If you had never heard of cryptocurrencies such as BitCoin and Etherum before 2021, you will almost certainly have heard about them this year. You can’t help but to have heard of it in the news, for both good and bad reasons.

Values of numerous cryptocurrencies soared to record heights, new cryptocurrencies hit the market and many companies such as Tesla, ExpressVPN and betanysports all began to accept cryptocurrencies of one form or another as payment.

However, despite all the highs this year, things have recently turned sour for many cryptocurrencies. Values have dipped and many people have lost a tonne of money, partly through investing at the wrong time, partly through a number of new crypto scams that are circulating around.

But why have cryptocurrencies all of a sudden begun to drop? And will they ever hit the heights they did earlier in 2021? Well, let us have a little look to see if we can figure it out.

The rise of cryptocurrencies in 2021

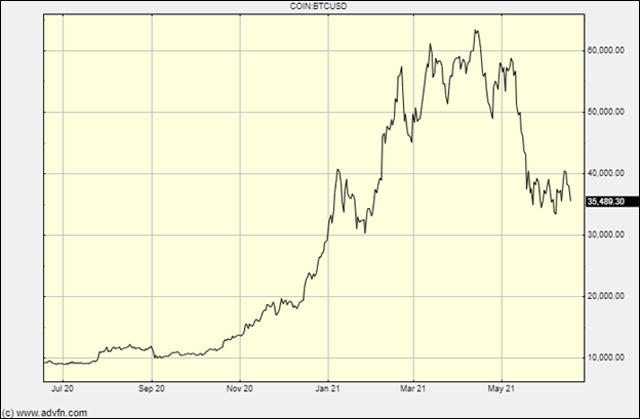

When it comes to cryptocurrencies, the biggest of them all is BitCoin. Go back 12 months to June 2020, and it was hovering around the value of $9,500 for 1 Bitcoin (BTC). Escalate that towards the end of April 2021, and the value of 1 BTC had soared to over $60,000, but within the last two months, BTC’s value plummeted, although it now seems to have settled around the $35,000 mark.

Source: https://uk.advfn.com/crypto/Bitcoin-BTC/chart

But why did cryptocurrencies all of a sudden rocket in value? Well, there are a few reasons to answer this. The first was the fear of missing out. Many people had begun to hear about cryptocurrencies, and how valuable they had become. Not wanting to lose out on the opportunity to make some money, many people began investing in cryptocurrency, or even mining it themselves.

The pandemic was also a reason as to why cryptocurrencies soared in value. Many Governments around the world introduced measures to help businesses and individuals get through these tough times. To do this, many places printed more money. This devalues those currencies because there is no set limit, more money can always be introduced to the market. Without a cap, this means that the value in terms of inflation will fall.

With cryptocurrency, there is a limited supply of any single cryptocurrency. So in a sense, it is like the earth’s natural resources. The fewer there are available, the more valuable those assets become. It’s simple supply and demand economics. And with people not wanting to miss out, combined with this, supply was dwindling and demand was constantly on the rise.

The third reason for the rise was the legitimacy of cryptocurrencies. Previously, they were unregulated and so Governments and investment hedge funds didn’t really look at them as a viable alternative to traditional currency. But as more businesses began to accept them, national institutions began to look at the legitimacy of them as well. Whilst they still are unregulated, it won’t likely be long before they are.

What caused the fall?

Well firstly, as with stocks and shares, you buy low, sell high. It’s how people make money. And cryptocurrency works the same way. Plenty of people were buying it, the more who bought it the higher the value went. But then it gets to a point where people begin to think, “I’ve made a lot of money now, I should withdraw before I lose it”. And as one person begins to sell, so do many others. The more that sell, the more the price begins to fall as demand for it falls.

But what sparked people to start selling? Well, there are a number of reasons, first up, Elon Musk. The CEO of Tesla became synonymous with the rise in value of cryptocurrency, as he began tweeting regularly about crypto markets. He announced his company Tesla was investing over $1 billion USD which grabbed the attention of many investors, who then followed suit.

He then started tweeting about smaller currencies, and they too began to rapidly rise. But before long he was saying how they contribute too heavily toward global warming and how developers of these cryptocurrencies need to lower their carbon footprint.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk, the 2nd (@elonmusk) May 12, 2021

This caused the values to begin dipping. But then the Chinese Government got involved too and things got even worse. They decided to ban financial companies from providing services for crypto trading.

Their concerns were to do with the fact cryptocurrencies were not regulated, but that could well be a cover. As it is known that China is developing its own Government-run cryptocurrency, the first to be legitimately recognised and regulated by a national state.

Where does the crypto market go from here?

Well, no one predicted how big a rise we would see this year, so the future is far from certain. But Bitcoin and other cryptocurrencies are always working on improving and growing, so it won’t be any doubt that at some point in time we will see more rises, and with it falls, in the value of all cryptocurrencies.

But with China starting up their own, other countries may follow suit. Or at least begin legitimately recognising cryptocurrencies. In fact, France has recently looked into the matter themselves.

But before many do, there may have to be the creation of some kind of regulatory body for this to happen. However, that may also put many people off, because they enjoy being invested in something not controlled by central banks. So if that were to happen, unless it was a body of crypto developers, it could cause the whole market to crash.