UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 29)*

Incyte Corporation

(Name of Issuer)

Common Stock,

Par Value $0.001 Per Share

(Title of Class of Securities)

45337C102

(CUSIP number)

Alexandra A. Toohey

Chief Financial Officer

Baker Bros. Advisors LP

860 Washington Street, 3rd Floor

New York, NY 10014

(212) 339-5690

(Name, address and telephone number of person

authorized to receive notices and communications)

May 7, 2024

(Date of event which requires filing of this statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ¨.

(Continued on the following pages)

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 45337C102 |

|

Page

2 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

Baker Bros. Advisors LP |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS*

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 36,308,584 (1) |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 36,308,584 (1) |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 36,308,584 (1) |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.2% (1)(2) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

IA, PN |

(1) Includes 111,414 shares

of common stock (“Common Stock”) of Incyte Corporation (the “Issuer”) underlying 111,414 non-qualified options

exercisable for Common Stock (“Stock Options”) and 2,505 shares of common stock underlying 2,505 restricted stock units (each,

an “RSU”) which vest into Common Stock within 60 days of the date of this filing.

(2) Based on 224,540,751 shares of Common Stock outstanding as of

April 23, 2024, as reported in the Issuer’s Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on

April 30, 2024 and 111,414 shares of Common Stock underlying 111,414 Stock Options, 15,000 shares of Common Stock received from Exercised Stock Options

(as defined in Item 4) and 2,505 shares of Common Stock underlying 2,505

RSUs.

| CUSIP

No. 45337C102 |

|

Page

3 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

Baker Bros. Advisors (GP) LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS*

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 36,308,584 (1) |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 36,308,584 (1) |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 36,308,584 (1) |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.2% (1)(2)

|

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

HC, OO |

(1) Includes 111,414 shares

of Common Stock underlying 111,414 (“Stock Options”) and 2,505 shares of common stock underlying 2,505 RSUs which vest into Common Stock

within 60 days of the date of this filing.

(2) Based on 224,540,751 shares of Common Stock outstanding as of April 23, 2024, as reported

in the Issuer’s Form 10-Q filed with the SEC on April 30, 2024 and 111,414 shares of Common Stock underlying 111,414 Stock Options, 15,000 shares of Common Stock received from Exercised Stock Options

(as defined in Item 4)

and 2,505 shares of Common Stock underlying 2,505 RSUs.

| CUSIP

No. 45337C102 |

|

Page

4 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

Julian C. Baker |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS*

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 36,666,662 (1) |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 36,666,662 (1) |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 36,666,662 (1) |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.3% (1)(2) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

IN, HC |

(1) Includes 111,414 shares

of Common Stock underlying 111,414 Stock Options and 2,505 shares of common stock underlying 2,505 RSUs which vest into Common Stock

within 60 days of the date of this filing.

(2) Based on 224,540,751 shares of Common Stock outstanding as of April 23, 2024, as reported

in the Issuer’s Form 10-Q filed with the SEC on April 30, 2024 and 111,414 shares of Common Stock underlying 111,414 Stock Options, 15,000 shares of Common Stock received from Exercised Stock Options

(as defined in Item 4)

and 2,505 shares of Common Stock underlying 2,505 RSUs.

| CUSIP

No. 45337C102 |

|

Page

5 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

Felix J. Baker |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS (See Instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 36,669,079 (1) |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 36,669,079 (1) |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 36,669,079 (1) |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.3% (1)(2) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

IN, HC |

(1) Includes 111,414 shares

of Common Stock underlying 111,414 Stock Options and 2,505 shares of common stock underlying 2,505 RSUs which vest into Common Stock

within 60 days of the date of this filing.

(2) Based on 224,540,751 shares of Common Stock outstanding as of

April 23, 2024, as reported in the Issuer’s Form 10-Q filed with the SEC on April 30, 2024 and 111,414 shares of Common Stock underlying

111,414 Stock Options, 15,000 shares of Common Stock received from Exercised Stock Options

(as defined in Item 4) and 2,505 shares of Common Stock underlying 2,505 RSUs.

| CUSIP

No. 45337C102 |

|

Page

6 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

FBB2, LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS (See Instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 14,755 |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 14,755 |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 14,755 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.01% (1) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

OO |

| (1) | Based

on 224,540,751 shares of Common Stock outstanding as of April 23, 2024, as reported in the

Issuer’s Form 10-Q filed with the SEC on April 30, 2024. |

| CUSIP

No. 45337C102 |

|

Page

7 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

FBB3 LLC |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS (See Instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 31,140 |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 31,140 |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 31,140 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.01% (1) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

OO |

| (1) | Based

on 224,540,751 shares of Common Stock outstanding as of April 23, 2024, as reported in the

Issuer’s Form 10-Q filed with the SEC on April 30, 2024. |

| CUSIP

No. 45337C102 |

|

Page

8 of 13 Pages |

| 1. |

NAMES

OF REPORTING PERSONS

FBB Associates |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a)

¨

(b) ¨ |

| 3. |

SEC

USE ONLY |

| 4. |

SOURCE

OF FUNDS (See Instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) |

¨ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

New York |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER: 33,410 |

| 8. |

SHARED

VOTING POWER: 0 |

| 9. |

SOLE

DISPOSITIVE POWER: 33,410 |

| 10. |

SHARED

DISPOSITIVE POWER: 0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON: 33,410 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.01% (1) |

| 14. |

TYPE

OF REPORTING PERSON (See Instructions)

PN, OO |

(1) Based on 224,540,751 shares of Common Stock outstanding

as of April 23, 2024, as reported in the Issuer’s Form 10-Q filed with the SEC on April 30, 2024.

Amendment No. 29 to Schedule 13D

This Amendment No. 29 to Schedule 13D amends and supplements the statements

on the previously filed Schedule 13D, as amended, filed by Baker Bros. Advisors LP (the “Adviser”), Baker Bros. Advisors

(GP) LLC (the “Adviser GP”), Julian C. Baker, Felix J. Baker, FBB2, LLC (“FBB2”), FBB3 LLC (“FBB3”)

and FBB Associates (“FBB”). Except as supplemented herein, such statements, as hereto amended and supplemented, remain in

full force and effect. Information given in response to each item shall be deemed incorporated by reference in all other items, as applicable.

Each capitalized term used but not defined herein has the meaning ascribed to such term in the Schedule 13D, as amended.

The Adviser GP is the sole general partner of the Adviser. Pursuant

to management agreements, as amended, among the Adviser, Baker Brothers Life Sciences, L.P. (“Life Sciences”), and 667, L.P.

(“667”, and together with Life Sciences, the “Funds”), and their respective general partners, the Funds’

respective general partners relinquished to the Adviser all discretion and authority with respect to the investment and voting power

of the securities held by the Funds, and thus the Adviser has complete and unlimited discretion and authority with respect to the Funds’

investments and voting power over investments.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of Schedule 13D is supplemented and amended, as the case may

be, as follows:

The disclosure in Item 4 below is incorporated herein by reference.

Item 4. Purpose

of the Transaction.

Item 4 of Schedule 13D is supplemented and superseded, as the case

may be, as follows:

On May 7, 2024 the Adviser acquired beneficial ownership of 15,000

shares of common stock (“Common Stock”) of Incyte Corporation (the “Issuer”), as a result of the exercise of

15,000 options to purchase Common Stock at $49.01 per share (the “Exercised Stock Options”) held directly by Julian C. Baker.

Julian C. Baker currently serves on the Issuer’s board of directors (the “Board”) as a representative of the Funds.

The policy of the Funds and the Adviser does not permit managing members of the Adviser GP or full-time employees of the Adviser to receive

compensation for serving as directors of the Issuer, and the Funds are instead entitled to the pecuniary interest in the Exercised Stock

Options. Julian C. Baker, as an agent in his capacity as a director of the Issuer, entered into a proceeds agreement (the “Proceeds

Agreement”) with the Adviser on May 7, 2024. Pursuant to the Proceeds Agreement, Julian C. Baker agreed that, with respect to the

Exercised Stock Options and the Common Stock received as a result of the exercise of the Exercised Stock Options on May 7, 2024, the

Adviser will have dispositive power as well as the ability to control the timing of exercise of the Exercised Stock Options and that

any proceeds from the sale of the Common Stock will be remitted to the Adviser net of brokerage commissions. Other than through their

control of the Adviser, Felix J. Baker and Julian C. Baker have neither voting nor dispositive power over and have no direct pecuniary

interest in, the Exercised Stock Options or the Common Stock. Pursuant to the Proceeds Agreement, the Adviser funded Julian C. Baker’s

exercise of the Exercised Stock Options through loans from the 667 and Life Sciences. The total amount expended on acquiring the Common

Stock was $735,150.

The foregoing description of the Proceeds Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Proceeds Agreement, which is filed as Exhibit 99.2

and is incorporated herein by reference.

In order to effect the exercise of the Exercised Stock Options, on

May 7, 2024, the Adviser entered into a Loan Agreement with 667 pursuant to which 667 loaned $55,918 to the Adviser for the purpose of

acquiring the Common Stock. The loan is due May 7, 2054, or earlier if the Common Stock is sold (the “Due Date”), with interest

payable through the Due Date at a rate of 4.55% annually. The Adviser drew down $679,232 for the purpose of acquiring Common Stock for

Life Sciences from a revolving note (the “Revolver”). The Revolver is due on May 1, 2053, or earlier if the Common Stock (or

any portion thereof) is sold, with interest payable through such date of 4.55% annually.

The foregoing descriptions of the Loan Agreement and the Revolver do

not purport to be complete and are qualified in their entirety by reference to the full texts of the Loan Agreement and Revolver, which

are filed as Exhibit 99.1 and Exhibit 99.3, respectively, and are incorporated herein by reference.

The Funds hold securities of the Issuer for investment purposes. The

Reporting Persons or their affiliates may purchase additional securities of the Issuer or dispose of securities in varying amounts and

at varying times depending upon the Reporting Persons’ continuing assessments of pertinent factors, including the availability

of shares of Common Stock or other securities for purchase at particular price levels, the business prospects of the Issuer, other business

investment opportunities, economic conditions, stock market conditions, money market conditions, the attitudes and actions of the Board

of Directors and management of the Issuer, the availability and nature of opportunities to dispose of securities of the Issuer and other

plans and requirements of the particular persons. The Reporting Persons may discuss items of mutual interest with the Issuer’s

management, other members of the Board and other investors, which could include items in subparagraphs (a) through (j) of Item 4 Schedule

13D.

Depending

upon their assessments of the above factors, the Reporting Persons or their affiliates may change their present intentions as stated

above and they may make suggestions to the management of the Issuer regarding financing, and may acquire additional securities of the

Issuer, including shares of Common Stock (by means of open market purchases, privately negotiated purchases, exercise of some or all

of the Stock Options (as defined in Item 5), vesting of restricted stock units (each, an “RSU”) or

otherwise) or may dispose of some or all of the securities of the Issuer, including shares of Common Stock, under their control.

Except as otherwise disclosed herein, at the present time, the Reporting

Persons do not have any plans or proposals with respect to any extraordinary corporate transaction involving the Issuer including, without

limitation, those matters described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

(a)

and (b) Items 7 through 11 and 13 of each of the cover pages of this Amendment No. 29 are incorporated herein by reference. Set forth

below is the aggregate number of shares of Common Stock directly held by each of the Funds and the percentage of the Issuer’s outstanding

shares of Common Stock such holdings represent. The information set forth below is based on 224,540,751 shares of Common Stock outstanding

as of April 23, 2024, as reported in the Issuer’s Form 10-Q filed with the SEC on April 30, 2024. Such percentage figures

are calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended.

| Holder | |

Shares of Common Stock | | |

Percent of Class Outstanding | |

| 667, L.P. | |

| 2,734,189 | | |

| 1.2 | % |

| Baker Brothers Life Sciences, L.P. | |

| 33,212,097 | | |

| 14.8 | % |

| Total | |

| 35,946,286 | | |

| 16.0 | % |

The Adviser GP, Felix J. Baker and Julian C. Baker as managing members

of the Adviser GP, and the Adviser may be deemed to be beneficial owners of securities of the Issuer directly held by the Funds.

Julian C. Baker and Felix J. Baker are also the sole managers of FBB2

and FBB3 and by policy they do not transact in or vote the securities of the Issuer held by FBB2 and FBB3.

Julian C. Baker and Felix J. Baker are also the sole partners of FBB

and as such may be deemed to be beneficial owners of securities owned by FBB and may be deemed to have the power to vote or direct the

vote and dispose or direct the disposition of those securities.

In connection with his service on the Issuer’s Board, Julian

C. Baker holds options to purchase Common Stock of the Issuer (“Stock Options”), RSUs, Common Stock and Common Stock received

from the exercise of Stock Options as disclosed in previous amendments to this Schedule 13D. On March 28, 2024, Julian C. Baker received

543 shares of Common Stock in lieu of quarterly cash director’s compensation.

Julian C. Baker serves on the Board

as a representative of the Funds. The policy of the Funds and the Adviser does not permit managing members of the Adviser GP or

full-time employees of the Adviser to receive compensation for serving as a director of the Issuer. Therefore, Julian C. Baker has no

pecuniary interest in the Stock Options, Common Stock, RSUs or Common Stock received from the exercise of Stock Options or vesting of

RSUs received as directors’ compensation. The Funds are instead entitled to the pecuniary interest in the Stock Options, Common

Stock, RSUs and Common Stock received from the exercise of Stock Options and vesting of RSUs received as directors’ compensation.

The Adviser has voting and investment power over the Stock Options,

RSUs, Common Stock and Common Stock underlying such Stock Options and Common Stock received from the exercise of Stock Options by Julian

C. Baker received as directors’ compensation. The Adviser GP, and Felix J. Baker and Julian C. Baker as managing members of the

Adviser GP, may be deemed to have the power to vote or direct the vote of and the power to dispose or direct the disposition of the Stock

Options, RSUs, Common Stock, Common Stock received from the exercise of Stock Options and Common Stock underlying such Stock Options

held by Julian C. Baker received as director’s compensation.

(c) The disclosures in Item 4 are incorporated by reference herein.

Except as disclosed herein or in any previous amendments to this Schedule 13D, none of the Reporting Persons or their affiliates has

effected any other transactions in securities of the Issuer during the past 60 days.

(d) Certain securities of the Issuer are held directly by 667, a limited

partnership the sole general partner of which is Baker Biotech Capital, L.P., a limited partnership the sole general partner of which

is Baker Biotech Capital (GP), LLC. Julian C. Baker and Felix J. Baker are the controlling members of Baker Biotech Capital (GP), LLC.

Certain securities of the Issuer are held directly by Life Sciences,

a limited partnership the sole general partner of which is Baker Brothers Life Sciences Capital, L.P., a limited partnership the sole

general partner of which is Baker Brothers Life Sciences Capital (GP), LLC. Julian C. Baker and Felix J. Baker are the controlling members

of Baker Brothers Life Sciences Capital (GP), LLC.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to the Securities of the Issuer.

Item 6 of this Schedule 13D is hereby supplemented and amended, as

the case may be, as follows:

The disclosure in Item 4 is incorporated

by reference herein.

The Loan Agreement, the Proceeds Agreement and the Revolver are filed

as Exhibits 99.1,99.2 and 99.3, respectively, and are incorporated by reference herein.

Item 7. Material to be Filed as Exhibits.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

May 9, 2024

| |

BAKER BROS. ADVISORS LP

By: Baker Bros. Advisors (GP) LLC, its general partner |

| |

|

|

| |

By: |

/s/

Scott L. Lessing |

| |

|

Name:

Scott L. Lessing

Title: President |

| |

BAKER

BROS. ADVISORS (GP) LLC |

| |

|

|

| |

By: |

/s/

Scott L. Lessing |

| |

|

Name:

Scott L. Lessing

Title: President |

| |

/s/

Julian C. Baker |

| |

Julian C. Baker |

| |

|

| |

/s/ Felix J. Baker |

| |

Felix J. Baker |

| |

FBB

Associates |

| |

|

|

| |

By: |

/s/

Julian C. Baker |

| |

|

Name:

Julian C. Baker

Title: Partner |

| |

FBB2,

LLC |

| |

|

|

| |

By: |

/s/

Julian C. Baker |

| |

|

Name:

Julian C. Baker

Title: Manager |

| |

FBB3

LLC |

| |

|

|

| |

By: |

/s/

Julian C. Baker |

| |

|

Name:

Julian C. Baker

Title: Manager |

Exhibit 99.1

Loan

Agreement Between 667, L.P and Baker Bros. Advisors LP

For value received, Baker Bros. Advisors LP (the “Management

Company”) promises to pay 667, L.P. (“667”), the amounts set forth in Schedule A below, payable on the Due Date (as

defined below) with interest payable through the Due Date (as defined below) at a rate of 4.55% annually.

667 is lending the Management Company these amounts so that Julian

Baker, as agent of the Management Company, may exercise 15,000 Incyte Corporation (“INCY”) Director’s Non-qualified

Stock Options at $49.01 per share (the “Shares”) and deposit the Shares into Julian Baker’s brokerage account held at

JPMorgan.

The “Due Date” shall be May 7, 2054, however, following

the sale by Julian Baker of all of the Shares, the Due Date shall accelerate to the date that is 10 days after date of the last sale of

Shares.

This Loan Agreement shall be construed in accordance with the laws

of the State of New York.

Baker Bros. Advisors LP

| /s/ Alexandra A. Toohey |

|

| /s/ Alexandra A. Toohey |

|

| By: Alexandra A. Toohey, Chief Financial Officer |

|

667, L.P.

By:

Baker Bros. Advisors LP, management company and investment adviser to 667, L.P., pursuant to authority granted to it

by Baker Biotech Capital, L.P., general partner to 667, L.P., and not as the general partner.

| /s/ Scott L. Lessing |

|

| |

|

| Scott Lessing |

|

| President |

|

Schedule A

| Fund | |

667, L.P. | |

| Loan | |

$ | 55,918 | |

Exhibit 99.2

PROCEEDS AGREEMENT

AGREEMENT dated as of May 7, 2024 by and

between Baker Bros. Advisors LP (the “Management Company”) and Julian Baker (the “Agent”).

WHEREAS, the Agent, in his capacity as a

director of Incyte Corporation (the “Company”), received non-transferable options (the “Options”) to purchase

15,000 shares of the Company common stock (the “Stock”) according to the below Schedule A;

WHEREAS, the Management Company provides

management and administrative service to each of Baker Brothers Life Sciences, L.P. and 667, L.P. (the “Funds”) in exchange

for a management fee from each (the “Management Fees”);

WHEREAS, the Company is a portfolio company

of the Funds;

WHEREAS, Pursuant to the Funds’ Limited

Partnership Agreements and the Management Company’s policies, directors’ fees, consulting fees and other remuneration (including

options, warrants or other equity securities) paid by Funds portfolio companies to an agent, officer or employee of the Management Company

shall reduce (but not below $0) the Management Fees; and

WHEREAS, the Agent and the Management Company

wish to memorialize their understanding with respect to the Options;

NOW, THEREFORE, for good and valuable consideration,

the parties agree as follows:

1. Subject

to the provisions of Section 2, the Agent agrees, as soon as practicable after receipt from the Company, to remit to the Management Company

any directors’ fees, consulting fees and other remuneration that the Agent receives from the Company.

2. The

Agent shall exercise the Options at the time directed by the Management Company. When the Agent exercises the Options, the Management

Company shall provide the Agent with the amount of cash necessary to enable the Agent to purchase the Stock for which the Options are

being exercised from the Company, in compliance with the terms of the Options.

3. Thereafter,

the Agent shall hold the Stock in a brokerage account at JPMorgan which is not commingled with other personal holdings of the Agent until

directed by the Management Company to sell the Stock. The Agent agrees, as soon as practicable after receiving direction from the Management

Company, to sell all, or any portion, of the Stock as directed by the Management Company and to remit the gross cash proceeds (but net

of brokerage commissions) from the sale of the Stock to the Management Company.

4. The

Agent agrees not to amend or modify the Options, waive any of the provisions thereof, or enter into any agreement or understanding with

respect to the Options or the Stock, without the prior written consent of the Management Company.

5. The

Agent shall not report any income attributable to these transactions as his own income, but instead, shall report such income on any and

all tax returns required to be filed by the Agent as received by him only in his capacity as an agent, officer or employee of the Management

Company. The Management Company shall report all such income on any and all tax returns required to be filed by the Management Company.

6. This

Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, legal representatives, successors

and assigns. This Agreement shall survive the death, merger, dissolution or termination of any of the parties hereto and shall continue

in full force and effect notwithstanding that the Agent shall cease to be an agent, officer or employee of the Management Company for

any reason.

7. This

Agreement may be amended or modified only by a writing signed on behalf of the parties hereto. No provision of this Agreement may be waived

except in writing signed on behalf of the party against whom such waiver is asserted.

8. From

and after the date of this Agreement, the parties shall execute and deliver such instruments, documents and other writings, and take such

other actions, as may be necessary to confirm and carry out and to effectuate fully the intent and purposes of the transactions on their

part respectively contemplated by this Agreement.

9. If

any of the benefits contemplated by this Agreement would be reduced or unachievable because of restrictions or prohibitions imposed by

law (by way of example only, the Securities Act of 1933, state securities laws, or the Company’s governing instruments), the parties

hereto shall use their best efforts to preserve the intent of this Agreement and the benefits contemplated hereby by amending, modifying

or waiving in an appropriate manner the provisions of this Agreement.

10. This

Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the undersigned have executed this Proceeds Agreement as of the date

first above written.

| |

MANAGEMENT COMPANY |

| |

|

| |

/s/ Alexandra A. Toohey |

| |

By: Alexandra A. Toohey |

| |

Title: Chief Financial Officer |

| |

|

| |

|

| |

AGENT |

| |

|

| |

/s/ Julian C. Baker |

| |

Julian Baker |

Schedule A

| | |

| | |

Baker Brothers Life | | |

| |

| Fund | |

667, L.P. | | |

Sciences, L.P. | | |

Total | |

| Loan | |

$ | 55,918 | | |

$ | 679,232 | | |

$ | 735,150 | |

Exhibit 99.3

REVOLVING NOTE

FEBRUARY 29, 2024

For value received, Baker Bros.

Advisors LP (the “Borrower”), hereby promises to pay to the Person identified as a “Lender” on the signature

pages hereof (the “Lender”), the aggregate unpaid principal amount of all Loans (as defined below) made by the Lender

to the Borrower, together with interest thereon as set forth below, on the Maturity Date (as defined below). Certain capitalized terms

used herein have the definitions provided therefor in Annex A.

Subject to the terms and conditions

set forth herein, the Lender may, in its sole discretion on a case-by-case basis as and when such Loans are requested by the Borrower,

make Loans in dollars to the Borrower from time to time during the period commencing on the date hereof and ending one Business Day prior

to the Maturity Date, in an aggregate principal amount that will not result in the aggregate outstanding principal amount of all Loans

exceeding the Maximum Facility Amount. Within the foregoing limits and subject to the terms and conditions set forth herein, the Borrower

may borrow, prepay and reborrow Loans, and may prepay any accrued interest thereon, from time to time, in whole or in part, without penalty.

Any optional prepayment shall first be applied to accrued and unpaid interest, with the remainder applied to principal.

The Lender shall maintain in

accordance with its usual practice, in the Lender’s own books and records (or by its agent on its behalf, including the Borrower),

an account or accounts evidencing the indebtedness of the Borrower to the Lender resulting from each Loan made by the Lender, including

the amounts of principal and interest payable and paid to the Lender from time to time hereunder. The entries made in the accounts maintained

pursuant to the immediately preceding sentence shall be prima facie evidence of the existence and amounts of the obligations recorded

therein; provided that the failure of the Lender to maintain such accounts or any error therein shall not in any manner affect

the Obligations.

The Borrower agrees to pay interest

on the outstanding amount of each Loan at a rate per annum equal to the Applicable Rate with respect to such Loan. The aggregate amount

of accrued interest hereunder at any time of determination, together with the then unpaid principal amount of the Loans, is collectively

referred to herein as the “Obligations”. Interest shall be computed on the basis of a 365/366-day year for the actual

number of days elapsed. All interest will be payable on the outstanding principal amount of each Loan on the earliest of the Maturity

Date, the date when the principal of such Loan is paid, or the date such Loan is forgiven.

Interest on this Note shall

not exceed the maximum amount of non-usurious interest that may be contracted for, taken, reserved, charged or received under law, and

any interest in excess of that maximum amount shall be credited on the principal of this Note or, if that has been paid, refunded. This

provision overrides all other provisions of this Note.

If any payment of principal

or interest under this Note is due on a day that is not a Business Day, such payment shall be due on the next succeeding Business Day.

All payments to be made by or on behalf of the Borrower with respect to this Note shall be made without set-off, counterclaim or other

defense. All payments of principal and interest in respect of the Loans shall be made payable to the Lender for the Lender’s account

in lawful money of the United States of America at such place as shall be designated by the Lender for such purpose.

The Borrower shall use the proceeds

of each Loan for purposes of facilitating an Agent’s exercise of the applicable remuneration (including any options or warrants)

in accordance with the terms of a specified Proceeds Agreement (each, a “Specified Proceeds Agreement”).

Notwithstanding anything to

the contrary herein, upon the sale at any time of any portion of the Securities referred to in a given Specified Proceeds Agreement, the

Borrower shall, not later than ten (10) days thereafter, pay to the Lender an amount equal to the lesser of (i) the aggregate amount of

the Obligations in respect of the Loan relating to such Specified Proceeds Agreement at such time and (ii) the net proceeds from the sale

of such Securities. For the avoidance of doubt, if the proceeds from the sale of all of the Securities that was purchased using the proceeds

of a Loan are less than the Obligations in respect of the applicable Loan, then the amount repaid by the Borrower to the Lender in satisfaction

of such Loan may be less than the unpaid principal of and accrued interest on such Loan. Any such shortfall shall be deemed forgiven by

the Lender, and the Obligations in respect of the applicable Loan shall be deemed paid in full.

The Borrower shall take such

action as may be reasonably requested by the Lender to effectuate the intentions and objects of this Note.

This Note may be amended by

a writing signed by the Lender and the Borrower.

The Lender may assign all or

a portion of its rights and obligations under this Note with the prior written consent of the Borrower. The Borrower may not assign or

delegate any of its obligations or agreements hereunder without the prior written consent of the Lender. This Note is binding upon the

Borrower and its successors and assigns, and inures, together with all rights and remedies, to the benefit of the Lender and its successors,

transferees and assigns.

Upon a failure by the Borrower

to make any payment of the Obligations due and owing by the date required hereunder, the Lender may exercise the rights and remedies available

to it under any applicable law. Each and every right, remedy and power hereby granted to the Lender or allowed it by law or any

other agreement shall be cumulative and not exclusive of any other right, remedy or power, and may be exercised by the Lender at any time

and from time to time. No failure on the part of any Lender to exercise, and no delay in exercising, any right, remedy or power hereunder

shall operate as a waiver thereof, nor shall any single or partial exercise by the Lender of any right, remedy or power hereunder preclude

any other or future exercise thereof or the exercise of any other right, remedy or power. This Note shall remain in full force and effect

until the payment in full of the Obligations.

The

BORROWER waives presentment, demand, protest and notice of protest, non-payment and notice of non-payment and dishonor and notice of dishonor

in the taking of any action to collect any amount called for pursuant to this Note. The Borrower agrees to pay all costs of collection,

including reasonable attorneys’ fees and disbursements, in the event this Note is not paid when due.

Every provision of this Note

is intended to be severable; if any term or provision of this Note shall be invalid, illegal or unenforceable for any reason, the validity,

legality and enforceability of the remaining provisions hereof shall not in any way be affected or impaired thereby.

This Note may be executed in

counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which

when taken together shall constitute a single agreement. Delivery of an executed counterpart of this Note in electronic (e.g., “pdf”

or “tif”) format shall be effective as delivery of a manually executed counterpart of this Note. The words “execution,”

“signed,” “signature,” and words of like import in this Note shall be deemed to include electronic

signatures or electronic records, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature

or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including

the Federal Electronic Signatures in Global and National Commerce Act, or any other similar state laws based on the Uniform Electronic

Transactions Act.

THE PROVISIONS OF THIS NOTE

SHALL, PURSUANT TO NEW YORK GENERAL OBLIGATIONS LAW SECTION 5-1401, BE CONSTRUED AND INTERPRETED, AND ALL RIGHTS AND OBLIGATIONS HEREUNDER

DETERMINED, IN ACCORDANCE WITH THE LAW OF THE STATE OF NEW YORK. THE BORROWER SUBMITS TO THE JURISDICTION OF STATE AND FEDERAL COURTS

LOCATED IN THE CITY AND STATE OF NEW YORK AND AGREES THAT ALL ACTIONS AND PROCEEDINGS RELATING DIRECTLY OR INDIRECTLY TO THIS NOTE SHALL

BE LITIGATED ONLY IN SAID COURTS, AND THAT SUCH COURTS ARE CONVENIENT FORUMS.

THE BORROWER WAIVES THE RIGHT

TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING BASED UPON, ARISING OUT OF OR IN ANY WAY CONNECTED TO THIS NOTE OR THE TRANSACTIONS CONTEMPLATED

HEREBY.

[Remainder of page intentionally left blank;

signature pages follow]

IN WITNESS WHEREOF, the parties

hereto have duly executed and delivered this Note as of the date first written above.

| |

EXECUTED BY: |

| |

|

| |

BAKER BROS. ADVISORS LP, |

| |

as Borrower |

| |

|

| |

By: |

/s/ Scott Lessing |

| |

Name: |

Scott Lessing |

| |

Title: |

|

[Signature Page to Revolving Note]

| |

Baker Brothers Life Sciences,

L.P., |

| |

as a Lender |

| |

|

| |

By: Baker Brothers Life Sciences Capital,

L.P., it general partner |

| |

|

| |

By: Baker Brothers Life Sciences Capital

(GP), LLC, its general partner |

| |

|

| |

|

| |

By: |

/s/ Julian Baker |

| |

Name: |

Julian Baker |

| |

Title: |

|

[Signature Page to Revolving

Note]

ANNEX A

Defined Terms

For purposes of this Note, the

following terms have the meanings set forth below:

“AFR” means

the long-term applicable federal rate as determined by the U.S. Internal Revenue Service.

“Applicable Rate”

means, with respect to any Loan, a rate per annum equal to the AFR as of the date such Loan is made.

“Business Day”

means any day that is not a Saturday, Sunday or other day that is a legal holiday under the laws of the State of New York or is a day

on which banking institutions in such state are authorized or required by law to close.

“Loan”

means each loan made pursuant to this Note to the Borrower by the Lender. Each Loan shall be made in connection with a single Specified

Proceeds Agreement, for the purposes described in and otherwise on the terms provided for in this Note.

“Maturity Date”

means May 1, 2053.

“Maximum Facility

Amount” means $50,000,000.

“Note”

means this Revolving Note, as amended, restated, supplemented or otherwise modified from time to time.

“Proceeds Agreement”

means a “Proceeds Agreement” or similar agreement by and between the Borrower and an employee of the Borrower (including,

without limitation, Felix Baker and Julian Baker) or such employee’s affiliate(s) (each such employee or affiliate, as applicable,

an “Agent”), pursuant to which the Borrower agrees to provide the applicable Agent with the amount of cash necessary

to enable such Agent to exercise the applicable remuneration (including any options or warrants).

“Securities”

means those securities or other interests received by an Agent in connection with the exercise of the remuneration (including any options

or warrants) pursuant to the applicable Specified Proceeds Agreement.

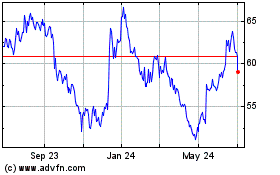

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Dec 2023 to Dec 2024