Charles River Laboratories International, Inc. (NYSE: CRL) today

reported its results for the first-quarter of 2009. For the

quarter, net sales decreased 10.7% to $301.5 million from $337.7

million in the first quarter of 2008. Sales declined in both the

Research Models and Services (RMS) and Preclinical Services (PCS)

segments, driven by the negative impact of foreign exchange and

softer market demand for the Company�s broad portfolio of products

and services, as pharmaceutical and biotechnology clients

reprioritize their drug development pipelines and restructure their

operations. Foreign currency translation reduced net sales by

5.8%.

On a GAAP basis, net income for the first quarter of 2009 was

$25.4 million, or $0.38 per diluted share, compared to net income

of $44.1 million, or $0.63 per diluted share, for the first quarter

of 2008.

On a non-GAAP basis, net income was $38.2 million for the first

quarter of 2009, compared to $50.8 million for the same period in

2008, a decrease of 24.8%. First-quarter diluted earnings per share

on a non-GAAP basis were $0.58, a decrease of 19.4% compared to

$0.72 per share in the first quarter of 2008. Both the GAAP and

non-GAAP results were impacted primarily by lower sales volume.

James C. Foster, Chairman, President and Chief Executive

Officer, said, �Our financial performance in the first quarter of

2009 was consistent with our expectations, which assumed softness

in demand for both RMS and PCS and a negative impact from foreign

currency exchange. While visibility in the preclinical market

remains limited, we are pleased to report that pricing, inquiry

levels and bookings appear to have stabilized, although at lower

levels than in the prior year. Based on these trends combined with

our disciplined focus on expenses, we believe we will achieve the

sales and earnings guidance that we previously provided for

2009.�

First-Quarter Segment

Results

Research Models and Services (RMS)

Sales for the RMS segment were $161.5 million in the first

quarter of 2009, a decrease of 4.2% from $168.6 million in the

first quarter of 2008. Foreign currency translation reduced sales

by 4.2%. Excluding the effect of foreign exchange, RMS sales were

flat as growth of academic accounts offset softer demand from

pharmaceutical and biotechnology clients. Higher sales of Endotoxin

and Microbial Detection products (formerly In Vitro) and the

addition of MIR Preclinical Services (acquired in September 2008)

were offset by lower sales for the Consulting & Staffing

Services business and the September 2008 divestiture of the Vaccine

business in Mexico.

Lower sales volume and higher operating costs related to new

capacity brought on line in California and Maryland in 2008

resulted in lower operating margins for the RMS segment. The 2009

first-quarter GAAP operating margin was 29.4% compared to 33.1% in

the first quarter of 2008. On a non-GAAP basis, the operating

margin was 31.6% compared to 33.4% for the first quarter of

2008.

Preclinical Services (PCS)

First-quarter 2009 net sales for the PCS segment were $140.0

million, a decrease of 17.2% from $169.1 million in the first

quarter of 2008. The PCS sales decline was due primarily to slower

market demand from both pharmaceutical and biotechnology companies,

and the negative effect of foreign currency translation, which

reduced sales by 7.4%. The sales decline was partially offset by

the addition of NewLab BioQuality AG, which was acquired in

September 2008.

As expected, lower capacity utilization, pricing pressure and

costs associated with the start-up of new facilities in China and

Canada resulted in lower operating margins for the PCS segment. The

2009 first-quarter GAAP operating margin declined to 7.5% from

13.8% in the first quarter of 2008. On a non-GAAP basis, the

operating margin declined to 15.5% from 18.3% in the first quarter

of 2008.

Items Excluded from Non-GAAP

Results

Items excluded from non-GAAP results in the first quarter of

2009 and 2008 are as follows:

($ in millions) �

1Q09 �

1Q08 Amortization of

intangible assets � $ 6.1 � $ 7.6 Severance related to cost-saving

actions � � 7.1 � � -- Impairment and other charges (1) � � 1.6 � �

0.7 Operating losses for PCS Arkansas and clinical Phase I Scotland

� � 1.5 � � -- SFAS No. 141(R) (Costs associated with evaluation of

acquisitions) � � 0.2 � � -- FSP No. APB 14-1 (Convertible debt

accounting) � � 2.4 � � 1.8

(1) In the first quarter of 2009, these items were related

primarily to an asset impairment charge associated with the

Company�s planned divestiture of its clinical Phase I business in

Scotland and additional miscellaneous expenses. In the first

quarter of 2008, these items were related primarily to Company�s

disposition of its legacy PCS facility in Worcester,

Massachusetts.

2009 Guidance

The Company reaffirms its forward-looking guidance for 2009,

which was originally provided on February 9, 2009. The sales

guidance includes the negative impact of foreign exchange, which is

expected to reduce sales by approximately 5.5-6.0%.

2009 GUIDANCE � � Net sales � (2)% - (7)% GAAP EPS estimate

$1.86 - $2.16 Amortization of intangible assets $0.27 Severance

related to cost-saving actions $0.08 Impairment and other charges

$0.02 Operating losses for PCS Arkansas and clinical Phase I

Scotland $0.04 FSP No. APB 14-1 (Convertible debt accounting) $0.11

Non-GAAP EPS estimate � $2.30 - $2.60

Acquisition of Piedmont

Research Center

On May 1, 2009, the Company completed the acquisition of the

business and assets of Piedmont Research Center, LLC, a provider of

preclinical discovery services focused on efficacy studies

primarily in oncology and other therapeutic areas for

pharmaceutical and biotechnology clients, for approximately $46

million. Piedmont�s addition expands Charles River�s Discovery and

Imaging Services business, and makes us one of the largest

providers of non-GLP efficacy studies.

Webcast

Charles River Laboratories has scheduled a live webcast on

Wednesday, May 6, at 8:30 a.m. ET to discuss matters relating to

this press release. To participate, please go to ir.criver.com and

select the webcast link. You can also find the associated slide

presentation and reconciliations of non-GAAP financial measures to

comparable GAAP financial measures on the website.

Use of Non-GAAP Financial

Measures

This press release contains non-GAAP financial measures, such as

non-GAAP earnings per diluted share, which exclude amortization of

intangible assets and other charges related to our acquisitions,

charges related to the dispositions of our clinical Phase I

business in Scotland and our legacy preclinical facility in

Worcester, Massachusetts, expenses associated with evaluating

acquisitions, operating losses attributable to our businesses we

plan to close or divest, severance costs associated with our 2009

first-quarter cost-saving actions, and the additional interest

recorded as a result of the adoption of FSP No. APB 14-1. We

exclude these items from the non-GAAP financial measures because

they are outside our normal operations. There are limitations in

using non-GAAP financial measures, as they are not prepared in

accordance with generally accepted accounting principles, and may

be different than non-GAAP financial measures used by other

companies. In particular, we believe that the inclusion of

supplementary non-GAAP financial measures in this press release

helps investors to gain a meaningful understanding of our core

operating results and future prospects without the effect of these

often-one-time charges, and is consistent with how management

measures and forecasts the Company's performance, especially when

comparing such results to prior periods or forecasts. We believe

that the financial impact of our acquisitions (and in certain

cases, the evaluation of such acquisitions, whether or not

ultimately consummated) is often large relative to our overall

financial performance, which can adversely affect the comparability

of our results on a period-to-period basis. In addition, certain

activities, such as business acquisitions, happen infrequently and

the underlying costs associated with such activities do not recur

on a regular basis. Non-GAAP results also allow investors to

compare the Company�s operations against the financial results of

other companies in the industry who similarly provide non-GAAP

results. The non-GAAP financial measures included in this press

release are not meant to be considered superior to or a substitute

for results of operations prepared in accordance with GAAP. The

Company intends to continue to assess the potential value of

reporting non-GAAP results consistent with applicable rules and

regulations. Reconciliations of the non-GAAP financial measures

used in this press release to the most directly comparable GAAP

financial measures are set forth in the text of this press release,

and can also be found on the Company�s website at

ir.criver.com.

Caution Concerning

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as �anticipate,� �believe,� �expect,� �will,� �may,�

�estimate,� �plan,� �outlook,� and �project� and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These statements

also include statements regarding our projected 2009 sales and

earnings; the future demand for drug discovery and development

products and services (particularly in light of the challenging

economic environment), including the outsourcing of these services

and present spending trends by our customers; the impact of

specific actions intended to improve overall operating efficiencies

and profitability; the timing of the opening of new and expanded

facilities by us and our competitors; our future stock purchase

activities; future cost reduction activities by our customers; and

Charles River�s future performance as delineated in our

forward-looking guidance, and particularly our expectations with

respect to sales growth and foreign exchange impact. In addition,

these statements include the availability of funding for our

customers and the impact of economic and market conditions on them

generally, and the anticipated strength of our balance sheet, the

effects of our first-quarter 2009 cost-saving actions and other

actions designed to manage expenses, operating costs and capital

spending, and to streamline efficiency, and the ability of the

Company to withstand the current market conditions. Forward-looking

statements are based on Charles River�s current expectations and

beliefs, and involve a number of risks and uncertainties that are

difficult to predict and that could cause actual results to differ

materially from those stated or implied by the forward-looking

statements. Those risks and uncertainties include, but are not

limited to: the ability to successfully integrate the acquisition

of the business and assets of Piedmont Research Center, LLC; a

decrease in research and development spending, a decrease in the

level of outsourced services, or other cost reduction actions by

our customers; the ability to convert backlog to sales; special

interest groups; contaminations; industry trends; new displacement

technologies; USDA and FDA regulations; changes in law; continued

availability of products and supplies; loss of key personnel;

interest rate and foreign currency exchange rate fluctuations;

changes in tax regulation and laws; changes in generally accepted

accounting principles; and any changes in business, political, or

economic conditions due to the threat of future terrorist activity

in the U.S. and other parts of the world, and related U.S. military

action overseas. A further description of these risks,

uncertainties, and other matters can be found in the Risk Factors

detailed in Charles River's Annual Report on Form 10-K as filed on

February 23, 2009, as well as other filings we make with the

Securities and Exchange Commission. Because forward-looking

statements involve risks and uncertainties, actual results and

events may differ materially from results and events currently

expected by Charles River, and Charles River assumes no obligation

and expressly disclaims any duty to update information contained in

this news release except as required by law.

About Charles River

Accelerating Drug Development. Exactly. Charles River provides

essential products and services to help pharmaceutical and

biotechnology companies, government agencies and leading academic

institutions around the globe accelerate their research and drug

development efforts. Our approximately 8,700 employees worldwide

are focused on providing clients with exactly what they need to

improve and expedite the discovery, development through

first-in-human evaluation, and safe manufacture of new therapies

for the patients who need them. To learn more about our unique

portfolio and breadth of services, visit www.criver.com.

CHARLES RIVER LABORATORIES INTERNATIONAL, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (dollars in

thousands, except for per share data) �

Three Months

Ended March 28, March 29, 2009

2008 � Total net sales $ 301,526 $ 337,685 Cost of products

sold and services provided �

193,306 � �

207,308 � Gross margin 108,220 130,377 Selling,

general and administrative 62,178 59,320 Amortization of

intangibles �

6,149 � �

7,571 � Operating

income 39,893 63,486 Interest income (expense) (4,604 ) (2,410 )

Other income (expense) �

(262 ) �

(837 ) Income before income taxes and

noncontrolling interests 35,027 60,239 Provision for income taxes �

10,158 � �

16,183 � Income before

noncontrolling interests 24,869 44,056 Noncontrolling interests �

536 � �

83 � Net income

$

25,405 �

$ 44,139 � �

Earnings per common share Basic $ 0.39 $ 0.65 Diluted $ 0.38 $ 0.63

� Weighted average number of common shares outstanding Basic

65,889,835 67,504,848 Diluted 66,020,082 70,559,456

CHARLES

RIVER LABORATORIES INTERNATIONAL, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in

thousands) � �

March 28, December 27, 2009

2008 Assets Current assets Cash and cash equivalents

$ 170,233 $ 243,592 Trade receivables, net 211,095 210,214

Inventories 97,560 96,882 Other current assets 102,576 67,218

Current assets of discontinued businesses �

256 �

233 Total current assets 581,720 618,139 Property,

plant and equipment, net 834,545 837,246 Goodwill, net 454,770

457,578 Other intangibles, net 126,914 136,100 Deferred tax asset

34,617 37,348 Other assets 50,835 50,815 Long-term assets of

discontinued businesses �

4,187 �

4,187

Total assets

$ 2,087,588 $

2,141,413 �

Liabilities and Shareholders�

Equity Current liabilities Current portion of long-term debt

& capital leases $ 35,376 $ 35,452 Accounts payable 37,280

40,517 Accrued compensation 41,425 54,870 Deferred revenue 83,689

86,707 Accrued liabilities 55,167 60,741 Other current liabilities

26,889 22,676 Current liabilities of discontinued businesses �

47 �

35 Total current liabilities 279,873

300,998 Long-term debt & capital leases 474,152 479,880 Other

long-term liabilities �

115,525 �

118,827

Total liabilities �

869,550 �

899,705

Total shareholders� equity �

1,218,038 �

1,241,708 Total liabilities and shareholders� equity

$ 2,087,588 $

2,141,413 CHARLES RIVER LABORATORIES INTERNATIONAL,

INC. SELECTED BUSINESS SEGMENT INFORMATION (UNAUDITED)

(dollars in thousands) � �

Three Months

Ended March 28, March 29, 2009

2008 Research Models and Services Net sales $ 161,490

$ 168,596 Gross margin 68,313 76,256 Gross margin as a % of net

sales 42.3 % 45.2 % Operating income 47,444 55,813 Operating income

as a % of net sales 29.4 % 33.1 % Depreciation and amortization

7,673 6,666 Capital expenditures 7,624 10,609 �

Preclinical

Services Net sales $ 140,036 $ 169,089 Gross margin 39,907

54,121 Gross margin as a % of net sales 28.5 % 32.0 % Operating

income 10,546 23,268 Operating income as a % of net sales 7.5 %

13.8 % Depreciation and amortization 14,297 15,681 Capital

expenditures 17,001 30,021 �

Unallocated Corporate Overhead

$ (18,097 ) $ (15,595 ) �

Total Net sales $ 301,526 $

337,685 Gross margin 108,220 130,377 Gross margin as a % of net

sales 35.9 % 38.6 % Operating income 39,893 63,486 Operating income

as a % of net sales 13.2 % 18.8 % Depreciation and amortization

21,970 22,347 Capital expenditures 24,625 40,630

CHARLES RIVER

LABORATORIES INTERNATIONAL, INC. RECONCILIATION OF GAAP TO

NON-GAAP SELECTED BUSINESS SEGMENT INFORMATION (UNAUDITED)

(1) (dollars in thousands) � �

Three Months

Ended March 28, March 29, 2009

2008 Research Models and Services Net sales $ 161,490

$ 168,596 Operating income 47,444 55,813 Operating income as a % of

net sales 29.4 % 33.1 % Add back: Amortization related to

acquisitions 887 534 Severance �

2,709 � �

- � Operating income, excluding specified charges

(Non-GAAP) $ 51,040 $ 56,347 Non-GAAP operating income as a % of

net sales 31.6 % 33.4 % �

Preclinical Services Net sales $

140,036 $ 169,089 Operating income 10,546 23,268 Operating income

as a % of net sales 7.5 % 13.8 % Add back: Amortization related to

acquisitions 5,261 7,037 Severance 2,776 - Impairment and other

charges

(2) 1,527 686 Operating losses for PCS Arkansas and

Phase I Scotland �

1,543 � �

- �

Operating income, excluding specified charges (Non-GAAP) $ 21,653 $

30,991 Non-GAAP operating income as a % of net sales 15.5 % 18.3 %

�

Unallocated Corporate Overhead $ (18,097 ) $ (15,595 ) Add

back: Severance 1,648 - Impairment and other charges

(2) 97

- SFAS No. 141(R) (costs associated with the evaluation of

acquisitions) 229 - FSP No. APB 14-1 (convertible debt accounting)

(3) �

44 � �

14 � Unallocated

corporate overhead, excluding specified charges (Non-GAAP) $

(16,079 ) $ (15,581 ) �

Total Net sales $ 301,526 $ 337,685

Operating income 39,893 63,486 Operating income as a % of net sales

13.2 % 18.8 % Add back: Amortization related to acquisitions 6,148

7,571 Severance 7,133 - Impairment and other charges

(2)

1,624 686 Operating losses for PCS Arkansas and Phase I Scotland

1,543 - SFAS No. 141(R) (costs associated with the evaluation of

acquisitions) 229 - FSP No. APB 14-1 (convertible debt accounting)

(3) �

44 � �

14 � Operating

income, excluding specified charges (Non-GAAP) $ 56,614 $ 71,757

Non-GAAP operating income as a % of net sales 18.8 % 21.2 % � �

(1) Charles River management believes that supplementary

non-GAAP financial measures provide useful information to allow

investors to gain a meaningful understanding of our core operating

results and future prospects, without the effect of one-time

charges, consistent with the manner in which management measures

and forecasts the Company�s performance. The supplementary non-GAAP

financial measures included are not meant to be considered superior

to, or a substitute for results of operations prepared in

accordance with GAAP. The Company intends to continue to assess the

potential value of reporting non-GAAP results consistent with

applicable rules and regulations.

(2) 2009 includes an asset

impairment due to the anticipated sale of our clinical Phase I

business in Scotland, as well as additional miscellaneous costs.

2008 includes the disposition of the Company's Preclinical Services

facility in Worcester, Massachusetts.

(3) 2009 and 2008

include the impact of FSP No. APB 14-1 for convertible debt

accounting, which increased depreciation expense.

CHARLES RIVER

LABORATORIES INTERNATIONAL, INC. RECONCILIATION OF GAAP

EARNINGS TO NON-GAAP EARNINGS (1) (dollars in thousands,

except for per share data) � �

Three Months

Ended March 28, March 29, 2009

2008 � Net income $ 25,405 $ 44,139 Add back: Amortization

related to acquisitions 6,148 7,571 Severance 7,133 - Impairment

and other charges

(2) 1,624 686 Operating losses for PCS

Arkansas and Phase I Scotland 1,543 - SFAS No. 141(R) (costs

associated with the evaluation of acquisitions) 229 - FSP No. APB

14-1 (convertible debt accounting), net

(3) 2,397 1,758 Tax

effect

(6,289) (3,348) Net income,

excluding specified charges (Non-GAAP)

$ 38,190

$ 50,806 � Weighted average shares outstanding - Basic

65,889,835 67,504,848 Effect of dilutive securities: 2.25% senior

convertible debentures - 1,421,424 Stock options and contingently

issued restricted stock 126,896 1,363,212 Warrants

3,351 269,972 Weighted average shares

outstanding - Diluted

66,020,082

70,559,456 � Basic earnings per share $ 0.39 $ 0.65

Diluted earnings per share $ 0.38 $ 0.63 � Basic earnings per

share, excluding specified charges (Non-GAAP) $ 0.58 $ 0.75 Diluted

earnings per share, excluding specified charges (Non-GAAP) $ 0.58 $

0.72 � �

(1) Charles River management believes that

supplementary non-GAAP financial measures provide useful

information to allow investors to gain a meaningful understanding

of our core operating results and future prospects, without the

effect of one-time charges, consistent with the manner in which

management measures and forecasts the Company�s performance. The

supplementary non-GAAP financial measures included are not meant to

be considered superior to, or a substitute for results of

operations prepared in accordance with GAAP. The Company intends to

continue to assess the potential value of reporting non-GAAP

results consistent with applicable rules and regulations.

(2) 2009 includes an asset impairment due to the anticipated

sale of our clinical Phase I business in Scotland, as well as

additional miscellaneous costs. 2008 includes the disposition of

the Company's Preclinical Services facility in Worcester,

Massachusetts.

(3) 2009 includes the impact of FSP No. APB

14-1 for convertible debt accounting, which increased interest

expense by $2,860, capitalized interest by $507 and depreciation

expense by $44. 2008 has been restated to include the impact of FSP

No. APB 14-1, which increased interest expense by $2,670,

capitalized interest by $926 and depreciation expense by $14.

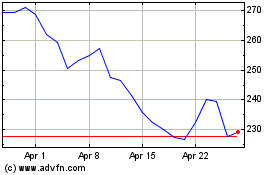

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jul 2023 to Jul 2024