Pfizer Revenue Growth Stalls as Company Mulls OTC Unit's Future--Update

May 01 2018 - 12:24PM

Dow Jones News

By Jonathan D. Rockoff and Cara Lombardo

Pfizer Inc.'s revenue was little changed in its latest quarter

as the drug company shifts focus to a new generation of products

and sorts out what to do with its over-the-counter medicines unit,

which hasn't attracted a buyer.

In the quarter, rising sales of newer drugs including cancer

treatments Ibrance and Xtandi and blood-thinner Eliquis offset

falling revenue for longtime products such as male-impotence pill

Viagra, which is facing lower-priced generic competition.

But the double-digit sales increases for some of the newer

products weren't enough to move the needle on the company's overall

revenue, which rose 1% from a year ago to $12.9 billion.

Chief Executive Ian Read said revenue will grow at a higher rate

as the company brings to the market drugs under development,

including what he said were 15 compounds each with the potential

for $1 billion in yearly sales. The drugs will require regulatory

approval before hitting the market.

"I'm really looking forward to the growth rates we will

produce," Mr. Read said during a conference call with analysts and

investors.

Both Mr. Read and Chief Financial Officer Frank D'Amelio

downplayed the possibility of finding growth by splitting up the

company or doing a major deal, moves for which they had previously

expressed more support.

"I don't see we need a transformative deal," Mr. Read said

during the call. "The best investment we have now is in our own

pipeline."

Pfizer has been exploring since late last year selling or

spinning off its consumer-health business, which sells products

such as Advil pain pills, Chapstick lip balm and Centrum

vitamins.

Analysts had predicted Pfizer could sell the business for $10

billion or more. But so far, potential buyers have opted to make

other deals.

GlaxoSmithKline PLC, which had been interested in Pfizer's

business, opted instead to buy Novartis AG's share in a joint

venture for $13 billion.

Reckitt Benckiser Group PLC, a U.K.-based consumer-products

maker, pulled out of talks for Pfizer's business in March, saying

it wasn't possible to buy only the parts it wanted.

Meantime, Procter & Gamble Co. agreed to buy Merck KGaA's

consumer-health business for $4.2 billion.

Mr. Read said Pfizer will decide by the end of the year what to

do with the consumer-health business. "If we can't get good value,

we will retain it," he said.

In the quarter, Pfizer's results were hurt by supply shortages

for some of the company's sterile injectable drugs. Overall, Pfizer

reported a first-quarter profit of $3.56 billion, up from $3.12

billion a year ago.

Pfizer shares, up 1% so far this year, slid 4.4% in trading

Tuesday.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

May 01, 2018 12:09 ET (16:09 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

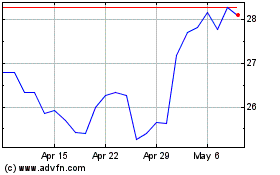

Pfizer (NYSE:PFE)

Historical Stock Chart

From May 2024 to Jun 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Jun 2023 to Jun 2024