Simon Property Beats Estimates - Analyst Blog

April 29 2011 - 10:30AM

Zacks

Simon Property Group

Inc. (SPG), a leading real estate investment trust (REIT),

reported first quarter 2011 FFO (funds from operations) of $570.6

million or $1.61 per share, compared to $325.6 million or $0.94 in

the year-earlier quarter. Fund from operations, a widely used

metric to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income.

The reported quarterly FFO exceeded

the Zacks Consensus Estimate by 7 cents. Total revenues during the

reported quarter increased to $1.0 billion from $925.1 million in

the year-ago period. Total revenues during the reported quarter

were well ahead of the Zacks Consensus Estimate of $964

million.

Occupancy in the regional malls and

premium outlet centers combined portfolio was 92.9% at quarter-end,

compared to 92.2% in the year-ago period. Comparable sales in the

combined portfolio increased to $500 per square foot, compared to

$462 in the prior-year quarter. Average rent per square foot in the

combined portfolio increased during first quarter 2011 to $39.26

from $38.72 in the year-ago period.

The company continued its active

development and redevelopment programs during the quarter. Simon

Property opened Paju Premium Outlets – its second Premium Outlet

Center in South Korea spanning 328,000 square feet of space. At the

same time, Simon Property opened a major expansion of Las Vegas

Outlet Center during the reported quarter. The expansion added 13

new stores and approximately 70,000 square feet of space. The

center was also renovated with a complete external makeover and

significant interior improvements, and was renamed as Las Vegas

Premium Outlets - South.

During the quarter, Simon Property

started expansion work on a 93,000 square foot expansion of Ami

Premium Outlets, near Tokyo, Japan. The company also continued

construction work on a premium outlet each in Malaysia, Japan, and

in New Hampshire.

At quarter-end, the company had

approximately $636.1 million of cash on hand. The company

maintained its quarterly dividend at 80 cents per share. With

strong quarterly and fiscal results, Simon Property increased its

2011 FFO guidance from the range of $6.45 – $6.60 per share to

$6.55 – $6.65.

We currently maintain our ‘Neutral’

recommendation on the stock, which presently has a Zacks #3 Rank

translating into a short-term ‘Hold’ rating. We also have a

‘Neutral’ recommendation and a Zacks #3 Rank for Macerich

Co. (MAC), one of the competitors of Simon Property.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

Zacks Investment Research

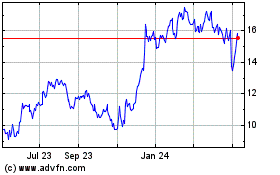

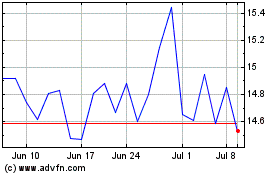

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024