false

0000033488

0000033488

2024-05-08

2024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| |

Date of report (Date of earliest event reported) |

May 8, 2024 |

ESCALADE, INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

Indiana

(State or Other Jurisdiction of Incorporation)

| 0-6966 |

13-2739290 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| 817 Maxwell Avenue, Evansville, Indiana |

47711 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(812) 467-1358

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of Exchange on which registered |

|

Common Stock, No Par Value

|

ESCA

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 – Corporate Governance and Management

Item 5.07 – Submission of Matters to a Vote of Security Holders

On May 8, 2024, Escalade, Incorporated (“Escalade” or the “Company”) held its Annual Meeting of Stockholders for which Escalade’s Board of Directors (the “Board”) solicited proxies. At the Annual Meeting, the stockholders voted on the election of directors, the appointment of the Company’s independent registered public accounting firm for the Company’s 2024 fiscal year and the approval, by non-binding vote, of the compensation of named executive officers.

In the election of directors, as described in the Company’s proxy statement relating to the Annual Meeting, the nominees presented for election include current directors, Richard F. Baalmann, Jr., Katherine F. Franklin, Walter P. Glazer, Jr., Patrick J. Griffin, and Edward E. Williams. Each individual elected will serve a one year term, expiring at the 2024 Annual Meeting or until their successors are elected and qualified. The results of the voting in the election of directors are as follows:

Number of Votes

|

Director Nominee

|

FOR

|

WITHHELD

|

|

Richard F. Baalmann, Jr.

|

8,176,322

|

403,604

|

|

Katherine F. Franklin

|

7,570,763

|

1,009,163

|

|

Walter P. Glazer, Jr.

|

8,338,257

|

241,669

|

|

Patrick J. Griffin

|

8,342,843

|

237,083

|

|

Edward E. Williams

|

7,684,964

|

894,962

|

Therefore, Messrs. Baalmann, Glazer, Griffin, and Williams and Ms. Franklin were elected to the Board. There were 4,094,734 broker non-votes with respect to the election of each of the nominees.

As to the appointment of the firm, FORVIS, LLP, to serve as the Company’s independent registered public accounting firm for the Company’s 2024 fiscal year, the Company’s stockholders ratified such appointment by a vote of 11,055,525 shares FOR, 1,428,040 shares AGAINST, and 191,095 shares ABSTAINED, with no broker non-votes. Therefore, the appointment of FORVIS, LLP was approved.

As to the approval, by non-binding vote, of the compensation of our named executive officers the Company’s stockholders ratified by a vote of 7,714,659 shares FOR, 819,206 shares AGAINST, and 46,061 shares ABSTAINED. There were 4,094,734 broker non-votes. Therefore, the compensation for our named executive officers was approved, by non-binding vote.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements relating to present or future trends or factors that are subject to risks and uncertainties. These risks include, but are not limited to: Escalade’s ability to achieve its business objectives; Escalade’s ability to successfully achieve the anticipated results of strategic transactions, including the integration of the operations of acquired assets and businesses and of divestitures or discontinuances of certain operations, assets, brands, and products; the continuation and development of key customer, supplier, licensing and other business relationships; Escalade’s ability to develop and implement our own direct to consumer e-commerce distribution channel; the impact of competitive products and pricing; product demand and market acceptance; new product development; Escalade’s ability to successfully negotiate the shifting retail environment and changes in consumer buying habits; the financial health of our customers; disruptions or delays in our business operations, including without limitation disruptions or delays in our supply chain, arising from political unrest, war, labor strikes, natural disasters, public health crises such as the coronavirus pandemic, and other events and circumstances beyond our control; the impact of management’s conclusion, in consultation with the Audit Committee, that material weaknesses existed in the Company’s internal control procedures over financial reporting; the evaluation and implementation of remediation efforts designed and implemented to enhance the Company’s control environment, which remediation efforts are ongoing; the potential identification of one or more additional material weaknesses in the Company’s internal control of which the Company is not currently aware or that have not yet been detected; the Company’s inability or failure to fully remediate material weaknesses in our internal control procedures over financial reporting or any other material weaknesses in the future could result in material misstatements in our financial statements; Escalade’s ability to control costs, including managing inventory levels; Escalade’s ability to successfully implement actions to lessen the potential impacts of tariffs and other trade restrictions applicable to our products and raw materials, including impacts on the costs of producing our goods, importing products and materials into our markets for sale, and on the pricing of our products; general economic conditions, including inflationary pressures; fluctuation in operating results; changes in foreign currency exchange rates; changes in the securities markets; continued listing of the Company’s common stock on the NASDAQ Global Market; the Company’s inclusion or exclusion from certain market indices; Escalade’s ability to obtain financing, to maintain compliance with the terms of such financing and to manage debt levels; the availability, integration and effective operation of information systems and other technology, and the potential interruption of such systems or technology; the potential impact of actual or perceived defects in, or safety of, our products, including any impact of product recalls or legal or regulatory claims, proceedings or investigations involving our products; risks related to data security of privacy breaches; the potential impact of regulatory claims, proceedings or investigations involving our products; potential residual impacts of the COVID-19 global pandemic on Escalade’s financial condition and results of operations; and other risks detailed from time to time in Escalade’s filings with the Securities and Exchange Commission. Escalade’s future financial performance could differ materially from the expectations of management contained herein. Escalade undertakes no obligation to release revisions to these forward-looking statements after the date of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Escalade, Incorporated has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 8, 2024

|

ESCALADE, INCORPORATED

|

|

|

|

|

|

|

|

|

By:

|

/s/ STEPHEN R. WAWRIN

|

|

|

|

Stephen R. Wawrin, Vice President and Chief Financial Officer |

|

v3.24.1.u1

Document And Entity Information

|

May 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ESCALADE, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 08, 2024

|

| Entity, Incorporation, State or Country Code |

IN

|

| Entity, File Number |

0-6966

|

| Entity, Tax Identification Number |

13-2739290

|

| Entity, Address, Address Line One |

817 Maxwell Avenue

|

| Entity, Address, City or Town |

Evansville

|

| Entity, Address, State or Province |

IN

|

| Entity, Address, Postal Zip Code |

47711

|

| City Area Code |

812

|

| Local Phone Number |

467-1358

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ESCA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000033488

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

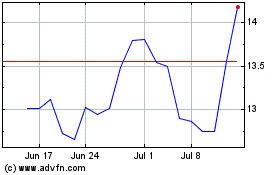

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From Apr 2024 to May 2024

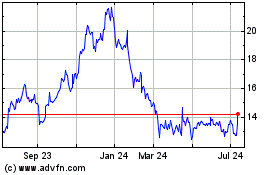

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From May 2023 to May 2024