Danaos Corporation ("Danaos") (NYSE: DAC), a leading international

owner of containerships, today reported unaudited results for the

quarter ended March 31, 2012.

Highlights for the First Quarter Ended March

31, 2012:

- Operating revenues of $134.2 million for the

three months ended March 31, 2012 compared to $99.0 million for the

three months ended March 31, 2011, an increase of 35.6%.

- Adjusted EBITDA(1) of

$96.4 million for the three months ended March 31, 2012 compared to

$65.2 million for the three months ended March 31, 2011, an

increase of 47.9%.

- Adjusted net income(1) of $17.6 million, or $0.16 per share, for the three months

ended March 31, 2012 compared to $11.4 million, or $0.10 per share,

for the three months ended March 31, 2011.

- During the first quarter of 2012, we took

delivery of three newly built containerships with an aggregate

carrying capacity of 34,730 TEU, which have been all deployed on

12-year time charters.

- The remaining average charter duration of our

fleet was 10.0 years as of March 31, 2012 (weighted by aggregate

contracted charter hire).

- Total contracted operating revenues were $5.4

billion as of March 31, 2012, through 2028.

- Charter coverage of 88% for the remainder of

2012 in terms of contracted operating days and 95% in terms of

operating revenues.

Three Months Ended March 31, 2012

Financial Summary

(Expressed in thousands of United States dollars, except per share amounts):

Three months Three months

ended ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

(unaudited) (unaudited)

Operating revenues $ 134,237 $ 98,989

Net income $ 9,342 $ 5,443

Adjusted net income1 $ 17,587 $ 11,354

Earnings per share $ 0.09 $ 0.05

Adjusted earnings per share1 $ 0.16 $ 0.10

Weighted average number of shares (in thousands) 109,605 108,611

Adjusted EBITDA1 $ 96,438 $ 65,178

Danaos' CEO Dr. John Coustas

commented:

During this first quarter, we evidenced the seeds of the

container market recovery. The Liner companies were aligned in box

rate hikes which, until now, have been pretty successful. The

charter market became more active with rates on some post-panamax

vessels almost doubling and we evidence a trickle down effect on

the large panamaxes. This development will put most liner companies

back in the black for 2012 and will greatly reduce the counterparty

risk that was troubling the market.

On the supply front, we continue to experience restraint in new

orders with the notable exception of the much awaited Evergreen

contract for 10 large post-panamaxes.

On the Company front, we continue with the delivery of our

fleet. As of today, we have taken delivery of all but two 13,100

TEU vessels, which are scheduled to be delivered until the end of

June 2012.

Our financial performance continues to improve. We recorded for

the quarter an adjusted EBITDA of $96.4 million and adjusted net

income of $17.6 million and 16 cents per share compared to $11.4

million and 10 cents per share for the 1st quarter of 2011.

Our charter coverage for the remainder of 2012 stands at 95% in

terms of operating revenues. We still have three vessels in cold

layup and we are evaluating their employment possibilities.

We are getting very close to the successful completion of one of

the most ambitious new building programs within the next quarter to

maximize the cash generating capacity of our company.

Three months ended March 31, 2012 compared to

the three months ended March 31, 2011

During the quarter ended March 31, 2012, Danaos had an average

of 60.1 containerships compared to 51.0 containerships for the same

period in 2011. During the first quarter of 2012, we took delivery

of three vessels, the Hyundai Together, on February 16, 2012, the

CMA CGM Melisande, on February 28, 2012 and the Hyundai Tenacity,

on March 8, 2012. Our fleet utilization was reduced to 94.5% in the

three months ended March 31, 2012 compared to 96.7% in the same

period of 2011, mainly due to the 246 days for which three of our

vessels were off-charter and laid-up by us in the first quarter of

2012.

Our adjusted net income was $17.6 million, or $0.16 per share,

for the three months ended March 31, 2012 compared to $11.4

million, or $0.10 per share, for the three months ended March 31,

2011. We have adjusted our net income in the first quarter of 2012

for unrealized gain on derivatives of $2.3 million, realized losses

on swaps of $6.9 million attributable to our over-hedging position

(as described below), as well as a non-cash expense of $3.7 million

for fees related to our comprehensive financing plan (related to

non-cash, amortizing and accrued finance fees). Please refer to the

Adjusted Net Income reconciliation table, which appears later in

this earnings release.

The increase of 54.4%, or $6.2 million, in adjusted net income

for the three months ended March 31, 2012 compared to the three

months ended March 31, 2011, was attributable to the increased

Income from Operations, which was partially off-set by an increase

in realized losses on our interest rate swap contracts (after the

adjustment of the over-hedging portion), as well as increased

interest expense (mainly due to the higher average indebtedness)

during the three months ended March 31, 2012 compared to the same

period in 2011.

On a non-adjusted basis our net income was $9.3 million, or

$0.09 per share, for the first quarter of 2012, compared to net

income of $5.4 million, or $0.05 per share, for the first quarter

of 2011.

As a result of our comprehensive financing plan, we are in an

over-hedged position under our cash flow interest rate swaps, which

is due to deferred progress payments to shipyards, cancellation of

three newbuildings in 2011, the replacement of variable interest

rate debt with fixed interest rate Vendor Financing and equity

proceeds from our private placement in 2010, all of which reduced

initially forecasted variable interest rate debt and resulted in

notional cash flow interest rate swaps being above our variable

interest rate debt eligible for hedging. The over-hedged position

described above will be gradually reduced and ultimately eliminated

during the second half of 2012, following the delivery of all of

our remaining newbuildings and the full drawdown of our committed

debt.

Operating Revenue Operating revenue

increased 35.6%, or $35.2 million, to $134.2 million in the three

months ended March 31, 2012, from $99.0 million in the three months

ended March 31, 2011. The increase was primarily attributable to

the addition of ten vessels to our fleet, as follows:

Vessel Name Vessel Size (TEU) Date Delivered

------------------------- ----------------- -----------------

Hanjin Italy 10,100 April 6, 2011

Hanjin Constantza 3,400 April 15, 2011

Hanjin Greece 10,100 May 4, 2011

CMA CGM Attila 8,530 July 8, 2011

CMA CGM Tancredi 8,530 August 22, 2011

CMA CGM Bianca 8,530 October 26, 2011

CMA CGM Samson 8,530 December 15, 2011

Hyundai Together 13,100 February 16, 2012

CMA CGM Melisande 8,530 February 28, 2012

Hyundai Tenacity 13,100 March 8, 2012

These additions to our fleet contributed revenues of $32.6

million during the three months ended March 31, 2012 (739 operating

days in total).

Furthermore, operating revenues for the three months ended March

31, 2012, reflect:

- $4.0 million of incremental revenues in the three months ended

March 31, 2012 compared to the same period of 2011, related to one

3,400 TEU containership (the Hanjin Algeciras, which was added to

our fleet on January 26, 2011) and one 10,100 TEU containership

(the Hanjin Germany, which was added to our fleet on March 10,

2011).

- $1.4 million decrease in revenues in the three months ended

March 31, 2012 compared to the same period of 2011. This was mainly

attributable to increased off-hire days by 153 days, to 303 days

(mainly due to the three vessels that were off-charter and laid up)

in the three months ended March 31, 2012, from 150 days in the

three months ended March 31, 2011, which was partially offset by

the increased revenue of our fleet in the first quarter of 2012

compared to the same period of 2011, due to the one additional

operating day in February 2012 compared to February 2011.

Vessel Operating Expenses Vessel operating

expenses increased 13.2%, or $3.5 million, to $30.1 million in the

three months ended March 31, 2012, from $26.6 million in the three

months ended March 31, 2011. The increase is mainly attributable to

the increased average number of vessels in our fleet during the

three months ended March 31, 2012 compared to the same period of

2011. The average daily operating cost per vessel decreased to

$5,945 for the three months ended March 31, 2012, from $6,162 for

the three months ended March 31, 2011 (excluding vessels on

lay-up).

Depreciation & Amortization

Depreciation & Amortization includes Depreciation and

Amortization of Deferred Dry-docking and Special Survey Costs.

Depreciation Depreciation expense increased 41.5%, or $9.3

million, to $31.7 million in the three months ended March 31, 2012,

from $22.4 million in the three months ended March 31, 2011. The

increase in depreciation expense was due to the increased average

number of vessels in our fleet (with higher cost base) during the

three months ended March 31, 2012 compared to the same period of

2011.

Amortization of Deferred Dry-docking and Special Survey Costs

Amortization of deferred dry-docking and special survey costs

decreased 20.0%, or $0.3 million, to $1.2 million in the three

months ended March 31, 2012, from $1.5 million in the three months

ended March 31, 2011.

General and Administrative Expenses

General and administrative expenses increased 4.3%, or $0.2

million, to $4.8 million in the three months ended March 31, 2012,

from $4.6 million in the same period of 2011. The increase was the

result of increased fees of $0.6 million to our Manager, due to the

increase in the average number of vessels in our fleet, which were

partially offset by a $0.4 million reduction mainly in legal and

advisory fees recorded in the three months ended March 31, 2012

compared to the same period of 2011.

Other Operating Expenses Other Operating

Expenses includes Voyage Expenses

Voyage Expenses Voyage expenses increased by $0.7 million, to

$2.9 million in the three months ended March 31, 2012, from $2.2

million in the three months ended March 31, 2011. The increase was

the result of increased commissions to our Manager, due to the

increase in the average number of vessels in our fleet and the

increase in the commission on gross charter hires to our Manager,

to 1.0% from 0.75%, effective January 1, 2012.

Interest Expense and Interest Income

Interest expense increased by 55.9%, or $6.6 million, to $18.4

million in the three months ended March 31, 2012, from $11.8

million in the three months ended March 31, 2011. The change in

interest expense was due to the increase in our average debt by

$525.8 million, to $3,125.1 million in the quarter ended March 31,

2012, from $2,599.3 million in the quarter ended March 31, 2011, as

well as the increased average LIBOR payable on interest under our

credit facilities in the three months ended March 31, 2012 compared

to the three months ended March 31, 2011. Furthermore, the

financing of our newbuilding program resulted in interest being

capitalized, rather than such interest being recognized as an

expense, of $2.6 million for the three months ended March 31, 2012

compared to $5.9 million of capitalized interest for the three

months ended March 31, 2011.

Interest income was $0.4 million in each of the three months

ended March 31, 2012 and 2011, respectively.

Other finance costs, net Other finance

costs, net, decreased by $0.5 million, to $3.9 million in the three

months ended March 31, 2012, from $4.4 million in the three months

ended March 31, 2011. This decrease was primarily because in the

first quarter of 2011, we had recorded an expense of $2.3 million

due to non-cash changes in fair value of warrants. This was offset

in part by increased amortization of $1.9 million in relation to

finance fees (which were deferred and are amortized over the life

of the respective credit facilities) in the first quarter of 2012

compared to the same period in 2011.

Other income/(expenses), net Other

income/(expenses), net, was an income of $0.2 million in the three

months ended March 31, 2012, compared to an expense of $1.9 million

in the three months ended March 31, 2011. This was mainly the

result of legal and advisory fees of $2.1 million attributable to

fees related to preparing and structuring the comprehensive

financing plan, which were recorded during the three months ended

March 31, 2011.

Unrealized (loss)/gain on derivatives

Unrealized gain on interest rate swap hedges decreased by $7.5

million, to $2.3 million in the three months ended March 31, 2012,

from $9.8 million in the three months ended March 31, 2011, which

is attributable to hedge accounting ineffectiveness and mark to

market valuation of two of our swaps not qualifying for hedge

accounting.

Realized (loss)/gain on derivatives

Realized loss on interest rate swap hedges, increased by $6.7

million, to $34.8 million in the three months ended March 31, 2012,

from $28.1 million in the three months ended March 31, 2011, which

is attributable to the higher average notional amount of swaps

during the three months ended March 31, 2012 compared to the same

period of 2011, as well as the reduction in the realized losses

being deferred for the respective periods (as discussed below)

following the gradual delivery of our vessels under construction,

which is partially offset by the higher floating LIBOR rates during

the three months ended March 31, 2012 compared to the same period

of 2011.

In addition, realized losses on cash flow hedges of $4.8 million

and $9.9 million in the three months ended March 31, 2012 and 2011,

respectively, were deferred in "Accumulated Other Comprehensive

Loss", rather than such realized losses being recognized as

expenses, and will be reclassified into earnings over the

depreciable lives of these vessels under construction, which are

financed by loans with interest rates that have been hedged by our

interest rate swap contracts. The table below provides an analysis

of the items discussed above, and which were recorded in the three

months ended March 31, 2012 and 2011:

Three months Three months

ended ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

(in millions)

Total realized losses of swaps $ (39.6) $ (38.0)

Realized losses of swaps deferred in OCL 4.8 9.9

------------- -------------

Realized losses of swaps expensed in P&L (34.8) (28.1)

Realized losses attributable to overhedging 6.9 9.8

------------- -------------

Adjusted realized losses attributable to

hedged debt $ (27.9) $ (18.3)

============= =============

Adjusted EBITDA Adjusted EBITDA increased

47.9%, or $31.2 million, to $96.4 million in the three months ended

March 31, 2012, from $65.2 million in the three months ended March

31, 2011. Adjusted EBITDA for the first quarter of 2012, is

adjusted for an unrealized gain on derivatives of $3.0 million and

realized losses on derivatives of $34.8 million. Tables reconciling

Adjusted EBITDA to Net Income can be found at the end of this

earnings release.

Recent News On April 27, 2012, we sold and

delivered the Montreal. The net sale consideration was $6.6

million. The Montreal was 28 years old and was generating revenue

under its time charter, which expired on March 31, 2012.

On May 3, 2012, we took delivery of the newbuilding 13,100 TEU

vessel, the Hyundai Smart. The vessel has been deployed on a

12-year time charter with one of the world's major liner

companies.

Conference Call and Webcast On Thursday,

May 10, 2012, at 9:00 A.M. EDT, the Company's management will host

a conference call to discuss the results.

Participants should dial into the call 10 minutes before the

scheduled time using the following numbers: 1 866 819 7111 (US Toll

Free Dial In), 0800 953 0329 (UK Toll Free Dial In) or +44 (0)1452

542 301 (Standard International Dial In). Please quote "Danaos" to

the operator.

A telephonic replay of the conference call will be available

until May 17, 2012 by dialing 1 866 247 4222 (US Toll Free Dial

In), 0800 953 1533 (UK Toll Free Dial In) or +44 (0)1452 550 000

(Standard International Dial In). Access Code: 1186615#

There will also be a live and then archived webcast of the

conference call through the Danaos website (www.danaos.com).

Participants to the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

About Danaos Corporation Danaos

Corporation is an international owner of containerships, chartering

its vessels to many of the world's largest liner companies. Our

current fleet of 62 containerships aggregating 336,849 TEUs ranks

Danaos among the largest containership charter owners in the world

based on total TEU capacity. Danaos is one of the largest US listed

containership companies based on fleet size. Furthermore, the

company has a contracted fleet of 2 additional containerships

aggregating 26,200 TEU with scheduled deliveries in June 2012. The

company's shares trade on the New York Stock Exchange under the

symbol "DAC".

Forward-Looking Statements Matters

discussed in this release may constitute forward-looking statements

within the meaning of the safe harbor provisions of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements reflect our

current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management's examination of historical operating

trends, data contained in our records and other data available from

third parties. Although Danaos Corporation believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, Danaos Corporation cannot assure you that it

will achieve or accomplish these expectations, beliefs or

projections. Important factors that, in our view, could cause

actual results to differ materially from those discussed in the

forward-looking statements include the strength of world economies

and currencies, general market conditions, including changes in

charter hire rates and vessel values, charter counterparty

performance, shipyard performance, changes in demand that may

affect attitudes of time charterers to scheduled and unscheduled

drydocking, changes in Danaos Corporation's operating expenses,

including bunker prices, dry-docking and insurance costs, ability

to obtain financing and comply with covenants in our financing

arrangements, actions taken by regulatory authorities, potential

liability from pending or future litigation, domestic and

international political conditions, potential disruption of

shipping routes due to accidents and political events or acts by

terrorists.

Risks and uncertainties are further described in reports filed

by Danaos Corporation with the U.S. Securities and Exchange

Commission.

Visit our website at www.danaos.com

Appendix

Fleet Utilization

Danaos had 303 off-hire days in the first quarter of 2012

(including 246 days related to Marathonas, Independence and Honour,

which have been off-charter and laid up). The following table

summarizes vessel utilization and the impact of the off-hire days

on the company's revenue relating to the last four quarters.

Second Third Fourth First

Vessel Utilization (No. of Quarter Quarter Quarter Quarter

Days) 2011 2011 2011 2012 Total

-------- -------- -------- -------- --------

Ownership Days 4,953 5,185 5,328 5,471 20,937

Less Off-hire Days:

Scheduled Off-hire Days (86) -- (4) (49) (139)

Other Off-hire Days (42) (32) (163) (254) (491)

-------- -------- -------- -------- --------

Operating Days 4,825 5,153 5,161 5,168 20,307

======== ======== ======== ======== ========

Vessel Utilization 97.4% 99.4% 96.9% 94.5% 97.0%

Operating Revenues(in

'000s of US Dollars) $114,764 $126,004 $128,344 $134,237 $503,349

Average Daily Charter Rate $ 23,785 $ 24,453 $ 24,868 $ 25,975 $ 24,787

Fleet List

The following table describes in detail our fleet deployment

profile as of May 9, 2012.

Vessel Size

Vessel Name (TEU) Year Built Expiration of Charter(1)

----------- ---------- ------------------------

Containerships

Hyundai Smart 13,100 2012 May 2024

Hyundai Tenacity 13,100 2012 March 2024

Hyundai Together 13,100 2012 February 2024

Hanjin Italy 10,100 2011 April 2023

Hanjin Germany 10,100 2011 March 2023

Hanjin Greece 10,100 2011 May 2023

CSCL Le Havre 9,580 2006 September 2018

CSCL Pusan 9,580 2006 July 2018

CMA CGM Melisande 8,530 2012 November 2023

CMA CGM Attila 8,530 2011 April 2023

CMA CGM Tancredi 8,530 2011 May 2023

CMA CGM Bianca 8,530 2011 July 2023

CMA CGM Samson 8,530 2011 September 2023

CSCL America 8,468 2004 September 2016

CSCL Europe 8,468 2004 June 2016

CMA CGM Moliere(2) 6,500 2009 August 2021

CMA CGM Musset(2) 6,500 2010 February 2022

CMA CGM Nerval(2) 6,500 2010 April 2022

CMA CGM Rabelais(2) 6,500 2010 June 2022

YM Mandate 6,500 2010 January 2028

CMA CGM Racine(2) 6,500 2010 July 2022

YM Maturity 6,500 2010 April 2028

Marathonas 4,814 1991 Laid-up

Messologi 4,814 1991 September 2012

Mytilini 4,814 1991 October 2012

Hyundai Commodore(3) 4,651 1992 March 2013

Hyundai Duke(4) 4,651 1992 February 2013

Hyundai Federal(5) 4,651 1994 September 2012

SNL Colombo(6) 4,300 2004 March 2019

YM Singapore 4,300 2004 October 2019

YM Seattle(7) 4,253 2007 July 2019

YM Vancouver 4,253 2007 September 2019

Derby D 4,253 2004 February 2014

Deva 4,253 2004 December 2013

ZIM Rio Grande 4,253 2008 May 2020

ZIM Sao Paolo 4,253 2008 August 2020

ZIM Kingston 4,253 2008 September 2020

ZIM Monaco 4,253 2009 November 2020

ZIM Dalian 4,253 2009 February 2021

ZIM Luanda 4,253 2009 May 2021

Honour 3,908 1989 Laid-up

Hope 3,908 1989 June 2012

Hanjin Constantza 3,400 2011 February 2021

Hanjin Algeciras 3,400 2011 November 2020

Hanjin Buenos Aires 3,400 2010 March 2020

Hanjin Santos 3,400 2010 May 2020

Hanjin Versailles 3,400 2010 August 2020

SCI Pride 3,129 1988 July 2012

Lotus 3,098 1988 July 2012

Independence 3,045 1986 Laid-up

Henry 3,039 1986 July 2012

Elbe 2,917 1991 May 2012

Kalamata 2,917 1991 August 2012

Komodo 2,917 1991 April 2013

Hyundai Advance 2,200 1997 June 2017

Hyundai Future 2,200 1997 August 2017

Hyundai Sprinter 2,200 1997 August 2017

Hyundai Stride 2,200 1997 July 2017

Hyundai Progress 2,200 1998 December 2017

Hyundai Bridge 2,200 1998 January 2018

Hyundai Highway 2,200 1998 January 2018

Hyundai Vladivostok 2,200 1997 May 2017

----------------------------

(1) Earliest date charters could expire. Some charters include

options to extend their terms. (2) Vessel subject to charterer's

option to purchase vessel after first eight years of time charter

term for $78.0 million. (3) On April 20, 2012, the APL Commodore

was renamed to Hyundai Commodore at the request of the charterer of

this vessel. (4) On January 29, 2012, the APL Duke was renamed to

Hyundai Duke at the request of the charterer of this vessel. (5) On

January 31, 2012, the APL Federal was renamed to Hyundai Federal at

the request of the charterer of this vessel. (6) On March 18, 2012,

the YM Colombo was renamed to SNL Colombo at the request of the

charterer of this vessel. (7) On April 9, 2012, the Taiwan Express

was renamed to YM Seattle at the request of the charterer of this

vessel.

New Deliveries

The following table describes the expected additions to our

fleet as a result of our new building containership program.

Vessel Size

Vessel Name (TEU) Expected Delivery Charter Term

----------- ------------------ ------------

Hull No S-459 13,100 June 2012 12 years

Hull No S-460 13,100 June 2012 12 years

DANAOS CORPORATION

Condensed Statements of Income- Unaudited

(Expressed in thousands of United States dollars, except per share amounts)

Three Three

months ended months ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

OPERATING REVENUES $ 134,237 $ 98,989

OPERATING EXPENSES

Vessel operating expenses (30,095) (26,602)

Depreciation & amortization (32,883) (23,966)

General & administrative (4,837) (4,629)

Other operating expenses (2,890) (2,218)

------------- -------------

Income From Operations 63,532 41,574

------------- -------------

OTHER EARNINGS (EXPENSES)

Interest income 353 353

Interest expense (18,390) (11,848)

Other finance cost, net (3,857) (4,427)

Other income/(expenses), net 196 (1,920)

Realized (loss)/gain on derivatives (34,794) (28,109)

Unrealized gain/(loss) on derivatives 2,302 9,820

------------- -------------

Total Other Income (Expenses), net (54,190) (36,131)

------------- -------------

Net Income $ 9,342 $ 5,443

============= =============

EARNINGS PER SHARE

Basic & diluted net income per share $ 0.09 $ 0.05

============= =============

Basic & diluted weighted average number of

common shares (in thousands of shares) 109,605 108,611

============= =============

Non-GAAP Measures*

Reconciliation of Net Income to Adjusted Net Income - Unaudited

Three Three

months ended months ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

Net income $ 9,342 $ 5,443

Unrealized gain on derivatives (2,302) (9,820)

Realized losses on over-hedging portion of

derivatives 6,886 9,769

Comprehensive Financing Plan related fees -- 2,089

Amortization of financing fees & finance fees

accrued 3,661 1,620

Non-cash change in fair value of warrants -- 2,253

------------- -------------

Adjusted Net Income $ 17,587 $ 11,354

============= =============

Adjusted Earnings Per Share $ 0.16 $ 0.10

============= =============

Weighted average number of shares 109,605 108,611

* The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). However,

management believes that certain non-GAAP financial measures used

in managing the business may provide users of this financial

information additional meaningful comparisons between current

results and results in prior operating periods. Management believes

that these non-GAAP financial measures can provide additional

meaningful reflection of underlying trends of the business because

they provide a comparison of historical information that excludes

certain items that impact the overall comparability. Management

also uses these non-GAAP financial measures in making financial,

operating and planning decisions and in evaluating the Company's

performance. See the Table above for supplemental financial data

and corresponding reconciliations to GAAP financial measures for

the three months ended March 31, 2012 and 2011. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, the Company's reported results prepared in accordance with

GAAP.

DANAOS CORPORATION

Condensed Balance Sheets

(Expressed in thousands of United States dollars)

As of As of

March 31, December 31,

------------- -------------

2012 2011

------------- -------------

(Unaudited)

ASSETS (Unaudited)

CURRENT ASSETS

Cash and cash equivalents $ 41,732 $ 51,362

Restricted cash 97 2,909

Accounts receivable, net 6,020 4,176

Other current assets 24,755 34,844

------------- -------------

72,604 93,291

------------- -------------

NON-CURRENT ASSETS

Fixed assets, net 3,688,152 3,241,951

Advances for vessels under construction 275,697 524,286

Deferred charges, net 97,447 99,711

Vessel held for sale 4,805 --

Fair value of financial instruments 3,765 3,964

Other non-current assets 27,436 24,901

------------- -------------

4,097,302 3,894,813

------------- -------------

TOTAL ASSETS 4,169,906 3,988,104

============= =============

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES

Long-term debt, current portion 41,958 41,959

Vendor Financing, current portion 21,618 10,857

Accounts payable, accrued liabilities &

other current liabilities 81,541 58,254

Fair value of financial instruments, current

portion 118,388 120,623

------------- -------------

263,505 231,693

------------- -------------

LONG-TERM LIABILITIES

Long-term debt, net of current portion 3,065,967 2,960,288

Vendor financing, net of current portion 93,514 54,288

Fair value of financial instruments, net of

current portion 275,796 291,829

Other long-term liabilities 7,818 7,471

------------- -------------

3,443,095 3,313,876

------------- -------------

STOCKHOLDERS' EQUITY

Common stock 1,096 1,096

Additional paid-in capital 545,907 545,884

Accumulated other comprehensive loss (444,699) (456,105)

Retained earnings 361,002 351,660

------------- -------------

463,306 442,535

------------- -------------

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 4,169,906 $ 3,988,104

============= =============

DANAOS CORPORATION

Condensed Statements of Cash Flows - (Unaudited)

(Expressed in thousands of United States dollars)

Three months Three months

ended ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

Operating Activities:

Net income $ 9,342 $ 5,443

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation 31,681 22,436

Amortization of deferred drydocking &

special survey costs, finance cost and

other finance fees accrued 4,863 3,150

Stock-based compensation 23 23

Payments for drydocking/special survey (2,035) (4,902)

Non-cash change in fair value of warrants -- 2,253

Amortization of deferred realized losses on

cash flow interest rate swaps 649 227

Unrealized gain on derivatives (2,951) (10,047)

Realized losses on derivatives deferred in

Other Comprehensive Loss (4,839) (9,910)

Changes in operating assets/liabilities:

Accounts receivable (1,844) 612

Other assets, current and non-current 7,554 (4,129)

Accounts payable and accrued liabilities 5,498 (19,278)

Other liabilities, current and non-current 17,878 (1,407)

------------- -------------

Net Cash provided by/(used in) Operating

Activities 65,819 (15,529)

------------- -------------

Investing Activities:

Vessels under construction and vessels

additions (183,874) (121,322)

------------- -------------

Net Cash used in Investing Activities (183,874) (121,322)

------------- -------------

Financing Activities:

Debt draw downs 117,320 98,238

Debt repayment (11,607) (31,967)

Deferred costs (100) (30,217)

Decrease in restricted cash 2,812 2,812

------------- -------------

Net Cash provided by Financing Activities 108,425 38,866

------------- -------------

Net Decrease in cash and cash equivalents (9,630) (97,985)

Cash and cash equivalents, beginning of period 51,362 229,835

------------- -------------

Cash and cash equivalents, end of period $ 41,732 $ 131,850

============= =============

Reconciliation of Net Income to Adjusted EBITDA

(Expressed in thousands of United States dollars)

Three Three

months ended months ended

March 31, March 31,

------------- -------------

2012 2011

------------- -------------

Net income $ 9,342 $ 5,443

Depreciation 31,681 22,436

Amortization of deferred drydocking & special

survey costs 1,202 1,530

Amortization of deferred finance costs and

other finance fees accrued 3,661 1,620

Amortization of deferred realized losses on

cash flow interest rate swaps 649 227

Interest income (353) (353)

Interest expense 18,390 11,848

Unrealized gain on derivatives (2,951) (10,047)

Realized loss on derivatives 34,794 28,109

Stock based compensation 23 23

Comprehensive Financing Plan related fees -- 2,089

Non-cash changes in fair value of warrants -- 2,253

------------- -------------

Adjusted EBITDA(1) $ 96,438 $ 65,178

============= =============

(1) Adjusted EBITDA represents net income before interest income

and expense, depreciation, amortization of deferred drydocking

& special survey costs and deferred finance costs, non-cash

changes in fair value of derivatives and warrants, realized

gain/(loss) on derivatives, stock based compensation and other

items in relation to the Company's comprehensive financing plan.

However, Adjusted EBITDA is not a recognized measurement under U.S.

generally accepted accounting principles, or "GAAP." We believe

that the presentation of Adjusted EBITDA is useful to investors

because it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in our

industry. We also believe that Adjusted EBITDA is useful in

evaluating our ability to service additional debt and make capital

expenditures. In addition, we believe that Adjusted EBITDA is

useful in evaluating our operating performance and liquidity

position compared to that of other companies in our industry

because the calculation of Adjusted EBITDA generally eliminates the

effects of financings, income taxes and the accounting effects of

capital expenditures and acquisitions, items which may vary for

different companies for reasons unrelated to overall operating

performance and liquidity. In evaluating Adjusted EBITDA, you

should be aware that in the future we may incur expenses that are

the same as or similar to some of the adjustments in this

presentation. Our presentation of Adjusted EBITDA should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items.

Note: Items to consider for comparability include gains and

charges. Gains positively impacting net income are reflected as

deductions to net income. Charges negatively impacting net income

are reflected as increases to net income.

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). However,

management believes that certain non-GAAP financial measures used

in managing the business may provide users of these financial

information additional meaningful comparisons between current

results and results in prior operating periods. Management believes

that these non-GAAP financial measures can provide additional

meaningful reflection of underlying trends of the business because

they provide a comparison of historical information that excludes

certain items that impact the overall comparability. Management

also uses these non-GAAP financial measures in making financial,

operating and planning decisions and in evaluating the Company's

performance. See the Tables above for supplemental financial data

and corresponding reconciliations to GAAP financial measures for

the three months ended March 31, 2012 and 2011. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, the Company's reported results prepared in accordance with

GAAP.

(1) Adjusted net income, adjusted earnings per share and

adjusted EBITDA are non-GAAP measures. Refer to the reconciliation

of net income to adjusted net income and net income to adjusted

EBITDA.

For further information please contact: Company Contact:

Evangelos Chatzis Chief Financial Officer Danaos Corporation

Athens, Greece Tel.: +30 210 419 6480 E-Mail: cfo@danaos.com

Investor Relations and Financial Media Nicolas Bornozis

President Capital Link, Inc. New York Tel. 212-661-7566 E-Mail:

danaos@capitallink.com Iraklis Prokopakis Senior Vice

President and Chief Operating Officer Danaos Corporation Athens,

Greece Tel.: +30 210 419 6400 E-Mail: coo@danaos.com

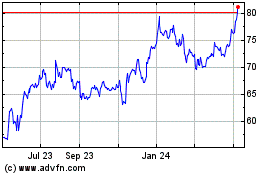

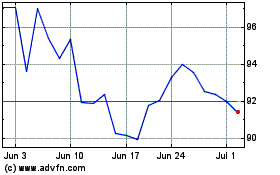

Danaos (NYSE:DAC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Danaos (NYSE:DAC)

Historical Stock Chart

From Sep 2023 to Sep 2024