Presto Automation Inc. (Nasdaq:PRST) (“Presto” or the “Company”),

one of the largest AI and automation technology providers to the

restaurant industry, today announced it has closed a financing led

by its existing investors, including Remus Capital, a fund

controlled by the Company’s Chairman, Krishna K. Gupta, and other

investors, involving the sale of $6.0 million of convertible

subordinated notes (the “Notes”). One of the existing investors is

also exchanging 3.0 million shares of the Company’s common stock

which was purchased on November 21, 2023 for $3.0 million of Notes.

Chardan acted as the placement agent for the offering.

“This capital injection is a strong signal of my commitment to

Presto and its shareholders - we have tremendous belief in the

Company’s prospects in its rapidly-growing market and our

continuing efforts to enhance shareholder value,” said Mr.

Gupta.

“On the commercial side, our Presto AI Voice product serving the

drive-thru restaurant market is enjoying significant momentum. Over

a period of 2 months, we have more than doubled our total number of

live stores on the Presto Voice technology to 145 as of February 1,

2024, including 54 locations that use the most advanced version of

our AI technology. Restaurant operators are embracing our solution

in part due to the California $20/hour minimum wage mandate which

is taking effect on April 1,” Mr. Gupta added.

Presto also announced that its Chief Executive Officer, Xavier

Casanova, has resigned effective immediately, and the Company

wishes him well. The Company will be announcing a replacement in

the near future.

“The board has full confidence in our exceptional executive

management team’s experience and ability to continue executing on

the commercial scale-up opportunity immediately in front of

Presto,” said Mr. Gupta

The Company has on February 8, 2024 received a court order

representing the favorable verdict received from the Singapore

Court of Appeal in the final hearing of its case against XAC

Automation Corp (5490.TWO) on January 16, 2024. The favorable

verdict dismissed XAC’s appeal and upheld the award of $11.1

million previously made to the Company adding an additional SGD

50,000 (approximately $32,000) award for costs associated with the

appeal. XAC has no further recourse to set aside the award.

Domesticating the award in Taiwan may take between several months

to more than a year, but the Company is currently exploring

alternatives to enforce or monetize the award in a shorter

timeline.

In addition, Presto said that it recently entered into an

amendment to its Cooperation Agreement with Hi Auto Ltd. (“Hi

Auto”) which supplies the AI technology used at 347 Checkers

corporate and franchised locations. Commencing on May 1, 2024, the

Company and Hi Auto will each be permitted to compete for the

Checkers relationship, including franchised locations.

The Notes are convertible into 36 million shares of common stock

at an initial conversion price of $0.25 per share and carry an

interest rate of 7.5% per annum on a pay-in-kind basis. The

issuance of the Notes triggered antidilution adjustments associated

with the Company’s previous financing rounds.

The Company projects that the net proceeds from the offering,

together with its other cash resources and projected revenue, are

sufficient to sustain operations through the end of February 2024.

The Company is required to raise at least an additional $6.0

million in gross proceeds on or before March 8, 2024 pursuant to

the terms of the Forbearance Agreement it entered into with its

lenders in order to receive additional forbearance.

In connection with the recent financing, Presto announced that

Matthew MacDonald had joined its Board of Directors. Mr. MacDonald

is a Managing Director of Erithmitic Inc., a commercial real estate

bridge lending platform, which he joined in June 2022. He is also

the founder of Cottage Avenue, a hospitality-focused investment

company, and a partner in Great Canadian Heli-Skiing. Mr.

MacDonald was a founder of Ventoux Acquisition Holdings, the

co-sponsor of Ventoux CCM Acquisition Corporation, the special

purpose acquisition company that merged with Presto.

About Presto Automation Inc.

Presto (Nasdaq: PRST) provides enterprise-grade AI and

automation solutions to the restaurant industry. Our solutions are

designed to decrease labor costs, improve staff productivity,

increase revenue, and enhance the guest experience. We offer our AI

solution, Presto Voice™, to quick service restaurants (QSR) and our

pay-at-table tablet solution, Presto Touch, to casual dining

chains. Some of the most recognized restaurant names in the United

States are among our customers, including Carl’s Jr., Hardee’s, and

Checkers for Presto Voice™ and Applebee’s, Chili’s, and Red

Lobster for Presto Touch.

Contact

Please direct any inquiries to:Krishna

Guptainvestor@presto.com

Forward Looking Statements

This press release contains statements that constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements, other

than statements of present or historical fact included in this

press release, regarding the Company’s strategy, future operations,

prospects, plans and objectives of management, are forward-looking

statements. When used in this press release, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” “initiatives,” “continue,” the

negative of such terms and other similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These

forward-looking statements are based on management’s current

expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of

future events. The forward-looking statements speak only as of the

date of this press release or as of the date they are made. The

Company cautions you that these forward-looking statements are

subject to numerous risks and uncertainties, most of which are

difficult to predict and many of which are beyond the control of

the Company. In addition, the Company cautions you that the

forward-looking statements contained in this press release are

subject to risks and uncertainties, including but not limited to,

the Company’s ability to secure additional capital resources, the

Company’s ability to compete successfully to maintain the

relationship with Checkers, the Company’s ability to continue to

roll out its AI technology with current franchisees, the Company’s

ability to engage with new customers for its AI technology, and

those additional risks and uncertainties discussed under the

heading “Risk Factors” in the Form 10-K filed by the Company with

the Securities and Exchange Commission (the “SEC”) on October 11,

2023 and the other documents filed, or to be filed, by the Company

with the SEC. Additional information concerning these and other

factors that may impact the operations and projections discussed

herein can be found in the reports that the Company has filed and

will file from time to time with the SEC. These SEC filings are

available publicly on the SEC’s website at www.sec.gov. Should one

or more of the risks or uncertainties described in this press

release materialize or should underlying assumptions prove

incorrect, actual results and plans could differ materially from

those expressed in any forward-looking statements. Except as

otherwise required by applicable law, the Company disclaims any

duty to update any forward-looking statements, all of which are

expressly qualified by the statements in this section, to reflect

events or circumstances after the date of this press release.

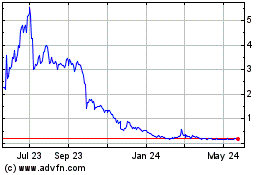

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From Oct 2024 to Oct 2024

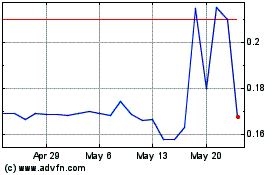

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From Oct 2023 to Oct 2024