UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. __)*

| BRERA HOLDINGS PLC |

| (Name of Issuer) |

| Class B Ordinary Shares, $0.005 nominal value per share |

| (Title of Class of Securities) |

|

Daniel Joseph McClory

c/o Brera Holdings PLC

Connaught House, 5th Floor

One Burlington Road

Dublin 4

D04 C5Y6

Ireland

+1 949 502 4408 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| February 29, 2024 |

| (Date of Event which Requires Filing of This Statement) |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

Page 2 of 7 pages

CUSIP

No. G13311108

|

1. |

NAMES OF REPORTING PERSONS

Pinehurst Partners LLC |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☐

(b) ☐ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

WC |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e) |

☐

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

2,250,000(1)(2)

|

| 8. |

SHARED VOTING POWER |

0

|

| 9. |

SOLE DISPOSITIVE POWER |

2,250,000(1)

|

| 10. |

SHARED DISPOSITIVE POWER |

0

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,250,000(1) |

| 12. |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES |

☐

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.0%(3) |

| 14. |

TYPE OF REPORTING PERSON

OO |

| (1) | Reflects 2,250,000

class B ordinary shares, $0.005 nominal value per share (“Class B Ordinary Shares”),

of Brera Holdings PLC, an Irish public limited company (the “Issuer”), issuable

upon conversion of 2,250,000 class A ordinary shares, $0.005 nominal value per share (“Class

A Ordinary Shares”), of the Issuer, held directly by Pinehurst Partners LLC. The Class

A Ordinary Shares will convert on a one-to-one basis into Class B Ordinary Shares (i) at

the option of the holder or (ii) automatically upon the transfer of the Class A Ordinary

Shares, except upon transfer to another holder of Class A Ordinary Shares. |

| (2) | The

holders of Class A Ordinary Shares are entitled to ten (10) votes for each Class A Ordinary

Share held of record, and the holders of Class B Ordinary Shares are entitled to one (1)

vote for each Class B Ordinary Share held of record, on all matters submitted to a vote of

the shareholders. The amounts of voting power reflect the assumed prior conversion of the

Class A Ordinary Shares beneficially owned by the Reporting

Persons (as defined below) into Class B Ordinary Shares. |

| (3) | The calculation assumes

that there was a total of 6,810,000 Class B Ordinary Shares outstanding as of February 29,

2024, which is the sum of (i) the 4,560,000 Class B Ordinary Shares outstanding as of February

29, 2024, and (ii) the 2,250,000 Class B Ordinary Shares issuable upon conversion of the

Class A Ordinary Shares beneficially owned by Pinehurst Partners LLC. |

Page 3 of 7 pages

CUSIP

No. G13311108

| 1. |

NAMES OF REPORTING PERSONS

Daniel Joseph McClory |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐

(b) ☐ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

PF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e) |

☐

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States and Italy |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

6,850,000(2)(4)

|

| 8. |

SHARED VOTING POWER |

0

|

| 9. |

SOLE DISPOSITIVE POWER |

6,850,000(4)

|

| 10. |

SHARED DISPOSITIVE POWER |

0

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,850,000(4) |

| 12. |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES |

☐

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%(5) |

| 14. |

TYPE OF REPORTING PERSON

IN |

| (4) | Reflects 6,850,000 Class B Ordinary Shares of the Issuer

issuable upon conversion of 6,850,000 Class A Ordinary Shares, consisting of (i) 4,600,000 Class A Ordinary Shares held directly by Daniel

Joseph McClory and (ii) 2,250,000 Class A Ordinary Shares held by Pinehurst Partners LLC, which Daniel Joseph McClory is deemed to beneficially

own. The Class A Ordinary Shares will convert on a one-to-one basis into Class B Ordinary Shares (i) at the option of the holder or (ii)

automatically upon the transfer of the Class A Ordinary Shares, except upon transfer to another holder of Class A Ordinary Shares. |

| (5) | The calculation assumes that there was a total of 11,410,000

Class B Ordinary Shares outstanding as of February 29, 2024, which is the sum of (i) the 4,560,000 Class B Ordinary Shares outstanding

as of February 29, 2024, and (ii) the 6,850,000 Class B Ordinary Shares issuable upon conversion of the Class A Ordinary Shares beneficially

owned by Daniel Joseph McClory (including the 4,550,000 Class A Ordinary Shares that were acquired by Mr. McClory). |

Page 4 of 7 pages

CUSIP

No. G13311108

Explanatory Note

The Reporting Persons (as defined below) previously

filed a Schedule 13G on February 14, 2024, pursuant to Rule 13d-1(d) of the Act. On February 29, 2024, Daniel Joseph McClory acquired

beneficial ownership of an aggregate of 4,550,000 Class A Ordinary Shares, which can convert on a one-to-one basis into Class B Ordinary

Shares, and upon conversion would constitute acquiring more than 2% of the outstanding Class B Ordinary Shares within a twelve-month period.

The Reporting Persons are filing this Schedule 13D (this “Schedule 13D”) in connection with this acquisition.

Item 1. Security and Issuer.

This Schedule 13D relates to the Class B Ordinary

Shares of the Issuer. The Issuer has its principal executive offices at Connaught House, 5th Floor, One Burlington Road, Dublin 4, D04

C5Y6, Ireland.

Item 2. Identity and Background.

| (a) | This Schedule 13D is being jointly filed by Pinehurst Partners LLC,

a Colorado limited liability company, and Daniel Joseph McClory, an individual (together,

the “Reporting Persons”), pursuant to a joint filing agreement, dated March 6, 2024 (the “Joint Filing Agreement”),

which is filed as Exhibit 1 to this Schedule 13D and is incorporated by reference herein. |

| (b) | The principal business address of Pinehurst Partners LLC is 6526 Gunpark Drive, Suite 370-103, Boulder,

CO 80301. The principal business address of Daniel Joseph McClory is c/o Brera Holdings PLC, Connaught House, 5th Floor, One Burlington

Road, Dublin 4, D04 C5Y6, Ireland. |

| (c) | The principal business of Pinehurst Partners LLC is to serve as an investment vehicle to hold and transact

securities for the Roth individual retirement account of Daniel Joseph McClory. Daniel Joseph McClory’s principal occupation or

employment is as an investment banker. Mr. McClory is the Chief Executive Officer of Boustead & Company Limited, and serves as the

Managing Director, Head of Equity Capital Markets and Head of China for its U.S.-based subsidiary, Boustead Securities, LLC. Mr. McClory

also serves as Executive Chairman and a director on the board of directors of the Issuer. |

| (d) | During the last five years, the Reporting Persons have not been convicted in any criminal proceeding (excluding

traffic violations or similar misdemeanors). |

| (e) | During the last five years, the Reporting Persons have not been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws. |

| (f) | Pinehurst Partners LLC is a Colorado limited liability company. Daniel Joseph McClory is a citizen of

the United States and Italy. |

Item 3. Source and Amount of Funds or Other

Consideration.

On February 29, 2024, Daniel Joseph McClory purchased

2,250,000 Class A Ordinary Shares in a private transaction pursuant to a share purchase agreement, dated as of February 29, 2024, between

Mr. McClory and Niteroi SpA, for $1,500,000 (the “Niteroi Purchase Agreement”). The price for the Class A Ordinary Shares

is to be paid in two payments of $375,000, one on or before March 4, 2024, and one on or before March 18, 2024, respectively, and one

payment of $750,000 on September 30, 2024. The Class A Ordinary Shares were transferred to Mr. McClory on February 29, 2024. The source

of funding for the purchase of the Class A Ordinary Shares is the personal funds of Daniel Joseph McClory. The foregoing description of

the Niteroi Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Niteroi

Purchase Agreement attached hereto as Exhibit 2.

Page 5 of 7 pages

CUSIP

No. G13311108

On February 29, 2024, Daniel Joseph McClory purchased

2,300,000 Class A Ordinary Shares in a private transaction pursuant to a share purchase agreement, dated as of February 29, 2024, between

Mr. McClory and Alessandro Aleotti, for $1,537,500 (the “Aleotti Purchase Agreement”). The price for the Class A Ordinary

Shares is to be paid in two payments of $375,000, one on or before March 4, 2024, and one on or before March 18, 2024, respectively, and

one payment of $787,500 on September 30, 2024. The Class A Ordinary Shares were transferred to Mr. McClory on February 29, 2024. The source

of funding for the purchase of the Class A Ordinary Shares is the personal funds of Daniel Joseph McClory. The foregoing description of

the Aleotti Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Aleotti

Purchase Agreement attached hereto as Exhibit 3.

Prior acquisitions not previously reported pursuant

to Regulation 13D consist of the following:

On September 21, 2022, Pinehurst Partners LLC

purchased 2,250,000 Class A Ordinary Shares, pursuant to a share subscription letter, dated as of September 21, 2022, between Pinehurst

Partners LLC and the Issuer (the “Pinehurst Subscription Letter”), for $11,250. The source of funding for the purchase of

the Class A Ordinary Shares was the working capital of Pinehurst Partners LLC. The foregoing description of the Pinehurst Subscription

Letter does not purport to be complete and is qualified in its entirety by reference to the full text of the Pinehurst Subscription Letter

attached hereto as Exhibit 4.

On October 5, 2022, Daniel Joseph McClory purchased

50,000 Class A Ordinary Shares, pursuant to a share subscription letter, dated as of October 5, 2022, between Mr. McClory and the Issuer

(the “McClory Subscription Letter”), for $250. The source of funding for the purchase of the Class A Ordinary Shares was the

personal funds of Mr. McClory. The foregoing description of the McClory Subscription Letter does not purport to be complete and is qualified

in its entirety by reference to the full text of the McClory Subscription Letter attached hereto as Exhibit 5.

Item 4. Purpose of Transaction.

The Reporting Persons’ acquisitions of Class

A Ordinary Shares reported on this Schedule 13D were for investment purposes. On July 11, 2022, Mr. McClory was elected as a director

of the Issuer, and on July 30, 2022, Mr. McClory was appointed as Executive Chairman of the Issuer, and in such capacity may have influence

over the corporate activities of the Issuer, including activities which may relate to items described in subparagraphs (a) through (j)

of Item 4 of Schedule 13D.

Except as disclosed in this Item, the Reporting

Persons do not have any current plans or proposals which relate to or would result in any of the events described in subparagraphs (a)

through (j) of Item 4 of Schedule 13D. The Reporting Persons, however, expect to evaluate on a continuing basis their goals and objectives,

other business opportunities available to them and may change their plans or proposals in the future. In determining from time to time

whether to sell the securities reported as beneficially owned in this Schedule 13D (and in what amounts) or to retain such securities,

the Reporting Persons will take into consideration such factors as they deem relevant, including the business and prospects of the Company,

anticipated future developments concerning the Company, existing and anticipated market conditions from time to time, general economic

conditions, regulatory matters, and other opportunities available to the Reporting Persons. In addition, the Reporting Persons may, from

time to time, transfer shares beneficially owned by them for tax, estate or other economic planning purposes. The Reporting Persons reserve

the right to acquire additional securities of the Issuer in the open market, in privately negotiated transactions (which may be with the

Issuer or with third parties) or otherwise, to dispose of all or a portion of their holdings of securities of the Issuer or to change

their intention with respect to any or all of the matters referred to in this Item 4.

Page 6 of 7 pages

CUSIP

No. G13311108

Item 5. Interest in Securities of the Issuer.

(a) and (b) The information contained in rows

7, 8, 9, 10, 11 and 13 on the cover pages of this Schedule 13D (including the footnotes thereto) is incorporated by reference into this

Item 5.

| (c) | The information provided in response to Item 3 and Item 4 hereof is incorporated by reference into this

Item 5(c). Except as described in this Schedule 13D, the Reporting Persons have not effected any transactions in the Class A Ordinary

Shares or the Class B Ordinary Shares during the past 60 days. |

| (d) | No person other than the Reporting Persons are known to have the right to receive, or the power to direct

the receipt of dividends from, or the proceeds from the sale of, the Class A Ordinary Shares held by the Reporting Person. |

Item 6. Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer.

The information provided in response to Item 3

and Item 4 hereof is incorporated by reference into this Item 6.

Other than the relationships described above,

there are no contracts, arrangements, understandings, or relationships (legal or otherwise) among the persons named in Item 2 and between

such persons and any other persons with respect to any securities of the Issuer, including, but not limited to, transfer or voting of

any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division

of profits or loss, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits.

|

Exhibit 1 |

|

Joint Filing Agreement, dated March 6, 2024 |

| Exhibit 2 |

|

Share Purchase Agreement, dated February 29, 2024, between Daniel Joseph McClory and Niteroi SpA |

| Exhibit 3 |

|

Share Purchase Agreement, dated February 29, 2024, between Daniel Joseph McClory and Alessandro Aleotti |

| Exhibit 4 |

|

Share Subscription Letter, dated September 21, 2022, of Pinehurst Partners LLC to Brera Holdings Limited |

| Exhibit 5 |

|

Share Subscription Letter, dated October 5, 2022, of Daniel Joseph McClory to Brera Holdings Limited |

Page 7 of 7 pages

CUSIP

No. G13311108

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: March 6, 2024 |

Pinehurst Partners LLC |

| |

|

|

| |

By: |

/s/ Daniel Joseph McClory |

| |

Name: |

Daniel Joseph McClory |

| |

Title: |

Managing Member |

| |

|

|

| |

/s/ Daniel Joseph McClory |

| |

Daniel Joseph McClory |

Exhibit 1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)

under the Securities Exchange Act of 1934, as amended, each of the undersigned hereby agrees to the joint filing on behalf of each of

them of a statement on Schedule 13D (including amendments thereto) with respect to the Class B Ordinary Shares, $0.005 nominal value per

share, of Brera Holdings PLC, and that this Agreement be included as an Exhibit to such joint filing.

Each of the undersigned acknowledges

that each shall be responsible for the timely filing of any statement (including amendments) on Schedule 13D, and for the completeness

and accuracy of the information concerning him, her, or it contained therein, but shall not be responsible for the completeness and accuracy

of the information concerning the other persons making such filings, except to the extent that he, she, or it knows or has reason to believe

that such information is inaccurate.

| Dated: March 6, 2024 |

Pinehurst Partners LLC |

| |

|

|

| |

By: |

/s/ Daniel Joseph McClory |

| |

Name: |

Daniel Joseph McClory |

| |

Title: |

Managing Member |

| |

|

|

| |

/s/ Daniel Joseph McClory |

| |

Daniel Joseph McClory |

Exhibit 2

SHARE

PURCHASE AGREEMENT

| Name

of Buyer: Daniel Joseph McClory |

Purchase

Price: $1,500,000 |

| Name

of Seller: Niteroi SpA (Adrio Maria de Carolis) |

Date:

February 29, 2024 |

| Name

of Issuer: Brera Holdings PLC |

|

| Amount

and Type of Securities: 2,250,000 Class A Ordinary Shares |

SHARE

PURCHASE AGREEMENT, dated as of the date set forth above (this “Agreement”), by and between the seller named

above (the “Seller”) and the Buyer named above (the “Buyer”). The Seller and the

Buyer are referred to herein as a “Party” and collectively, as the “Parties”.

BACKGROUND

Seller

intends to sell and Buyer intends to purchase the amount and type of securities listed above (the “Securities”)

of the issuer named above (the “Company”).

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and the mutual promises and covenants herein contained, the Seller and the Buyer hereby

agree as follows:

1. Purchase

and Sale. The Seller shall sell, transfer, convey and deliver unto the Buyer the Securities, and the Buyer shall acquire and purchase

from the Seller the Securities.

2. Purchase

Price. The purchase price (the “Purchase Price”) for the Securities, in the aggregate, is the amount, in

immediately available U.S. dollars that is listed above, and it is payable at the Closings (defined below). All payments to be made to

the Seller under this agreement shall be made in U.S. dollars by electronic transfer of immediately available funds to [ ].

Payment in accordance with this clause shall be a good and valid discharge of the Buyer’s obligations to pay the sum in question,

and the Buyer shall not be concerned to see the application of the monies so paid.

3. The

Closings. The first closing of the transactions contemplated by this Agreement (the “First Closing”) shall

take place by exchange of documents among the Parties by fax or courier, as appropriate, on the date hereof. At the First Closing, to

occur on or before March 4, 2024, the Buyer shall pay to the Seller $375,000, and the Seller shall transfer to the Buyer the Securities.

The Buyer shall pay to the Seller a further $375,000 less stamp duty for all Securities purchased hereunder, on or before March 18, 2024

(the “Second Closing”). The Buyer shall pay the remaining $750,000 to the Seller on September 30, 2024 (the

“Third Closing” and together with the First Closing and the Second Closing, the “Closings”).

At the First Closing, the Seller shall deliver to the Buyer (i) a stock transfer form in respect of the Securities duly executed in favour

of the Buyer; and (ii) its Tax Reference Number, having the meaning given to that term by the Stamp Duty (e-Stamping of Instruments and

Self-Assessment) Regulations 2012 (S.I. No. 234 of 2012). At each of the Closings, the Buyer shall pay the Purchase Price to the Seller

in accordance with this Section 3.

4. Representations

and Warranties of the Seller. The Seller represents and warrants to the Buyer as follows:

(a)

The Seller has the power and authority to execute, deliver and perform its obligations under this Agreement and to sell, assign, transfer

and deliver to the Buyer the Securities as contemplated hereby. No permit, consent, approval or authorization of, or declaration, filing

or registration with any governmental or regulatory authority or consent of any third party is required in connection with the execution

and delivery by Seller of this Agreement and the consummation of the transactions contemplated hereby.

(b)

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby or compliance with

the terms and conditions hereof by the Seller, will violate or result in a breach of any term or provision of any agreement to which

the Seller is bound or is a party, or be in conflict with or constitute a default under, or cause the acceleration of the maturity of

any obligation of the Seller under any existing agreement or violate any order, writ, injunction, decree, statute, rule or regulation

applicable to the Seller or any properties or assets of the Seller.

(c)

This Agreement has been duly and validly executed by the Seller, and constitutes the valid and binding obligation of the Seller, enforceable

against the Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency or other laws affecting

creditors’ rights generally or by limitations, on the availability of equitable remedies.

(d)

The Seller owns the Securities free and clear of all liens, charges, security interests, encumbrances, claims of others, options, warrants,

purchase rights, contracts, commitments, equities or other claims or demands of any kind (collectively, “Liens”),

and upon delivery of the Securities to the Buyer, the Buyer will acquire good, valid and marketable title thereto free and clear of all

Liens. The Seller is not a party to any option, warrant, purchase right, or other contract or commitment that could require the Seller

to sell, transfer, or otherwise dispose of any shares or other securities of the Company (other than pursuant to this Agreement). The

Seller is not a party to any voting trust, proxy, or other agreement or understanding with respect to the voting of any shares of the

Company.

(e)

The Seller acknowledges and understands that the Buyer may possess material nonpublic information regarding the Company not known to

the Seller that may impact the value of the Securities, including, without limitation, (x) information received by the Buyer in the Buyer’s

capacity as a director, officer, and significant shareholder of the Company, (y) information otherwise received from the Company on a

confidential basis, and (z) information received on a privileged basis from the attorneys and financial advisers representing the Company

(collectively, the “Information”), and that the Buyer is not disclosing the Information to the Seller. The

Seller understands, based on its experience, the disadvantage to which the Seller is subject due to the disparity of information between

the Seller and the Buyer. Notwithstanding such disparity, the Seller has deemed it appropriate to enter into this Agreement and to consummate

the transactions contemplated hereby.

5. Representations

and Warranties of the Buyer. The Buyer represents and warrants to the Seller as follows:

(a)

The Buyer has full power and authority to enter into this Agreement and to carry out the transactions contemplated hereby. This Agreement

constitutes a valid and binding obligation of the Buyer enforceable in accordance with its terms, except as (i) the enforceability hereof

may be limited by bankruptcy, insolvency or similar laws affecting the enforceability of creditor’s rights generally and (ii) the

availability of equitable remedies may be limited by equitable principles of general applicability.

(b)

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby or compliance with

the terms and conditions hereof by the Buyer, will violate or result in a breach of any term or provision of any agreement to which the

Buyer is bound or is a party, or be in conflict with or constitute a default under, or cause the acceleration of the maturity of any

obligation of the Seller under any existing agreement or violate any order, writ, injunction, decree, statute, rule or regulation applicable

to the Seller or any properties or assets of the Seller.

(c)

The Buyer is acquiring the Securities for its own account for investment and not for the account of any other person and not with a view

to or for distribution, assignment or resale in connection with any distribution within the meaning of the Securities Act of 1933, as

amended. The Buyer agrees not to sell or otherwise transfer the Securities unless they are registered under applicable federal and state

securities laws, or an exemption or exemptions from such registration are available.

(d)

No permit, consent, approval or authorization of, or declaration, filing or registration with any governmental or regulatory authority

or the consent of any third party is required in connection with the execution and delivery by the Buyer of this Agreement and the consummation

of the transactions contemplated hereby. The Buyer shall pay stamp duty to the Irish authorities prior to the registration of the shares

purchased hereunder in the register of members of the Company, and deduct this one percent (1.0%) fee from the proceeds of the Second

Closing.

(e)

The Buyer (i) is an “accredited investor” as defined in Rule 501(a) under the Securities Act of 1933, as amended, and (ii)

has such experience in business and financial matters that it is capable of evaluating the merits and risks of an investment in the Securities.

The Buyer acknowledges that an investment in the Securities is speculative and involves a high degree of risk.

6. Purchase

Price Adjustment. Each Party further covenants, agrees, and acknowledges that in the event, prior to the First Closing, of any reorganization,

recapitalization, reclassification, or split-up of the outstanding share capital of the Company, or if the Company shall declare a share

dividend or distribute shares to its shareholders, then, and in each such case, the number of Securities immediately prior to such subdivision

shall be proportionally adjusted as applicable and the Purchase Price shall be adjusted in accordance therewith. Any such adjustment

shall be effective at the close of business on the effective date of such subdivision or combination or if any adjustment is the result

of a share dividend or distribution then the effective date for such adjustment thereon shall be the record date therefor.

7. Post-Closings

Covenants. The Parties agree that if at any time after the Closings any further action is necessary or desirable to carry out the

purposes of this Agreement, each of the Parties will take such further action (including the execution and delivery of such further instruments

and documents) as any other Party may reasonably request, all at the sole cost and expense of the requesting Party. The Seller declares

that so long as it remains the registered holder of any of the Securities after the First Closing, it will:

(a)

hold those Securities and all dividends and other distributions in respect of them, and all other rights arising out of or in connection

with them, in trust for the Buyer and its successors in title; and

(b)

at all times deal with and dispose of those Securities, and all such dividends, distributions and rights attaching to them, as the Buyer

or any such successor may direct.

8. Company

Consent. The Parties have sought and obtained the consent of the Company to the transfer of the Securities and the waiver of any

applicable transfer restrictions. A copy of the Consent is attached to this Agreement as Exhibit A.

9. Miscellaneous.

(a)

Facsimile Execution and Delivery. Facsimile execution and delivery of this Agreement is legal, valid and binding execution and

delivery for all purposes.

(b)

No Third-Party Beneficiaries. This Agreement shall not confer any rights or remedies upon any person other than the Parties and

their respective successors and permitted assigns.

(c)

Entire Agreement. This Agreement (including the documents referred to herein) constitutes the entire agreement among the Parties

and supersedes any prior understandings, agreements, or representations by or among the Parties, written or oral, to the extent they

related in any way to the subject matter hereof.

(d)

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of

which together will constitute one and the same instrument.

(e)

Headings. The Section headings contained in this Agreement are inserted for convenience only and shall not affect in any way the

meaning or interpretation of this Agreement.

(f)

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of Ireland without regard to principles

of conflicts of laws.

(g)

Amendments and Waivers. No amendment of any provision of this Agreement shall be valid unless the same shall be in writing and

signed by the Buyer and the Seller or their respective representatives. No waiver by either Party of any default, misrepresentation,

or breach of warranty or covenant hereunder, whether intentional or not, shall be deemed to extend to any prior or subsequent default,

misrepresentation, or breach of warranty or covenant hereunder or affect in any way any rights arising by virtue of any prior or subsequent

such occurrence.

(h)

Severability. Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall

not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending

term or provision in any other situation or in any other jurisdiction.

(i)

Expenses. Each of the Parties will bear his or its own costs and expenses (including legal fees and expenses) incurred in connection

with this Agreement and the transactions contemplated hereby.

(j)

Specific Performance. Each Party acknowledges and agrees that the other Party would be damaged irreparably in the event any of

the provisions of this Agreement are not performed in accordance with their specific terms or otherwise are breached. Accordingly, each

Party agrees that the other Party shall be entitled to an injunction or injunctions to prevent breaches of the provisions of this Agreement

and to enforce specifically this Agreement and the terms and provisions hereof in any action instituted in any court of the United States

or any state thereof having jurisdiction over the Parties and the matter, in addition to any other remedy to which they may be entitled,

at law or in equity.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement by their duly authorized representatives as of the date first written

above.

| SELLER |

|

| |

|

| /s/ Niteroi SpA (Adrio Maria de Carolis) |

|

| |

|

| BUYER |

|

| |

|

| /s/ Daniel Joseph McClory |

|

EXHIBIT

A

CONSENT

OF COMPANY

Reference

is made to that certain Share Purchase Agreement, dated February 29, 2024 (the “Share Purchase Agreement”), between

Daniel Joseph McClory (the “Buyer”) and Niteroi SpA (Adrio Maria de Carolis) (the “Seller”) relating

to the sale of the Securities as described therein. Capitalized terms used, but not otherwise defined, herein have the meanings ascribed

to them in the Share Purchase Agreement.

Brera

Holdings PLC (the “Company”) hereby consents to the terms and provisions of the Share Purchase Agreement and agrees

to waive any Company imposed transfer restrictions on the transfer of the Securities. The Company hereby grants approval to the Company’s

transfer agent to remove the transfer restrictions on the Securities subject to this Share Purchase Agreement.

IN

WITNESS WHEREOF, the Company is executing this consent on February 29, 2024.

| |

Brera Holdings PLC |

| |

|

|

| |

By: |

/s/

Pierre Galoppi |

| |

|

Name: Pierre Galoppi |

| |

|

Title: Chief Executive

Officer |

Exhibit 3

SHARE

PURCHASE AGREEMENT

| Name of Buyer: Daniel Joseph McClory |

Purchase Price: $1,537,500 |

| Name of Seller: Alessandro Aleotti |

Date: February 29, 2024 |

| Name of Issuer: Brera Holdings PLC |

|

| Amount and Type of Securities: 2,300,000 Class A Ordinary Shares |

SHARE

PURCHASE AGREEMENT, dated as of the date set forth above (this “Agreement”), by and between the seller named

above (the “Seller”) and the Buyer named above (the “Buyer”). The Seller and the

Buyer are referred to herein as a “Party” and collectively, as the “Parties”.

BACKGROUND

Seller

intends to sell and Buyer intends to purchase the amount and type of securities listed above (the “Securities”)

of the issuer named above (the “Company”).

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and the mutual promises and covenants herein contained, the Seller and the Buyer hereby

agree as follows:

1. Purchase

and Sale. The Seller shall sell, transfer, convey and deliver unto the Buyer the Securities, and the Buyer shall acquire and purchase

from the Seller the Securities.

2. Purchase

Price. The purchase price (the “Purchase Price”) for the Securities, in the aggregate, is the amount, in

immediately available U.S. dollars that is listed above, and it is payable at the Closings (defined below). All payments to be made to

the Seller under this agreement shall be made in U.S. dollars by electronic transfer of immediately available funds to [ ].

Payment in accordance with this clause shall be a good and valid discharge of the Buyer’s obligations to pay the sum in question,

and the Buyer shall not be concerned to see the application of the monies so paid.

3. The

Closings. The first closing of the transactions contemplated by this Agreement (the “First Closing”) shall

take place by exchange of documents among the Parties by fax or courier, as appropriate, on the date hereof. At the First Closing, to

occur on or before March 4, 2024, the Buyer shall pay to the Seller $375,000, and the Seller shall transfer to the Buyer the Securities.

The Buyer shall pay to the Seller a further $375,000 less stamp duty for all Securities purchased hereunder, on or before March 18, 2024

(the “Second Closing”). The Buyer shall pay the remaining $787,500 to the Seller on September 30, 2024 (the

“Third Closing” and together with the First Closing and the Second Closing, the “Closings”).

At the First Closing, the Seller shall deliver to the Buyer (i) a stock transfer form in respect of the Securities duly executed in favour

of the Buyer; and (ii) its Tax Reference Number, having the meaning given to that term by the Stamp Duty (e-Stamping of Instruments and

Self-Assessment) Regulations 2012 (S.I. No. 234 of 2012). At each of the Closings, the Buyer shall pay the Purchase Price to the Seller

in accordance with this Section 3.

4. Representations

and Warranties of the Seller. The Seller represents and warrants to the Buyer as follows:

(a)

The Seller has the power and authority to execute, deliver and perform its obligations under this Agreement and to sell, assign, transfer

and deliver to the Buyer the Securities as contemplated hereby. No permit, consent, approval or authorization of, or declaration, filing

or registration with any governmental or regulatory authority or consent of any third party is required in connection with the execution

and delivery by Seller of this Agreement and the consummation of the transactions contemplated hereby.

(b)

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby or compliance with

the terms and conditions hereof by the Seller, will violate or result in a breach of any term or provision of any agreement to which

the Seller is bound or is a party, or be in conflict with or constitute a default under, or cause the acceleration of the maturity of

any obligation of the Seller under any existing agreement or violate any order, writ, injunction, decree, statute, rule or regulation

applicable to the Seller or any properties or assets of the Seller.

(c)

This Agreement has been duly and validly executed by the Seller, and constitutes the valid and binding obligation of the Seller, enforceable

against the Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency or other laws affecting

creditors’ rights generally or by limitations, on the availability of equitable remedies.

(d)

The Seller owns the Securities free and clear of all liens, charges, security interests, encumbrances, claims of others, options, warrants,

purchase rights, contracts, commitments, equities or other claims or demands of any kind (collectively, “Liens”),

and upon delivery of the Securities to the Buyer, the Buyer will acquire good, valid and marketable title thereto free and clear of all

Liens. The Seller is not a party to any option, warrant, purchase right, or other contract or commitment that could require the Seller

to sell, transfer, or otherwise dispose of any shares or other securities of the Company (other than pursuant to this Agreement). The

Seller is not a party to any voting trust, proxy, or other agreement or understanding with respect to the voting of any shares of the

Company.

5. Representations

and Warranties of the Buyer. The Buyer represents and warrants to the Seller as follows:

(a)

The Buyer has full power and authority to enter into this Agreement and to carry out the transactions contemplated hereby. This Agreement

constitutes a valid and binding obligation of the Buyer enforceable in accordance with its terms, except as (i) the enforceability hereof

may be limited by bankruptcy, insolvency or similar laws affecting the enforceability of creditor’s rights generally and (ii) the

availability of equitable remedies may be limited by equitable principles of general applicability.

(b)

Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated hereby or compliance with

the terms and conditions hereof by the Buyer, will violate or result in a breach of any term or provision of any agreement to which the

Buyer is bound or is a party, or be in conflict with or constitute a default under, or cause the acceleration of the maturity of any

obligation of the Seller under any existing agreement or violate any order, writ, injunction, decree, statute, rule or regulation applicable

to the Seller or any properties or assets of the Seller.

(c)

The Buyer is acquiring the Securities for its own account for investment and not for the account of any other person and not with a view

to or for distribution, assignment or resale in connection with any distribution within the meaning of the Securities Act of 1933, as

amended. The Buyer agrees not to sell or otherwise transfer the Securities unless they are registered under applicable federal and state

securities laws, or an exemption or exemptions from such registration are available.

(d)

No permit, consent, approval or authorization of, or declaration, filing or registration with any governmental or regulatory authority

or the consent of any third party is required in connection with the execution and delivery by the Buyer of this Agreement and the consummation

of the transactions contemplated hereby. The Buyer shall pay stamp duty to the Irish authorities prior to the registration of the shares

purchased hereunder in the register of members of the Company, and deduct this one percent (1.0%) fee from the proceeds of the Second

Closing.

(e)

The Buyer (i) is an “accredited investor” as defined in Rule 501(a) under the Securities Act of 1933, as amended, and (ii)

has such experience in business and financial matters that it is capable of evaluating the merits and risks of an investment in the Securities.

The Buyer acknowledges that an investment in the Securities is speculative and involves a high degree of risk.

6. Purchase

Price Adjustment. Each Party further covenants, agrees, and acknowledges that in the event, prior to the First Closing, of any reorganization,

recapitalization, reclassification, or split-up of the outstanding share capital of the Company, or if the Company shall declare a share

dividend or distribute shares to its shareholders, then, and in each such case, the number of Securities immediately prior to such subdivision

shall be proportionally adjusted as applicable and the Purchase Price shall be adjusted in accordance therewith. Any such adjustment

shall be effective at the close of business on the effective date of such subdivision or combination or if any adjustment is the result

of a share dividend or distribution then the effective date for such adjustment thereon shall be the record date therefor.

7. Post-Closings

Covenants. The Parties agree that if at any time after the Closings any further action is necessary or desirable to carry out the

purposes of this Agreement, each of the Parties will take such further action (including the execution and delivery of such further instruments

and documents) as any other Party may reasonably request, all at the sole cost and expense of the requesting Party. The Seller declares

that so long as it remains the registered holder of any of the Securities after Closing, it will:

(a)

hold those Securities and all dividends and other distributions in respect of them, and all other rights arising out of or in connection

with them, in trust for the Buyer and its successors in title; and

(b)

at all times deal with and dispose of those Securities, and all such dividends, distributions and rights attaching to them, as the Buyer

or any such successor may direct.

8. Company

Consent. The Parties have sought and obtained the consent of the Company to the transfer of the Securities and the waiver of any

applicable transfer restrictions. A copy of the Consent is attached to this Agreement as Exhibit A.

9. Miscellaneous.

(a)

Facsimile Execution and Delivery. Facsimile execution and delivery of this Agreement is legal, valid and binding execution and

delivery for all purposes.

(b)

No Third-Party Beneficiaries. This Agreement shall not confer any rights or remedies upon any person other than the Parties and

their respective successors and permitted assigns.

(c)

Entire Agreement. This Agreement (including the documents referred to herein) constitutes the entire agreement among the Parties

and supersedes any prior understandings, agreements, or representations by or among the Parties, written or oral, to the extent they

related in any way to the subject matter hereof.

(d)

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of

which together will constitute one and the same instrument.

(e)

Headings. The Section headings contained in this Agreement are inserted for convenience only and shall not affect in any way the

meaning or interpretation of this Agreement.

(f)

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of Ireland without regard to principles

of conflicts of laws.

(g)

Amendments and Waivers. No amendment of any provision of this Agreement shall be valid unless the same shall be in writing and

signed by the Buyer and the Seller or their respective representatives. No waiver by either Party of any default, misrepresentation,

or breach of warranty or covenant hereunder, whether intentional or not, shall be deemed to extend to any prior or subsequent default,

misrepresentation, or breach of warranty or covenant hereunder or affect in any way any rights arising by virtue of any prior or subsequent

such occurrence.

(h)

Severability. Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall

not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending

term or provision in any other situation or in any other jurisdiction.

(i)

Expenses. Each of the Parties will bear his or its own costs and expenses (including legal fees and expenses) incurred in connection

with this Agreement and the transactions contemplated hereby.

(j)

Specific Performance. Each Party acknowledges and agrees that the other Party would be damaged irreparably in the event any of

the provisions of this Agreement are not performed in accordance with their specific terms or otherwise are breached. Accordingly, each

Party agrees that the other Party shall be entitled to an injunction or injunctions to prevent breaches of the provisions of this Agreement

and to enforce specifically this Agreement and the terms and provisions hereof in any action instituted in any court of the United States

or any state thereof having jurisdiction over the Parties and the matter, in addition to any other remedy to which they may be entitled,

at law or in equity.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement by their duly authorized representatives as of the date first written

above.

| SELLER |

|

| |

|

| /s/ Alessandro Aleotti |

|

| |

|

| BUYER |

|

| |

|

| /s/ Daniel Joseph McClory |

|

EXHIBIT

A

CONSENT

OF COMPANY

Reference is made to that certain Share Purchase Agreement, dated February

29, 2024 (the “Share Purchase Agreement”), between Daniel Joseph McClory (the “Buyer”) and Alessandro

Aleotti (the “Seller”) relating to the sale of the Securities as described therein. Capitalized terms used, but not

otherwise defined, herein have the meanings ascribed to them in the Share Purchase Agreement.

Brera

Holdings PLC (the “Company”) hereby consents to the terms and provisions of the Share Purchase Agreement and agrees

to waive any Company imposed transfer restrictions on the transfer of the Securities. The Company hereby grants approval to the Company’s

transfer agent to remove the transfer restrictions on the Securities subject to this Share Purchase Agreement.

IN

WITNESS WHEREOF, the Company is executing this consent on February 29, 2024.

| |

Brera Holdings PLC |

| |

|

|

| |

By: |

/s/

Pierre Galoppi |

| |

|

Name: Pierre Galoppi |

| |

|

Title: Chief Executive

Officer |

Exhibit 4

SHARE SUBSCRIPTION LETTER

| To: |

The Directors |

| |

Brera Holdings Limited, |

| |

5th Floor Rear Connaught House, |

| |

1 Burlington Road, Dublin 4 |

Dated 21 day of September 2022

Re: Brera Holdings Limited (company number:

721923) (the “Company”)

Dear Sirs,

We, the undersigned, hereby irrevocably and unconditionally

subscribe for 2,250,000 A Ordinary Shares of $0.005 each (the “Shares”) in the capital of the Company for a total subscription

price of $11,250 (the “Subscription Amount”).

We hereby confirm that we have lodged the Subscription

Amount to the Company’s bank account of as consideration for the Shares.

We hereby irrevocably request and agree that,

upon receipt by the Company of the Subscription Amount, you allot the Shares to and enter our name in the register of members of the Company

as the legal holder of the Shares and forward to us the appropriate share certificate in respect of the Shares.

We hereby irrevocably acknowledge and agree that

the Shares shall have the rights set out in the Constitution of the Company as adopted from time to time.

This letter and all non-contractual obligations

arising from or connected with it shall be governed by, and shall be construed in accordance with, the laws of Ireland.

This letter may be executed using an electronic

signature and in any number of counterparts, each of which will be deemed to be an original and which together will constitute the same

letter.

Signed:

| /s/ Daniel Joseph McClory |

|

| For and on behalf of |

|

| PINEHURST PARTNERS LLC |

|

Exhibit 5

SHARE SUBSCRIPTION LETTER

| To: |

The Directors |

| |

Brera Holdings Limited, |

| |

5th Floor Rear Connaught House, |

| |

1 Burlington Road, Dublin 4 |

Dated 5 day of October 2022

Re: Brera Holdings Limited

(company number: 721923) (the “Company”)

Dear

Sirs,

I, the undersigned, hereby irrevocably

and unconditionally subscribe for 50,000 A Ordinary Shares of $0.005 each (the “Shares”) in the capital of the Company

for a total subscription price of $250.00 (the “Subscription Amount”).

I hereby confirm that I have lodged the Subscription Amount

to the Company’s bank account of as consideration for the Shares.

I hereby irrevocably request and

agree that, upon receipt by the Company of the Subscription Amount, you allot the Shares to and enter my name in the register of members

of the Company as the legal holder of the Shares.

I hereby irrevocably acknowledge and agree that the Shares

shall have the rights set out in the Constitution of the Company as adopted from time to time.

This letter and all non-contractual obligations arising

from or connected with it shall be governed by, and shall be construed in accordance with, the laws of Ireland.

This letter may be executed using an electronic signature

and in any number of counterparts, each of which will be deemed to be an original and which together will constitute the same letter.

Signed:

| /s/ Daniel McClory |

|

| DANIEL MCCLORY |

|

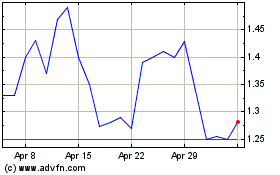

Brera (NASDAQ:BREA)

Historical Stock Chart

From Apr 2024 to May 2024

Brera (NASDAQ:BREA)

Historical Stock Chart

From May 2023 to May 2024