Republic First Bancorp, Inc. Reports 263% Increase in First Quarter

Earnings PHILADELPHIA, April 20 /PRNewswire-FirstCall/ -- Republic

First Bancorp, Inc. (NASDAQ:FRBK), the holding company for Republic

First Bank (PA), today reported first quarter 2005 earnings from

continuing operations of $2.1 million or $0.28 per diluted share.

That compares with $585,000 or $0.08 for the comparable prior year

period. The improvement in 2005 earnings reflected commercial loan

and core deposit growth, increases in non-interest income and the

payoff of the high cost Federal Home Loan Bank borrowings. Average

commercial and construction loans grew in excess of 21% in first

quarter 2005 compared to the comparable prior year period. Total

shareholders' equity stood at $55.8 million with a book value per

share of $7.72 at March 31, 2005. The Company remains well

capitalized. Chairman Madonna stated: "Management and the Board are

very pleased with the improvement in earnings and we believe the

Bank is well situated to continue to increase profitability."

Republic First Bank (PA) is a full-service, state-chartered

commercial bank, whose deposits are insured by the Federal Deposit

Insurance Corporation (FDIC). The Bank provides diversified

financial products through its eleven offices located in Abington,

Ardmore, Bala Cynwyd, East Norriton, Media, and Philadelphia,

Pennsylvania. The Company may from time to time make written or

oral "forward-looking statements," including statements contained

in the Company's filings with the Securities and Exchange

Commission. These forward-looking statements include statements

with respect to the Company's beliefs, plans, objectives, goals,

expectations, anticipations, estimates, and intentions that are

subject to significant risks and uncertainties and are subject to

change based on various factors, many of which are beyond the

Company's control. The words "may," "could," "should," "would,"

"believe," "anticipate," "estimate," "expect," "intend," "plan,"

and similar expressions are intended to identify forward- looking

statements. All such statements are made in good faith by the

Company pursuant to the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. The Company does not

undertake to update any forward- looking statement, whether written

or oral, that may be made from time to time by or on behalf of the

Company. Republic First Bancorp, Inc. Condensed Income Statement

(Dollar amounts in thousands except per share data) (Unaudited)

Three Months Ended March 31, 2005 2004 (1) Net Interest Income

$7,198 $4,546 Provision for Loan Losses 703 699 Other Income 1,143

593 Other Expenses 4,471 3,602 Income Taxes 1,045 253 Income From

Continuing Operations 2,122 585 Income From Discontinued

Operations, Net of Tax - 928 Net Income $2,122 $1,513 Diluted EPS

From Continuing Operations $0.28 $0.08 Diluted EPS From

Discontinued Operations, Net of Tax - 0.12 Diluted EPS $0.28 $0.20

Republic First Bancorp, Inc. Condensed Balance Sheet (Dollar

amounts in thousands) Assets March 31, March 31, 2005 2004 (2)

Federal Funds Sold and Other Interest-Bearing Cash $68,697 $69,276

Investment Securities 46,593 66,713 Commercial and Other Loans

563,563 476,307 Allowance for Loan Losses (6,713) (7,336) Other

Assets 54,330 48,400 Total Assets $726,470 $653,360 Liabilities and

Shareholders' Equity: Transaction Accounts $396,966 $259,797 Time

Deposit Accounts 225,777 189,708 FHLB Advances and Trust Preferred

Securities 39,241 148,686 Other Liabilities 8,647 6,242

Shareholders' Equity 55,839 48,927 Total Liabilities and

Shareholders' Equity $726,470 $653,360 (1) Prior year EPS has been

restated for the 10% stock dividend paid August 24, 2004. (2) Prior

year has been adjusted to exclude the First Bank of Delaware

balance sheet, reflecting the spin-off of that bank effective

January 1, 2005. Republic First Bancorp, Inc. March 31, 2005

(Unaudited) At or For the Three Months Ended March 31, March 31,

Financial Data: 2005 2004 (1) Return on average assets on

continuing operations 1.15% 0.36% Return on average equity on

continuing operations 15.48% 4.90% Share information: Book value

per share $7.72 $6.81 Shares o/s at period end, net of Treasury

shares 7,235,000 7,187,000 Average diluted shares o/s 7,700,000

7,521,000 (1) Prior year amounts have been adjusted for the

spin-off of First Bank of Delaware effective January 1, 2005.

Republic First Bancorp, Inc. (Dollars in thousands except per share

data) (Unaudited) Credit Quality Ratios: March 31, March 31, 2005

2004 (1) Non-accrual and loans accruing, but past due 90 days or

more $3,212 $7,821 Restructured loans - - Total non-performing

loans 3,212 7,821 OREO 137 207 Total non-performing assets $3,349

$8,028 Non-performing loans as a percentage of total loans 0.57%

1.64% Non-performing assets as a percentage of total assets 0.46%

1.23% Allowance for loan losses to total loans 1.19% 1.54%

Allowance for loan losses to total non-performing loans 209.00%

93.80% (1) Prior year has been adjusted to exclude the First Bank

of Delaware loans, reflecting the spin-off of that bank effective

January 1, 2005. Republic First Bancorp, Inc. (Dollars in

thousands) (Unaudited) Quarter-to-Date Average Balance Sheet Three

months ended Three months ended March 31, 2005 March 31, 2004 (1)

Interest-Earning Average Average Assets: Average Yield/ Average

Yield/ Balance Interest Cost Balance Interest Cost Commercial and

other loans $567,247 $9,912 7.09% $469,872 $7,693 6.64% Investment

securities 48,779 444 3.64 68,012 575 3.43 Federal funds sold

77,425 476 2.50 81,272 215 1.07 Total interest- earning assets

693,451 10,832 6.33 619,156 8,483 5.56 Other assets 43,694 37,389

Total assets $737,145 $10,832 $656,545 $8,483 Interest-bearing

liabilities: Interest-bearing deposits $512,341 $2,996 2.37%

$371,702 $1,846 2.01% Borrowed funds 68,336 638 3.79 154,355 2,091

5.50 Interest-bearing liabilities 580,677 3,634 2.54 526,057 3,937

3.04 Non-interest and interest-bearing funding 674,235 3,634 2.19

601,754 3,937 2.66 Other liabilities: 8,077 6,992 Total liabilities

682,312 608,746 Shareholder's equity 54,833 47,799 Total

liabilities & shareholder's equity $737,145 $656,545 Net

interest income $7,198 $4,546 Net interest margin 4.20% 2.97% (1)

Prior year has been adjusted to exclude the First Bank of Delaware,

reflecting the spin-off of that bank effective January 1, 2005

DATASOURCE: Republic First Bancorp, Inc. CONTACT: Paul Frenkiel,

CFO, Republic First Bancorp, Inc., +1-215-735-4422 ext. 5255

Copyright

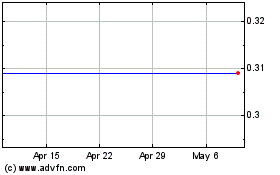

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

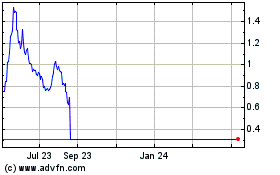

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024