0001511820

client had edits

true

0001511820

2023-01-01

2023-06-30

0001511820

2023-06-30

0001511820

2022-12-31

0001511820

2023-04-01

2023-06-30

0001511820

2022-04-01

2022-06-30

0001511820

2022-01-01

2022-06-30

0001511820

us-gaap:CommonStockMember

2022-03-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001511820

us-gaap:RetainedEarningsMember

2022-03-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001511820

STEK:SubTotalMember

2022-03-31

0001511820

us-gaap:NoncontrollingInterestMember

2022-03-31

0001511820

2022-03-31

0001511820

us-gaap:CommonStockMember

2021-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001511820

us-gaap:RetainedEarningsMember

2021-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001511820

STEK:SubTotalMember

2021-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2021-12-31

0001511820

2021-12-31

0001511820

us-gaap:CommonStockMember

2023-03-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001511820

us-gaap:RetainedEarningsMember

2023-03-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001511820

STEK:SubTotalMember

2023-03-31

0001511820

us-gaap:NoncontrollingInterestMember

2023-03-31

0001511820

2023-03-31

0001511820

us-gaap:CommonStockMember

2022-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001511820

us-gaap:RetainedEarningsMember

2022-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001511820

STEK:SubTotalMember

2022-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2022-12-31

0001511820

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001511820

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001511820

STEK:SubTotalMember

2022-04-01

2022-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2022-04-01

2022-06-30

0001511820

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001511820

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001511820

STEK:SubTotalMember

2022-01-01

2022-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-06-30

0001511820

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001511820

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001511820

STEK:SubTotalMember

2023-04-01

2023-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0001511820

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001511820

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001511820

STEK:SubTotalMember

2023-01-01

2023-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-06-30

0001511820

us-gaap:CommonStockMember

2022-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001511820

us-gaap:RetainedEarningsMember

2022-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001511820

STEK:SubTotalMember

2022-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2022-06-30

0001511820

2022-06-30

0001511820

us-gaap:CommonStockMember

2023-06-30

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001511820

us-gaap:RetainedEarningsMember

2023-06-30

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001511820

STEK:SubTotalMember

2023-06-30

0001511820

us-gaap:NoncontrollingInterestMember

2023-06-30

0001511820

STEK:RBCDHoldingsMember

2018-05-06

2018-05-07

0001511820

STEK:RBCDHoldingsMember

2019-01-01

2019-12-31

0001511820

STEK:StemtechInternationalMember

2023-06-30

0001511820

STEK:StemtechInternationalMember

2022-12-31

0001511820

STEK:LFRAcquisitionMember

2023-01-01

2023-06-30

0001511820

STEK:PatentProductsMember

2023-01-01

2023-06-30

0001511820

STEK:PatentProductsMember

2022-01-01

2022-12-31

0001511820

STEK:TradeNamesAndTrademarksMember

2023-01-01

2023-06-30

0001511820

STEK:TradeNamesAndTrademarksMember

2022-01-01

2022-12-31

0001511820

STEK:CustomerOrDistributionListMember

2023-01-01

2023-06-30

0001511820

STEK:CustomerOrDistributionListMember

2022-01-01

2022-12-31

0001511820

STEK:NonCompeteAgreementMember

2023-01-01

2023-06-30

0001511820

STEK:NonCompeteAgreementMember

2022-01-01

2022-12-31

0001511820

2022-01-01

2022-12-31

0001511820

STEK:MiramarFloridaMember

STEK:SunbearnPropertiesIncMember

2021-08-16

0001511820

STEK:SecuredRoyalParticipationAgreementMember

2023-06-30

0001511820

STEK:SecuredRoyalParticipationAgreementMember

2022-12-31

0001511820

STEK:VehicleAndEquipmentLoansMember

2023-06-30

0001511820

STEK:VehicleAndEquipmentLoansMember

2022-12-31

0001511820

STEK:NotesPayableMember

2023-06-30

0001511820

STEK:NotesPayableMember

2022-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2023-06-30

0001511820

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001511820

STEK:SecuredRoyaltyParticipationAgreementsMember

2023-03-15

2023-03-16

0001511820

STEK:VehicleAndEquipmentLoansMember

2019-12-31

0001511820

STEK:VehicleAndEquipmentLoansMember

2019-01-01

2019-12-31

0001511820

STEK:ThreeLendersMember

2019-12-31

0001511820

STEK:ThreeLendersMember

2019-01-01

2019-12-31

0001511820

STEK:FourLendersMember

2020-12-31

0001511820

STEK:AllLendersMember

2022-12-31

0001511820

STEK:TwoPromissoryNotesMember

STEK:InvestorsMember

2021-10-20

0001511820

STEK:TwoPromissoryNotesMember

STEK:InvestorsMember

2023-06-11

2023-06-12

0001511820

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001511820

STEK:ConvertibleNotesPayable1Member

STEK:ExtensionAgreementMember

2022-04-01

2022-06-30

0001511820

STEK:ConvertibleNotesPayable1Member

STEK:SecondExtensionAgreementMember

2022-08-17

2022-08-18

0001511820

STEK:ConvertibleNotesPayable2Member

STEK:WarrantsMember

2022-07-12

2022-07-13

0001511820

STEK:ConvertibleNotesPayable2Member

us-gaap:CommonStockMember

2022-07-12

2022-07-13

0001511820

STEK:ConvertibleNotesPayable2Member

2022-07-12

2022-07-13

0001511820

STEK:ConvertibleNotesPayable2Member

2022-09-07

2022-09-08

0001511820

us-gaap:ConvertibleNotesPayableMember

STEK:MCUSAndLeoniteMember

2022-06-01

2022-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001511820

STEK:PromissoryNotesMember

2023-01-01

2023-01-31

0001511820

2023-01-01

2023-01-31

0001511820

STEK:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-02-27

2023-02-28

0001511820

STEK:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-02-28

0001511820

STEK:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-06-30

0001511820

STEK:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001511820

STEK:ConvertiblePromissoryNoteMember

STEK:InvestmentAgreementMember

STEK:InstitutionalInvestorMember

2023-03-27

0001511820

2023-04-11

0001511820

2023-04-30

2023-05-01

0001511820

2023-05-01

0001511820

STEK:MCUSMember

2023-06-30

0001511820

STEK:MCUSMember

2023-01-01

2023-06-30

0001511820

STEK:SharingServicesGlobalCorporationMember

2023-04-30

2023-05-01

0001511820

STEK:ConvertibleNote1Member

2023-06-30

0001511820

STEK:ConvertibleNote2Member

2023-06-30

0001511820

STEK:ConvertibleNote3Member

2023-06-30

0001511820

STEK:ConvertibleNote1Member

2022-12-31

0001511820

STEK:ConvertibleNote2Member

2022-12-31

0001511820

STEK:ConvertibleNote3Member

2022-12-31

0001511820

STEK:ThreeConvertibleNotesMember

2023-06-30

0001511820

STEK:ThreeConvertibleNotesMember

2022-12-31

0001511820

STEK:ConvertibleNotesMember

2022-01-01

2022-12-31

0001511820

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001511820

STEK:ConvertibleNotesMember

2023-01-01

2023-06-30

0001511820

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001511820

us-gaap:MeasurementInputSharePriceMember

2023-01-01

2023-06-30

0001511820

us-gaap:MeasurementInputSharePriceMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-06-30

0001511820

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputPriceVolatilityMember

2023-01-01

2023-06-30

0001511820

us-gaap:MeasurementInputPriceVolatilityMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-01-01

2023-06-30

0001511820

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-01-01

2022-12-31

0001511820

2023-05-05

0001511820

STEK:OfficersEmployeesAndVendorsMember

2023-01-01

2023-06-30

0001511820

STEK:VestingOfCommonStockOfOneOfficerMember

2023-01-01

2023-06-30

0001511820

STEK:VestingOfCommonStockOfOneOfficerMember

2022-01-01

2022-06-30

0001511820

STEK:OfficersEmployeesAndVendorsMember

STEK:AccumulatedPastServicesMember

2023-01-01

2023-06-30

0001511820

STEK:OfficersEmployeesAndVendorsMember

STEK:AccumulatedPastServicesMember

STEK:ChairmanAndCEOMember

2023-01-01

2023-06-30

0001511820

STEK:LFRMember

2023-01-01

2023-06-30

0001511820

STEK:NoteExtensionMember

2022-06-01

2022-06-08

0001511820

STEK:LoanExtensionMember

STEK:NoteSept2021Member

2022-07-12

2022-07-13

0001511820

STEK:LoanExtensionMember

STEK:NoteMay2022Member

2022-08-17

2022-08-18

0001511820

STEK:ANoteHolderMember

2022-08-25

2022-08-26

0001511820

STEK:NotesPayableMember

2022-09-18

2022-09-19

0001511820

STEK:NotesPayableMember

2022-09-20

2022-09-21

0001511820

STEK:NotesPayableMember

2022-09-28

2022-09-29

0001511820

STEK:NotesPayableMember

2022-12-08

2022-12-09

0001511820

STEK:NotesPayable1Member

2022-12-08

2022-12-09

0001511820

STEK:NotesPayableMember

2023-01-12

2023-01-13

0001511820

STEK:NotesPayableMember

2023-01-22

2023-01-23

0001511820

STEK:NotesPayableMember

2023-04-25

2023-04-26

0001511820

STEK:NotesPayableMember

2023-06-06

2023-06-07

0001511820

STEK:NotesPayableMember

2023-04-30

2023-05-01

0001511820

STEK:NotesPayableMember

2023-06-20

2023-06-21

0001511820

STEK:NotesPayableMember

2023-06-11

2023-06-12

0001511820

STEK:ChairmanAndCEOMember

2022-06-30

0001511820

STEK:ChairmanAndCEOMember

2022-01-01

2022-06-30

0001511820

STEK:CompanyWithCommonDirectorMember

2021-09-01

0001511820

STEK:CompanyWithCommonDirectorMember

2022-06-30

0001511820

srt:ChiefFinancialOfficerMember

2022-01-01

2022-06-30

0001511820

STEK:ChairmanAndCEOMember

2023-01-01

2023-06-30

0001511820

STEK:ChairmanAndCEOMember

2023-06-30

0001511820

STEK:PresidentAndCOOMember

2023-01-01

2023-06-30

0001511820

STEK:CorporateSecretaryMember

2023-01-01

2023-06-30

0001511820

STEK:CorporateSecretaryMember

2023-06-30

0001511820

srt:ChiefFinancialOfficerMember

2023-01-01

2023-06-30

0001511820

STEK:CompanyWithCommonDirectorMember

2023-06-30

0001511820

STEK:CompanyWithCommonDirectorMember

2022-12-31

0001511820

STEK:RayCarterMember

2023-06-30

0001511820

STEK:RayCarterMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

Table of Contents

As filed with the Securities and Exchange Commission

on August 31, 2023

Registration No. 333-271846

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1/A

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

STEMTECH CORPORATION

(Exact name of registrant as specified in its

charter)

| Nevada |

|

7370 |

|

87-2151440 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

4851 Tamiami Trail North, Suite 200

Naples, FL 34103

(954) 715-6000

(Address, including zip code and telephone number,

including area code, of registrant’s principal executive offices)

Charles S. Arnold

Chief Executive Officer

4851 Tamiami Trail North, Suite 200

Naples, FL 34103

(Name, address, including zip code and telephone

number, including area code, of agent for service)

Copies of all communications, including communications

sent to agent for service, should be sent to:

Joseph M. Lucosky, Esq.

Soyoung Lee, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Iselin, NJ 08830

(732) 395-4400

Approximate date of commencement of proposed sale

to the public:

As soon as practicable after the effective date

of this registration statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

AUGUST 31, 2023

PRELIMINARY PROSPECTUS

165,200,135

Shares of Common Stock

This prospectus relates to the resale, from time

to time, of up to 165,200,135 shares (the “Shares”) of our Common Stock, par value $0.001 per share (“Common

Stock”), by the selling stockholders (each, a “Selling Stockholder” and collectively, the “Selling Stockholders”)

identified in this prospectus under “Selling Stockholders” (the “Offering”), comprised of:

| |

(i) |

up

to 65,909,091 Shares issuable upon conversion of that certain Senior Secured Promissory Note dated March 27, 2023 (the “2023

Note”) issued by the Company to one (1) Selling Stockholder pursuant to the Securities Purchase Agreement between the Company

and such Selling Stockholder dated March 27, 2023 (the “2023 Purchase Agreement”); |

| |

(ii) |

up to 32,954,545

Shares issuable upon exercise of those certain Series 1 Warrants issued pursuant to the 2023 Purchase Agreement, exercisable

immediately, for a term of 60 months, at an initial exercise price of $0.10 per share, subject to customary adjustment provisions

(the “Series 1 Warrants”); and |

| |

(iii) |

up to 32,954,545

Shares issuable upon exercise of those certain Series 2 Warrants issued pursuant to the 2023 Purchase Agreement, exercisable

immediately, for a term of 60 months, at an initial exercise price of $0.15 per share, subject to customary adjustment provisions

(the “Series 2 Warrants” and together with the Series 1 Warrants, the “2023 Warrants”); |

| |

|

|

| |

(iv) |

up to 15,390,621 Shares

issuable upon conversion of that certain Promissory Convertible Note (of which 9,825,859 was already issued) dated effective August

30, 2021 (the “MCUS 2021 Note”) issued by the Company to MCUS, LLC (“MCUS”) pursuant to the Securities Purchase

Agreement between the Company and MCUS dated August 30, 2021 (the “MCUS 2021 SPA”) and pursuant to a debt settlement

agreement dated December 9, 2022 (the “Debt Settlement Agreement”) in exchange for $250,000 in liquidated damages three

tranches 2,559,600 shares of the Company’s common stock totaling 7,678,800 shares of the Company’ common stock; |

| |

|

|

| |

(v) |

up to 93,115 Shares issuable

upon exercise of that certain Common Share Purchase Warrant (the “MCUS 2021 Warrant”) issued to MCUS pursuant to the

MCUS 2021 SPA, exercisable until August 30, 2024 at an exercise price of $3.00 per share; |

| |

|

|

| |

(vi) |

5,695,920 Shares issued

upon conversion of that certain Promissory Convertible Note dated effective August 31, 2021 (the “2021 Leonite Note) issued

by the Company to Leonite Fund I, LP (“Leonite”); |

| |

|

|

| |

(vi) |

up to 10,500,000 Shares

issued to Leonite (the “Leonite Settlement Shares”) pursuant to that certain Global Settlement & Exchange of Senior

Secured Convertible Promissory Note (of which 6,340,591 was already issued) dated February 28, 2023 between the Company and Leonite

(the “Leonite Exchange Agreement”); |

| |

|

|

| |

(vii) |

up to 110,000 Shares

(the “Leonite Warrant Exchange Shares”) issued in exchange for warrants held by Leonite pursuant to the Leonite Exchange

Agreement; |

| |

|

|

| |

(viii) |

up to 38,152 Shares issued to Leonite (the “Outstanding Equity Interest Shares”) pursuant to the Leonite Exchange Agreement; |

| |

|

|

| |

(ix) |

up to 1,400,000 Shares issuable upon exercise of that certain Common Stock Warrant (the “Sharing Services Warrant” and together with the Series 1 Warrants, the Series 2 Warrants, the MCUS 2021 Warrant, collectively, the “Warrants”) issued to Sharing Services pursuant to the Sharing Services SPA, exercisable at any time until September 13, 2024 at an exercise price of $0.05 per share; and |

| |

|

|

| |

(x) |

up to 154,173 Shares issued to Sharing Services as an origination fee (the “Origination Fee Shares”) pursuant to the Sharing Services SPA. |

We are not selling any shares of our Common Stock

under this prospectus and will not receive any proceeds from the sale of the Shares. We will, however, receive proceeds from any Warrants

that are exercised through the payment of the exercise price in cash. The Selling Stockholders will bear all commissions and discounts,

if any, attributable to the sale of the Shares. We will bear all costs, expenses and fees in connection with the registration of the Shares.

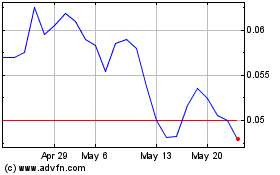

Our

Common Stock is quoted on the OTCQB Marketplace operated by OTC Markets Group Inc. (“OTCQB”) under the symbol

“STEK.” On August 21, 2023, the last reported sale price of our Common Stock on OTCQB was $0.0375 per share.

Investing in our securities involves risks.

See “Risk Factors” beginning on page 7 of this prospectus. We and our board of directors are not making any recommendation

regarding the exercise of your rights.

No securities may be sold without delivery of

this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 31, 2023.

TABLE OF CONTENTS

Unless the context requires otherwise, references

in this prospectus to “Stemtech,” “our company,” “we,” “our” “us” and similar

terms refer to Stemtech Corporation, a Nevada corporation, and its subsidiaries, unless the context otherwise requires.

PROSPECTUS SUMMARY

The following summary highlights selected information

contained in this prospectus. Because the following is only a summary, it does not contain all of the information you should consider

before investing in our securities. Before making an investment decision, you should carefully read all of the information contained in

this prospectus, including the risks described under “Risk Factors” and our consolidated financial statements and the related

notes from our 2022 Annual Report on Form 10-K before making an investment decision.

Overview

Stemtech Corporation and its subsidiaries (collectively, the “Company,”,

“Stemtech,” “we,” “us,” or “our”) was incorporated in the State of Nevada, USA on September 4, 2009 under the name

Globe Net Wireless Corp., with ticker symbol “GNTW”. We have changed our corporate name to Stemtech Corporation in the state

of Nevada and listed on the OTCQB with the ticker symbol “STEK”. Stemtech is a global network marketing company that develops

science-based products that it believes supports wellness by helping the body maintain healthy stem cell physiology, also known as stem

cell enhancers. Known as the Stem Cell Nutrition Company®, the Company is a pioneer in nutritional stem cell science and believes

it can demonstrate that adult stem cells function as the natural renewal system of the body. The Company believes our products enhance

and support the work of the body’s stem cells by releasing more stem cells, helping to circulate them in the blood and migrate

them into tissues, where they can perform their daily function of renewal for optimal health. Our Mission is to enhance wellness and

prosperity around the world. These products are marketed internationally by the Company’s subsidiaries and through Independent

Business Partners (“IBPs”). The Company markets its products under the following brands: RCM System, stemrelease3™,

Stemflo® MigraStem™, OraStem® (Oral Health Care), and D-Fuze™ (Electromagnetic Frequency (“EMF”)

blocker). Stemtech also introduced a new skincare product in December 2022: Cellect One™ Rapid Renew Stem Cell Peptide Night Cream.

Stemtech has also trade-marked the term “stemceuticals™” as a brand, which is the combination of ‘stem cells’

and ‘nutraceuticals’.

On August 19, 2021, Stemtech Corporation (“Stemtech”),

a (Delaware corporation), entered into a Merger Agreement (the “Merger Agreement”) with Globe Net Wireless Corp. (“Globe

Net” or “GNTW”) (the “Merger”). The Merger was accounted for as a reverse acquisition and recapitalization

in accordance with the Accounting Standards Codification topic 805, Business Combinations (“ASC 805”). Management evaluated

the guidance contained in ASC 805 with respect to the identification of the acquirer in the Merger and concluded, based on a consideration

of the pertinent facts and circumstances, that Stemtech acquired Globe Net for financial accounting purposes. On November 9, 2021, the

Company changed its fiscal year end date from August to December.

Implications of Being an Emerging Growth Company

Emerging Growth Company - We are an emerging

growth company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, or the Securities Act. We will continue to be

an emerging growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of at least $1.07

billion; (ii) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our Common Stock

pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year

period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer,

as defined in Section 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which means the market value of

our Common Stock that is held by non-affiliates exceeds $700 million as of the prior June 30.

As an emerging growth company, we are exempt from:

| |

· |

Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation; |

| |

· |

The requirement to provide, in any registration statement, periodic report or other report to be filed with the SEC certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement; |

| |

· |

Compliance with new or revised accounting standards until those standards are applicable to private companies; |

| |

· |

The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, to provide auditor attestation of our internal controls and procedures; and |

| |

· |

Any Public Company Accounting Oversight Board, or “PCAOB”, rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public. |

We have elected to use the extended transition

period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined

in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to

Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley

Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

Stemtech offers and sells our products primarily

through Independent Business Partners (“IBPs”), similar to Herbalife or Amway distribution systems with a limited

number of wholesale and/or independent distributors, or consumers who purchase products directly online through Stemtech’s global

website. IBPs sell products directly to consumers and through their own network of IBPs they have developed. IBP’s can purchase

products at wholesale prices for resale to earn profits. IBPs also earn commissions based upon a multi-tiered program for sales purchased

by consumers registered under an IBP or one of their networked IBPs. Currently Stemtech has offices in the United States, Canada,

Mexico, Ecuador, and Taiwan. IBPs sell Stemtech products and provide details and information to customers about our all-natural health

products. The majority of our products are shipped directly to the consumer direct from the company where no individual IBP has to carry

or store inventory. Most fulfillment is done by the Company, saving time and providing more efficiency for our IBPs and the Company.

Product Development, Production and Distribution

In every country we sell our products, we register

our products adhering to local laws and registration requirements prior to sales in the particular country. Our IBPs are commission based

with a down line plan that offers IBPs income possibilities based upon how many customers they introduce to our products. Our IBPs generate

income on up to 6 downlines of distribution. The Company pays the IBPs direct weekly and monthly commissions, as well as bonuses. The

system is maintained for efficiency through Exigo, LLC, a company that specializes in payment processing with a focus on our specific

industry. The Company currently has six (6) patents on the formulations for our products. These products are manufactured to Stemtech`s

specifications in various cGMP manufacturing facilities that meet federal requirements. To date, there has never been a recall

associated with our Stemtech products.

In the first quarter of 2023, Stemtech acquired

Life Factor Research (“LFR”). LFR developed the IP and produced our most recent new product “Cellect One”. With

Stemtech`s acquisition of LFR, Stemtech plans to develop and offer new health related products for our direct sales division for distributors

as well as to be able to develop non Stemtech products for other companies as clients seeking innovative products.

As a wholly owned subsidiary of Stemtech, LFR

is responsible for the development of new products has access to research and development scientists who are developing products within

the stem cell niche. In addition, LFR is working on updating current product formulations with current science and more state-of-the-art

ingredients to enable Stemtech with the goal to provide more disruptive, leading-edge health products. Stemtech formulates products to

be compliant with the health regulation agencies for each country in which we do business.

Most of the nutritional supplements are contract

manufactured at our business manufacturing partner located in Miami, FL. Our partner carries United States Food and Drug Administration

(“FDA”) licenses and manufactures in accordance with current Good Manufacturing Practices (cGMP) standards. Raw materials

are received into quarantine, lab tested to match Stemtech’s specification and put into storage until required for production.

Tests are again taken after the manufacturing process and issued with a Certificate of Analysis. For some countries, we ship in a bulk

blend (meaning a complete product but not yet encapsulated or bottled) where the receiving subsidiary’s contract manufacturing

partners, which are also cGMP certified, complete the process.

The finished goods products are then sent to the

distribution facilities and stored until orders are placed by our IBPs or customers. No orders are shipped until payment is received.

Stemtech has no accounts receivable from our customers. Stemtech products are primarily sold through our network marketing model, but

not exclusively. In some cases, we have entered into licensing agreements with a business wanting to distribute our products. In such

situations, the licensee is prohibited from selling the products, customized for that country and compliant with local regulations and

is not sold through the network marketing or commissionable model.

Competitors

Stemtech

is a pioneer in stem cell nutrition, with the original products developed in 2005. Our products are all natural, plant based and have

been sold since their original introduction with over $600 million in total sales. According to a “Research and Marketing”

publication of February 2023 “Stem Cell Therapy Global Market Report 2023 Region: Global, 175 pages”, “the stem cell

therapy market will grow from $5.14 billion in 2022 to $6.4 billion in 2023 at a compound annual growth rate (CAGR) of 25.5%. The

stem cell therapy market is expected to grow to $11.88 billion in 2027 at a CAGR of 16.5%.” We believe the emergence of new products

being developed in stem cell therapy will raise the attention of all stem cell work and validate our products and method of distribution

in the stem cell nutrition field.

Competitive Advantage

Stemtech products have been sold for over 18

years and we believe has created a strong brand for our products within our consumer base even though our products are not currently

a household name or widely distributed. This belief is based on the numerous remarkable stories consumers have provided based

on their personal experience with our products. Although our products are not currently widely distributed or known by many consumers,

we believe our experienced leadership and network of research and development partners provides us with a competitive advantage in our

space.

Recent Developments

2023 Purchase Agreement

On March 27, 2023, the Company and one Selling

Stockholder (the “Holder”) executed an investment agreement for up to $7,000,000 pursuant to a Securities Purchase Agreement

(the “2023 Purchase Agreement”), a Senior Secured Convertible Promissory Note (the “2023 Note”), Series 1 Warrants

(the “Series 1 Warrants”), Series 2 Warrants (the “Series 2 Warrants” and together with the Series 1 Warrants,

the “2023 Warrants”) and Registration Rights Agreement (the “Registration Rights Agreement”).

The 2023 Note has a principal amount of up to

$7,000,000 with an original issue discount of 12% and is to be disbursed in four (4) disbursements as set forth on Schedule A of the

2023 Note and as follows: (i) the first disbursement in the amount of $1,000,000 occurred on March 27, 2023; (ii) the second disbursement

in the amount of $200,000 occurred on May 5, 2023; (iii) the third disbursement in the amount of $500,000 is due forty-five (45) days

after effectiveness of this registration statement; and (iv) $120,000 is due forty-five (45) days after the third disbursement. The 2023

Note carries an interest rate equal to seven percent (7%) per annum and is redeemable by the Company at any time at an amount equal to

one hundred twenty-five percent (125%) of the then outstanding principal and interest accrued on the Note. All additional disbursements

will be made at the Holder’s discretion, at any time, and if the Holder’s broker refuses to custody the securities issued

in connection therewith, the Holder will have no obligation to make a disbursement under the disbursement schedule, but will have the

option to make such disbursement. In addition, on May 5, 2023 and June 1, 2023, the Holder made additional disbursements in the amount

of $50,000 and $61,000, respectively. On May 9, 2023, the Holder made an additional $250,000 advance of the required disbursements to

the Company.

The Company is required to repay the 2023

Note twelve months after each disbursement.

The Initial Conversion Price applicable to the 2023 Note is 125%

of the closing stock price on the date of disbursement (the “Initial Conversion Price”) and will be effective for sixty (60)

days following the disbursement date. After the initial sixty (60) days following the disbursement date, the conversion price shall equal

the lower of: (i) the Initial Conversion Price and (ii) ten cents ($0.10) per share of Common Stock.

The amount of stock registered for resale

was determined by adding all outstanding debt and common stock equivalents, from Holders who were entitled to have their shares registered,

on an as-if converted basis.

The Series 1 Warrant is exercisable immediately

for a number of shares equal to fifty percent (50%) of the shares issuable upon conversion of the Note, for a term of 60 months, at an

initial exercise price of $0.10 per share, subject to customary adjustments. The Series 2 Warrants is exercisable immediately for a number

of shares equal to fifty percent (50%) of the shares issuable upon conversion of the Note, for a term of 60 months, at an initial exercise

price of $0.15 per share.

The Holder agreed that neither it nor any of its

affiliates shall engage in any short-selling or hedging of our Common Stock during any time while the 2023 Note remains outstanding or

while the Selling Stockholder holds any 2023 Warrants.

Leonite Exchange Agreement

On February 28, 2023, the Company and Leonite

Fund I, LP entered into that certain Global Settlement & Exchange of Senior Secured Convertible Promissory Note (the “Exchange

Agreement”) with Leonite Fund I, LP (“Leonite”), a Selling Stockholder. Pursuant to the terms of the Exchange Agreement,

Leonite agreed to exchange the total balance due under its Senior Secured Convertible Promissory Note dated September 1, 2021, as amended,

for 10,500,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”). Additionally,

under the Exchange Agreement, the Company agreed to (i) issue 110,000 shares of Common Stock in exchange for warrants previously issued

to Leonite and (ii) issue 38,152 shares of Common Stock (the “Outstanding Equity Interest Shares”). For the avoidance

of doubt, the Exchange Agreement did not amend or alter them terms and provisions of the 2021 Leonite Note.

MCUS Amendment Agreement

On April 11, 2023, the Company entered into an

Amendment of Promissory Note with MCUS, whereby MCUS agreed to amend its conversion price to $0.05. All other terms in the note remain

as is and unchanged.

Sharing Services Amendment Agreement

On May 1, 2023, the Company entered into an Amendment

of Promissory Note with Sharing Services whereby Sharing Services relinquished its right to conversion of the note into common stock,

in exchange for immediate payment of outstanding accrued interest and monthly payments beginning June 1, 2023, until maturity on September

1, 2024.

Our Corporate History

Stemtech Corporation and its subsidiaries (collectively,

the “Company”, or “Stemtech”) was incorporated in the State of Nevada, USA on September 4, 2009 under the name

Globe Net Wireless Corp., with ticker symbol “GNTW”. We have changed our corporate name to Stemtech Corporation in the state

of Nevada, and our Common Stock is listed on the OTCQB with the ticker symbol “STEK”. Stemtech is a global network

marketing company that develops science-based products that it believes support wellness by helping the body maintain healthy stem cell

physiology, also known as stem cell enhancers. Known as the Stem Cell Nutrition Company®, the Company is a pioneer in nutritional

stem cell science and believes it can demonstrate that adult stem cells function as the natural renewal system of the body. The Company

believes our products enhance and support the work of the body’s stem cells by releasing more stem cells, helping to circulate

them in the blood and migrate them into tissues, where they can perform their daily function of renewal for optimal health. Our mission

is to enhance wellness and prosperity around the world. These products are marketed internationally by the Companies subsidiaries and

through Independent Business Partners (IBPs). The Company markets its products under the following brands: RCM System, stemrelease3™,

Stemflo® MigraStem™, OraStem® (Oral Health Care), and D-Fuze™ (Electromagnetic Frequency (EMF) blocker). Stemtech

also introduced a new skincare product in December 2022: Cellect One™ Rapid Renew Stem Cell Peptide Night Cream. Stemtech has also

trade-marked the term “stemceuticals™” as a brand, which is the combination of stem cells and nutraceuticals.

On August 19, 2021, Stemtech Corporation (“Stemtech”),

a (Delaware corporation), entered into a Merger Agreement (the “Merger Agreement”) with Globe Net Wireless Corp. (“Globe

Net” or “GNTW”) (the “Merger”). The Merger is accounted for as a reverse acquisition and recapitalization

in accordance with the Accounting Standards Codification topic 805, Business Combinations (“ASC 805”). Management evaluated

the guidance contained in ASC 805 with respect to the identification of the acquirer in the Merger and concluded, based on a consideration

of the pertinent facts and circumstances, that Stemtech acquired Globe Net for financial accounting purposes. On November 9, 2021, the

Company changed its fiscal year end date from August to December.

SUMMARY OF THE OFFERING

This prospectus relates to the resale, from time

to time, of up to 165,200,135 shares (the “Shares”) of our Common Stock, par value $0.001 per share (“Common Stock”),

by the selling stockholders identified in this prospectus under “Selling Stockholders” (the “Offering”), comprised

of:

| |

(i) |

up to 65,909,091

Shares issuable upon conversion of that certain Senior Secured Promissory Note dated March 27, 2023 (the “2023 Note”)

issued by the Company to one (1) Selling Stockholder pursuant to the Securities Purchase Agreement between the Company and such Selling

Stockholder dated March 27, 2023 (the “2023 Purchase Agreement”); |

| |

(ii) |

up to 32,954,545

Shares issuable upon exercise of those certain Series 1 Warrants issued pursuant to the 2023 Purchase Agreement, exercisable immediately,

for a term of 60 months, at an initial exercise price of $0.10 per share, subject to customary adjustment provisions (the “Series

1 Warrants”); and |

| |

(iii) |

up to 32,954,545

Shares issuable upon exercise of those certain Series 2 Warrants issued pursuant to the 2023 Purchase Agreement, exercisable immediately,

for a term of 60 months, at an initial exercise price of $0.15 per share, subject to customary adjustment provisions (the “Series

2 Warrants” and together with the Series 1 Warrants, the “2023 Warrants”); |

| |

|

|

| |

(iv) |

up to 15,390,621 Shares

issuable upon conversion of that certain Promissory Convertible Note (of which 9,825,859 was already issued) dated effective August

30, 2021 (the “MCUS 2021 Note”) issued by the Company to MCUS, LLC (“MCUS”) pursuant to the Securities Purchase

Agreement between the Company and MCUS dated August 30, 2021 (the “MCUS 2021 SPA”) and pursuant to a debt settlement

agreement dated December 9, 2022 (the “Debt Settlement Agreement”) in exchange for $250,000 in liquidated damages three

tranches 2,559,600 shares of the Company’s common stock totaling 7,678,800 shares of the Company’ common stock; |

| |

|

|

| |

(v) |

up to 93,115 Shares issuable

upon exercise of that certain Common Share Purchase Warrant (the “MCUS 2021 Warrant”) issued to MCUS pursuant to the

MCUS 2021 SPA, exercisable until August 30, 2024 at an exercise price of $3.00 per share; |

| |

|

|

| |

(vi) |

5,695,920 Shares issuable

upon conversion of that certain Promissory Convertible Note dated effective August 31, 2021 (the “2021 Leonite Note) issued

by the Company to Leonite Fund I, LP (“Leonite”); |

| |

|

|

| |

(vi) |

up to 10,500,000 Shares

issued to Leonite (the “Leonite Settlement Shares”) issued to Leonite pursuant to that certain Global Settlement &

Exchange of Senior Secured Convertible Promissory Note (of which 6,340,591 was already issued) dated February 28, 2023 between the

Company and Leonite (the “Leonite Exchange Agreement”); |

| |

|

|

| |

(vii) |

up to 110,000 Shares

(the “Leonite Warrant Exchange Shares”) issued in exchange for warrants held by Leonite pursuant to the Leonite Exchange

Agreement; |

| |

|

|

| |

(viii) |

up to 38,152 Shares

issued to Leonite (the “Outstanding Equity Interest Shares”) pursuant to the Leonite Exchange Agreement; |

| |

|

|

| |

(ix) |

up to 1,400,000 Shares

issuable upon exercise of that certain Common Stock Warrant (the “Sharing Services Warrant” and together with the Series

1 Warrants, the Series 2 Warrants, the MCUS 2021 Warrant, collectively, the “Warrants”) issued to Sharing Services pursuant

to the Sharing Services SPA, exercisable at any time until September 13, 2024 at an exercise price of $0.05 per share; and |

| |

|

|

| |

(x) |

up to 154,173 Shares

issued to Sharing Services as an origination fee (the “Origination Fee Shares”) pursuant to the Sharing Services SPA. |

We are not selling any shares of our Common Stock

under this prospectus and will not receive any proceeds from the sale of the Shares. We will, however, receive proceeds from any Warrants

that are exercised through the payment of the exercise price in cash. The Selling Stockholders will bear all commissions and discounts,

if any, attributable to the sale of the Shares. We will bear all costs, expenses, and fees in connection with the registration of the

Shares.

| Issuer |

|

Stemtech Corporation |

| |

|

|

| Shares of Common Stock offered by us |

|

None |

| |

|

|

| Shares of Common Stock offered by the Selling Stockholders |

|

189,121,101 shares (1) |

| |

|

|

| Shares of Common Stock outstanding before the Offering |

|

100,169,170 shares (2) |

| |

|

|

| Shares of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby |

|

253,861,000 shares (2) |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the resale of the common stock by the Selling Stockholders. |

| |

|

|

| Market for Common Stock |

|

Our Common Stock is quoted on OTCQB under the symbol “STEK.” |

| |

|

|

| Risk Factors |

|

Investing in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 7 and in the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our securities. |

| |

(1) |

This amount consists of up to (i) 76,446,281 Shares issuable

upon conversion of the 2023 Note, (ii) 38,223,141 Shares issuable upon exercise of the Series 1 Warrants, (iii) 38,223,140 Shares

issuable upon exercise of the Series 2 Warrants, (iv) up to 10,715,781 Shares issuable upon conversion of the MCUS 2021 Note,

(v) up to 93,115 Shares issuable upon exercise of the MCUS 2021 Warrant, (vi) 13,217,318 Shares issuable upon conversion of

the August 2021 Leonite Note, (vii) 10,500,000 Leonite Settlement Shares, (viii) 110,000 Leonite Warrant Exchange Shares,

(ix) up to 38,152 Outstanding Equity Interest Shares, (x) 1,400,000 Shares issuable upon exercise of the Sharing Services Warrant,

and (xi) 154,173 Origination Fee Shares. |

| |

(2) |

The number of shares of Common Stock outstanding before

and after the Offering is based on 100,169,170 shares outstanding as of August 21, 2023. |

RISK FACTORS

Investing in our securities involves a high

degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information

contained in this prospectus, before making an investment decision with respect to our securities. The occurrence of any of the following

risks or those incorporated by reference, or additional risks and uncertainties not presently known to us or that we currently believe

to be immaterial could materially and adversely affect our business, financial condition, results of operations or cash flows. In any

such case, the trading price of common stock and the trading price of Series A warrants, if any, could decline, and you may lose all or

part of your investment. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties.

Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including

the risks and uncertainties described below and those incorporated by reference.

Risks Related to our Business

The Company is a development stage business

and subject to the many risks associated with new businesses.

Our business has a limited operating history and

is subject to all of the risks inherent with a development stage enterprise. Our likelihood of success must be considered in light of

the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of

a development stage enterprise. We have incurred losses and may continue to operate at a net loss for at least the next several years

as we execute our business plan. The Company has experienced recurring net losses and negative cash flows from operations since inception

and has an accumulated deficit of approximately $21.6 million and a working capital deficiency of approximately $6.8 million at December

31, 2022.

Our financial situation creates doubt whether

we will continue as a going concern.

There can be no assurances that we will be able

to achieve a level of revenues adequate to generate sufficient cash flow from operations or obtain funding or additional financing through

private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds

generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working

capital and no assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These

conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we

may be forced to discontinue operations, which would cause investors to lose their entire investment.

Based on the report from our independent auditors

dated April 17, 2023, management stated that our financial statements for the year ended December 31, 2022, were prepared assuming

substantial doubt about the Company’s ability to continue as a going concern for a period of one year from the issuance of these

financial statements. The Company’s consolidated financial statements have been prepared assuming that it will continue as a going

concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business.

We are not profitable and may never be profitable.

Since inception through the present, we have been

dependent on raising capital to support our working capital needs. During this same period, we have recorded net accumulated losses and

are yet to achieve profitability. Our ability to achieve profitability depends upon many factors, including our ability to sell current

products and develop and commercialize new products. There can be no assurance that we will ever achieve any significant revenues or profitable

operations.

Our operating expenses exceed our revenues

and will likely continue to do so for the foreseeable future.

We are in an early stage of our development, and

we have not generated sufficient revenues to offset our operating expenses. Our operating expenses will likely continue to exceed our

operating income for the foreseeable future, until such time as we are able to monetize our products and generate substantial revenues,

particularly as we undertake payment of the increased costs of operating as a public company.

We have assumed a significant amount of

debt and our operations may not be able to generate sufficient cash flows to meet our debt obligations, which could reduce our financial

flexibility and adversely impact our operations.

The Company currently has considerable obligations

under notes, related party notes and lines of credit outstanding with various lenders. Our ability to make payments on such indebtedness

will depend on our ability to generate cash flow. The Company may not generate sufficient cash flow from operations to enable us to repay

this indebtedness and to fund other liquidity needs, including capital expenditure requirements. Such indebtedness could affect our operations

in several ways, including the following:

| |

· |

a significant portion of our cash flows could be required to be used to service such indebtedness; |

| |

|

|

| |

· |

a high level of debt could increase our vulnerability to general adverse economic and industry conditions; |

| |

|

|

| |

· |

any covenants contained in the agreements governing such outstanding indebtedness could limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments; |

| |

|

|

| |

· |

a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore, our competitors may be able to take advantage of opportunities that our indebtedness may prevent us from pursuing; and |

| |

|

|

| |

· |

debt covenants to which we may agree may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry. |

A high level of indebtedness increases the risk

that we may default on our debt obligations. We may not be able to generate sufficient cash flows to pay the principal or interest on

our debt. If we cannot service or refinance our indebtedness, we may have to take actions such as selling significant assets, seeking

additional equity financing (which will result in additional dilution to stockholders) or reducing or delaying capital expenditures, any

of which could have a material adverse effect on our operations and financial condition. If we do not have sufficient funds and are otherwise

unable to arrange financing, our assets may be foreclosed upon which could have a material adverse effect on our business, financial condition

and results of operations.

As of August 21, 2023, the Company has aggregate

debt of approximately $2,555,000, net of discount. On March 27, 2023, the Company and an institutional investor executed an investment

agreement for up to $7,000,000 pursuant to a Convertible Promissory Note, Share Purchase Agreement

and Warrant Agreement (collectively, the “Agreements”). The Convertible Promissory Note includes a 12% Original Issue Discount

(the “OID”), which means the Company will be able to draw up to $5,180,000 against the face value of the Convertible Promissory

Note. The remaining $3,680,000 available to the Company under the Convertible Promissory Note is disbursed at the discretion of the investor

and may never be fully received by the Company. In addition, on May 5, 2023 and June 1, 2023, the Holder made additional

disbursements in the amount of $50,000 and $61,000, respectively. On May 9, 2023, the Holder made an additional $250,000 advance of the

required disbursements to the Company.

We will need additional capital, which may

be difficult to raise as a result of our limited operating history as a public company or any number of other reasons.

We expect that we will need to raise additional

capital within the next 12 months. However, in the event that we exceed our expected growth, we would need to raise additional capital.

There is no assurance that additional equity or debt financing will be available to us when needed, on acceptable terms, or even at all.

Our limited operating history makes investor evaluation and an estimation of our future performance substantially more difficult. As a

result, investors may be unwilling to invest in us or such investment may be offered on terms or conditions that are not acceptable. In

the event that we are not able to secure financing, we may have to scale back our growth plans or cease operations.

We face intense and increasing competition.

If we do not provide products that are helpful and desirable by consumers, we may not remain competitive, and our potential revenues and

operating results could be adversely affected.

Our business is rapidly evolving and intensely

competitive, and is subject to changing consumer trends, economic and regulatory conditions, shifting consumer needs and frequent introductions

of new products and offerings from competitors. Our ability to compete successfully depends heavily on providing digital content that

is useful and enjoyable for our users and delivering our content through innovative technologies in the marketplace. It is necessary for

us to continue creating new focused products with the intention to be disruptive and innovative in the marketplace.

We face competition from others in the wellness

and nutrition industries. Our current and potential competitors range from large and established companies to emerging start-ups. Established

companies have longer operating histories and more established relationships with customers and users, and they can use their experience

and resources in ways that could affect our competitive position, including by making acquisitions, investing aggressively in research

and development, aggressively initiating intellectual property claims (whether or not meritorious) and competing aggressively for consumers.

Emerging start-ups may be able to innovate and provide products and services faster than we can.

Additionally, our operating results would suffer

if our products are not timed with market opportunities, or if our new products are not effectively brought to market. As the nutrition

and wellness industry continues to evolve with consumer trends and scientific discoveries, our competitors may be able to offer products

that are, or that are seen to be, substantially similar to or better than, ours. This may force us to compete in different ways and expend

significant resources in order to remain competitive. If our competitors are more successful than we are in developing compelling products

or attracting and retaining customers, our revenues and operating results could be adversely affected.

If we fail to retain existing customers,

or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly

harmed.

The size of our customer base and the attraction

of new customers are critical to our success. Our financial performance will be significantly determined by our success in adding, retaining,

and engaging customers. If consumers do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract

or retain customers or otherwise maintain or increase the frequency in which they use our products. Any number of factors could potentially

negatively affect customer retention, growth, and engagement, including if:

| |

● |

We fail to introduce new products or services that consumers find beneficial or if we introduce new products or services, or make changes to existing products and services, that are not favorably received; |

| |

● |

Consumer behavior and desires change; |

| |

● |

Consumers adopt new products or offerings where our products may be displaced in favor of other products or offerings; |

| |

● |

There may be changes being considered by legislation, regulatory authorities, that could adversely affect our industry of dietary supplements and all-natural plant-based products; |

| |

● |

Distribution or other problems could prevent us

from delivering our products in a rapid and reliable manner or otherwise negatively impact our relationship with customers; such as backorders

or possible issues related for force majeure, civil unrest, war, electrical grid power interruptions, energy supply such as gasoline and

diesel for transportation.

Supply chain challenges may occur if geo-political

uncertainty and unrest rise to new levels of contention, given that several of our raw materials are imported from countries within those

regions for manufacturing. |

Labor Strikes

| |

● |

We make changes in how we promote different products and services across our business; |

| |

● |

Initiatives designed to attract and retain customers are unsuccessful or discontinued, whether as a result of actions by us, third parties, or otherwise; or |

| |

● |

We fail to provide adequate customer service, training and support, recognition, events, cruises and other rewards. |

If we are unable to maintain or increase our customer

base, our revenue and financial results may be adversely affected. Any decrease in customer retention, growth, or engagement could render

our products less attractive, which is likely to have a material and adverse impact on our revenue, business, financial condition, and

results of operations.

We face competition from additional new

products entering the markets.

Other companies like Cerule International LLC

and Stemsation International, Inc., which were each formed by prior Stemtech employees, operate with a similar plan as Stemtech. Other

new competitors can emerge as the stem cell market continues to grow. Our success will be highly dependent on our ability to raise capital

and develop and market new products.

We are subject to risks associated with

leveraging independent business partners and direct to consumer distribution.

Our business model uses Independent Business

Partners (“IBPs”) and direct to consumer methods to distribute our products to customers. The use of IBPs and direct to consumer

distribution introduces various risks and uncertainties to our business, including, but not limited to, our ability to have sufficient

inventory on hand to meet customer demand on a timely basis, our ability to timely pay commission to our IBPs, providing our IBPs with

the tools to effectively market and sell our products and our success in retaining and adding new IBPs to meet demand. Our success will

be highly dependent on our IBPs over whom we have no direct control.

We are subject to risks associated with

leveraging assignments through one or more license agreements.

We currently have three active licenses of

product and/or sales platform to third-party licensees for the territories of Kuwait, New Zealand and South Africa. Currently, there

are no material revenues associated with these territories, but our growth can be impacted if these licensors cancel their agreements

if the Company cannot fulfill customer and/or IBP sales through alternative methods.

Acquisitions and new product offerings may

disrupt growth.

We may pursue strategic acquisitions and new product

offerings in the future. Risks in acquisition transactions include difficulties in the integration of acquired businesses into our operations

and control environment, difficulties in assimilating and retaining employees and intermediaries, difficulties in retaining the existing

clients of the acquired entities, assumed or unforeseen liabilities that arise in connection with the acquired businesses, the failure

of counterparties to satisfy any obligations to indemnify us against liabilities arising from the acquired businesses, and unfavorable

market conditions that could negatively impact our growth expectations for the acquired businesses. Fully integrating an acquired company

or business into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these

risks or any other problems encountered with acquisitions and other strategic transactions. These risks may prevent us from realizing

the expected benefits from acquisitions and could result in the failure to realize the full economic value of a strategic transaction

or the impairment of goodwill and/or intangible assets recognized at the time of an acquisition. These risks could be heightened if we

complete a large acquisition or multiple acquisitions within a short period of time.

Additionally, the integration of new product offerings

carries many of the same risks associated with acquisitions. We may incur difficulties in the integration of new products into our current

business and providing new products may take a significant amount of time and financial resources. We cannot assure that the offering

of new products will be successful and that such risks may prevent us from realizing the expected benefits from the development and offering

of new products and services.

We depend on our key management personnel

and the loss of their services could adversely affect our business.

We place substantial reliance upon the efforts

and abilities of our executive officers and directors. Though no individual is indispensable, the loss of the services of these executive

officers could have a material adverse effect on our business, operations, revenues or prospects. We do not currently maintain key man

life insurance on the lives of these individuals.

If we are unable to protect our intellectual

property, the value of our brands and other intangible assets may be diminished, and our business may be adversely affected.

We rely and expect to continue to rely on a combination

of confidentiality, assignment, and license agreements with our employees, consultants, and third parties with whom we have relationships,

as well as trademark, copyright, patent, trade secret, and domain name protection laws, to protect our proprietary rights. In the United

States and internationally, we have filed various applications for protection of certain aspects of our intellectual property, and we

currently hold a number of registered trademarks and issued patents in multiple jurisdictions and have acquired patents and patent applications

from third parties. Third parties may knowingly or unknowingly infringe our proprietary rights, third parties may challenge proprietary

rights held by us, and pending and future trademark and patent applications may not be approved. In addition, effective intellectual property

protection may not be available in every country in which we operate +or intend to operate our business. In any or all of these cases,

we may be required to expend significant time and expense in order to prevent infringement or to enforce our rights. Although we have

generally taken measures to protect our proprietary rights, there can be no assurance that others will not offer products or concepts

that are substantially similar to ours and compete with our business. In addition, we regularly contribute software source code under

open-source licenses and have made other technology we developed available under other open licenses, and we include open-source software

in our products. If the protection of our proprietary rights is inadequate to prevent unauthorized use or appropriation by third parties,

the value of our brands and other intangible assets may be diminished and competitors may be able to more effectively mimic our products,

services, and methods of operations. Any of these events could have an adverse effect on our business and financial results.

We need to manage growth in operations to

maximize our potential growth and achieve our expected revenues and our failure to manage growth will cause a disruption of our operations,

resulting in the failure to generate revenue.

In order to maximize potential growth in our current

and potential markets, we believe that we must expand our marketing operations. This expansion will place a significant strain on our

management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial

controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees.

Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the general strategies of

our company we need to maintain and search for hard-working employees who have innovative initiatives, while at the same time, keep a

close eye on any and all expanding opportunities in our marketplace.

The laws and regulations concerning dietary

supplements are continually evolving; our actual or perceived failure to comply with these laws and regulations could harm our business.

No significant costs noted due to any changes in the laws and regulations concerning dietary supplements.

Our products are classified as foods and dietary

supplements. In both domestic and foreign markets, the formulation, manufacturing, packaging, labeling, distribution, advertising, importation,

exportation, licensing, sale, and storage of our products are subject to extensive government regulation. This regulation takes the form

of laws, governmental regulations, administrative determinations, court decisions, and other similar constraints and exists at the federal,

state, and local levels in the United States and at all levels of government in foreign jurisdictions. There can be no assurance that

we or our partners are, or will remain, in compliance with all of these regulations. Our failure or our partners’ failure to comply

with applicable regulations could disrupt the manufacturing of our products, our marketing activity, our partners’ sale of our products,

or lead to increased costs, legal or regulatory proceedings, the imposition of significant penalties, or harm our reputation, any of which

could adversely impact our business, financial condition, and operating results. In addition, regulatory authorities periodically review

legislative and regulatory policies and initiatives, and may promulgate new or revised, or adopt changes in the interpretation and enforcement

of existing, regulations at any time. The adoption of new regulations or changes in the interpretations of existing regulations may result

in significant compliance costs or discontinuation of impacted product sales and may negatively impact the marketing of our products or

require us to change or cease aspects of our business, any of which could result in significant loss of sales and harm our business, financial

condition, and operating results.

For example, we are subject to the rules of the

FDA, including for cGMPs. Any failure by us or our contract manufacturers to comply with the cGMPs could negatively impact

our reputation and ability to sell our products even after the situation has been rectified and, in the case of our contract manufacturers,

even though we are not directly liable under the cGMPs for their compliance. In complying with the dietary supplement cGMPs

we have experienced increases in production costs due to increases in required testing of raw ingredients, work in process, and finished

products. In addition, regulators and other governmental authorities limit the types of claims that we and our partners can make about

our products, including nutrition content claims, health claims, and therapeutic claims and otherwise regulate the marketing of our products.

For example, the FTC’s Guides explain how the FTC interprets prohibitions on unfair or deceptive acts or practices. Consequently,

the FTC could bring an enforcement action based on practices that are inconsistent with the FTC’s Guides. It is possible that our

use, and that of our partners, of marketing materials, including testimonials about our products, may be significantly impacted by laws,

rules, and regulations governing the marketing of our products and therefore might negatively impact our sales.

If we receive inquiries from regulators and third

parties requesting information concerning our products, we fully cooperate with these inquiries including, when requested, by the submission

of detailed technical documents addressing product composition, manufacturing, process control, quality assurance, and contaminant testing.

We are confident in the safety of our products when used as directed. However, there can be no assurance that regulators, including in

countries where we plan to commence or expand operations, will not take actions that may adversely affect our business and our sales,

including preventing or delaying entry into markets or the introduction of new products or requiring the reformulation or the temporary