0001770141false00017701412024-01-112024-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 11, 2024

Date of Report (date of earliest event reported)

UpHealth, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-38924 (Commission File Number) | 83-3838045 (I.R.S. Employer Identification Number) |

| | | | | | | | |

| 14000 S. Military Trail, Suite 203 | |

| Delray Beach, FL 33484 | |

| (Address of principal executive offices, including zip code) | |

| | |

(888) 424-3646 |

| (Registrant's telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | UPH(1) | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

___________________________________________________

(1)On December 11, 2023, UpHealth, Inc. (the “Company”) received written notice from the staff of NYSE Regulation that it has commenced proceedings to delist the common stock, par value $0.0001 per share, of the Company (ticker symbol: UPH) (the “Common Stock”), from the New York Stock Exchange (“NYSE”), and suspended trading in the Common Stock pending the completion of such proceedings. As a result, effective December 12, 2023, the Common Stock is trading in the over-the-counter market under the symbol “UPHL”. The Company timely filed an appeal of this determination with the NYSE and requested a hearing before the NYSE Regulatory Oversight Committee’s Committee for Review. On January 12, 2024, the NYSE granted the Company’s request for a hearing, which is expected to take place on April 17, 2024.

| | | | | |

Item 1.01 | Entry into a Material Definitive Agreement. |

Tripartite Agreement

On January 11, 2024, UpHealth, Inc. (the “Company”) entered into an agreement of resignation, appointment and acceptance, dated as of January 11, 2024 (the “Tripartite Agreement”), with Wilmington Trust, National Association (the “Resigning Trustee”), and The Bank of New York Mellon Trust Company, N.A. (the “Successor Trustee”), with respect to the indenture, dated as of June 9, 2021, by and among UpHealth and the Resigning Trustee, in its capacity as trustee thereunder, governing the Company’s 6.25% Unsecured Convertible Notes due 2026 (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Unsecured Notes Indenture”), pursuant to which the Resigning Trustee has resigned, and the Successor Trustee has been appointed its successor, in its capacities as trustee, note registrar, custodian, conversion agent and paying agent under the Unsecured Notes Indenture.

The Tripartite Agreement provides that, effective as of the date thereof, (a) the Resigning Trustee assigns, transfers, delivers and confirms to the Successor Trustee all of its rights, title and interest under the Unsecured Notes Indenture and all of the rights, trusts and powers as trustee, note registrar, custodian, conversion agent and paying agent under the Unsecured Notes Indenture, and (b) the Successor Trustee accepts its appointment as successor trustee, note registrar, custodian, conversion agent and paying agent under the Unsecured Notes Indenture, and accepts and shall assume the rights, powers, duties and obligations of the Resigning Trustee as trustee under the Unsecured Notes Indenture; provided, however, that the Resigning Trustee’s resignation as note registrar, custodian, conversion agent and paying agent, and the Successor Trustee’s appointment as successor in those capacities, will become effective ten business days following the date of the Tripartite Agreement.

The foregoing description of the Tripartite Agreement is qualified in its entirety by reference to the full text of the Tripartite Agreement, a copy of which is filed as Exhibit 4.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

| | | | | |

Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As previously disclosed in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission (the “SEC”) on December 13, 2023, on December 11, 2023, the Company received written notice from the staff of NYSE Regulation (the “Staff”) that, because the Company was no longer in compliance with the continued listing standard under Section 802.01B of the NYSE Listed Company Manual requiring listed companies to maintain an average global market capitalization over a consecutive 30 trading day period of at least $15,000,000 (the “Market Capitalization Rule”), the Staff has commenced proceedings to delist the common stock, par value $0.0001 per share, of the Company (the “Common Stock”), from the New York Stock Exchange (the “NYSE”), and suspended trading in the Common Stock pending the completion of such proceedings. As a result, the Common Stock commenced trading in the over-the-counter market on December 12, 2023 under the trading symbol “UPHL.”

The Company on December 26, 2023 timely filed an appeal with the NYSE that the Common Stock remain listed on the NYSE and requested a hearing before the NYSE Regulatory Oversight Committee’s Committee for Review (the “CFR”). On January 12, 2024, the NYSE granted the Company’s request for a hearing before the CFR. At the CFR hearing, which is expected to take place on April 17, 2024, the Company will submit its plan to regain, and to sustain long-term, compliance with all applicable requirements for continued listing on the NYSE, including compliance with the Market Capitalization Rule.

The delisting action by the Staff will be stayed pending the CFR hearing and the expiration of any additional extension period granted by the CFR following the hearing. The Company intends to continue to take definitive steps in an effort to evidence compliance with the Market Capitalization Rule and other NYSE continued listing requirements; however, there can be no assurance that the CFR will grant the Company’s request for continued listing or that the Company will be able to evidence compliance with the Market Capitalization Rule and other NYSE continued listing requirements at the time of the hearing or within any extension period that may be granted by the CFR.

The information contained in, or incorporated into, Items 1.01 and 3.01 above is incorporated herein by reference.

Closing of Thrasys Transition Agreements

As previously disclosed by the Company in its Current Report on Form 8-K filed with the SEC on September 19, 2023, that same day, UpHealth Holdings, Inc., a wholly-owned subsidiary of the Company (“UpHealth Holdings”), filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). In addition, as previously disclosed by the Company in its Current Report on Form 8-K filed with the SEC on October 20, 2023, that same day, two of UpHealth Holdings’ wholly-owned subsidiaries, Thrasys, Inc. (“Thrasys”) and Behavioral Health Services, LLC (“BHS”), and each of the subsidiaries of Thrasys and BHS (such subsidiaries, collectively with UpHealth Holdings, Thrasys and BHS, being referred to individually herein and collectively as the “Debtors”), filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court. The Chapter 11 cases of the Debtors are being jointly administered under the caption In re UpHealth Holdings, Inc., Case No. 23-11476 (U.S. Bankr. D. Del.), for procedural purposes only.

Furthermore, as previously disclosed by the Company in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 filed with the SEC on November 21, 2023, Thrasys entered into three transition agreements, dated as of November 15, November 16

and November 17, 2023, respectively, with its customers, (i) Local Initiative Health Authority for Los Angeles County, a local public entity operating and doing business as L.A. Care Health Plan, (ii) EmpiRx Health LLC, a Delaware corporation and (iii) the County of Alameda, California, USA (each, a “Transition Agreement”), providing for, among other things, the grant to each customer of a perpetual, non-exclusive license of the applicable source code and related SyntraNetTM platform and the provision by Thrasys of certain transition services during the transition term provided under the applicable Transition Agreement, with the consummation of the transactions contemplated by each Transition Agreement subject to the entry by the Bankruptcy Court of an order authorizing and approving the Transition Agreements, which order was subsequently entered by the Bankruptcy Court.

Accordingly, on December 28, 2023, Thrasys consummated the closing of the transactions contemplated by the Transition Agreements. Following the closing, Thrasys no longer has any operations. Except as otherwise provided in the Transition Agreements, Thrasys will continue to own all intellectual property, subject to the non-exclusive licenses granted pursuant to the Transition Agreements.

Supplement to Risk Factors

As of the date of this Current Report, the Company updates and supplements the risk factors disclosed in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 31, 2023, as supplemented and updated by the risk factors disclosed in the Company’s Quarterly Report on Form 10-Q for the quarterly period September 30, 2023 filed with the SEC on November 21, 2023, with the following risk factor. Any of these risk factors disclosed in the Company’s Annual Report on Form 10-K, Quarterly Report on Form 10-Q, proxy statements on Schedule 14A or herein could result in a significant or material adverse effect on the results of operations or financial condition of the Company. Additional risk factors not presently known to the Company or that it currently deems immaterial may also impair the Company’s business or results of operations. The Company may disclose changes to such risk factors or disclose additional risk factors from time to time in future filings with the SEC.

If we fail to regain compliance with the continued listing requirements of the NYSE, our Common Stock may be delisted and the price of our Common Stock and our ability to access the capital markets could be negatively impacted.

Our Common Stock is currently listed for trading on the NYSE, however, on December 11, 2023, we received written notice from the staff of NYSE Regulation stating that we were no longer in compliance with the continued listing standard under Section 802.01B of the NYSE Listed Company Manual requiring listed companies to maintain an average global market capitalization over a consecutive 30 trading day period of at least $15,000,000 (the “Market Capitalization Rule”), and, as a result, the staff of NYSE Regulation has commenced proceedings to delist our Common Stock and suspended trading of the Common Stock pending the completion of such proceedings. As a result, our Common Stock commenced trading in the over-the-counter market on December 12, 2023 under the trading symbol “UPHL.”

On December 26, 2023, we filed an appeal with the NYSE that the Common Stock remain listed on the NYSE and requested a hearing before the NYSE Regulatory Oversight Committee’s Committee for Review (the “CFR”). On January 12, 2024, the NYSE granted the Company’s request for a hearing before the CFR. At the CFR hearing, which is expected to take place on April 17, 2024, the Company will submit its plan to regain, and to sustain long-term, compliance with all applicable requirements for continued listing on the NYSE, including compliance with the Market Capitalization Rule. The delisting action by the staff of NYSE Regulation will be stayed pending the CFR hearing and the expiration of any additional extension period granted by the CFR following the hearing. We intend to continue to take definitive steps in an effort to evidence compliance with the Market Capitalization Rule and other NYSE continued listing requirements; however, there can be no assurance that the CFR will grant our request for continued listing or that we will be able to evidence compliance with the Market Capitalization Rule and other NYSE continued listing requirements at the time of the hearing or within any extension period that may be granted by the CFR.

The filing of the Chapter 11 cases by the Debtors constituted an event of default under our indenture, dated as of June 9, 2021 (the “Unsecured Notes Indenture”) governing our 6.25% Convertible Senior Notes due 2026 (the “2026 Notes”), and our indenture, dated as of August 18, 2022 (the “Senior Secured Notes Indenture” and together with the Unsecured Notes Indenture, the “Indentures”) governing our Variable Rate Convertible Senior Secured Notes due 2025 (the “2025 Notes”), that accelerated our obligations under the Senior Secured Notes Indenture, and if our request for continued listing of our Common Stock is not granted by the CFR, the delisting of our Common Stock could also lead to an event of default under our Indentures that could result in the acceleration of our obligations under the Indentures, and as a result of such acceleration of our debt obligations in respect of the 2025 Notes, we believe there is substantial doubt about our ability to continue as a going concern. We have entered into the membership interests purchase agreement, dated as of November 16, 2023 (the “Purchase Agreement”), with our wholly-owned subsidiary, Cloudbreak Health, LLC (“Cloudbreak”), and Forest Buyer, LLC (“Forest Buyer”), and the transaction support agreement, dated as of November 16, 2023 (the “Transaction Support Agreement”), with Cloudbreak, Forest Buyer, and certain beneficial holders of the 2025 Notes (being the holders of at least 69% of the 2025 Notes, the “Consenting Senior Secured Noteholders”) and certain beneficial holders of the 2026 Notes (being the holders of at least 88% of the 2026 Notes, the “Consenting Unsecured Noteholders”, and together with the Consenting Senior Secured Noteholders, the “Consenting Noteholders”), pursuant to which, among other things, and subject to obtaining the approval of our stockholders, we will sell Cloudbreak to Forest Buyer and use the proceeds for payment in full of the 2026 Notes and payment in part of the 2025 Notes, and we will enter into waiver and rescission agreements (“Waiver and Rescission Agreements”) with a sufficient percentage of each of the beneficial holders of the 2025 Notes (the “2025 Noteholders”) and the beneficial holders of the 2026 Notes (the “2026 Noteholders”) necessary to waive the existing events of default under the Indentures, and with a sufficient percentage of the 2025 Noteholders to rescind the acceleration of our payment obligations in respect of the 2025 Notes, with such Waiver and Rescission Agreements providing for such waivers and rescission, as applicable. In addition, on December 28, 2023, Thrasys consummated the closing of the transactions contemplated by the Transition Agreements and ceased operations, which going forward will result in substantial reduction of administrative expenses in respect of Thrasys. If the sale of Cloudbreak and the other transactions contemplated

by the Purchase Agreement and the Transaction Support Agreement are consummated, we will retain and focus solely on our profitable operations in our consolidated subsidiary, TTC Healthcare, Inc., a wholly-owned subsidiary of UpHealth Holdings (“TTC Healthcare”), that is a growing, cash-flow positive business engaged in providing behavioral health services, and which has not filed for Chapter 11 protection and is operating in the normal course of business; however, as TTC Healthcare is owned by UpHealth Holdings, which is currently in Chapter 11 bankruptcy, we will need to resolve the Chapter 11 cases in order to own TTC Healthcare without an intermediate entity that is in bankruptcy directly owning TTC Healthcare. We believe that advancement on, and completion of, the above-described transactions will result in significant positive market reaction and an increase in both the trading price of our Common Stock and our market capitalization such that we will evidence full compliance with the Market Capitalization Rule.

We must satisfy the NYSE’s continued listing requirements, including, among other things, the Market Capitalization Rule, or our Common Stock will be delisted from the NYSE, which could have a material adverse effect on our business. If our Common Stock is delisted from the NYSE, it could be more difficult to buy or sell our Common Stock or to obtain accurate quotations and the price of our Common Stock could suffer a material decline, and delisting could also impair our ability to raise capital on acceptable terms, if at all. As of December 12, 2023, our Common Stock is trading in the over-the-counter market, which is a significantly more limited market than the NYSE, and quotation on the over-the-counter market likely results in a less liquid market for existing and potential stockholders to trade our Common Stock and could further depress the trading price of our Common Stock. We can provide no assurance that our Common Stock will continue to trade on this market, that broker-dealers will continue to provide public quotes of our Common Stock on this market, or that the trading volume of our Common Stock will be sufficient to provide for an efficient trading market. Furthermore, if our Common Stock is delisted from the NYSE, it could materially reduce the liquidity of our Common Stock and result in a corresponding material reduction in the price of our Common Stock as a result of the loss of market efficiencies associated with the NYSE and the loss of federal preemption of state securities laws. In addition, delisting could harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of U.S. federal securities laws. Such forward-looking statements include, but are not limited to, statements regarding the hearing before the CFR, including its timing, the Company’s ability to demonstrate compliance with the listing requirements of the NYSE, the delisting of the Common Stock from the NYSE in the event the Company’s appeal is unsuccessful, the trading of the Company’s Common Stock in the over-the-counter market, obtaining customary stockholder approval of the sale of Cloudbreak, the closing, including its timing, of the sale of Cloudbreak, the use of proceeds of the sale, the projected operation and financial performance of the Company and its various subsidiaries, its product offerings and developments and reception of its product by customers, and the Company’s expectations, hopes, beliefs, intentions, plans, prospects or strategies regarding the future revenue and the business plans of the Company’s management team. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this Current Report are based on certain assumptions and analyses made by the management of the Company considering their respective experience and perception of historical trends, current conditions, and expected future developments and their potential effects on the Company as well as other factors they believe are appropriate in the circumstances. There can be no assurance that future developments affecting the Company will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the parties), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the outcome of the CFR hearing and whether the CFR will grant the Company’s request for continued listing, whether the Company will be able to regain and sustain compliance with the continued listing standards of the NYSE or comply with the initial listing standards of another national securities exchange, the closing conditions for the sale of Cloudbreak not being satisfied, the ability of the parties to close the sale on the expected closing date or at all, the ability of the Company to service or otherwise pay its debt obligations, including to holders of the Company’s convertible notes, the mix of services utilized by the Company’s customers and such customers’ needs for these services, market acceptance of new service offerings, the ability of the Company to expand what it does for existing customers as well as to add new customers, uncertainty with respect to how the International Court of Arbitration or the Indian courts shall decide various matters that are before them or that the board of directors of Glocal Healthcare Systems Private Limited (“Glocal”) will act in compliance with its fiduciary duties to Glocal’s shareholders, that the Company will have sufficient capital to operate as anticipated, and the impact that the novel coronavirus and the illness, COVID-19, that it causes, as well as government responses to deal with the spread of this illness and the reopening of economies that have been closed as part of these responses, may have on the Company’s operations, the demand for the Company’s products, global supply chains and economic activity in general. Should one or more of these risks or uncertainties materialize or should any of the assumptions being made prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except as may be required under applicable securities laws.

Additional Information and Where to Find It

In connection with the proposed sale of Cloudbreak, the Company will file with the SEC and furnish to the Company’s stockholders a proxy statement. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN

THE PROXY STATEMENT (IF ANY) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED SALE OF CLOUDBREAK AND THE PARTIES TO THE PROPOSED SALE OF CLOUDBREAK. Investors and stockholders may obtain a free copy of documents filed by the Company with the SEC at the SEC’s website at http://www.sec.gov. In addition, investors and stockholders may obtain a free copy of the Company’s filings with the SEC from the Company’s website at http://investors.uphealthinc.com.

Participants in the Solicitation

The Company and certain of its directors, executive officers, and certain other members of management and employees of the Company may be deemed to be participants in the solicitation of proxies from stockholders of the Company in favor of the proposed sale of Cloudbreak. Information about directors and executive officers of the Company is set forth in the proxy statement for the Company’s Annual Meeting, as filed with the SEC on Schedule 14A on December 12, 2023. Additional information regarding the interests of these individuals and other persons who may be deemed to be participants in the solicitation will be included in the proxy statement with respect to the proposed sale of Cloudbreak that the Company will file with the SEC and furnish to the Company’s stockholders.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | | | | |

| | | |

Exhibit No. | | Description | |

| | | |

4.1 | | |

| | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 18, 2024 UPHEALTH, INC.

| | | | | |

By: | /s/ Martin S.A. Beck |

Name: | Martin S.A. Beck |

Title: | Chief Executive Officer |

AGREEMENT OF RESIGNATION, APPOINTMENT AND ACCEPTANCE (this “Agreement”), dated as of January 11, 2024 (the “Effective Date”) by and among UPHEALTH, INC., a corporation duly organized and existing under the laws of the State of Delaware and having its principal office at 1400 Military Trail, Delray Beach, Florida 33484 (the “Company”), WILMINGTON TRUST, NATIONAL ASSOCIATION, a banking corporation duly organized and existing under the laws of the United States and having a corporate trust office at 50 South Sixth Street, Suite 1290, Minneapolis, Minnesota 55402, Global Capital Markets (the “Resigning Trustee”), and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., a banking corporation duly organized and existing under the laws of the United States and having a corporate trust office at 4655 Salisbury Road, Suite 300, Jacksonville, Florida 32256 (the “Successor Trustee” and together with the Company and the Resigning Trustee, the “Parties” and each a “Party”).

RECITALS:

WHEREAS, there was originally authorized and issued $160,000,000 in aggregate principal amount of the Company’s 6.25% Convertible Senior Notes due June 15, 2026 under an Indenture, dated as of June 9, 2021, by and between the Company and the Resigning Trustee (said 6.25% Convertible Senior Notes are hereinafter referred to as “Securities” and said Indenture, as supplemented, modified, or amended from time to time, is hereinafter referred to as the “Indenture”);

WHEREAS, Section 7.09 of the Indenture provides that the Trustee may at any time resign by giving written notice of such resignation to the Company, effective upon the acceptance by a successor Trustee of its appointment as a successor Trustee;

WHEREAS, Section 7.09 of the Indenture provides that, if the Trustee shall resign, the Company shall promptly notify all Holders and appoint a successor Trustee by written instrument, in duplicate executed by order of the Board of Directors;

WHEREAS, Section 7.10 of the Indenture provides that any successor Trustee appointed in accordance with the Indenture shall execute, acknowledge and deliver to the Company and to

its predecessor Trustee an instrument accepting such appointment under the Indenture, and thereupon the resignation of the predecessor Trustee shall become effective, and such successor Trustee, without any further act, deed or conveyance, shall become vested with all rights, powers, duties and obligations of the predecessor Trustee; provided, however, that the predecessor Trustee shall retain a lien in parity with the lien of the successor Trustee to which the Securities are subordinate on all money or property held or collected by such predecessor Trustee as such, except for funds held in trust for the benefit of Holders of particular Securities, to secure any amounts then due to such predecessor Trustee pursuant to the provisions of Section 7.06 of the Indenture;

WHEREAS, the Resigning Trustee was appointed Note Registrar, Custodian, Conversion Agent and Paying Agent by the Company;

WHEREAS, the Resigning Trustee desires to resign as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture, and the Company desires to appoint the Successor Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent to succeed the Resigning Trustee in its capacities under the Indenture; and

WHEREAS, the Successor Trustee is willing to accept such appointment as successor Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture;

NOW, THEREFORE, the Parties, for and in consideration of the premises and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, hereby consent and agree as follows:

ARTICLE ONE

THE RESIGNING TRUSTEE

1.1. Pursuant to Section 7.09 of the Indenture, the Resigning Trustee hereby notifies the Company that the Resigning Trustee is hereby resigning as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture.

1.2. The Resigning Trustee hereby represents and warrants to the Successor Trustee that:

(a) To the best of the knowledge of the Responsible Officer of the Resigning Trustee who is signing this Agreement, no covenant or condition contained in the Indenture has been waived by the Resigning Trustee or by the Holders of the percentage in aggregate principal amount of the Securities required by the Indenture to effect any such waiver.

(b) There are Events of Default under Sections 6.01(h) and (g) of the Indenture to the extent any of the debtors in the jointly-administered bankruptcy cases styled In re UpHealth Holdings, Inc., Case No. 23-11476 (jointly administered), filed in the United States Bankruptcy Court for the District of Delaware, are Significant Subsidiaries.

(c) There is no action, suit or proceeding pending or, to the best of the knowledge of the Responsible Officer of the Resigning Trustee who is signing this Agreement or threatened against the Resigning Trustee before any court or any governmental authority arising out of any action or omission by the Resigning Trustee as Trustee under the Indenture.

(d) On or promptly following the Effective Date of this Agreement, to the extent not necessary to pay the Resigning Trustee’s fees and expenses, the Resigning Trustee shall transfer all property held by it as Trustee to the Successor Trustee, subject to the lien provided for the Resigning Trustee’s benefit in Section 7.06 of the Indenture.

(f) Pursuant to Section 2.04 of the Indenture, Resigning Trustee duly authenticated and delivered, on June 9, 2021, $160,000,00 in aggregate principal amount of Securities. Securities in the aggregate principal amount of $115,000,000 are outstanding as of the Effective Date.

(h) This Agreement has been duly authorized, executed and delivered on behalf of the Resigning Trustee and constitutes its legal, valid and binding obligation.

1.3. The Resigning Trustee hereby assigns, transfers, delivers and confirms to the Successor Trustee all right, title and interest of the Resigning Trustee in and to the trust under the Indenture and all the rights, powers and trusts of the Trustee under the Indenture. At the Company’s expense, the Resigning Trustee shall execute and deliver such further instruments and shall do such other things as reasonably required so as to more fully and certainly vest and confirm in the Successor Trustee all the rights, trusts and powers hereby assigned, transferred, delivered and confirmed to the Successor Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent.

1.4. The Resigning Trustee shall deliver to the Successor Trustee, as of or promptly after the Effective Date, the documents listed on Exhibit A hereto.

1.5. The Resigning Trustee shall have no liability or responsibility under or related to the Indenture or any other related transaction documents for any matters occurring after the Effective Date of this Agreement or for any act or omission of the Successor Trustee or any of its agents under or related to the Indenture or other related transaction documents.

ARTICLE TWO

THE COMPANY

2.1. The Company hereby accepts the resignation of the Resigning Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture.

2.2. The Secretary or Assistant Secretary of the Company who is attesting to the execution of this Agreement by the Company hereby certifies that Exhibit B annexed hereto is a copy of the Board Resolutions, which were duly adopted by the Board of Directors of the Company, which are in full force and effect on the date hereof, and which authorize certain officers of the Company to (a) accept the Resigning Trustee’s resignation as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture; (b) appoint the Successor Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture; and (c) execute and deliver such agreements and other instruments as may

be necessary or desirable to effectuate the succession of the Successor Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture.

2.3. The Company hereby appoints the Successor Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture to succeed to, and hereby vests the Successor Trustee with, all the rights, powers, duties and obligations of the Resigning Trustee under the Indenture with like effect as if originally named as Trustee in the Indenture.

2.4. Promptly after the Effective Date, the Company shall cause a notice, substantially in the form of Exhibit C annexed hereto, to be sent to each Holder of the Securities in accordance with the provisions of Section 7.09 of the Indenture.

2.5. The Company hereby represents and warrants to the Resigning Trustee and the Successor Trustee that:

(a) The Company is a corporation duly and validly organized and existing pursuant to the laws of the State of Delaware.

(b) The Indenture was validly and lawfully executed and delivered by the Company and is in full force and effect, and the Securities were validly issued by the Company.

(c) The Indenture and the Securities are binding obligations of the Company, as applicable, as set forth in the Indenture.

(d) There have been no other written supplements, amendments, or waivers to the Indenture or any related documents other than such supplements, amendments, and waivers described in Exhibit A hereto.

(e) The Company has performed or fulfilled prior to the date hereof, and will continue to perform and fulfill after the date hereof, each covenant, agreement, condition, obligation and responsibility under the Indenture, other than as a result of the Events of Default referenced in Section 1.2(b) above.

(f) No covenant or condition contained in the Indenture has been waived by the Company or, to the best of the Company’s knowledge, by Holders of the percentage in aggregate principal amount of the Securities required to effect any such waiver, it being understood and agreed

that certain Holders have agreed to waive the above referenced Events of Default and amend certain provisions of the Indenture following execution of this Agreement.

(g) There is no action, suit or proceeding pending or, to the best of the Company’s knowledge, threatened against the Company or the Resigning Trustee before any court or any governmental authority arising out of any action or omission by Company under the Indenture.

(h) This Agreement has been duly authorized, executed and delivered on behalf of the Company and constitutes its legal, valid and binding obligation.

(i) All conditions precedent relating to the appointment of The Bank of New York Mellon Trust Company, N.A., as successor Trustee under the Indenture have been complied with by the Company.

ARTICLE THREE

THE SUCCESSOR TRUSTEE

3.1. The Successor Trustee hereby represents and warrants to the Resigning Trustee and

to the Company that this Agreement has been duly authorized, executed and delivered on behalf

of the Successor Trustee and constitutes its legal, valid and binding obligation.

3.2. The Successor Trustee represents and warrants to the Resigning Trustee and the

Company that it is eligible to serve as Trustee under Section 7.08 of the Indenture.

3.3. The Successor Trustee hereby accepts its appointment as successor Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture and accepts and, as of the Effective Date, shall assume, the rights, powers, duties and obligations of the Resigning Trustee as Trustee under the Indenture, upon the terms and conditions set forth therein, with like effect as if originally named as Trustee under the Indenture.

3.4. References in the Indenture to “Corporate Trust Office” or other similar terms shall be deemed to refer to the Corporate Trust Office of the Successor Trustee at 4655 Salisbury

Road, Suite 300, Jacksonville, Florida 32256 or any other office of the Successor Trustee at which, at any particular time, its corporate trust business shall be administered.

3.5. The Successor Trustee shall have no liability or responsibility under or related to the Indenture or any other related transaction documents for any matters occurring prior to the Effective Date of this Agreement or for any act or omission of the Resigning Trustee or any of its agents under or related to the Indenture or other related transaction documents.

ARTICLE FOUR

MISCELLANEOUS

4.1. Except as otherwise expressly provided herein or unless the context otherwise requires, all terms used herein which are defined in the Indenture shall have the meaning assigned to them in the Indenture.

4.2. This Agreement and the resignation, appointment and acceptance regarding the position of “Trustee” hereunder shall be effective as of the opening of business on the Effective Date, upon the execution and delivery hereof by each of the Parties hereto; provided, that the resignation of the Resigning Trustee as Paying Agent, Note Registrar, Custodian, and

Conversion Agent, and the appointment of the Successor Trustee as Paying Agent, Note Registrar, Custodian, and Conversion Agent under the Indenture, shall be effective 10 Business Days after the Effective Date.

4.3. Notwithstanding the resignation of the Resigning Trustee as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent, the Company shall remain obligated under the Indenture to compensate, reimburse, and indemnify the Resigning Trustee in connection with its prior service as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent, as provided in the Indenture, and nothing contained in this Agreement shall in any way abrogate the obligations of the Company to the Resigning Trustee under the Indenture or any and all related transaction documents or any lien created in favor of the Resigning Trustee thereunder. The

Company and the Successor Trustee acknowledge and affirm that the rights, indemnities, and protections of the Resigning Trustee set forth in the Indenture, including (but not limited to) in

Section 7.06 thereof, shall continue in full force and effect and shall not be affected by, and shall survive the execution of, this Agreement. Subject to the rights, indemnities, and protections of the Resigning Trustee set forth in the Indenture, the Successor Trustee will take the same actions (if any) to obtain payment of the Resigning Trustee’s fees and expenses under the Indenture as the Successor Trustee takes with respect to its own fees and expenses under the Indenture.

4.4. This Agreement shall be governed by and construed in accordance with the laws of the State of New York. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT.

4.5. This Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall be deemed an original, but such counterparts shall together constitute but one and the same instrument. Delivery of an executed signature page of this Agreement by facsimile or other electronic transmission (e.g., “pdf’ or “tif’ format) shall be effective as delivery of a manually executed counterpart hereof.

4.6. The illegality or unenforceability of any provision of this Agreement shall not in any way affect or impair the legality or enforceability of the remaining provisions of this Agreement.

4.7. Execution of this Agreement by the Successor Trustee, the Resigning Trustee, and the Company shall constitute delivery of written acceptance of appointment of the Successor Trustee to the Resigning Trustee and to the Company pursuant to Section 7.10 of the Indenture.

4.8. The Company, the Resigning Trustee and the Successor Trustee hereby acknowledge receipt of an executed and acknowledged counterpart of this Agreement and the effectiveness thereof.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Parties hereto have caused this Agreement of Resignation, Appointment and Acceptance to be executed as of the day and year first above written.

UPHEALTH, INC.

Attest: By: /s/ Martin S.A. Beck

Name: Martin S.A. Beck

Title: Chief Executive Officer

/s/ Jeremy Livianu Address: 14000 S. Military Trail, Suite 203

Secretary, Assistant Secretary Delray Beach, FL 33484

or Authorized Officer Telephone: (888) 424-3646

WILMINGTON TRUST, NATIONAL

ASSOCIATION, AS RESIGNING

TRUSTEE

By: /s/ Jennifer J. Provenzano

Name: Jennifer J. Provenzano

Title: Senior Vice President

Address: 1100 N. Market Street

Wilmington, Delaware 19890

Telephone: (302) 498-4481

THE BANK OF NEW YORK MELLON

TRUST COMPANY, N.A., AS

SUCCESSOR TRUSTEE

By: /s/ Michael C. Jenkins

Name: Michael C. Jenkins

Title: Vice President

Address: 4655 Salisbury Road, Suite 300,

Jacksonville, Florida 32256

Telephone: (904) 645-1909

EXHIBIT A

Documents to be delivered by the Resigning Trustee to the Successor Trustee as to the Indenture:

1.Executed copy of Indenture dated as of June 9, 2021;

2.Global Note(s);

3.A copy of the most recent Compliance Certificate delivered pursuant to Section 4.08 of the Indenture;

4.A copy of the most recent official notice sent by the Trustee to all the Holders of the Securities pursuant to the terms of the Indenture; and

5.Such other documents as may be agreed in writing by the Resigning Trustee and the Successor Trustee.

EXHIBIT B

CERTIFIED COPY OF RESOLUTIONS

OF

THE BOARD OF DIRECTORS

OF

UPHEALTH, INC.

The undersigned, Jeremy Livianu, hereby certifies that he is the duly appointed, qualified, and acting Secretary of UpHealth, Inc. a Delaware corporation (the “Company”), and further certifies that the following is a true and correct copy of certain resolutions duly adopted by the Board of Directors of said Company as of January 3, 2024, and that said resolutions have not been amended, modified, or rescinded:

NOW, THEREFORE, BE IT RESOLVED, that, the Company appoint The Bank of New York Mellon Trust Company, N.A. as successor Trustee (“Successor Trustee”) under the Indenture dated as of June 9, 2021 (the “Indenture”) by and between the Company and Wilmington Trust, National Association (the “Resigning Trustee”), as Trustee, pursuant to which the Company issued $160,000,000 aggregate principal amount of the Company’s 6.25% Convertible Senior Notes due 2026; and that the Company accept the resignation of Resigning Trustee as Trustee under the Indenture, such resignation to be effective upon the execution and delivery by Successor Trustee to the Company of an instrument or instruments accepting such appointment as successor Trustee under the Indenture; and it is further

RESOLVED, that the Chairman of the Board, the CEO of the Company, and the CFO of the Company be, and each of them hereby is, authorized, empowered, and directed to execute and deliver in the name and on behalf of the Company an instrument or instruments appointing Successor Trustee as the successor Trustee and accepting the resignation of Resigning Trustee; and it is further

RESOLVED, that the proper officers of the Company are hereby authorized, empowered, and directed to do or cause to be done all such acts or things, and to execute and deliver, or cause to be executed or delivered, any and all such other agreements, amendments, instruments, certificates, documents, or papers (including, without limitation, any and all notices and certificates required or permitted to be given or made on behalf of the Company to Successor Trustee or to Resigning Trustee), under the terms of any of the executed instruments in connection with the resignation of Resigning Trustee and the appointment of Successor Trustee, in the name and on behalf of the Company as any of such officers, in their discretion, may deem necessary or advisable to effectuate or carry out the purposes and intent of the foregoing resolutions; and to exercise any of the Company’s obligations under the instruments and agreements executed on behalf of the Company in connection with the resignation of Resigning Trustee and the appointment of Successor Trustee.

IN WITNESS WHEREOF, I have hereunto set my hand as Secretary on this 5th day of January, 2024.

By: /s/ Jeremy Livianu

Name: Jeremy Livianu

Title: Secretary

EXHIBIT C

NOTICE

To the Holders of

6.25% Convertible Senior Notes due 2026 issued by UpHealth, Inc.

CUSIP No. 51602UAC2

Reference is hereby made to that certain Indenture dated as of June 9, 2021 (as supplemented, modified, or amended from time to time, the “Indenture”), by and among UpHealth, Inc. (the “Company”) and Wilmington Trust, National Association, (the “Resigning Trustee”), as Trustee, pursuant to which the above-referenced Securities were issued and are outstanding.

NOTICE IS HEREBY GIVEN, pursuant to Section 7.09 of the Indenture, that the Resigning Trustee has resigned as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture.

NOTICE IS HEREBY FURTHER GIVEN, pursuant to Sections 7.09 and 7.10, respectively, of the Indenture, that the Company has appointed The Bank of New York Mellon Trust Company, N.A., a corporation duly organized and existing under the laws of the United States (the “Successor Trustee”), as Trustee, Note Registrar, Custodian, Conversion Agent and Paying Agent under the Indenture, and the Successor Trustee has accepted such appointment. The address of the Corporate Trust Office of the Successor Trustee is at 4655 Salisbury Road, Suite 300, Jacksonville, Florida 32256.

NOTICE IS HEREBY FURTHER GIVEN that the Resigning Trustee’s resignation as Trustee and the Successor Trustee’s, appointment as successor Trustee was effective as of the opening of business on January 11, 2024. The Resigning Trustee’s resignation as Note Registrar, Custodian, Conversion Agent, and Paying Agent will be effective ten (10) Business Days thereafter.

Dated: Delray Beach, Florida

January 11, 2024

Very truly yours,

By: /s/ Martin S.A. Beck

Name: Martin S.A. Beck

Title: Chief Executive Officer

v3.23.4

Cover

|

Jan. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity Registrant Name |

UpHealth, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38924

|

| Entity Tax Identification Number |

83-3838045

|

| Entity Address, Address Line One |

14000 S. Military Trail

|

| Entity Address, Address Line Two |

Suite 203

|

| Entity Address, City or Town |

Delray Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33484

|

| City Area Code |

888

|

| Local Phone Number |

424-3646

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

UPH(1)

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001770141

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

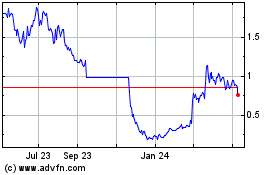

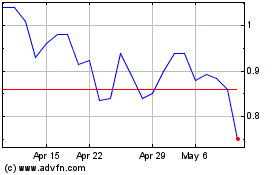

UpHealth (PK) (USOTC:UPHL)

Historical Stock Chart

From Apr 2024 to May 2024

UpHealth (PK) (USOTC:UPHL)

Historical Stock Chart

From May 2023 to May 2024