Semi Equipment Nose-Diving - Analyst Blog

April 12 2011 - 11:40AM

Zacks

We have been watching the semi equipment stocks closely over the

last few days and it seems as if our fears have been realized. Over

the last five days, shares of KLA-Tencor (KLAC),

Novellus Systems (NVLS) and Lam Research

Corporation (LRCX) lost 5.9%, 5.9% and 3.8%,

respectively.

Moreover, the decline was more pronounced after April 7, when

Taiwan Semiconductor Manufacturing Company (TSM)

lowered its outlook on semiconductor unit growth for 2011, citing

concerns related to Japan.

We cannot say we are surprised. We have been thinking that the

Japan crisis could have a more far-reaching effect on semiconductor

manufacturing than immediately met the eye. This is because Japan

is not only a significant consumer of semiconductors, but also a

significant supplier.

What this basically means is that components coming out of Japan

will be in short supply, as we have seen in the case of components

for Apple Inc’s (AAPL) iPad. This would mean that

the components not coming out of Japan, which are also

designed into the iPad (for example) would fall into excess, when

the end product did not sell as much as previously expected. This

would result in accumulation of component inventories, caution at

manufacturers and a lower level of demand overall.

For those lucky companies that do not have direct operations in

Japan, there will not be any costs associated with resumption of

production and trade. And for those like Texas

Instruments (TXN) that are able to transfer most of the

manufacturing elsewhere, lead times may not stretch out too

much. But others will have to take charges depending on the

extent of damage.

The companies that have been worst affected have been

tight-lipped about the extent of damage and here the assessment

process appears to be ongoing. For equipment companies, this is

negative in the short term, since supply to Japan will come to a

standstill, with ripple effects impacting spending in other regions

as well.

However, it could be a positive longer-term, since Japan will

have to rebuild infrastructure, which would prove beneficial for

these companies. Therefore, the weakness could be a buying

opportunity. Also, some equipment makers, such as Cymer

Inc (CYMI) have seen their strongest competition

demolished by the tsunami, so they will continue to enjoy

stronger-than-expected demand in the near-to-medium term.

The Zacks Ranks for KLA-Tencor, Novellus, Lam Research and Cymer

remain #2, indicating a Buy recommendation over the next 1-3

months.

APPLE INC (AAPL): Free Stock Analysis Report

CYMER INC (CYMI): Free Stock Analysis Report

KLA-TENCOR CORP (KLAC): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

TAIWAN SEMI-ADR (TSM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

Zacks Investment Research

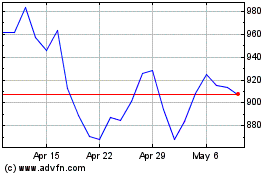

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Aug 2024 to Sep 2024

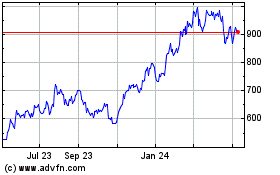

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Sep 2023 to Sep 2024