7 million in the fourth quarter of 2023. Testing Services revenue benefited from continued revenue cycle management initiatives including unpaid claims from test results delivered in prior quarters. These efforts added approximately $3.7 million in revenue in the first quarter.

Total AlloSure® and AlloMap® patient results provided in the first quarter 2024 were approximately 42,000, a decrease of 16% as compared to the same quarter a year ago, and an increase of 6% compared to the fourth quarter of 2023. Patient and Digital Solutions revenue for the first quarter 2024 was $9.6 million, compared to $8.6 million in the same period in 2023, an increase of 12%. Product revenue for the first quarter 2024 was $8.6 million, compared to $6.9 million in the same period in 2023, an increase of 25%.

For the first quarter of 2024 net loss was $16.7 million, compared to a net loss of $23.7 million in the first quarter of 2023. Basic and diluted net loss per share in the first quarter of 2024 was $0.32, compared to basic and diluted net loss per share of $0.44 in the first quarter of 2023.

Non-GAAP net loss was $1.4 million in the first quarter of 2024, compared to a non-GAAP net loss of $5.8 million in the first quarter of 2023. Basic and diluted non-GAAP net loss per share was $0.03 in the first quarter of 2024, compared to a basic and diluted non-GAAP net loss per share of $0.11 in the first quarter of 2023.

Adjusted EBITDA for the first quarter of 2024 was a loss of $1.9 million, compared to an adjusted EBITDA loss of $6.4 million in the first quarter of 2023, and $10.3 million adjusted EBITDA loss in the fourth quarter of 2023.

CareDx delivered strong financial and operational performance in the first quarter and is raising guidance for the full year 2024 revenue which is expected to be in the range of $274 million to $282 million.

About CareDx – The Transplant Company

CareDx, Inc., headquartered in Brisbane, California, is a leading precision medicine solutions company focused on the discovery, development, and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers. CareDx offers testing services, products, and digital healthcare solutions along the pre- and post-transplant patient journey and is the leading provider of genomics-based information for transplant patients. For more information, please visit: www.CareDx.com.

Forward Looking Statements

This press release includes forward-looking statements, including expectations regarding CareDx’s 2024 revenue, CareDx’s focus in 2024 and CareDx’s proposed path to profitability. These forward-looking statements are based upon information that is currently available to CareDx and its current expectations, speak only as of the date hereof, and are subject to numerous risks and uncertainties, all of which are difficult to predict and many of which are beyond our control, including general economic and market factors, among others discussed in CareDx’s filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed by CareDx with the SEC on February 28, 2024, the quarterly report on Form 10-Q for the quarter ended March 31, 2024 filed by CareDx with the SEC on May 9, 2024 and other reports that CareDx has filed with the SEC. Any of these may cause CareDx’s actual results, performance, or achievements to differ materially and adversely from those anticipated or implied by CareDx’s forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements. CareDx expressly disclaims any obligation, except as required by law, or undertaking to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Measures

CareDx has presented in this release certain financial information in accordance with U.S. Generally Accepted Accounting Principles ("GAAP") and also on a non-GAAP basis, including non-GAAP cost of testing services, non-GAAP cost of product, non-GAAP cost of patient and digital solutions, non-GAAP research and development expenses, non-GAAP sales and marketing expenses, non-GAAP general and administrative expenses, non-GAAP other income, net, non-GAAP income tax expense, non-GAAP gross profit, non-GAAP gross margin (%), non-GAAP net loss, non-GAAP basic and diluted net loss per share, adjusted EBITDA and non-GAAP operating expenses.

We define non-GAAP net loss and per share results as the GAAP net loss and per share results excluding the impacts of stock-based compensation; changes in estimated fair value of contingent consideration; acquisition-related impairment charges and amortization of purchased intangible assets and related tax effects; costs involved with completing an acquisition; unrealized loss on investments; restructuring charges and certain other charges.

We define adjusted EBITDA as non-GAAP net loss before net interest income, income tax (benefit) expense, depreciation and other expense, net.

We are presenting these non-GAAP financial measures to assist investors in assessing our operating results through the eyes of management and because we believe that these measures provide an additional tool for investors to use in comparing our core business operating results over multiple periods. Management believes this non-GAAP information is useful for investors, when considered in conjunction with CareDx’s GAAP financial statements, because management uses such information internally for its operating, budgeting, and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of CareDx’s operating results as reported under GAAP. These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. These non-GAAP financial measures are not necessarily comparable to similarly titled measures presented by other companies. A reconciliation between GAAP and non-GAAP financial information is provided immediately following the financial tables.

CareDx, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| Testing services revenue | $ | 53,837 | | | $ | 61,784 | | | | | |

| Product revenue | 8,594 | | | 6,861 | | | | | |

| Patient and digital solutions revenue | 9,618 | | | 8,617 | | | | | |

| Total revenue | 72,049 | | | 77,262 | | | | | |

| Operating expenses: | | | | | | | |

| Cost of testing services | 13,632 | | | 15,296 | | | | | |

| Cost of product | 5,344 | | | 4,066 | | | | | |

| Cost of patient and digital solutions | 6,958 | | | 6,604 | | | | | |

| Research and development | 18,711 | | | 24,357 | | | | | |

| Sales and marketing | 19,830 | | | 23,231 | | | | | |

| General and administrative | 26,911 | | | 28,032 | | | | | |

| | | | | | | |

| Total operating expenses | 91,386 | | | 101,586 | | | | | |

| Loss from operations | (19,337) | | | (24,324) | | | | | |

| Other income: | | | | | | | |

| Interest income, net | 2,885 | | | 2,666 | | | | | |

Change in estimated fair value of common stock warrant liability | — | | | 7 | | | | | |

| Other expense, net | (290) | | | (1,974) | | | | | |

| Total other income | 2,595 | | | 699 | | | | | |

| Loss before income taxes | (16,742) | | | (23,625) | | | | | |

| Income tax benefit (expense) | 83 | | | (124) | | | | | |

| Net loss | $ | (16,659) | | | $ | (23,749) | | | | | |

| Net loss per share: | | | | | | | |

| Basic | $ | (0.32) | | | $ | (0.44) | | | | | |

| Diluted | $ | (0.32) | | | $ | (0.44) | | | | | |

Weighted-average shares used to compute net loss per share: | | | | | | | |

| Basic | 51,692,358 | | | 53,643,216 | | | | | |

| Diluted | 51,692,358 | | | 53,643,216 | | | | | |

CareDx, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 93,299 | | | $ | 82,197 | |

| Marketable securities | 122,622 | | | 153,221 | |

| Accounts receivable | 60,149 | | | 51,061 | |

| Inventory | 20,130 | | | 19,471 | |

| Prepaid and other current assets | 6,895 | | | 7,763 | |

| Total current assets | 303,095 | | | 313,713 | |

| Property and equipment, net | 34,411 | | | 35,246 | |

| Operating leases right-of-use assets | 28,591 | | | 29,891 | |

| Intangible assets, net | 43,330 | | | 45,701 | |

| Goodwill | 40,336 | | | 40,336 | |

| Restricted cash | 583 | | | 586 | |

| Other assets | 2,060 | | | 1,353 | |

| Total assets | $ | 452,406 | | | $ | 466,826 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 9,976 | | | $ | 12,872 | |

| Accrued compensation | 14,565 | | | 19,703 | |

| Accrued and other liabilities | 45,670 | | | 45,497 | |

| Total current liabilities | 70,211 | | | 78,072 | |

| Deferred tax liability | 43 | | | 136 | |

| | | |

| Deferred payments for intangible assets | 1,348 | | | 2,461 | |

| Operating lease liability, less current portion | 26,893 | | | 28,278 | |

| Other liabilities | 97,686 | | | 96,551 | |

| Total liabilities | 196,181 | | | 205,498 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Common stock | 49 | | | 49 | |

| Additional paid-in capital | 959,734 | | | 946,511 | |

| Accumulated other comprehensive loss | (8,108) | | | (6,963) | |

| Accumulated deficit | (695,450) | | | (678,269) | |

| Total stockholders’ equity | 256,225 | | | 261,328 | |

| Total liabilities and stockholders’ equity | $ | 452,406 | | | $ | 466,826 | |

CareDx, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Cost of testing services reconciliation: | | | | | | | |

| GAAP cost of testing services | $ | 13,632 | | | $ | 15,296 | | | | | |

| Stock-based compensation expense | (457) | | | (479) | | | | | |

| Acquisition related-amortization of purchased intangibles | (329) | | | (329) | | | | | |

| Non-GAAP cost of testing services | $ | 12,846 | | | $ | 14,488 | | | | | |

| Cost of product reconciliation: | | | | | | | |

| GAAP cost of product | $ | 5,344 | | | $ | 4,066 | | | | | |

| Stock-based compensation expense | (317) | | | (360) | | | | | |

| Acquisition related-amortization of purchased intangibles | (420) | | | (418) | | | | | |

| Non-GAAP cost of product | $ | 4,607 | | | $ | 3,288 | | | | | |

| Cost of patient and digital solutions reconciliation: | | | | | | | |

| GAAP cost of patient and digital solutions | $ | 6,958 | | | $ | 6,604 | | | | | |

| Stock-based compensation expense | (372) | | | (402) | | | | | |

| Acquisition related-amortization of purchased intangibles | (271) | | | (248) | | | | | |

| Other income | 5 | | | — | | | | | |

| Non-GAAP cost of patient and digital solutions | $ | 6,320 | | | $ | 5,954 | | | | | |

| Research and development expenses reconciliation: | | | | | | | |

| GAAP research and development expenses | $ | 18,711 | | | $ | 24,357 | | | | | |

| Stock-based compensation expense | (1,760) | | | (1,962) | | | | | |

| | | | | | | |

| Other charges | (25) | | | — | | | | | |

| Non-GAAP research and development expenses | $ | 16,926 | | | $ | 22,395 | | | | | |

| Sales and marketing expenses reconciliation: | | | | | | | |

| GAAP sales and marketing expenses | $ | 19,830 | | | $ | 23,231 | | | | | |

| Stock-based compensation expense | (3,044) | | | (3,737) | | | | | |

| Acquisition related-amortization of purchased intangibles | (633) | | | (595) | | | | | |

| | | | | | | |

| Other charges | (8) | | | — | | | | | |

| Non-GAAP sales and marketing expenses | $ | 16,145 | | | $ | 18,899 | | | | | |

| General and administrative expenses reconciliation: | | | | | | | |

| GAAP general and administrative expenses | $ | 26,911 | | | $ | 28,032 | | | | | |

| Stock-based compensation expense | (7,394) | | | (6,814) | | | | | |

| Change in estimated fair value of contingent consideration | (319) | | | (421) | | | | | |

| Acquisition related fees and expenses | (35) | | | (284) | | | | | |

| Restructuring charges | — | | | (58) | | | | | |

| Other income | 66 | | | — | | | | | |

| Non-GAAP general and administrative expenses | $ | 19,229 | | | $ | 20,455 | | | | | |

| Total other income (expense) reconciliation: | | | | | | | |

| GAAP other income, net | $ | 2,595 | | | $ | 699 | | | | | |

| Unrealized loss on long-term marketable equity securities | — | | | 905 | | | | | |

| Asset impairments and write-downs | — | | | 1,000 | | | | | |

| Other charges | — | | | 20 | | | | | |

| Non-GAAP other income, net | $ | 2,595 | | | $ | 2,624 | | | | | |

| Income tax benefit (expense) reconciliation: | | | | | | | |

| GAAP income tax benefit (expense) | $ | 83 | | | $ | (124) | | | | | |

| Tax effect related to amortization of purchased intangibles | (102) | | | (101) | | | | | |

| Non-GAAP income tax expense | $ | (19) | | | $ | (225) | | | | | |

CareDx, Inc.

GAAP and Non-GAAP Operating Expenses

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| GAAP operating expenses: | | | |

| Research and development | $ | 18,711 | | | $ | 24,357 | |

| Sales and marketing | 19,830 | | | 23,231 | |

| General and administrative | 26,911 | | | 28,032 | |

| Total GAAP operating expenses | $ | 65,452 | | | $ | 75,620 | |

| | | |

| Non-GAAP operating expenses: | | | |

| Research and development | $ | 16,926 | | | $ | 22,395 | |

| Sales and marketing | 16,145 | | | 18,899 | |

| General and administrative | 19,229 | | | 20,455 | |

| Total Non-GAAP operating expenses | $ | 52,300 | | | $ | 61,749 | |

CareDx, Inc.

Reconciliation of GAAP to Non-GAAP Gross Profit and Gross Margin

(Unaudited)

(In thousands, except percentages)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Total revenue | $ | 72,049 | | | $ | 77,262 | |

| GAAP cost of sales | 25,934 | | | 25,966 | |

| GAAP gross profit | 46,115 | | | 51,296 | |

| Stock-based compensation expense | 1,146 | | | 1,241 | |

| Other income | (5) | | | — | |

| Acquisition related-amortization of purchased intangibles | 1,020 | | | 995 | |

| Non-GAAP gross profit | $ | 48,276 | | | $ | 53,532 | |

| Non-GAAP gross margin % | 67 | % | | 69 | % |

| | | |

CareDx, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| GAAP net loss | $ | (16,659) | | | $ | (23,749) | |

| Stock-based compensation expense | 13,344 | | | 13,754 | |

| Acquisition related-amortization of purchased intangibles | 1,653 | | | 1,590 | |

| Acquisition related fees and expenses | 35 | | | 284 | |

| Change in estimated fair value of contingent consideration | 319 | | | 421 | |

Other income and charges | (38) | | | 20 | |

| Tax effect related to amortization of purchased intangibles | (102) | | | (101) | |

| Asset impairments and write-downs | — | | | 1,000 | |

| Unrealized loss on long-term marketable equity securities | — | | | 905 | |

| Restructuring charges | — | | | 58 | |

| Non-GAAP net loss | $ | (1,448) | | | $ | (5,818) | |

| | | |

| GAAP basic and diluted net loss per share | $ | (0.32) | | | $ | (0.44) | |

| | | |

| Non-GAAP basic net loss per share | $ | (0.03) | | | $ | (0.11) | |

| Non-GAAP diluted net loss per share | $ | (0.03) | | | $ | (0.11) | |

| | | |

| Shares used in computing non-GAAP basic net loss per share | 51,692,358 | | | 53,643,216 | |

| Shares used in computing non-GAAP diluted net loss per share | 51,692,358 | | | 53,643,216 | |

CareDx, Inc.

Reconciliation of Non-GAAP to Adjusted EBITDA

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Non-GAAP net loss | $ | (1,448) | | | $ | (5,818) | | | | | |

| Interest income | (2,885) | | | (2,666) | | | | | |

Income tax expense | 19 | | | 225 | | | | | |

| Depreciation expense | 2,168 | | | 1,808 | | | | | |

Other expense, net | 290 | | | 36 | | | | | |

| Adjusted EBITDA | (1,856) | | | (6,415) | | | | | |

| Unrecognized AlloSure Kidney Medicare claims | — | | | 8,912 | | | | | |

| Adjusted EBITDA assuming recognition of paused claims | $ | (1,856) | | | $ | 2,497 | | | | | |

CareDx, Inc.

Media Relations

Anna Czene

818-731-2203

aczene@caredx.com

Investor Relations

Greg Chodaczek

investor@caredx.com

Patrick G, Kidney Transplant Recipient Q1 2024 Earnings Presentation May 9, 2024 The Transplant Company™

Safe Harbor Statement These slides and the accompanying oral presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact contained in this presentation, including statements regarding the future financial position of CareDx®, Inc. (together with its subsidiaries, “CareDx” or the “Company”), including financial targets and expectations, business strategy, and plans and objectives for future operations, are forward-looking statements. The words "believe," "may," "will," "potentially," "estimate," "continue," "anticipate," "intend," "could," "should," "would," "project," "plan," "target," "contemplate," "predict," "expect," and the negative and plural forms of these words and similar expressions are intended to identify that CareDx has based these forward-looking statements on its own estimates and assumptions and its current expectations and projections about future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those contained in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (the "SEC") on February 28, 2024 and Quarterly Report on Form 10Q for the fiscal quarter ended March 31, 2024, to be filed with the SEC on or about May 9, 2024. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. CareDx undertakes no obligation to update publicly or revise any forward-looking statements for any reason after the date of this presentation or to conform these statements to actual results or to changes in CareDx’s expectations. These slides and the accompanying oral presentation contain certain non-GAAP financial measures, which are provided to assist in an understanding of the business and performance of CareDx. These measures should always be considered only as a supplement to, and not as superior to, financial measures prepared in accordance with GAAP. Please refer to the Appendix included in these slides for a reconciliation of the non-GAAP financial measures included in these slides and the accompanying oral presentation to the most directly comparable financial measures prepared in accordance with GAAP. Further information regarding our non-GAAP financial measures can be found in our filings with the SEC. Certain data in this presentation was obtained from various external sources, and neither the Company nor its affiliates, advisers or representatives has verified such data with independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data or undertakes any obligation to update such data after the date of this presentation. Such data involves risks and uncertainties and is subject to change based on various factors. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company. 2

John W. Hanna Appointed CareDx President and CEO Profile • Molecular diagnostics and life sciences tools industry • Prior CEO with record of delivering consistent, strong results • Deep corporate strategy experience • Significant public company investor relations John W. Hanna, President and CEO 3

Q1 2024 Financial and Business Highlights • Strong Q1 revenue of $72.0 million • Third consecutive quarter of Testing Services volume growth; revenue increased 10% quarter over quarter • SHORE data demonstrated that HeartCare outperforms dd-cfDNA alone in identifying allograft rejection • Expanded payer coverage by 14 million lives • Grew Patient and Digital Solutions and Products business 12% and 25% respectively, year-over-year • Ended Q1 with strong cash position of $216 million • Raised 2024 revenue guidance to $274 — $282 million • John W. Hanna appointed President and CEO 4

5 Test Results Paired with EMB-Proven Acute Cellular Rejection.1 HeartCare Outperforms dd-cfDNA Testing Alone in Identifying Allograft Rejection Dual Positive Results with HeartCare® Better Identified Acute Cellular Rejection.1 Supports Patient Risk Stratification Strategies. 1.Data adapted from 2024 ISHLT (International Society for Heart and Lung Transplantation) late-breaking abstract oral presentation presented during ISHLT scientific session Positive Negative Negative Positive AlloMap® AlloSure® 1.6% 1.9% 4.5% 9.1% SHORE (Surveillance in HeartCare Outcomes Registry) Study Details Largest heart transplant study of its kind Observational, prospective study 67 transplant centers across the US Over 2,700 patients Encompasses over 11,000 patient visits Study end points: • Survival and graft function • Reduction in surveillance biopsies Samples: N=6041

HeartCare Predicts Clinically Relevant Long-Term Outcomes 6 1. Data adapted from 2024 ISHLT (International Society for Heart and Lung Transplantation) late-breaking abstract oral presentation presented during ISHLT scientific session. 60% 65% 70% 75% 80% 85% 90% 95% 100% 180 240 300 360 420 480 540 600 660 720 Fr ee do m F ro m D ea th o r G ra ft D ys fu nc tio n Time Post Transplant (Days) No Dual Positive (n=204) Dual Positive (n=204) 60% 65% 70% 75% 80% 85% 90% 95% 100% 180 240 300 360 420 480 540 600 660 720 Fr ee do m F ro m D ea th o r G ra ft D ys fu nc tio n Time Post Transplant (Days) No Rejection n=1594 Rejection n=142 p<0.01 p=0.31 No Dual Positive Dual Positive Patients with dual positive results in the first 6-months post-transplant are at higher risk of allograft dysfunction or death 2 years post-transplant.1 The occurrence of rejection in the first 6-months does not prognosticate outcomes.1 No Rejection Rejection

Three Consecutive Quarters of Testing Services Volume Growth 49.9k Q1 2023 37.5k Q2 2023 38.4k Q3 2023 39.9k Q4 2023 42.1k Q1 2024 Back to Growth Billing Article Impact +2% +4% +6% 7

Strong Testing Services Revenue Growth in Q1 2024 $46.4 $3.7 $0.3 Q4 2023 Q1 2024 $46.7 $53.8 in m ill io ns U SD +15% +8%1 Revenue associated with RCM initiatives, including collections from unpaid claims from test results delivered in prior quarters. $50.1 8 Actual Adjusted 1. Adjusted for revenue associated with revenue cycle management (RCM) initiatives as described above

Strong Year-Over-Year Revenue Growth Across Products and Digital Solutions Businesses $6.9 $8.6 Q1 2023 Q1 2024 $8.6 $9.6 Q1 2023 Q1 2024 Products Patient and Digital Solutions +25% +12% in m ill io ns U SD in m ill io ns U SD 9

Significant Improvement in Adjusted EBITDA Losses in Q1 2024 -$10.31 -$1.91 -$0.32 -$3.72 Q4 2023 Q1 2024 -$10.6 -$5.6in m ill io ns U SD 1.Reported adjusted EBITDA losses; 2.Testing Services revenue associated with revenue cycle management (RCM) initiatives including collections from unpaid claims from test results delivered in prior quarters +$5.0 10 +$8.4 Actual Adjusted

Revised 2024 Guidance Guide Prior Guidance Revised Assumptions Total Revenue $260M - $274M $274M - $282M Testing Services • Low double-digit growth for Testing Services based on annualized actual testing services revenue for the fourth quarter 2023 • Other previously reported assumptions remain unchanged1 Products • High single-digit growth YoY Patient and Digital Solutions • Mid-single-digit growth YoY Non-GAAP Gross Margin 63% - 65% 63% - 65% • Expected to be at the high end of the range • Driven by improvement in Testing Services gross margin Adjusted EBITDA Losses ($20M) - ($30M) ($14M) - ($24M) • Improved top-line and gross margin assumptions 1.No change in Medicare coverage. No incremental revenue assumed from new private payer coverage decisions or one-time benefits associated with collections. 11

Revised 2024 Guidance Assumes High Single-Digit Growth Based on Adjusted 2023 Revenue Revised Guidance May 2024 2024 Mid-point Revised Revenue Guidance 1. Adjusted 2023: Q4 ‘23 testing services revenue of $47.6M annualized; Actual 2023 revenue for Products and Patient and Digital Solutions. The Company believes the comparison to Adjusted 2023 Revenue is appropriate given that Testing Services revenue was negatively impacted due to the Medicare Billing Article changes over the course of 2023. $257 $278 2023 Adjusted Revenue1 2023 Revenue Adjusted1Actual in m ill io ns U SD $280 $187 $34 $37 $257 Patient and Digital Solutions Products Testing Services +8% in m ill io ns U SD 12 Actual Adjusted1

13

Appendix 14

Reconciliation of Adjusted EBITDA Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 GAAP Net Loss (23.7) (25.0) (23.5) (118.1) (16.7) Stock-based compensation expense 13.8 12.7 12.7 10.0 13.3 Impairments & write-downs 1.0 - - - - Unrealized loss (gain) on investments 0.9 (0.1) 0.3 - - Realized gain on investments - - - (1.5) - Acquisition related amortization of purchased intangibles 1.6 1.6 1.6 1.7 1.7 Acquisition related fees and expenses 0.3 - 0.3 0.1 0.0 Change in estimated fair value of contingent consideration 0.4 0.1 1.2 0.9 0.3 Restructuring 0.1 0.8 0.0 1.5 (0.0) Litigation expense - - - 96.3 - Other charges (gain) 0.0 0.0 (2.1) - - Tax effect related to amortization of purchased intangibles (0.1) (0.1) (0.1) (0.1) (0.1) Non–GAAP Net Loss (5.8) (9.9) (9.6) (9.3) (1.4) Interest income (2.7) (2.9) (3.2) (3.2) (2.9) Income tax expense (benefit) 0.2 0.1 (0.2) 0.3 0.0 Depreciation expense 1.8 2.1 2.0 2.0 2.2 Other expense (income), net 0.0 0.3 (0.0) (0.1) 0.3 Adjusted EBITDA (6.4) (10.4) (10.9) (10.3) (1.9) in millions USD 15

Reconciliation of Non-GAAP Gross Margin Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Revenue 77.3 70.3 67.2 65.6 72.0 GAAP Cost of Revenue 26.0 25.9 24.5 25.8 25.9 GAAP Gross Profit 51.3 44.4 42.7 39.8 46.1 GAAP Gross Margin % 66% 63% 64% 61% 64% Non-GAAP Expense: Stock-based compensation expense (1.2) (1.1) (1.1) (0.9) (1.1) Restructuring - (0.0) 0.0 (0.2) 0.0 Acquisition related amortization of purchased intangibles (1.0) (1.0) (1.0) (1.0) (1.0) Non-GAAP Cost of Revenue 23.8 23.8 22.4 23.7 23.8 Non-GAAP Gross Profit 53.5 46.5 44.8 41.9 48.3 Non-GAAP Gross Margin % 69% 66% 67% 64% 67% in millions USD (except %) 16

v3.24.1.u1

Cover Page

|

May 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

CAREDX, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36536

|

| Entity Tax Identification Number |

94-3316839

|

| Entity Address, Address Line One |

8000 Marina Boulevard, 4th Floor

|

| Entity Address, City or Town |

Brisbane,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94005

|

| City Area Code |

415

|

| Local Phone Number |

287-2300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

CDNA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001217234

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

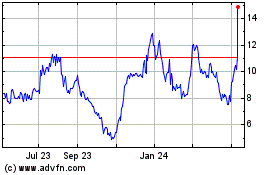

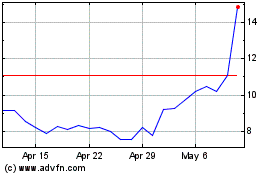

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From Apr 2024 to May 2024

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From May 2023 to May 2024